Author: Felipe Montealegre, Theia Blockchain CIO; Translation: Jinse Finance xiaozou

Press: Telegram Bot, represented by Unibot, has become popular recently. Before the encrypted VC Theia Blockchain announced its investment in Unibot on July 13, let us look at the investment logic of encrypted VCs in Unibot.

We are pleased to announce our investment in Unibot. Unibot lets you trade on Uniswap via a Telegram bot, including regular trades, private RPC node trades (to avoid MEV), and limit orders. The Unibot team is rapidly building integrations with other DeFi protocols.

Our investment judgment on Unibot is based on the following points:

* Unibot's huge existing market - DeFi needs better UI tools.

* Great confidence in near-term growth as the team develops their roadmap.

* Attractive valuation, about 10 times earnings (based on our average entry price)

* First-class team

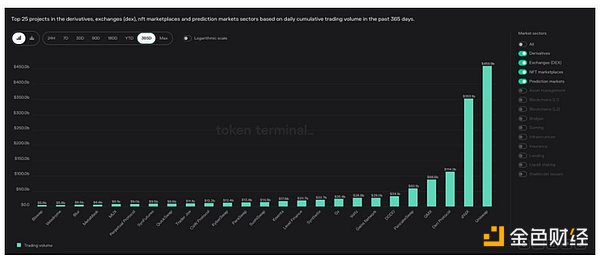

1. Huge existing market

Daily trading volume:

Unibot: $1.1 million

Uniswap: $1.1 billion

We like investing in protocols that can perform well without recovering market volume. We believe that front-end applications will eventually account for more than 10% of the total transaction volume of DeFi. This is more than 100 times the market growth.

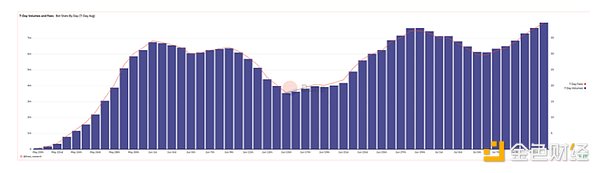

2. The current development direction of Unibot is a single business line - trading on Uniswap, and will continue to grow.

We expect to see multiple new business lines in areas such as perpetual futures, options, and structured products.

We expect new front-end options (such as web applications) to work with Gecko terminals.

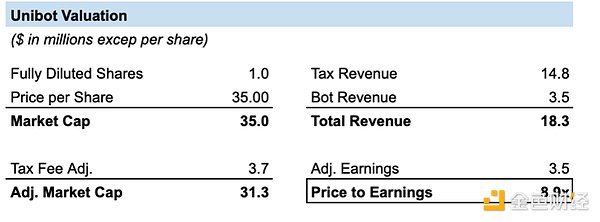

3. At our average entry price of $35 per share, the valuation is attractive at about 9x earnings.

The composition of Unibot income is as follows:

· Bot Fees: A fee of less than 1% is charged on all transactions made through the TG bot, currently $3.5 million per year.

Taxes: A 5% fee is charged on all Unibot token transactions, currently $14.8 million per year.

Instructions for Valuation:

· Market cap: We assume taxes and fees continue until end-2023 and are deducted from the purchase price (net cash inflow).

Earnings: 40% of bot fees are paid out as dividends and 60% is reinvested by the team.

Our earnings do not include taxes.

4. First-class Unibot team

We encourage you to give Unibot a try and see how attractive a good UI really is.