Original Author: YOND

Original Source: DEGEN Club

If the theme of OP Summer is to be hyped in the near future, Velodrome should be the first target to pay attention to. Here I list some potential catalyst events to prepare for the upcoming flywheel.

Some data V2 vs. V1

We are now at Epoch 61, which is 6 weeks after the release of Velo V2. Let's take a quick look at some key metrics.

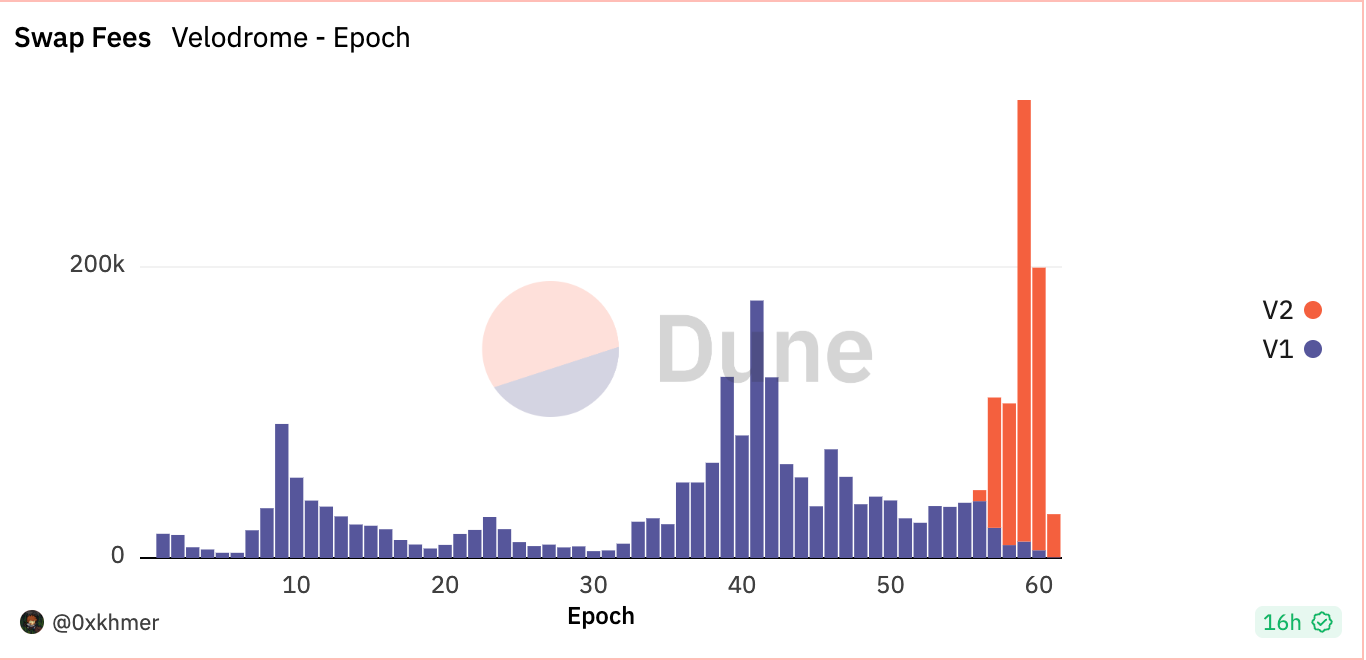

Transaction fee (https://dune.com/0xkhmer/velodrome)

Transaction fee (https://dune.com/0xkhmer/velodrome)

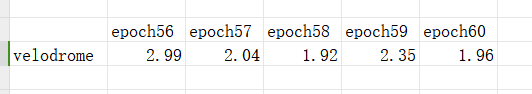

Bribe efficiency (total emission value / bribe expenditure, by @wu_xiuchen )

Bribe efficiency (total emission value / bribe expenditure, by @wu_xiuchen )

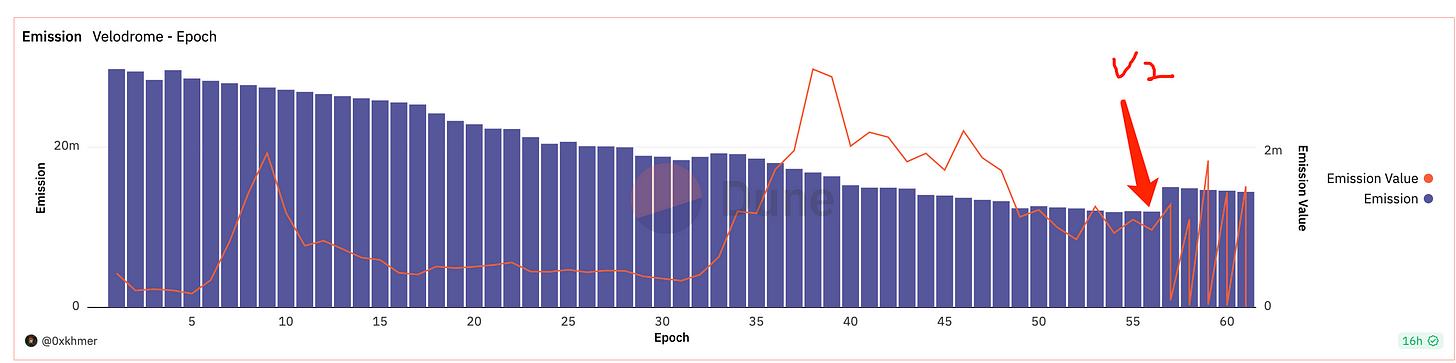

Emission data (https://dune.com/0xkhmer/velodrome)

Emission data (https://dune.com/0xkhmer/velodrome)

If the provided stats are accurate, bribery efficiency is stable at around 2, and emissions haven't increased significantly, transaction fees have skyrocketed to all-time highs from V2 onwards (the data may not be accurate, but this is the only source I can find, welcome to discuss)

Even if there is a wash trading, or there is an error in the calculation method, I still believe that Velodrome will have similar peak data sooner or later after implementing the centralized liquidity model.

Basechain Narrative

Velodrome is developing Aerodrome ! Velodrome has already beaten Uniswap and Curve on Optimism, and I don't think it will be too difficult for them to achieve the same on Base.

As the most anticipated narrative in 2023, L2 is expected to have a huge performance improvement due to Proto darksharding after the Ethereum Dencun upgrade. If you are bullish on $ARB/$OP/$CELO/$MNT all these L2 tokens, you should also keep an eye on Velodrome/Aerodrome. The trend of the top ecological agreement of a chain is often consistent with the token price behavior of the chain, but it has higher volatility (smaller market value)

Ecology is starting

To start the ve(3,3) flywheel, there must be enough loyal participants in the chain ecology. Optimism clearly lacks a robust native protocol like GMX/Treasure DAO on Arbitrum.

Most of the main holders of veVELO are multi-chain protocols. They hope to get a share of VELO emissions through the protocol's own liquidity, which makes little contribution to the actual adoption rate and does not bring organic growth to ecological development.

veVELO holders (https://dune.com/0xkhmer/velodrome-vevelo-leaderboard)

veVELO holders (https://dune.com/0xkhmer/velodrome-vevelo-leaderboard)

The stronger the original assets on a chain, the greater the stickiness of the ve(3,3) DEX on the chain, and the ve(3,3) flywheel starts according to this path:

Strong native project with healthy token economics → increased user adoption (high demand for using/trading tokens) → need for deeper liquidity to reduce slippage → ve(3,3) provides access to high liquidity Transformation → Higher bribes and emissions value → Positive flywheel

If Velo V2 delivers a roadmap update in time, Launchpad will be a huge boost to the Optimism ecosystem.

Lego

There are already several protocols building Lego around Velodrome, or announcing airdrops to veVELO/VELO holders. I expect a more mature Velodrome ecosystem to emerge.

@ExtraFi_io allows users to add leverage mining to Velodrome LP (similar to Alpaca Finance)

@Augusta_finance allows you to lend ETH with $veVELO as collateral, improving capital efficiency. Users will be rewarded with veVELO bribes and its native token $AUGU.

@BikeProtocol @aerodromefi both announced an airdrop of tokens to $veVELO holders.

There will be more projects built around Velodrome's bribe mechanism or LP, and I will keep an eye on it.