Author: chaindebrief . Compiled: Cointime.com QDD

The OPNX exchange , a claims marketplace started by 3AC co-founders Soo and Kyle Davis, has recently come under fire for its allegedly questionable business model.

OPNX, which stands for "Open Exchange," allowed users to trade cryptocurrencies and tokenize claims on the now-defunct cryptocurrency exchange FTX.

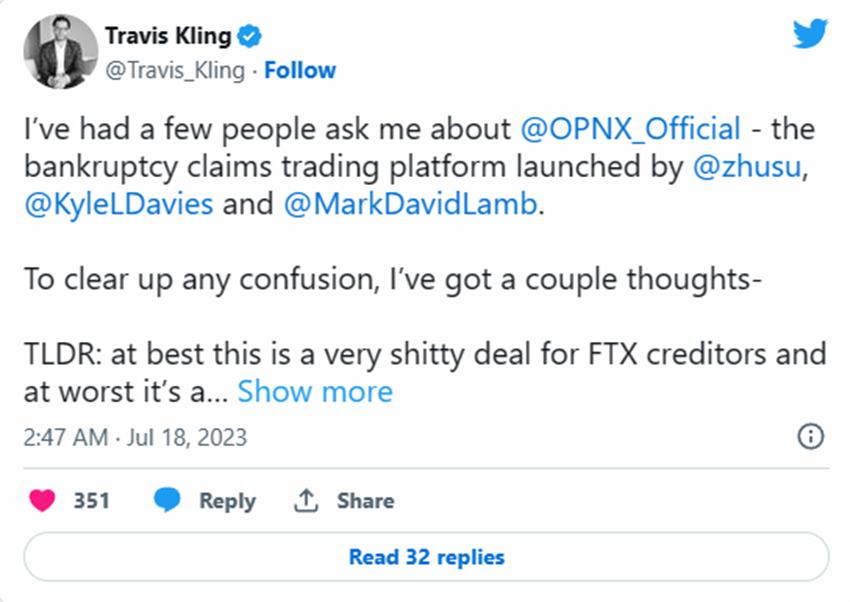

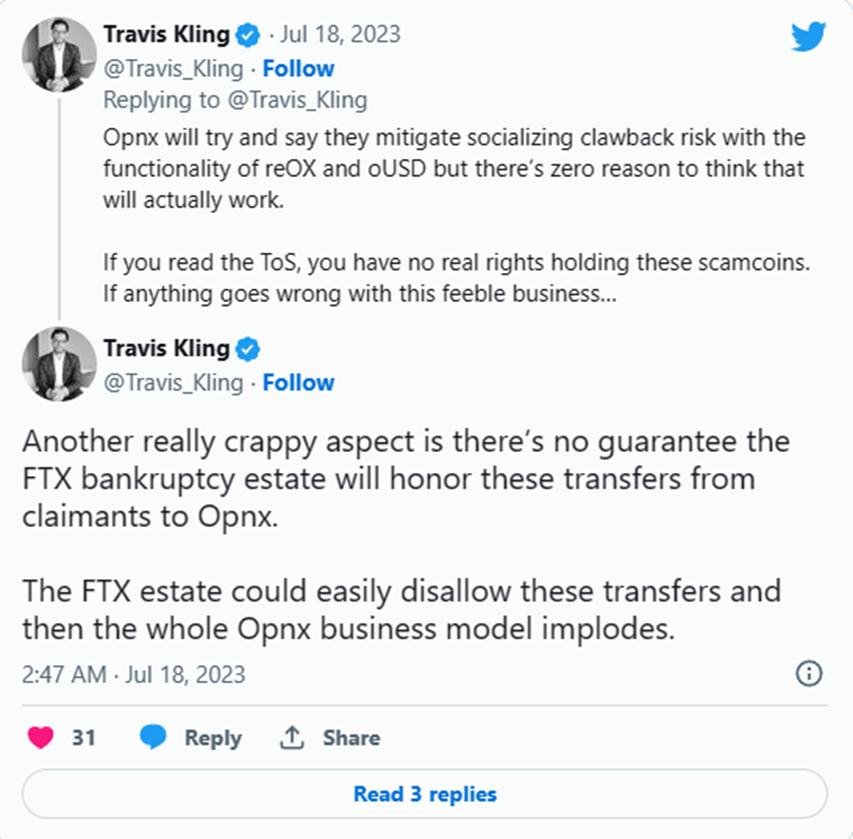

However, the technical details of these debt transactions were questioned on social media, with Twitter user and ikigai fund manager Travis Kling pointing out: "At best this is a very bad deal for FTX's creditors, at worst it is a total scam," and warned his followers not to use the platform.

His allegations are based on OPNX’s business model and the token structure of its native token $OX.

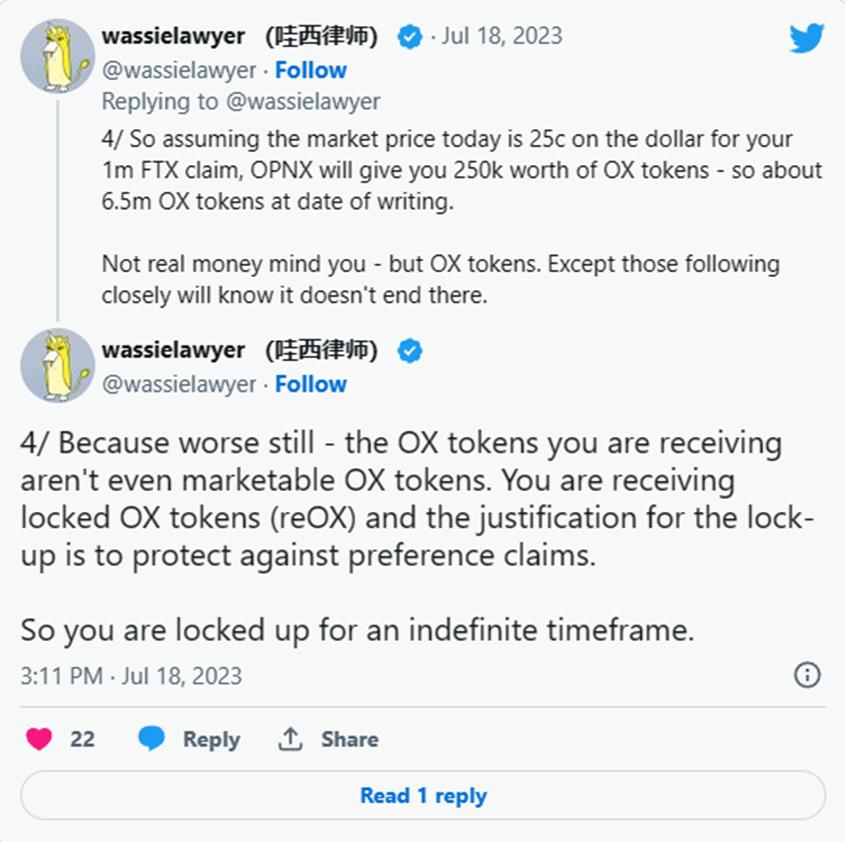

According to the official OPNX page , creditors wishing to realize their claims immediately can exchange them for $reOX tokens on the site. $reOX is a locked version of $OX that is unlocked when claim preferences are resolved and can be used as collateral for transactions on the platform.

In addition, users can also choose to exchange their claims for $oUSD, which can be purchased at a 1:1 ratio on OPNX. However, claims made through $reOX are currently available for double the amount.

Travis noted that not only is OPNX’s token “mechanically suspect,” but those FTX claims could “be gone forever” if the exchange faced distress. He also pointed out that FTX may not honor the deal made on OPNX at all.

Twitter user Wassielawyer echoed this view, saying that OPNX's purchase of claims with "a bunch of OX tokens printed by OPNX" is a major red flag in its business model. Additionally, one of the largest holders of $OX is a creditor of CoinFlex, a yield platform that allegedly went bankrupt after a client failed to meet a margin call .

$FLEX, the native token of the now-defunct CoinFlex, can be exchanged for unlocked $OX at a ratio of 1:100. The former CEO of CoinFlex, Mark Lamb, is also the co-founder of the OPNX exchange.

Is anyone even using OPNX?

While OPNX publicly reported impressive statistics, far from the dismal picture they started out with, some were quick to point out that the numbers seemed implausible.

OPNX attributes these sudden spikes in volume to its market makers, who can earn anywhere from $5,000 to $500,000 per month depending on their market-making volume.

However, the sheer number of negative comments about OPNX is indicative of negative perceptions of the platform and negatively impacting the reputation of its co-founders.

Surprisingly, their native token $OX has been on the rise, doubling in a relatively short period of time.