Bitcoin security is broken and may fail in 5-9 years leaving inflation as the only solution to break the 21M supply limit.

Written by Justin Bons

Compiled by: LayerTwo Labs

Bitcoin’s security model is broken.

——Europe ’s oldest cryptocurrency fund [1] @CyberCapital [2] Founder @Justin_Bons [3]

3:23 - Original Twitter post on September 9, 2023 [4]

3:23 - Original Twitter post on September 9, 2023 [4]

What is the Bitcoin cybersecurity budget issue?

1/36) BTC’s security model is broken and for a century, its price must double every four years or suffer extremely high fees! Just to maintain the current level of security...it's impossible because it has exceeded global GDP in 31 years. Therefore, BTC security is a foregone conclusion

2/36) Each halving reduces the security budget exponentially; until it disappears! After more than 80 years of global GDP, these halvings are still continuing until they are completely exhausted, which if you understand indexes and economics you should know is完全不可能的!

3/36) Due to the ratcheting effect of the fee market, fees will never reach持续的极端水平. In a highly competitive market, it is unrealistic to pay hundreds of dollars for a single TX. When fees soar, users will leave. This is all due to an unnecessary increase in the block size limit!

4/36) This all means that without extremely high transaction fees in the future, the long-term security of BTC is unsustainable! , the security of BTC will inevitably continue to decline until攻击变得有利可图, which I predict will在5-9 年后发生! (2-3 halved)

5/36) Computing power does not equal security; Bitcoin enthusiasts like @saylor do not understand PoW [5] . This miner income chart proves that现在BTC 的安全性实际上比2 年前还要低! This chart shows that BTC 矿工收入(block rewards), not hashrate, is declining:

6/36) Hashrate is an almost meaningless metric for computational security as miner revenue will likely go down while hash rate goes up because as hardware improves the cost of generating those hashes increases will decrease, which is why we can't calculate the hash to determine the security budget!

7/36) Because it’s not the hashes that protect BTC: it’s the cost of generating those hashes that protects BTC! In other words;要的是攻击BTC 的成本, which is not determined by computing power! It is determined by the attacker's cost/reward calculation

8/36) Cryptoeconomics game theory relies on penalties and rewards; carrots plus sticks, which is why miner revenue determines the cost of an attack, when it comes to the reward side of calculations: The double spend of a 51% attack on an exchange is A realistic attack vector:

9/36) Set the minimum threshold for attacks to millions per day, assuming prices don’t increase significantly we’d predict reaching this target in 5-9 years, censorship is also likely to occur when security budgets are too low , as evil actors gain a majority

10/36) There is a common but patently wrong rebuttal to this; nodes secure the network, which is a ridiculous claim since there is no Sybil resistance to non-mining nodes! Since security comes from block production incentives, pure "full nodes" do not share block production incentives.

11/36) So what does this all mean? This means that BTC 的长期安全陷入深渊. Without extremely high transaction fees, the security of BTC will inevitably continue to decline until it drops so low that the network becomes monetizable by attacks, thereby making BTC Becoming unsafe!

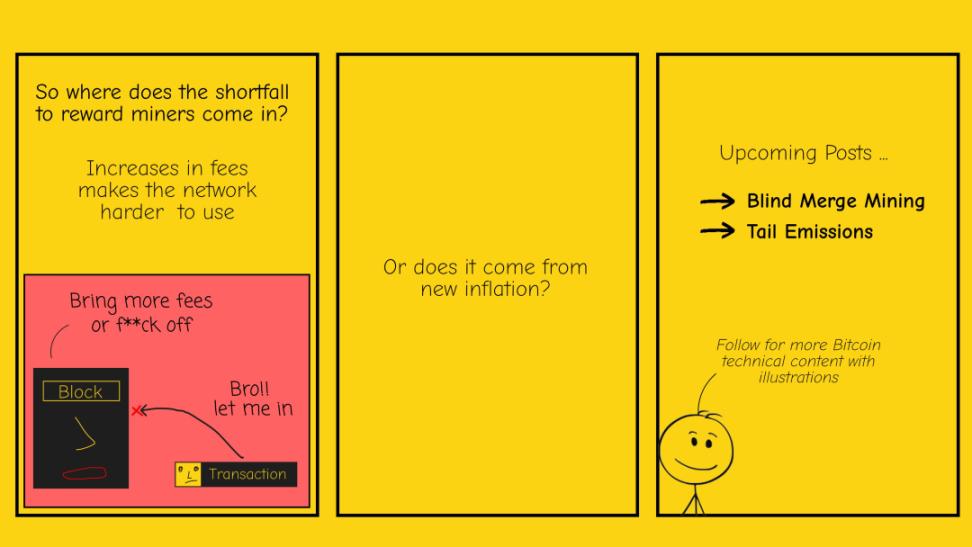

12/36) There are only two options left at this time:

- Increasing BTC supply inflation by over 21 million! [Additional issuance? 】

- Allowing the network to be vulnerable to double spends and censorship attacks BTC is somewhere between a pet rock and a hard place; think about it and consider who else is saying this:

Translator's note:

Meet Bitcoin’s iPhone moment

13/36) @ercwl [6] and @gametheorizing [7] , both agree with me in our debate on this topic, even top core developers like @peterktodd [8] agree that the writing is on the wall : "比特币持有者将不得不做出这个艰难的选择,否则就会眼睁睁地看着比特币的安全性在他们眼前崩溃」

14/36) As a BTC critic, I don’t think BTC will be able to resolve this dilemma in time, as it is designed to overturn its main touted benefits, which Bitcoin proponents in favor of increasing supply clearly don’t see, and I am Bitcoiners who speak this truth have the utmost respect

15/36) Because they are doing everything they can to protect the origin of BTC, Bitcoin supporters who deny this will only make the situation worse, promising people that BTC will always have a 21M limit damages trust; letting them down, once It’s natural to feel betrayed!

16/36) Because they are misleading people to support BTC based on false excuses! BTC is not a good or competitive SoV, choosing between security and scarcity is not a good choice, especially when competitors can provide security, scarcity and capacity; all, with BTC different!

17/36) The most likely outcome in 5-9 years is that both options happen simultaneously splitting the network in half again and causing more chaos in the process, one with inflation and the other without inflation, both more Vulnerable to attacks, falling prices further worsen security posture

18/36) This all happened because BTC’s governance couldn’t resolve such a dilemma without fragmentation, my original 2013 thesis on investing in BTC was ruined by the people we trusted to maintain it, and problems ensued ;What we are witnessing is a failure of governance:

19/36) BTC’s history of power struggles and civil wars is symptomatic of this failure. The fact is that the main client “Bitcoin Core” has effectively achieved centralized control over the development of BTC, transforming it into a one-party system, with Bitcoin Core acting as gatekeeper of all change

20/36) Currently, more than 99% of all nodes are using Bitcoin Core, which is extremely centralized! There is actually only one main defender who has the final say on all decisions, making it a dictatorship, and like all dictatorships, there are limits to their power.

21/36) This is still a complete misrepresentation of the idea of decentralization that BTC is supposed to represent. Another consequence of the block size debate is that it inhibits competing customers in favor of Core, which is what hinders all efforts to solve the security dilemma. s reason.

22/36) The myth of BTC; is a decentralized meritocracy , which is far from the truth. Bitcoin Core has disproportionate power to make any changes, such as the RBF while expelling anyone who disagrees with them, such as Gavin Andresen, Mike Hearn & Jeff Garzik

23/36) This is why diverse competing client implementations are so important for true decentralization, BTC has been effectively captured, which is a clear failure of decentralized governance, a topic I dive deeper into that you can Find it here:

[Original text: Theory On Bitcoin Governance; Three Stage Model (v.1.0)](https://medium.com/cyber-capital/theory-on-bitcoin-governance-three-stage-model-v-1-0- 98a8b83095b0 "Original text: Theory On Bitcoin Governance; Three Stage Model (v.1.0 "Original text: Theory On Bitcoin Governance; Three Stage Model (v.1.0)")")

24/36) The roots of this major flaw can be traced back to the historical block size debate. The original design of BTC was not so incredibly flawed. The fact is that BTC changed its purpose during the block size debate. Economy and Vision, contrary to popular belief:

25/36) Not increasing the block size limit is a significant departure from the original vision and purpose of Bitcoin, and conceivably, serving a large number of traders and paying a small fee per trader is a more realistic path to sustainable development , as opposed to a handful of traders paying high fees

26/36) As in the previous case, BTC will provide valuable utility to billions of people, which is clearly what BTC has always wanted to do, and is even clearly stated in the Bitcoin white paper, allowing Bitcoin to truly become a currency rights were taken away from us by those in power.

27/36) To make this even more tragic: BTC could achieve massive scale while remaining decentralized If it only borrowed some code from BCH, it could support VISA scale on a laptop from ten years ago! The threat of supporting larger blocks is exaggerated!

28/36) Block size limits now limit BTC’s throughput to between 7-22 transactions per second which means it would take over seventy years for everyone in the world to make just one transaction! It is completely impossible to make BTC widely and widely used!

29/36) Because from a technical perspective, usage is actually already limited, it cannot and will never be the “future of money”. Congestion also causes BTC transactions to become unreliable as fees cannot be perfectly predicted, resulting in failed transactions.

30/36) Some people have proposed the Lightning Network as a solution to this problem. However, getting people onto the Lightning Network in a non-custodial way would actually require multiple on-chain transactions. During periods of congestion, high fees would also be passed on to Lightning Network users. , forcing the channel to close

31/36) The block size limit destroys all potential use cases for BTC because any significant usage is impossible. Whenever real use cases do take off, it just leads to skyrocketing fees and congestion which ultimately drives people away. ;This is why BTC has no utility

32/36) It is this lack of utility that is at the heart of BTC’s inability to generate sufficient fee revenue to sustain its security model and is what transforms BTC from a useful medium of exchange and store of value to a purely speculative store of value. The decline of

33/36) The bad guys are misleading people by downplaying this threat and leading them into this waiting disaster. You can verify this for yourself with a full node! BTC is not impossible to fix; by increasing the block size limit and building apps that people will want to use and pay for!

34/36) No matter how unlikely I think this is possible after the utility companies were kicked out following the block size debate If you are a Bitcoin enthusiast and want to fight for Bitcoin this is how to do it; by allowing utility Programs and real-world use cases thrive in BTC, just like they do in ETH. It’s your choice!

35/36) I fight to protect Bitcoin and its original vision. We are lost, BTC is now an empty shell, twisted and captured现在我们要警告人们即将到来的失败because I do believe in this movement. Even BTC’s security model will fail within ten years!

36/36) Conclusion BTC security has been broken and may fail in 5-9 years , leaving (additional issuance) inflation as the only solution to break through the 21M supply limit! Bitcoin Governance Blocks Any Solution Before It's Too Late Our beautiful experiment is now teaching us through its failure!

References

[1] Europe’s oldest cryptocurrency fund: https://cyber.capital/

[2]@CyberCapital: https://twitter.com/CyberCapital

[3]@Justin_Bons: https://twitter.com/Justin_Bons

[4]Twitter original post: https://twitter.com/Justin_Bons/status/1700228438798287150

[5] Bitcoin enthusiasts like @saylor don’t understand PoW: https://twitter.com/saylor

[6]@ercwl: https://twitter.com/ercwl

[7]@gametheorizing: https://twitter.com/gametheorizing

[8]@peterktodd: https://twitter.com/peterktodd