Inflation fell a lot faster than most investors and analysts predicted, hitting 3% in June. The recession most analysts predicted has not arrived, proportionally. unemployment is 3.6% near a 50-year low and the S&P 500 Index shows a 19% YTD gain.

While current market performance may lead investors to believe a recession has been avoided, three metrics consistently predict recessions over time. These leading economic indicators are key economic variables that tend to precede changes in overall economic activity, providing an early warning system of changes in the business cycle. The article will analyze these 3 indicators and explain how investors can interpret them.

The yield curve shows the relationship between short-term and long-term interest rates for government bonds. Typically, long-term bonds have a higher yield than short-term bonds to compensate investors for the risk of holding their money for longer periods of time.

Historically, yield-curve inversions have often preceded recessions. This indicator shows that investors are worried about the near future and expect interest rates to fall due to a potential recession.

US 10-year yield vs 2-year yield | Source: TradingView

The 2-year Treasury yield is currently 3.25%, while the 10-year Treasury yield is 2.95%, typical of pre-recession periods. However, that's been happening since September 2022, and historically, there's been a delay of 9 to 24 months before the contraction takes place.

The Conference Board, a nonprofit research organization, compiles a set of economic indicators known as leading economic indicators (LEI). These indicators include a variety of data points, such as building permits, stock prices, consumer expectations, Medium weekly hours worked, and more.

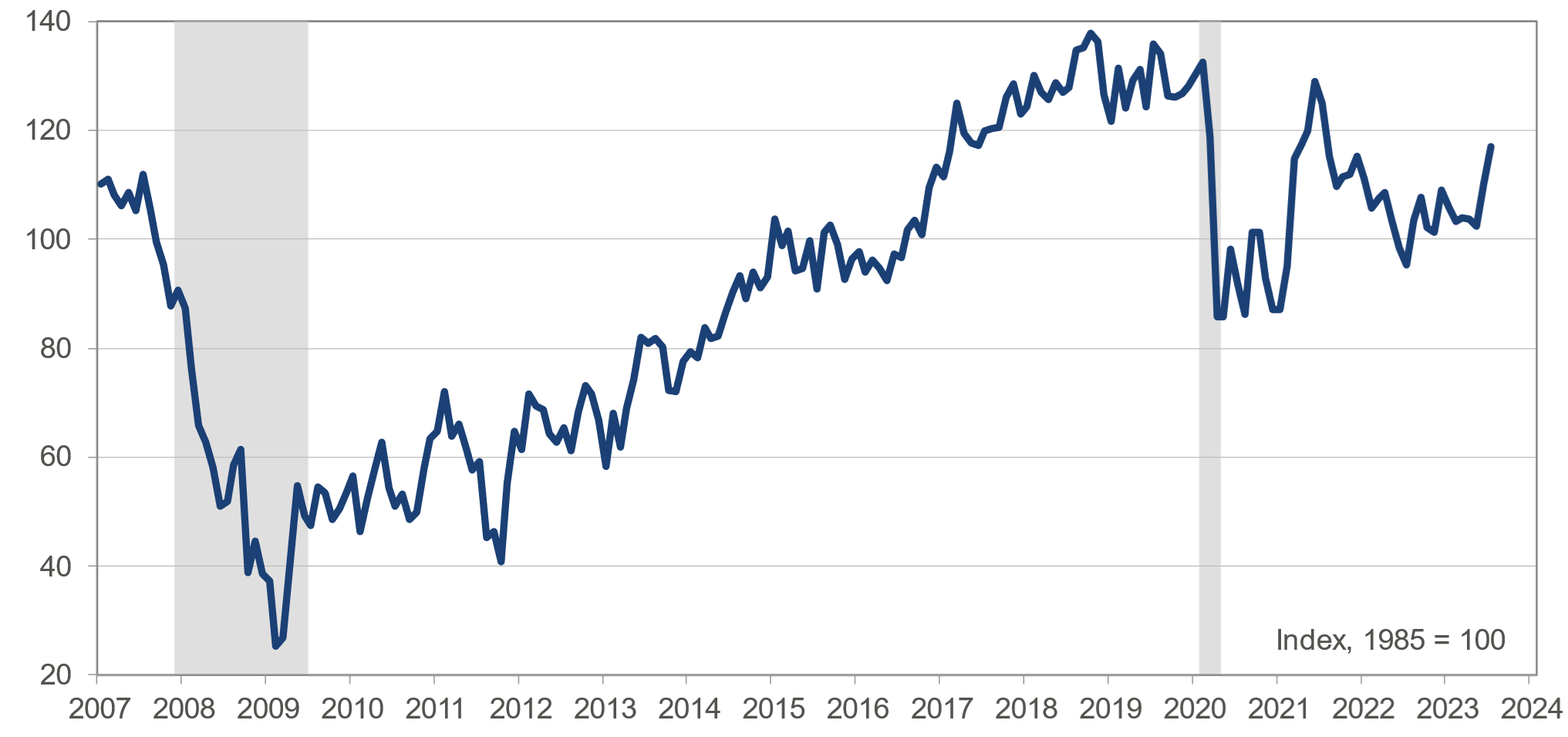

US Consumer Confidence Index | Source: The Conference Board

When these indicators start to decline or show a negative movement pattern, it could signal an impending recession. Consumer confidence index in July reached 117, the highest level in 2 years. Furthermore, according to The Conference Board, the probability of a recession in the next six months is 25%, down from 30% in June.

The Purchasing Managers' Index (PMI) is based on five key metrics: new orders, inventory levels, production, supplier deliveries, and the employment environment. PMI above 50 represents expansion and vice versa. PMI is considered a very reliable tool as it provides timely and accurate data on the manufacturing sector.

The US S&P Global Manufacturing PMI fell to 46 in July 2023, from 46.9 in June and 48.4 in May. This is the lowest reading since December 2022 and only that the manufacturing sector is in a state of contraction. In short, the global economy is slowing down and has a negative impact on demand for exports from the United States.

The US economy is currently showing mixed signals. Despite strong consumer demand due to rising wages and low unemployment, industrial growth indicators remain weak throughout 2023. Furthermore, the bond market shows reluctance to add positions. risk acceptance.

This hesitant sentiment is due to the fact that the US Federal Reserve (Fed) is expected to tighten monetary policy and raise interest rates in 2023. These signals indicate a difficult situation for the future. who is responsible for the interest rate.

If the Fed tightens policy too much, they can slow the economy very quickly, leading to a recession. On the other hand, if the Fed is too lenient, it can cause high inflation, erode purchasing power and destabilize the currency.

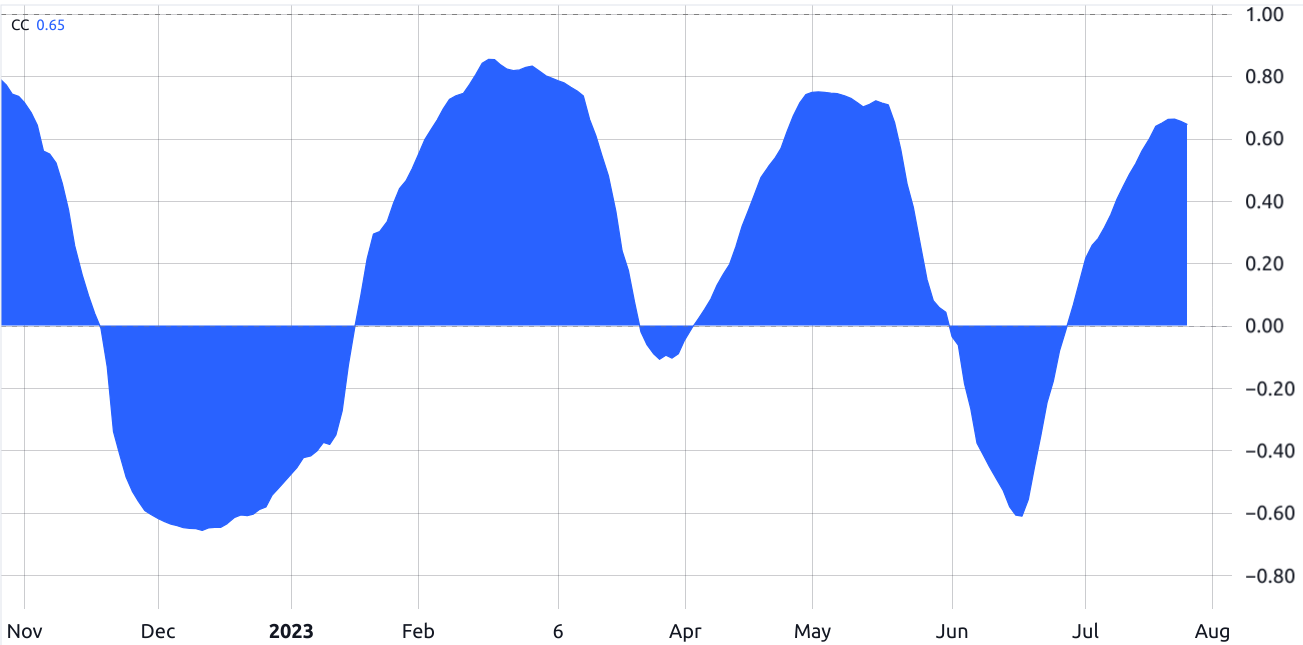

For crypto investors, there is an additional variable that further complicates the analysis. Despite the high long-term correlation between Bitcoin and the equity market, the past 8 months have shown periods of inverse trends, meaning the two assets move in different directions.

S&P 500 Futures Contract 50-Day Correlation Against Bitcoin | Source: TradingView

Amid crypto market turmoil, Fed decisions are key to revealing economic confidence. Rate hike signifies stability, potentially bountiful for crypto markets in the short term, while rate cut indicates economic concerns, which could weigh on risk markets Generally speaking. As a result, monitoring the Fed will provide timely guidance to investors during uncertain economic times.

You can see the Coin prices here.

Join Telegram of Bitcoin Magazine: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Minh Anh

According to Cointelegraph