Short-term Bitcoin holders are in a state of floating losses

According to The Block , after falling over the past two weeks, Bitcoin’s “Short-Term Holder Payout Profit Ratio (STH-SOPR)” has dropped from 1 to 0.9809. "Short-term holder payout profit ratio" is an on-chain metric used to measure the profitability of short-term holders of Bitcoin when trading.

Specifically, when STH-SOPR is above 1, it means that short-term holders are on average profitable when selling Bitcoin, but when it is below 1, it means that short-term holders are selling. Bitcoin usually loses money. CryptoQuant analyst Adam Mourad said that after the news of Grayscale’s victory came out, the surge in Bitcoin prices caused STH-SOPR to stabilize at the level of 1, which means that short-term holders are at the break-even point, but the decline in the past two weeks Causing this number to fall below 1 means that short-term holders are currently losing money on average.

Adam Mourad Warning:

“During a price correction, the decline in STH-SOPR indicates that many short-term holders may panic sell their Bitcoin, causing the overall price to decline. This behavior may lead to a vicious cycle of continued price decline.”

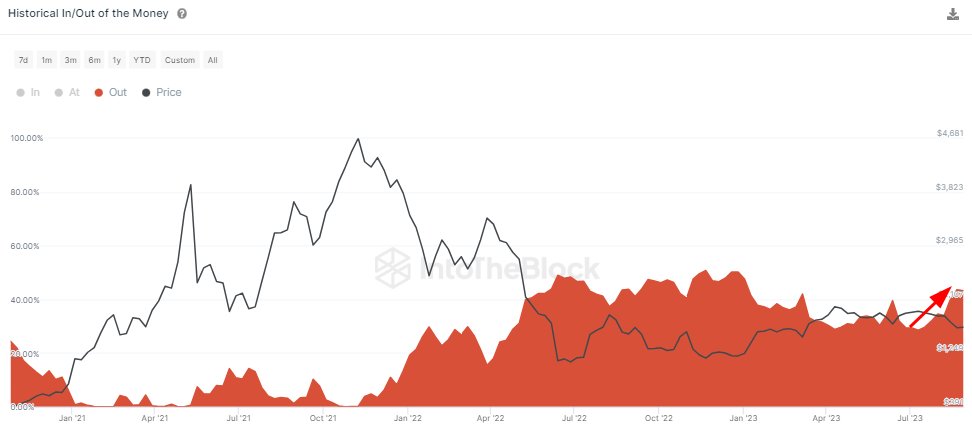

The proportion of Ethereum holders with floating losses has surged

On the other hand, according to IntoTheBlock, most current Ethereum holders are also in a state of floating losses. Data shows that the proportion of Ethereum holders with floating losses has increased from about 27% in early July to the current 44.2%. The highest level we have seen since the start of the bear market is around 50%, which may mean we may be approaching a cyclical bottom, but it is also possible that we will see a higher floating loss ratio.