By Tyler Pearson & Adam Morgan McCarthy, DL News

Compiled by: Felix, PANews

After a blowout 2022, crypto market sentiment is in the doldrums, characterized by declining trading volumes and a lack of liquidity.

How serious is it?

To help make sense of it all, this article provides three charts that explain the current state of the industry.

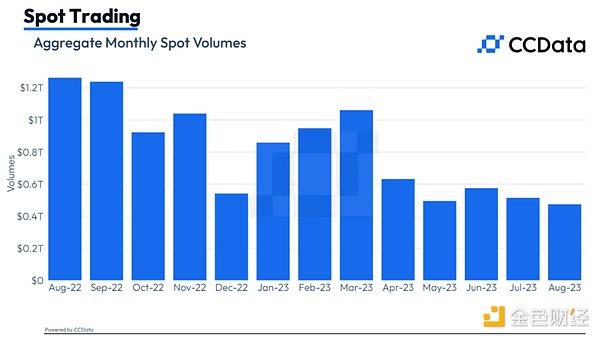

Spot trading volume hits 2019 low

In 2023, cryptocurrency spot trading volume continued to decline. Volume hit multi-year lows in May and then hit multi-year lows again in August.

According to crypto research and analytics firm CCData, trading volume on centralized exchanges last month was just $475 billion, a drop of nearly 8%. The company said this was the lowest spot trading volume since March 2019.

CCData analysts said that on August 26, the daily trading volume of centralized exchanges was nearly $6 billion, which was the lowest level since February 2019.

Monthly spot trading volume (CCData/CCData)

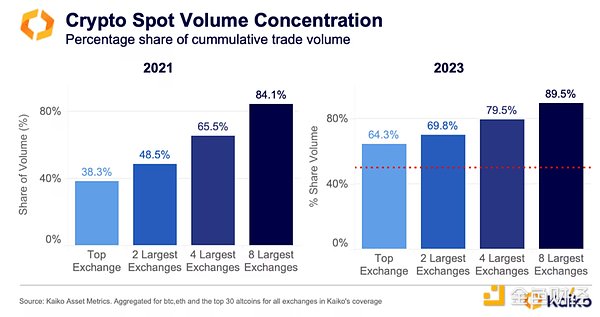

The crypto market is too concentrated

As research firm Kaiko points out, the market is overly concentrated in a handful of exchanges.

The company said eight centralized exchanges currently control nearly 90% of cryptocurrency market trading volume, up from 84% in 2021.

Most notable among the improvements over the past few years is Binance’s overwhelming leadership – its share of global trading volume has almost doubled to 64%.

Cryptocurrency spot trading volume concentrated on CEX (Kaiko)

Kaiko commentators highlighted the potential dangers of liquidity concentration, which could lead to a single point of failure causing large amounts of liquidity to disappear, as seen with the FTX crash in 2022.

Analysts at CCData said Binance remains the largest spot trading venue for cryptocurrencies, with trading volume reaching $183 billion. However, they added that the exchange's market share has declined for the sixth consecutive month, falling to 38% in August, its lowest market share since August 2022.

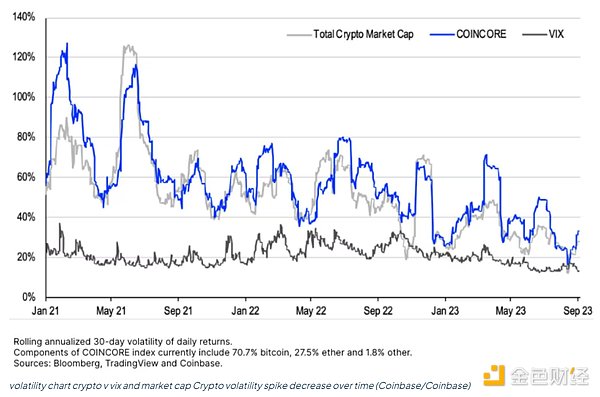

Volatility has declined steadily since 2021

Although the cryptocurrency market is known for high volatility, it has been declining steadily over the past three years, resulting in fewer volatility spikes.

Crypto market volatility is represented on the chart by the line labeled Coincore (blue line below), which is Coinbase’s measure of crypto volatility. David Duong, director of institutional research at Coinbase, noted that the trend has been downwards.

Recently, cryptocurrency volatility has even been “close” to the Cboe Volatility Index, also known as the VIX, David Duong said.

The VIX, sometimes called the "fear gauge," is a measure of expected volatility and investor sentiment. It tracks the S&P 500 and rises when there is uncertainty or panic in financial markets.

Volatility chart

Last month, Bitcoin volatility hit an all-time low, with prices plummeting days later and investors suffering over $1 billion in liquidations on August 17.

A report released on Tuesday by K33 Research (formerly Arcane) showed that volatility will increase going forward. The company said volatility is widening compared with previous weeks.

While volatile markets are dangerous and can lead to higher losses, they can also provide higher rewards for traders willing to accept the risk. Professional traders love volatility because volatile markets provide better opportunities to exploit pricing gaps.

Bitcoin rebounds

Bitcoin is a bright spot in the cryptocurrency market. It's up more than 50% so far this year. The global market capitalization of all cryptocurrencies has grown by nearly $200 billion to $1.1 trillion.

Bitcoin price action so far this year

James Butterfill, head of research at CoinShares, said that although it failed to reverse the downward trend in trading volume, the plunge in trading volume was "reminiscent of the pre-bull market in 2019 and 2020," but it was already a very high bar.

In 2021 and 2022, daily trading volume has soared to approximately US$14 billion and US$11 billion respectively. This year, daily trading volumes for the leading cryptocurrency by market capitalization have averaged approximately $7 billion.

Binance’s decision to end its zero-fee campaign for traders in March this year led to a drop in trading volume.

Binance has been making 13 Bitcoin spot trading pairs fee-free, including Bitcoin and Tether trading pairs.