Investor caution developed ahead of the FOMC regular meeting, causing the market to move sideways

BTC dominance rises due to expectations of approval of BTC spot ETF and bad news about altcoins

Glassnode Co-Founder Glassnode Reveals Mixed BTC Outlook

In particular, expectations for the approval of the Bitcoin (BTC) spot ETF, the possibility of FTX disposing of altcoins, and additional regulations on altcoins combined to create a strong trend for Bitcoin dominance.

Markus Thielen, senior researcher at Matrixport, said in an interview with CoinDesk TV about the rise in Bitcoin dominance, “Bitcoin is under buying pressure due to expectations of the approval of a spot ETF, while altcoins are on the verge of decline.” He mentioned.

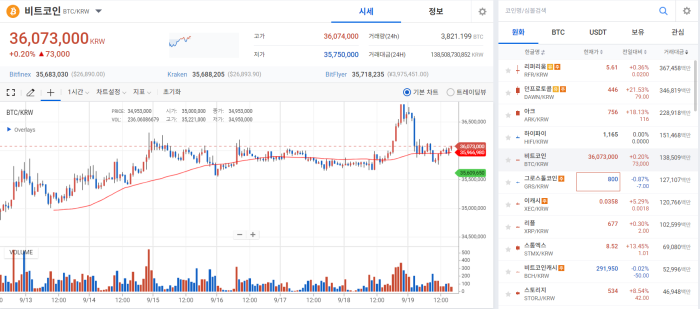

◇Bitcoin = As of Upbit at 5 p.m. on the 19th, the price of Bitcoin (BTC) is recording 36.07 million won. Bitcoin market share (dominance) was 50.01%.

At the FOMC regular meeting in September, the price outlook surrounding Bitcoin also showed mixed results, as all scenarios, including interest rate hikes and freezes, were possible.

Glassnode co-founder 'Negentropic' predicted Bitcoin's market turnaround through his X account.

He pointed out, "As a result of analyzing recent on-chain data, Bitcoin's risk level has decreased below 60," and "Despite the movement of many people selling Bitcoin, Bitcoin is maintaining its current position without a significant decline."

Generally, a risk value of 60 in on-chain data means a ‘market turn’.

He pointed to $28,200 as the next resistance level and predicted that Bitcoin would eventually break through it and reach $30,000.

On the other hand, Glassnode analyzed in its own report that Bitcoin's rise would be greatly limited, pointing out the absence of any particular Bitcoin upward momentum.

Glassnode's weekly report analyzed, "As Bitcoin fell below $26,000 in mid-August, most short-term holders returned to 'loss status'" and "upward momentum is expected to be weak."

◇ Rising Coin = Based on Upbit, the cryptocurrency that rose the steepest on the 19th was Dawn Protocol (DAWN), which rose by about 22%.

Dawn Protocol is a native token used in Dawn Protocol, a platform that provides tournament competition services to users of PC games such as Call of Duty and Dota. Dawn Protocol is traded as admission fees, item purchases, and rewards within the ‘Play to Earn (P2E)’ game service.

◇Fear and Greed Index = The cryptocurrency fear-greed index provided by Alternative has entered the ‘Fear’ stage with 46 points. The fear stage (25-49) is the stage where price volatility and trading volume increase and the price falls. There is a high possibility of a short-term low forming, so you should be cautious when purchasing.

Reporter Seungwon Kwon ksw@