Original author: @unexployed_

Original translation: Huohuo/Vernacular Blockchain

The cryptocurrency social platform Friend Tech has been popular recently, but @unexployed_ research found that snipers used some strategies to control high-value accounts on the platform, causing sharp fluctuations in supply and price increases.

This story highlights some of the challenges in the cryptocurrency world, including supply manipulation and price manipulation, and how social platforms are addressing these issues. Through this article, I hope to convey the stories behind these events, as well as thoughts and suggestions on how to deal with these problems. This situation is not just a technical transaction, but also involves the health of the platform ecosystem and the interests of users.

The following is the text:

MEV is evolving at @friendtech and this article tells the story of multiple snipers grabbing ~20 shares from each other and dumping on each other. This is a true MEV player versus player feast.

Let’s take a look at what’s going on, how they might be doing it, including, of course, how much profit this bot is making.

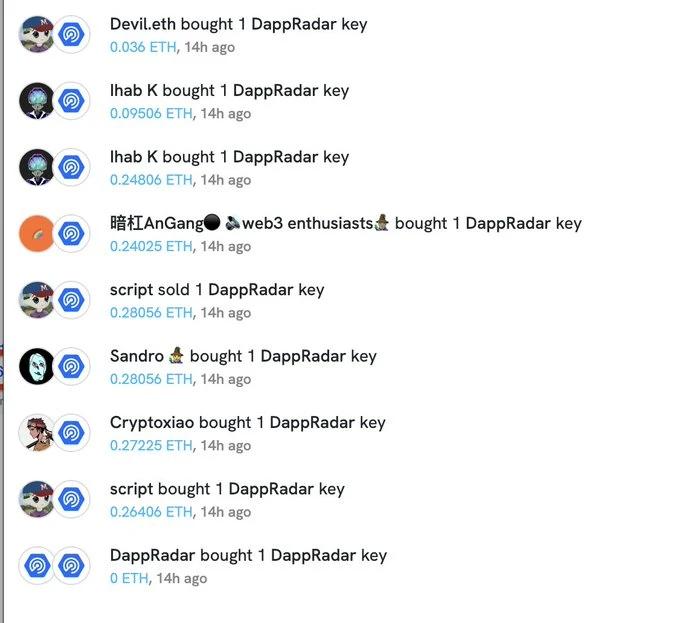

So, @0x GhostCasper and I have been trying to build a good bot for @friendtech. One of our goals is to find high value accounts. Recently, our script notified us of @DappRadar registrations, but to our surprise the share price started to be very high!

What's happening here?

When looking at Friend Tech itself, you will immediately see that the price is 0.26 ETH. But it's unclear who pushed prices to this point. This is most likely because the sniper address is not using a registered account, but is interacting directly with the smart contract.

To view the purchase, we need to drill into basescan ( https://basescan.org/txsInternal?a=0x84652f7a1839d383eb029a1d37fcc98d0fdfa1d3&p= 2 ) and navigate to @DappRadar’s FT address and internal transaction.

This allows you to find the chronological order of buyers and sellers.

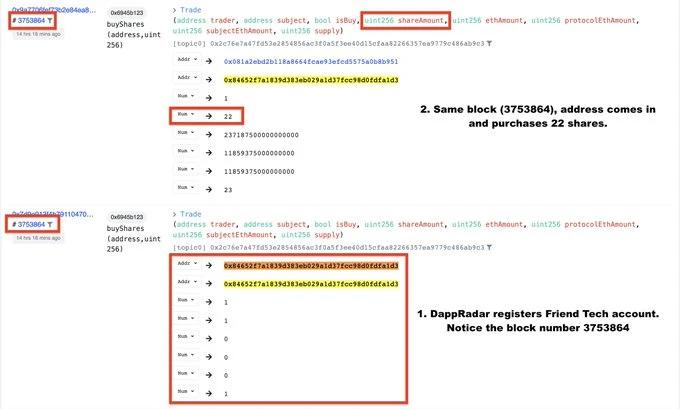

Block 3753864 (t): @DappRadar registered their account, 0x 081...951 managed to purchase 22 shares.

Block 3753865 (t+1): Two more sniper addresses purchased shares, 20 shares each.

Block 3753867 (t+3): The fourth sniper purchased 2 shares from an unverified contract.

In the first 4 blocks, there are already 65 shares on the market.

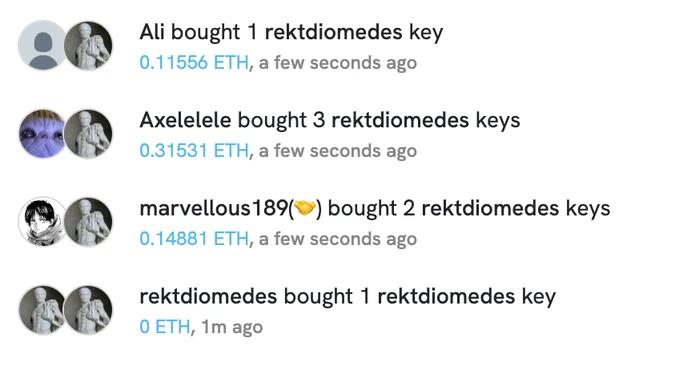

And, @dappradar is not alone, there are many other examples, like @moonshilla and @rektdiomedes, where snipers instantly take control of someone's FT supply.

Now, back to our first sniper: 0x 081...951 .

Before highlighting how much he actually made, let's consider how he earned those shares in the first place.

Pretty simple: He made over 20,000 transactions, going on and on, which took up almost the entire blockchain. ( https://basescan.org/address/0x081a2ebd2b118a8664fcae93efcd5575a0b8b951 )

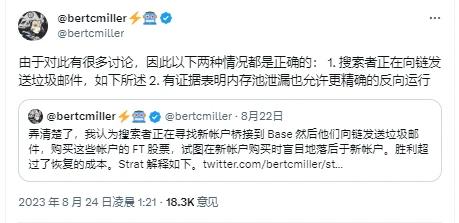

This crappy behavior has been happening in Friend Tech's first week and has been reported by Flashbots ' Bert Miller (see attached tweet). Apparently, mempool leaks are a key explanation here as well.

Now that we may have revealed his methods, let's see how much this guy actually made from this sniping.

Remember, in the first 4 blocks, the critical supply increased to 65 shares, of which he controlled about 1/3.

He was the first to buy and one of the first to sell!

Block 3753913 (t+49): He sold his 5 shares for 1.15 ETH when the total supply was 67.

Block 3753965 (t+99): He sold his last 17 shares for 0.94 ETH when the total supply was 40.

Sniper #1: Profit: 1.84 ETH (2.09 E - 0.24 E after gas and FT fees)

As you can see, supply decreased significantly between his two sales.

This is because the third sniper decided that enough was enough and he sold his 20 shares, taking a considerable loss in case more sales occurred.

Sniper #2: Loss: 0.5 E (3.48 E - 2.98 E after gas and FT fees)

And you still think @friendtech is about making friends... No, in fact it is also a peer-to-peer crypto competition on the chain.

What we learned:

1) Ordinary people have almost no opportunity to obtain cheap high-value materials.

2) High value materials have little chance of preserving their supply.

I hope @friendtech can solve these problems. For now, it looks like it's worth adopting the classic "buy after the sniper is out" strategy.

Especially given that the price curve is a bit skewed, this could lead to a rather unhealthy situation if large profiles were immediately subject to sniper attacks.

@0x GhostCasper and I support CL’s proposed solution to allow creators to purchase more shares upon registration.

This might solve part of the problem and hopefully you learned something!

DappRadar FT address: 0x84652f7a1839d383Eb029a1d37fCC98D0fdFa1d3

Sniper #1 Address: 0x081a2ebd2b118a8664fcae93efcd5575a0b8b951

Sniper #3 Address: 0x3530427f4217e66b2a873e331133fefa4bb72893

Sniper #2 Address: 0xff231524719db94a0ef08a88fc4e6939134eade8

Huge shout out to @castle__cap for bringing the big guys together.

Another major problem is that these purchases are not displayed on the interface.

Uninformed users may have missed Sniper’s sharp price increase and impending sell-off.

This actually does a disservice to the organic and genuine users of the platform.