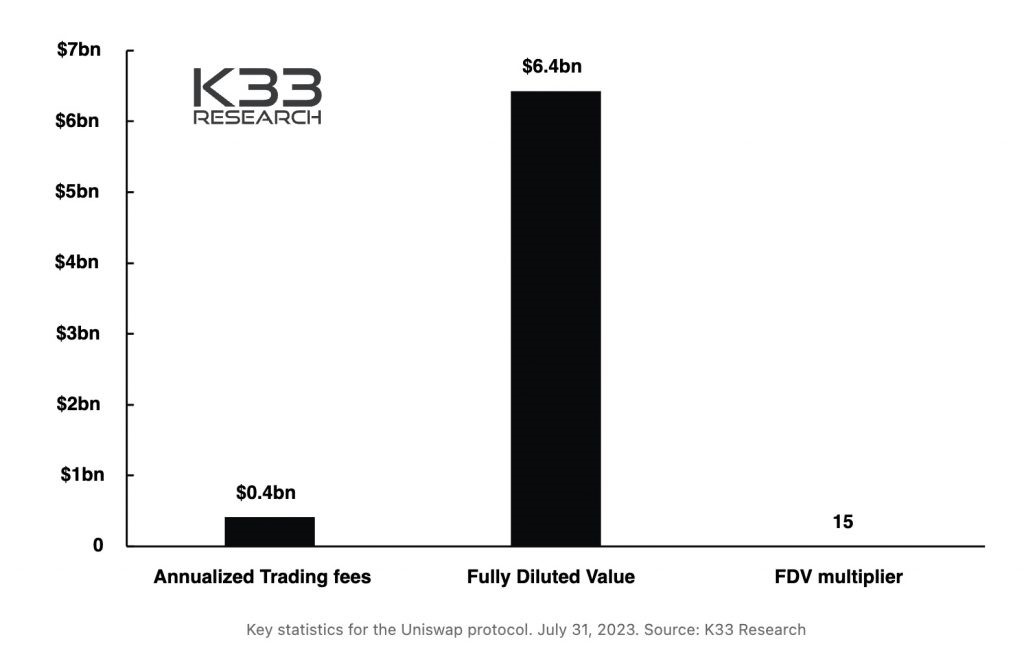

Recently, K33 Research conducted an in-depth analysis of the UNI Token 's potential as the governance mechanism of the Uniswap decentralized exchange (DEX) protocol. These findings shed light on why the UNI Token may have trouble capturing a significant portion of the impressive $3 billion in transaction fees on the platform. Although UNI was initially seen as a viable means of distributing fees to holders, it appears that various obstacles are standing in the way of this vision.

Source: K33 Research

At its core, the UNI Token serves as a governance mechanism, allowing holders to have a say in the platform's operation and future development. Currently, Uniswap operates at a fee of 0.3% per transaction. All these fees are routed to the LP. However, governance votes have the power to redefine this fee structure, potentially passing fees on to UNI holders as dividends. In addition, the Token supply is fixed, so a majority vote is required to issue more UNI Token, similar to the decision-making process in a regular shareholder setup.

The main value proposition of the UNI Token is Uniswap's substantial transaction fee share. However, analysis by K33 Research has pointed to a number of factors that may hinder the realization of this vision.

1. User preference for Liquidation: Liquidation is the lifeblood of DEX platforms, and users are always flocking to exchanges that offer the best rates and wide range of trading options. Uniswap's popularity largely depends on its impressive Liquidation across different Token pairs. As a result, UNI faces a challenge in providing incentives directly to users to remain exclusive in the Uniswap ecosystem.

2. Ease of replication: DEX protocols that mirror Uniswap's functionality are becoming increasingly popular. It is relatively easy and cost-effective to make such copies, leading to fierce competition. Rival protocols have the potential to entice LP with attractive offers, thereby reducing Uniswap's market position and undermining the UNI Token's value proposition.

3. LP Holds Power: The ability to quickly switch between DEX protocols gives LP an advantage in charging transaction fees. With valuable assets in hand, LP can easily switch to the most profitable platform, putting UNI Token and the Uniswap protocol at a disadvantage.

Despite the obvious hurdles, Uniswap stands firm as the pioneering DEX protocol. As the DeFi landscape continues to evolve rapidly, UNI may find other ways to deliver value to holders. While the immediate potential for garnering substantial transaction fees may seem limited, Uniswap and the UNI Token can adapt to market dynamics and come up with new solutions in the long run.

In summary, the path that UNI Token need to traverse to capture a decent portion of Uniswap transaction fees seems challenging. The complex user interaction for Liquidation, the ease of protocol replication, and the advantages enjoyed by LP create a fiercely competitive environment. However, as the DeFi ecosystem continues to grow, Uniswap and its Governance Token could surprise us with innovative strategies to redefine their role and enhance the utility of the UNI Token . to the parties involved.

Join Telegram of Bitcoin Magazine: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Home home

According to AZCoin News