Written by: TechFlow Intern

When CEX and centralized institutions have experienced a series of trust crisis events, we expect DEX to rise more than ever. At the same time, we have also seen the emergence of many DEX products, among which the most mentioned concept is "providing decentralized products consistent with the centralized exchange experience". But to achieve a consistent experience, the construction of "experts" is indispensable.

Experts who have worked in exchanges often have a better understanding of the operating mechanism and inherent defects of CEX's existing products, the shortcomings of DEXs, and the breakthrough points that can be further improved in user experience.

In this interview, we invited Roger, an expert who has been working in traditional finance and centralized exchanges for many years, and he also brought his new product - Substance Exchange (hereinafter referred to as SubstanceX), a DEX that surpasses competing products in the market in terms of product power and user experience.

How should decentralized exchanges make products and which users should they capture? And how to grasp the golden window period of regulatory vacuum and barbaric growth , and achieve considerable development?

In this issue, as the CEO & Founder of SubstanceX, Roger will use his profound experience in the industry and first-hand research on user needs to share with us his insights on centralized exchanges and decentralized exchanges, and share how SubstanceX builds product strength and moves towards the goal of the top DEX.

Intention and Choice: Make Something People Want

TechFlow: Can you briefly share your background and what you are doing?

Roger :

Hi, I'm Roger, CEO and Founder of SubstanceX. My interest and career development in the digital currency space goes back more than a decade.

In 2013, when I was studying physics at the University of Waterloo, I personally started trading contracts on a domestic platform called 796, which may be one of the earliest digital currency exchanges that support contracts.

In 2017, I officially entered the digital currency industry, initially as a market maker at OKX. At the time, my team and I were leading the market in volume for many of the large coin-based quarterly contract pairs.

Since OKX, I have been working in a centralized exchange, mainly responsible for trading derivatives related sectors. In the middle of 2022, I will become the CEO of a centralized exchange ranked in the top 20 by CMC and CGC* , and hold this position for about half a year. (*CMC and CGC: Coinmarketcap/Coingecko)

In January of this year, I left my job to start Substance Exchange. This is my personal background and my current work situation. We completed the financing in March and April of this year. On July 25, our testnet version was launched on Arbitrum Goerli. At the same time, we have also prepared generous rewards. We welcome everyone to experience and give feedback.

TechFlow TechFlow: From your introduction above, it can be said that you are a relatively successful "industry insider". Then why are you willing to start a business again and enter the DEX track? What is your original intention? Do you have any unfulfilled ideals?

Roger :

I think this matter can be summed up in my personal character traits, market situation and entry time point.

First of all, if I want to summarize my personal characteristics, I would say that I am a person with a "rebel spirit" . I really believe in the concept of decentralization from the bottom of my heart. I don't want to do something centralized under a decentralized shell.

However, some DEXs in the market now are actually behind the CEX team. Their matching engines are still off-chain, but they only use on-chain wallets to ensure the relative security of assets, and conduct transactions through off-chain prices and matching; in this case, the off-chain accounts still cannot be verified to be correct.

There are mainly two types of teams working on DEX in this market: one is a purely decentralized team, and the other is a purely Web3 team.

- The former has a huge number of users, and they have iterated the product many times, but their thinking may be more limited to how to accomplish this efficiently rather than how to accomplish it fairly;

- The latter may not be good enough to understand the needs of users, because they have not faced long-term user demands and feedback, and there is no effective feedback mechanism to iterate the product.

Our team is in between. We hope to provide an excellent product, and we hope to graft a fair and just system on this excellent product .

Finally, the crisis of trust caused by the bankruptcy of centralized exchanges such as FTX, and the gradual maturity of the current Layer 2 performance have created a suitable and mature external environment for us to enter this field. In my opinion, the timing is very good, which is why I chose to enter this field again.

TechFlow: What do you think are the advantages of yourself or your team on the current track, where is your competitiveness reflected, and how to keep your team competitive for a long time?

Roger :

I think the core strength lies in strong technical capabilities and consistent vision.

In terms of technical capabilities, the team is mainly composed of members from centralized exchanges , such as OKX and Bybit, etc. We have many years of working experience and a deep foundation of trust.

In the previous 5-6 years of work experience, we have participated in the complete project process of ETF, options and perpetual contracts and other product sectors from project establishment to development, testing, public beta, official launch and continuous product iteration for millions of users or more. Therefore, in terms of technical level and engineering ability, it has a great advantage over the original Web 3 team.

In addition , we have a very consistent vision - Make Something People Want . This is also the driving force for everyone to jump out of the relatively high-paying CEX and do what they are doing now.

We feel that the current products on the market, whether it is GMX or some CEX products, are not transparent enough on the CEX product side, and the product power is relatively weak on decentralized products, so we came out to make something that real users can like and accept.

When it comes to competitiveness, I think the key is to have an effective feedback mechanism and to face these unfiltered customer demand information .

Judging from my working experience in CEX, a lot of user feedback information I got has actually been filtered through multiple layers. The customer service department has a lot of manpower to collect and sort out user feedback information with subjective judgments, and you will find that the information that has been filtered layer by layer is quite different from the original customer demand feedback.

Now our team is only 20-30 people in size, but what I ask everyone is that all competing products on the market must have in-depth transactions and experience, including but not limited to GNS, Level Finance, GMX, etc.

Basically all of these products, all of us from design, product, development, operation to market, everyone started to follow up this project from the very beginning, from its first Twitter, after the testnet to the launch, we are actually the most experienced group of users among these competing products.

It is because of the personal experience of follow-up that I feel that I can directly face the needs of users, face the product itself, and go through a set of effective feedback mechanisms to iterate out a product that truly meets the needs of users.

If you don't experience it yourself, you won't be able to perceive the irrationality of many subtle experiences.

For example, when GMX deducts the loan rate, it is first deducted from your user's margin. Although the loan rate is very low, the design of deducting the margin means that your margin has been decreasing linearly since you opened the position, resulting in the liquidation price.

This example shows that it is difficult to realize this very small appeal when you just let UI/UX go through the page or let the product read the document on the surface, but in fact it has a very big impact on users.

Therefore, to maintain an advantage in the competition for a long time is to thoroughly understand a need of your competitors and your customers, and try to face these unfiltered information as much as possible.

TechFlow TechFlow: There are many products that talk about the narrative of "nearly centralized product experience". In your opinion, what is the real "nearly centralized product experience"?

Roger :

We might as well take GMX as an example first.

GMX is indeed getting bigger and bigger, attracting a lot of user traffic, and it is also the first batch of DEXs to remove market makers and build a LP and Trader betting model. But I don't think GMX is a very good exchange, and I don't think GMX's BTC-USDT perpetual contract is a very good product .

In fact, if you compare it with any BTC-USDT perpetual contract trading pair in CEX, its product power is poor: in terms of overall costs, CEX only has transaction fees and funding rates.

But in fact, GMX V2 needs to charge not only the funding rate, but also the lending rate, and then there are impact fees (because of slippage and market depth), and at the same time, an on-chain gas fee must be paid.

In addition, comparing UI/UX, you will find that there are a lot of unreasonable front-end and back-end interface designs, and it is more like a low-profile trial version than CEX.

But if you take a closer look at the perpetual contracts of CEX, you will find that the entire contract system has been iterated in CEX for nearly 10 years. Hundreds of thousands of engineers have spent ten years on this product, iterating this product for millions and tens of millions of users. Therefore, within a certain period of time, the contract products on CEX may be the ultimate form.

Based on this comparison, we believe that it is actually the best product to transfer the original flavor (in terms of experience) of CEX’s perpetual contract product to Arbitrum .

But find a way to do its matching, settlement, price feeding, etc. in a decentralized manner. The product is still the same product, but the presentation method turns it into decentralization, which is the ultimate form in my opinion.

To sum up, "decentralized product experience close to centralization" means that the product itself does not need to be innovative. You move the product that has been iterated for 10 years and is very close to the full score to the chain, and change its mechanism to decentralization. If so, users will definitely pay. This is Make Something People Want.

If DEX and CEX are very consistent in terms of login experience and product strength, then there is no reason for users to put money in a black box and rely on a person's moral standards or company reputation to trust the exchange. It will be safer to follow the logic on the chain.

Products and strategies: lowering the threshold and polishing the best DEX experience

TechFlow: Starting from the product, what do you think are the core advantages of SubstanceX?

Roger :

I think the advantages can be briefly manifested in the following aspects:

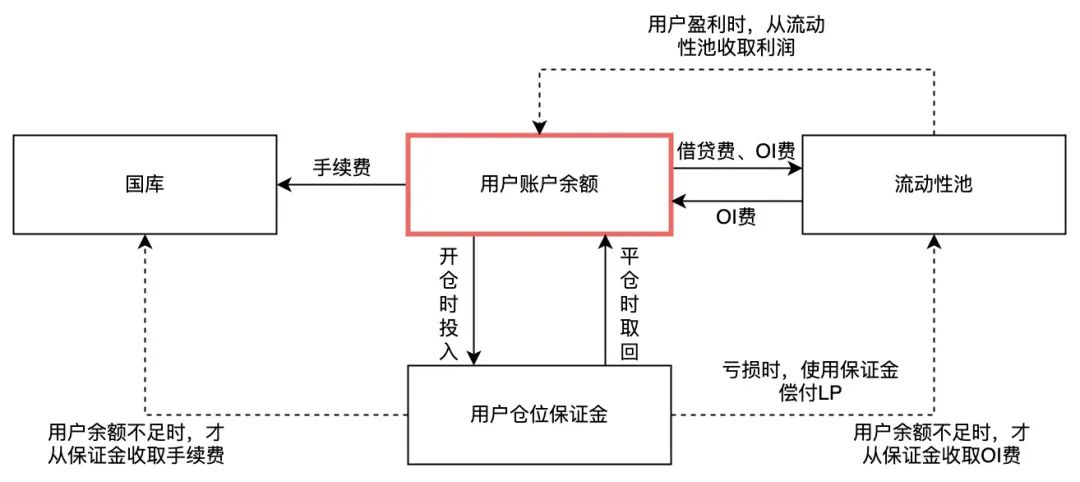

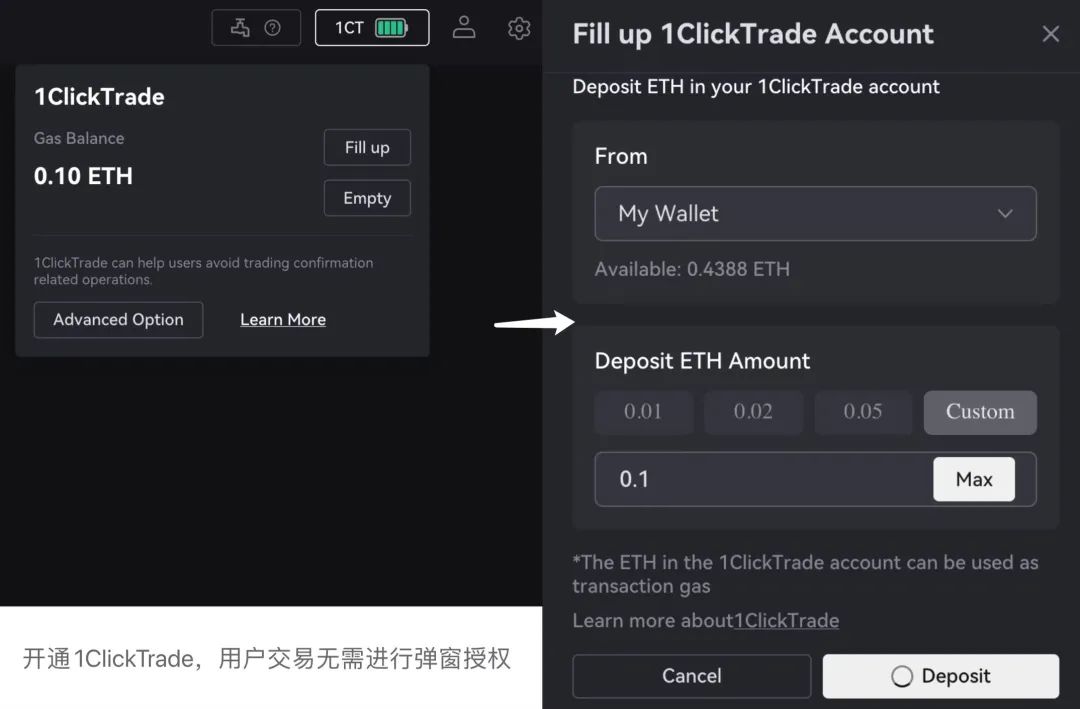

- Login experience : Support Web2 login and bank card deposit, support one-click transaction, and avoid confirmation pop-up window. Multi-level invitation mechanism and VIP level mechanism, and VIP can exempt part of the handling fee;

- Fee deduction method : The handling fee is paid out of the balance first to ensure the user's opening deposit;

- Liquidation mechanism : Liquidation gives priority to guaranteeing the rights and interests of LP;

- Fee collection method : only charged when opening a position, and the comprehensive handling fee is reduced;

- OI calculation method : it is more reasonable, and the borrowing fee borne by users is reduced. On the market external lending rate benchmark, we offer a 1/3 discount, which is subsidized by $SEX (SubstanceX’s native token), and the LP income is also higher;

Also, we can talk about the design differences in detail.

Some decentralized exchanges on the market that claim to be close to the centralized experience actually just fork the code of GMX. Because GMX is open source, the time to develop a set of DEX with similar functions is very fast. If you replace a set of UI/UX, contract and other functions directly copy GMX, we estimate that it will be launched in about 2 weeks.

But in reality, SubstanceX doesn't do that.

In addition to borrowing from GMX 's LP VS Trader betting mode in terms of design concept , the whole set of trading logic and code is completely developed by ourselves , without any fork, and it is very different from GMX.

We officially started the SubstanceX project in February, and it lasted for 5 months until July, and we have iterated 4 versions. In fact, I think the product strength has been stronger than GMX since V3 , but we still iterate to V4, which reflects the "benefits" of the bear market. We have time to polish this product to the most satisfactory level before launching it.

Afterwards, the online version of the testnet released to everyone is the V4 version of the internal iteration, but whether to iterate V5 in the short term depends on the feedback given to us by the testnet users. But judging from the current product version, the underlying mechanism has far surpassed GMX.

Taking the fee rate and liquidation mechanism as an example, our handling fee, loan fee, and funding fee have all been optimized, and the deduction of fees is preferentially deducted from the user's account balance rather than from the contract deposit.

In addition, when we are close to liquidation, we have a more reasonable liquidation process. The user's handling fee submission priority is the last, and we will give priority to helping the user liquidate his position at an appropriate price; in addition, when the user is liquidated, we also give priority to repaying LP loan fees and counterparty funds . The lowest priority of payment is the handling fee charged by the team.

The advantage of this design is actually reflected in the details. When opening an order at the same time and price, the liquidation price on SubstanceX will be a little lower than that on GMX, and it is often this difference that determines whether the user will liquidate .

In addition, there are some unique designs, such as one click trade (one-click order), which can achieve no pop-up window trading. The colleague from Halborn who helped us with the security audit also directly said: "If one click trade goes online, it will be much stronger than existing competing products in terms of product strength and security", because we have done strict encryption design in front-end, back-end, user sharding and other aspects.

So to sum up, I am very confident in the product power of SubstanceX. From the bottom layer of the transaction itself, the efficiency of transaction execution, the effectiveness of transaction execution, the number of concurrent transaction requests, and the security of the entire transaction logic, including the priority of liquidation, I am very confident in these aspects. We are the best bottom-level team on the market.

Of course, whether the market buys this product depends on the follow-up operation and publicity, as well as user feedback. Finally, our products will also be open source, and the copyright will be retained for 2-3 years, and others may not be able to use them for large-scale commercial use.

TechFlow: As TechFlow as we know, SubstanceX mainly targets users who are "centralized exchanges at the waist". Can you talk about the selection of this user segment? In addition, what do you think is the most difficult part to attract this part of users?

Roger :

We choose the users of the "centralized exchange at the waist" as the target, mainly for two reasons.

First of all, the top centralized exchanges, such as Bybit, OKEX, Binance, etc., have a strong matching system as a moat, and they can carry millions or even tens of millions of users, which cannot be carried by the current public chain. Even if you can get their users, such a large volume will cause the public chain to go down.

Secondly, there is a large trust risk in the centralized exchanges at the waist. The user’s 1 dollar in it must actually be less than 1 dollar. Most CEXs cannot 100% repay all user funds. In addition, their user base and matching capabilities are relatively small, and we can provide an approximate user experience while addressing their trust risks.

In addition, the biggest challenge in attracting this part of users lies in the barriers to entry. At present, users need to go through a series of complicated steps to conduct transactions on DEX, including downloading MetaMask plug-ins, generating wallets, remembering private keys or seed phrase, recharging Gas fees, signing multiple contracts, etc. This process takes a lot of time, and errors in any step may result in the loss of user assets. In contrast, the user experience of CEX is much better, from registration to transaction, the whole process may not take more than five minutes.

Many people actually overlook one thing. 90% of the users did not use GMX products and chose not to use them because they felt it was not good. Instead, 90% of the users could not reach the step of GMX opening a position at all, and were persuaded to quit by the complicated process in the middle .

Therefore, our main job is to completely move the Web2 login system to the decentralized exchange, so that users can complete all the steps before opening a position with the most centralized experience. We have connected multiple Web2 login wallets and selected the best two. At the same time, we have also connected MoonPay and Alchemy Pay's OTC, allowing users to conduct C2C transactions directly. Our goal is to lower the barriers to entry for decentralized exchanges and provide a better user experience.

TechFlow TechFlow: Uniswap, GMX , etc. are the absolute leaders in decentralized exchanges. Do you want to surpass them in the future? Or how do you think you can surpass them?

Roger :

Our goal is not to cut out a part of the market from decentralized exchanges like GMX, but to expand the pie of the entire market.

Our main target user groups are those on centralized exchanges, such as Matcha, Lbank, BitMart and other exchanges. We hope to introduce these users to the Arbitrum chain. We have also seen the layout of these exchanges on the chain, hoping to find a way of win-win cooperation. As long as we can attract 30% to 40% of the users of a second-tier centralized exchange, it will already exceed the existing user base of GMX.

Of course, whether the final revenue can exceed GMX still depends on the product of the unit price and the number of users. Our operating market strategy is not to attract their traffic on Arbitrum, but to try to introduce the traffic from centralized exchanges to decentralized exchanges and to the Arbitrum chain. Therefore, many KOLs we cooperate with are actually users who bring orders, attract traffic and rebate commissions on centralized exchanges, and most of the projects we participate in are project parties that cooperate with centralized exchanges.

To surpass them, I think we need to do two things, which are more or less answered in the previous questions.

- First, we need to lower the barriers to entry so that more users can join SubstanceX.

- Second, we need to provide products that are superior to GMX or similar competitors in order to attract and retain users.

The value generated by the multiplication of these two things is our strategy to outperform GMX and similar competitors.

TechFlow TechFlow: For the decentralized exchange, how big do you think it will be in the long run, and how much cake will SubstanceX eat?

Roger :

I think the leading centralized exchanges, such as Binance, OKX, Bybit, etc., will continue to exist due to their efficiency and performance advantages.

However, second- and third-tier centralized exchanges may be forced to transform into decentralized exchanges. The trend I have observed is that the flow of users' funds is either to the top centralized exchange or to the chain. Almost no users withdraw cash from a second-tier centralized exchange and go to another second-tier centralized exchange with a similar ranking .

I think the volume of decentralized exchanges will continue to grow. Especially for decentralized derivatives trading, the cake in this part of the market will become bigger and bigger.

- In terms of spot trading, decentralized exchanges have replaced centralized exchanges to a certain extent. Any new project will be launched on a decentralized exchange such as Uniswap first, and then it may pass the review of the currency listing department of a first-tier centralized exchange such as Binance.

- However, in terms of contracts and other more profitable derivatives transactions, centralized exchanges currently still have certain advantages, but it remains to be seen whether this advantage will be eroded in the future.

As for how much cake SubstanceX can eat, it will depend on our product strength and market strategy. Our goal is to attract and retain more users and provide products and services that are superior to competing products. We hope to have a place in this trend.

Industry and Development: Grasp the DEX Golden Opportunity Window

TechFlow TechFlow: On the track of "decentralized exchanges", what do you think can only be achieved through "decentralization", but cannot be achieved by "centralization"? In other words, what are the opportunities or characteristics that make SubstanceX stand out?

Roger :

On the track of "decentralized exchanges", I think there are two main advantages, which cannot be realized by centralized exchanges.

- First, decentralized exchanges can achieve atomic-level alignment of accounts . In centralized exchanges, due to the need to manage a large number of currencies, each currency has its own destruction method, Tokenomics, etc., so the management of accounts is very complicated. Moreover, the accounts of centralized exchanges are not transparent, and only a few people have access to them. However, all accounts of decentralized exchanges are open and transparent, which allows them to achieve atomic-level alignment of accounts, which is impossible for centralized exchanges.

- Second, decentralized exchanges can avoid regulatory issues . A centralized exchange must have an entity, must have employees, must have a company, and must abide by the laws and regulations of the place of operation. This makes them need to invest a lot of time and energy in obtaining licenses, compliance, etc. Decentralized exchanges can avoid these problems. In addition, due to the current regulatory environment, regulators often do not have enough resources and time to focus on decentralized exchanges, which provides a golden time window for decentralized exchanges to develop and expand.

These two advantages, I think, are the key to SubstanceX's ability to stand out. We can provide transparent accounts and be free from regulatory issues in the short to medium term, which is not possible with centralized exchanges. This is also the reason why I choose to develop on this track.

TechFlow TechFlow: Looking back at the SEC’s supervision/thunderstorms of centralized exchanges, they are actually promoting users to adopt “decentralized” solutions. Do you think there will be similar key events in the future that will make users want to “decentralize”?

Roger :

In my opinion, decentralized exchanges are inherently a better business model. I often use a metaphor to explain this point of view: the problem of a centralized exchange is like squeezing water out of a sponge, while a decentralized exchange is a better basin to catch the water.

In centralized exchanges, a lot of repetitive manpower and costs are used to maintain the matching engine and upgrade risk control. In decentralized exchanges, these tasks can be completed by the underlying facilities of the public chain, avoiding the waste of resources caused by repeated wheel creation in many exchanges.

The key event in the future may be the further improvement of the underlying technology of the public chain. For example, the Arbitrum chain has undergone two upgrades. With the further improvement of the Cancun upgrade, the handling fee will be greatly reduced. It's like our "basin" has become better and better able to catch the "water" squeezed out of the "sponge". Therefore, I also hope that Arbitrum's team will work harder to do a good job at the bottom layer, reaching or even surpassing the performance of first- and second-tier centralized exchanges.

In addition, our project side needs to make better products on this better bottom layer, providing lower entry barriers and better user experience. As long as the bottom layer is efficient, the cost is low, and the product is excellent, users will naturally turn to decentralized exchanges. Therefore, I think what we should count on is not the thunderstorm of the centralized exchange, but our decentralized project and the bottom layer to do things well.

TechFlow: The last question, what do you hope SubstanceX will eventually develop into, and how do you hope users will evaluate SubstanceX?

Roger :

I hope that SubstanceX can provide a seamless user experience, so that users can feel that our service experience is as good as a centralized exchange during the entire process of logging in to the web page, registering an account, trading, settlement, and withdrawal.

However, if users are willing to dig deeper, they will find that our settlement, execution and asset ownership processes are fully decentralized and all implemented on Arbitrum. Therefore, on the premise of decentralization as much as possible, we can provide as strong a product as possible. This is how I want users to feel about SubstanceX.

Finally, in this interview, we felt that Roger, as an insider of the exchange, has a deep insight into the entire CEX/DEX business model, inherent problems and future development, as well as a detailed insight into all competing products and the pursuit of user experience details.

As an industry observer, we look forward to seeing more projects like SubstanceX land, which can provide a user experience comparable to centralized exchanges while maintaining decentralization. We also look forward to seeing the advancement of public chain technology and the emergence of better decentralized products, pushing the entire industry to develop in a more transparent, secure and user-friendly direction.