Recently, the easily observable fluctuations in the market seem to be concentrated on the tokens traded by friendtech and DWF.

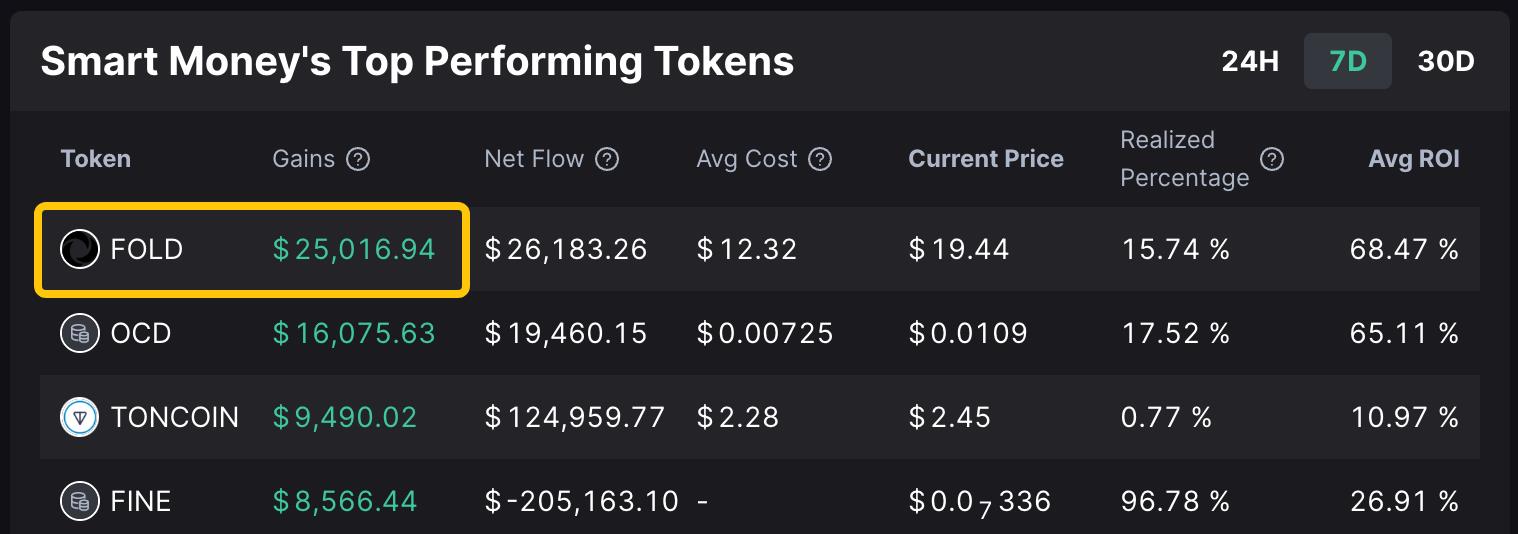

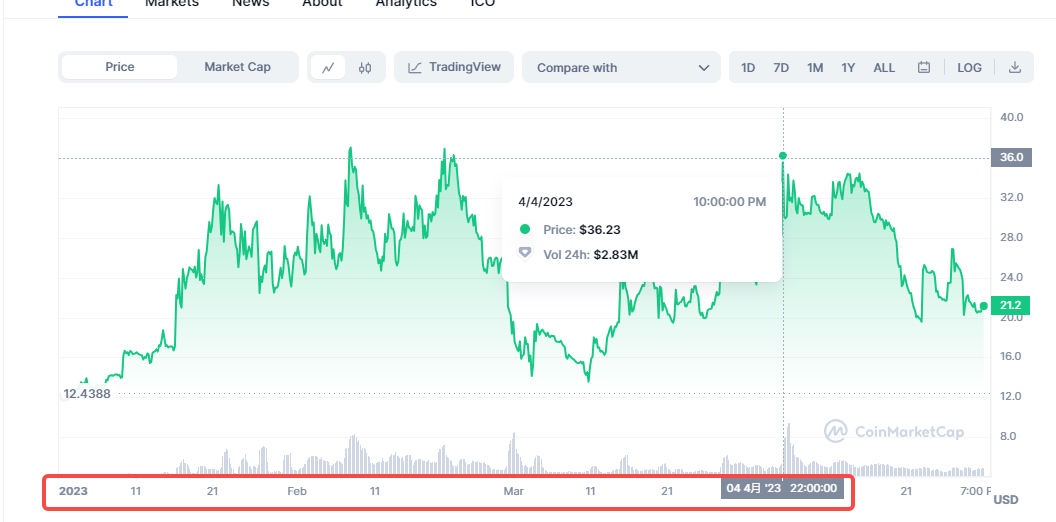

Outside the mainstream view, Manifold Finance’s old currency $FOLD quietly completed an increase of more than 100% in 7 days.

At the same time, FOLD also ranked first in the ranking of token returns bought by smart money.

However, because FOLD tokens do not have liquidity on larger CEXs, and Manifold Finance’s business is relatively technical in the MEV field and is not so intuitive and easy to understand, so few people in the Chinese area have conducted in-depth research and introduction to it.

But we all know that rapid price movements are often driven by expectations and narratives.

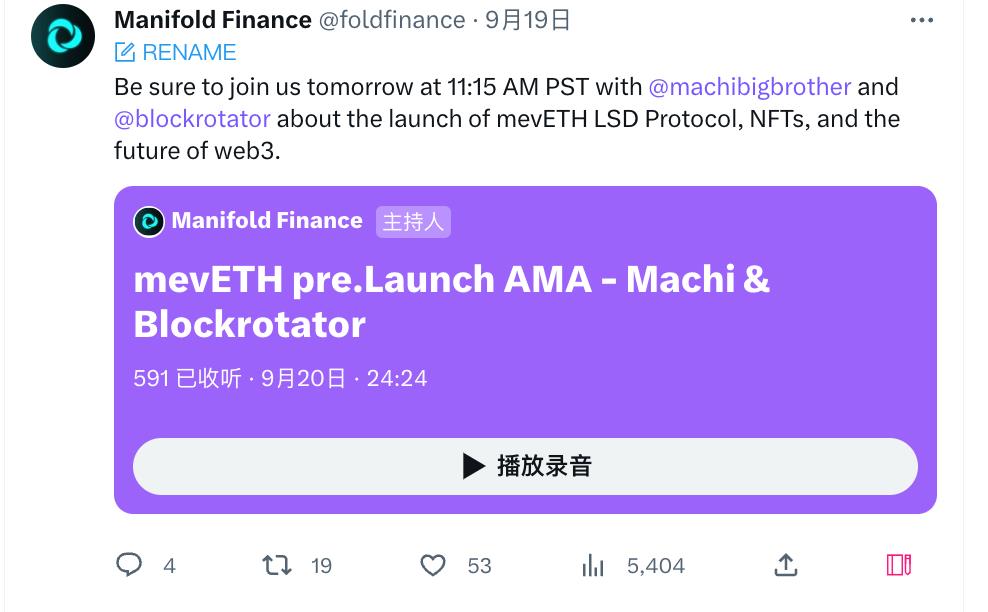

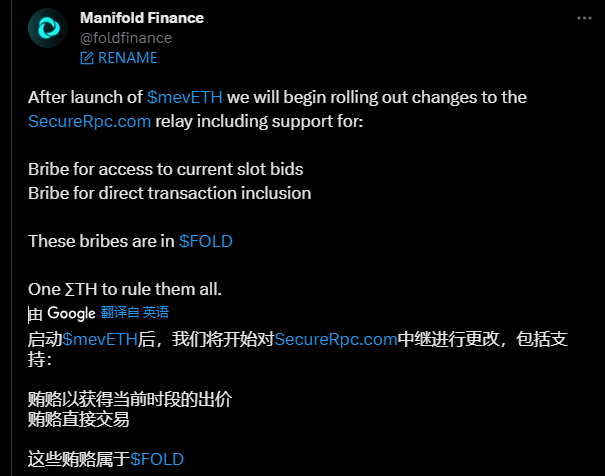

Manifold Finance recently announced on its Twitter that the mevETH protocol related to LSD will be released soon, and invited Machi Big Brother and others to hold an AMA to build momentum.

As can be seen from the prefix mevETH, MEV, liquidity staking and income optimization, multiple concepts have guided speculative expectations and become the catalyst for the recent increase in $FOLD.

At present, the LSD track is gradually involution, and Manifold’s mevETH may provide a unique solution to increase returns.

If Manifold builds its own new LSD staking protocol, the higher returns will make it a disruptor; if other pledgers choose to integrate its mevETH solution, then this will be a greater benefit to the protocol itself.

When liquidity staking is supported by MEV income, will FOLD tokens have new functions? What changes will the entire LSD track usher in?

Manifold already has business: building high-value blocks and SecureRPC

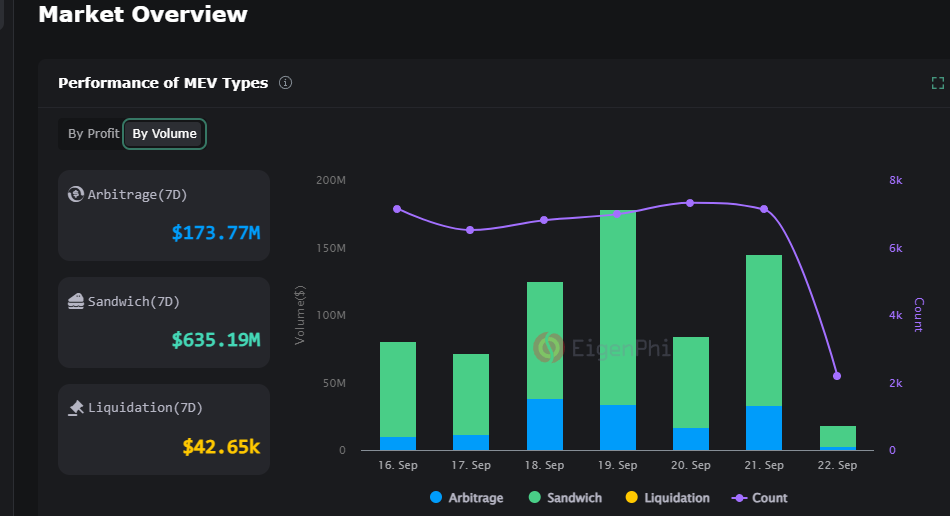

As Ethereum transitions from Proof of Work (PoW) to Proof of Stake (PoS), the issue of miner extractable value (MEV) has received increasing attention. The MEV phenomenon produces a series of undesirable behaviors in transaction processing, such as sandwich attacks and front-running, which harm users’ transaction experience and increase transaction costs. Worse, it also increases the risk of network centralization, as those nodes with more resources and computing power may capture more MEV benefits.

The role and value of Manifold

Manifold Finance is a pioneer in solving the MEV problem, especially after the Ethereum Shanghai upgrade, its business began to receive more and more attention. As a block builder, Manifold has the ability to sequence and optimize transactions about to enter the blockchain. This is particularly important because it directly relates to the rewards and fees validators receive from new blocks.

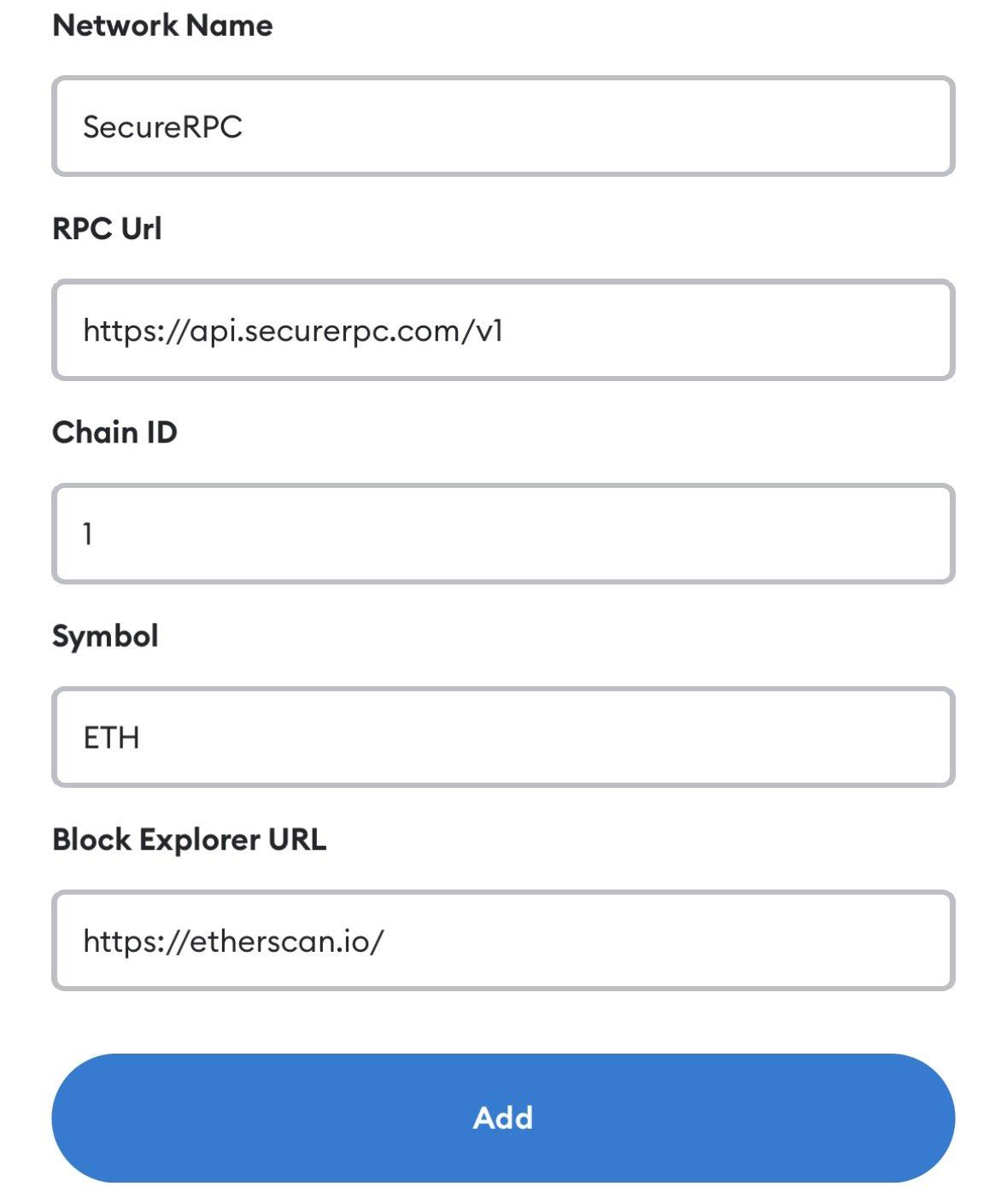

By partnering with major validators and DeFi protocols such as Sushiswap, Manifold uses its proprietary SecureRPC private nodes to receive more private transaction order flow. This allows Manifold to optimize transaction ordering and build blocks of higher value. Higher value blocks mean more transaction fees, which will directly increase the revenue of the validators.

Validators’ rewards come from two aspects: newly generated block rewards and transaction fees. Because Manifold can more effectively include high-value, high-fee transactions in new blocks, this not only increases the overall value of new blocks, but also brings more fee income to validators. Therefore, validators have more incentive to choose Manifold as a block builder, creating a virtuous cycle.

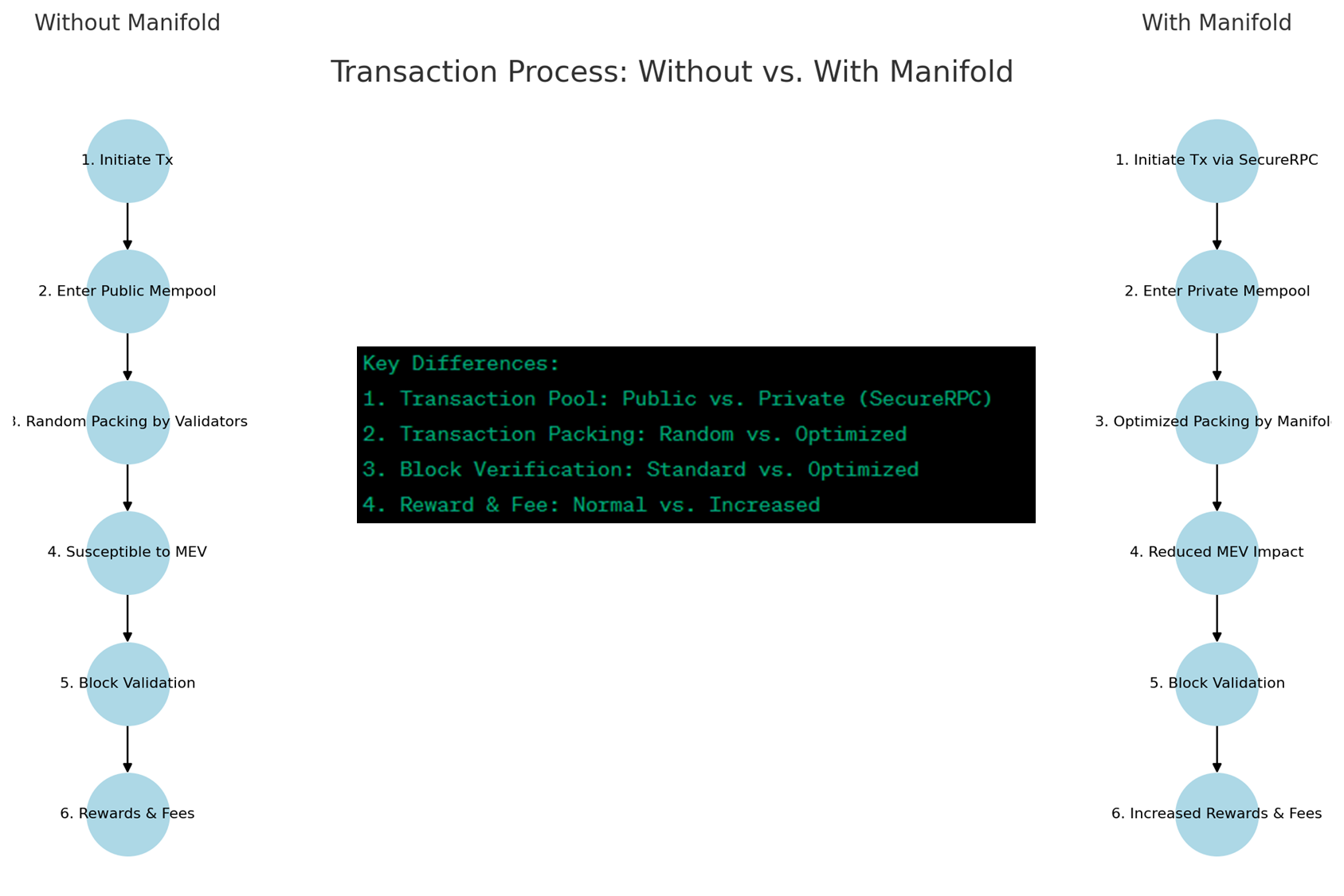

Before and after comparison with and without Manifold

Without Manifold: Transactions enter blocks randomly and are easily affected by MEV bots, resulting in increased transaction costs and decreased user experience.

With Manifold: Through the order flow of SecureRPC and other partners, Manifold is able to optimize the ordering of transactions, thereby reducing the negative impact of MEV and improving transaction efficiency and security of the entire network.

To sum up, Manifold not only solves a series of problems caused by MEV, but also brings direct economic benefits to validators and users by optimizing transactions and increasing block value.

Switching to the LSD protocol, from behind the scenes to in front of the stage

Since after the Shanghai upgrade, users can withdraw the ETH funds pledged by the proof-of-stake consensus mechanism, how to increase the pledge income has become a key issue.

Help more protocols extract MEV profits and increase revenue... Manifold's expectation to help other protocols was once related to the timeline of the Ethereum Shanghai upgrade.

It can be seen from the trend of its token FOLD that FOLD experienced a huge increase from the beginning of this year to the completion of the Ethereum Shanghai upgrade.

Later, with the completion of the upgrade, we also saw the popularity of liquid staking protocol such as Lido and RPL; at the same time, the LSD track itself received more attention and favor, and various new gameplay methods such as LST were also derived.

Rather than just providing back-end support for other protocols, it is better to enter this track yourself and use its expertise in MEV and transaction optimization.

For Manifold itself, since it has the ability to help other protocols optimize profits through MEV solutions, when the LSD track is hot, it is also technically feasible to choose to step from behind the scenes to the front and build an LSD protocol by itself.

So we see that Manifold Finance is trying to become an important player in this track through its upcoming mevETH product. Unlike traditional wrapped ETH, mevETH is an end-to-end LSD solution that not only provides liquidity but also optimizes the MEV yield of transactions, which is of great value to both liquidity providers and end users.

From a technical perspective, it is relatively easier to use an MEV protocol to make LSD than to use an LSD protocol to make MEV. Manifold itself is a block builder, and it also has established solutions such as private RPC (SecureRPC). It seems logical to do LSD easily; but if you let LSD protocols such as Lido do PRC specifically, it seems to be more gain than loss. A better way is Directly integrate solutions from MEV optimization providers.

mevETH: More profitable and more convenient staking

mevETH is Manifold Finance’s upcoming end-to-end LSD solution, specifically addressing the problem of MEV (Miner Extractable Value). It achieves higher staking returns and better transaction efficiency. The implementation of mevETH mainly relies on Manifold's ability as a block builder, which can sequence transactions to build high-value blocks and obtain more MEV opportunities through its private RPC (SecureRPC).

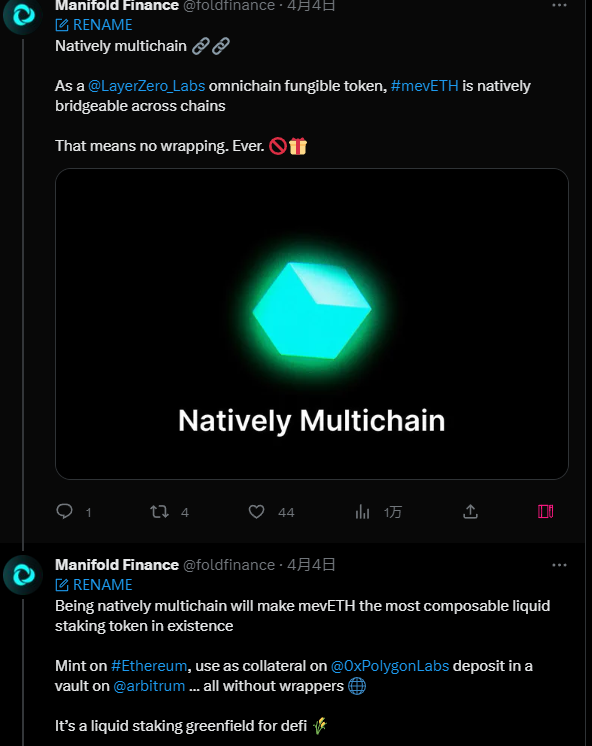

Manifold already has a partnership with Sushiswap, and Balancer and LayerZero also have collaborations. In terms of design, mevETH adopts LayerZero’s omni solution, making cross-chain matters easier.

On its Official Twitter, it gave an easier-to-understand example: mint mevETH on Ethereum, then use it as collateral on Polygon, and then deposit it into Arbitrum’s protocol... After a set of processes, the assets do not need to be converted, and mevETH is still the same. mevETH, there is no concept of adding another layer of wrapped token.

If this design can be realized, it will be a great boost to the liquidity of LST, and it will become possible for the financial matryoshka to activate more protocols.

However, it should be noted that mevETH is not yet online, but there are heated discussions on its official community and Twitter, and the specific products remain to be seen. With the expectation that mevETH will bring higher profits and liquidity to liquidity staking, FOLD has experienced an astonishing rise in the past week.

But maybe when the product is launched, it is expected that there will be a substantial retracement after the end.

mevETH may affect

To summarize the above, the possible impacts of mevETH are:

Higher staking returns : Because Manifold can optimize MEV, both partners and end users can earn higher returns by staking mevETH.

Cross-chain capabilities : mevETH is not limited to Ethereum, but can also be used on other blockchains such as Polkadot and Binance Smart Chain, which greatly increases its flexibility and application scenarios.

Impact on other LSD staking protocols : The emergence of mevETH may threaten other LSD staking protocols such as LDO and RPL, as it provides higher staking returns and more flexibility. Other protocols either integrate similar mev solutions, or face a situation where they cannot compete with each other in terms of revenue. A foreseeable revenue competition and technology upgrade may be coming soon.

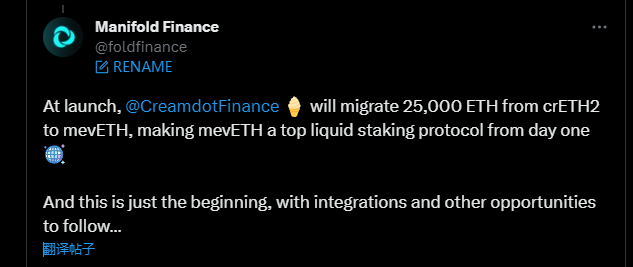

Judging from the currently known information, the lending protocol CreamdotFinance has decided to directly convert its crETH2 into mevETH to provide initial liquidity.

According to this cooperation model and trend, more protocols with LST may follow suit after seeing the benefits and complete the docking with mevETH.

In fact, this also embodies a new way to break through in the internal coil track: instead of directly competing with giants with dominant pledge shares to grab share, it uses the rigid needs that can increase profits to cooperate with more ecological protocols. Find ways to disrupt things from the edge.

Will FOLD usher in a new catalyst?

As a protocol and function, mevETH’s direct beneficiary is naturally its own token.

The 100% increase in FOLD itself is a short-term phenomenon, but will the token itself gain additional empowerment by entering the LSD track to gain long-term value?

The answer is yes, the most notable of which is the bribe mechanism, which uses the FOLD token as an intermediary.

vote-buying mechanism

In the mevETH protocol, the bribe mechanism allows users to increase the priority of their transactions in SecureRPC by paying a certain amount of FOLD tokens. This mechanism provides utility and demand for the FOLD token, as users and validators now have a direct incentive to hold and use FOLD.

Although the specific details of this vote-buying mechanism have not been disclosed, we can make a reasonable deduction:

Suppose Alice is a DeFi user and she wishes to execute a high-value transaction in a specific Ethereum block. Bob is a validator and is responsible for confirming transactions in the block.

Without Manifold and FOLD tokens, Alice's transactions may be affected by MEV bots, causing her to have to pay higher mining fees or face other disadvantages.

But now, with Manifold’s SecureRPC relay and FOLD token, things are different.

Alice uses FOLD tokens as a "bribe" : Alice decides to use a certain amount of FOLD tokens as a "bribe" to ensure that her transaction is processed first in that block.

Submit to SecureRPC relay : Alice submitted her transaction and FOLD tokens through Manifold’s SecureRPC relay.

Prioritization : Since Alice paid FOLD tokens as a "bribe", her transaction is prioritized in the SecureRPC relay and pushed to the validator (such as Bob) that cooperates with Manifold.

Bob selects the highest value block : As a validator, Bob receives multiple potential high value block options from Manifold, one of which includes Alice’s transaction. Because of Alice's "bribery", the block containing her transaction has a higher value to Bob.

The transaction is executed successfully : Bob finally selects this high-value block and successfully adds it to the Ethereum chain. Alice's transaction was successfully executed, and Bob and Manifold also received additional FOLD tokens as rewards.

Data plane

After the token’s fundamentals receive functional updates, we can look at some details on the data side.

First of all, based on the current market value estimation, if FXS is used as a reference and reaches the same market value as FXS, FOLD still has room for 16 times (theoretical reference only, NFA).

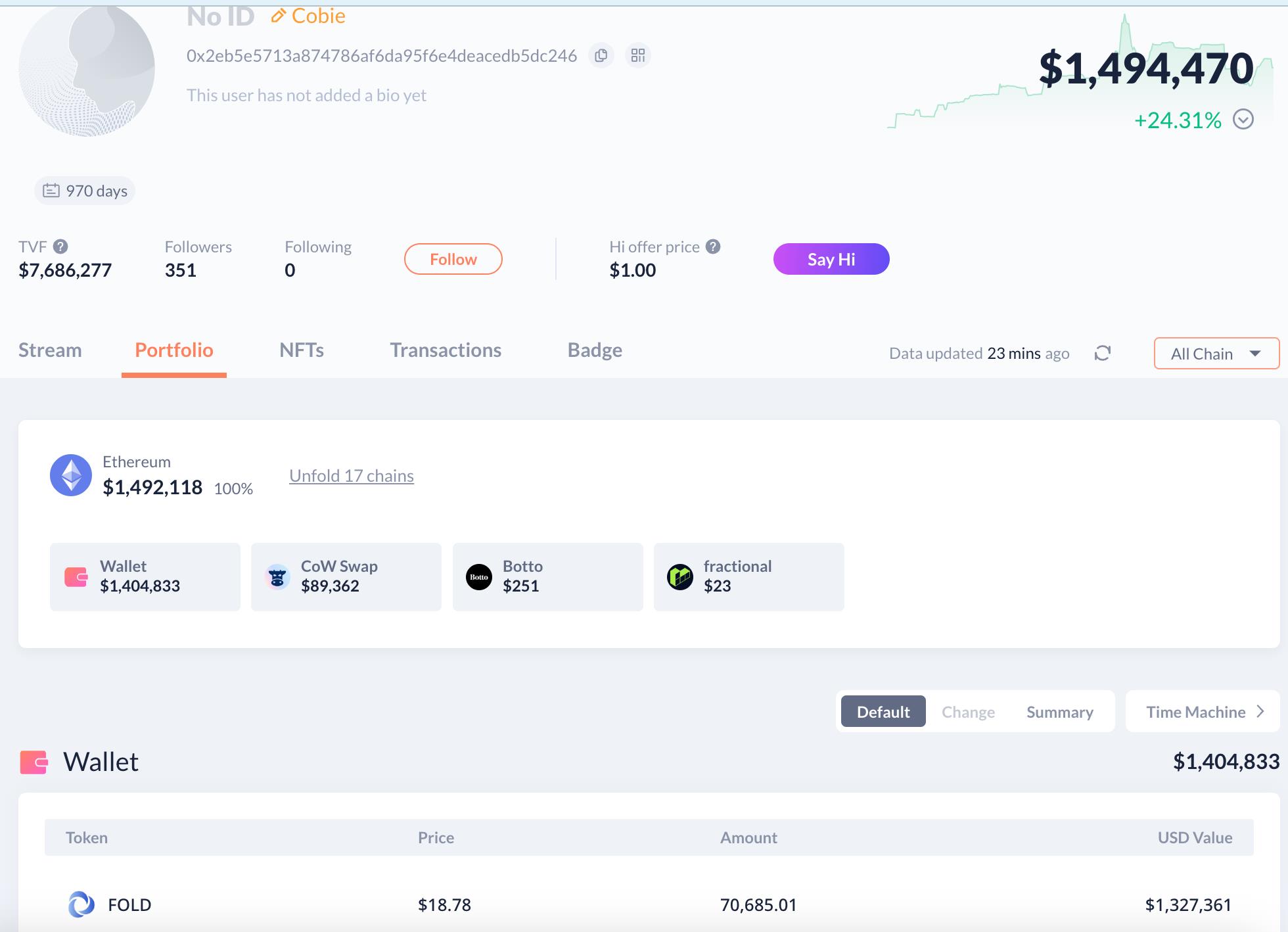

At the same time, well-known tycoon Cobie still holds US$1.5 million in FOLD in his publicly disclosed wallet mamoca.eth. After checking the historical records, we found that this address has transferred FOLD to other addresses many times this year, but there is still a certain amount of bottom positions left.

In addition, from the perspective of circulation, the total amount of FOLD is relatively small, and the current circulation accounts for more than 80% of the total. Considering that there is still a certain amount of FOLD pledged in the Manifold protocol, compared to other tokens that still have VC rounds that have not been unlocked, theoretically there is not much so-called unlocking and selling pressure.

Considering the relatively low market value, the current token fluctuations are still reasonable, but the subsequent performance is still questionable, and it is also necessary to observe whether the market buys into the concept of mevETH.

However, the good news is that mevETH is not yet online. Whether Manifold is a disruptor of LSD or a passer-by, there is still time to observe and study in advance.

Finally, I would like to summarize some things that I think are not OK:

The launch was slow, mevETH was announced in April and has not yet been released;

The information disclosed in the document is limited, and the complete mevETH design is basically not visible, and it is mainly based on social media hype expectations;

FOLD's pledge has exposed negative events such as the opaque mechanism.

DYOR