Written by: Miles Jennings, General Counsel, a16z crypto

Compiled by: Babywhale, Foresight News

Web3 should beat Web2 because Web3 can achieve decentralization. Decentralization will reduce censorship and promote freedom. Freedom makes it possible to oppose power, and opposition to power promotes greater progress. But first, we need to solve the problem of decentralized governance.

Since decentralized governance is still in its early stages, many Web3 protocols and DAOs are still working on solutions to problems that arise in decentralized governance. As someone who closely tracks decentralization governance practices across Web3 (both how decentralization is affected and how it is incorporated into various decentralization models ), I believe that applying Machiavellian principles to decentralization in Web3 Governance can address current inadequacies because Machiavelli's philosophy was developed on the basis of a pragmatic understanding of power struggles in society that formed at the time. These social power struggles are similar to those experienced by protocols and their DAOs, which often have unclear, volatile, or inefficient social hierarchies.

In another post , I outlined four Machiavellian principles as guidelines for designing stronger and more effective decentralized governance, or “Machiavellian” DAOs: Embrace governance minimization; Build a Balance leadership so that it is always challenged by opposition; provide avenues for continuous leadership change; and strengthen leadership accountability. In this article, I will share the factors, strategies, and tactics to consider when creating a “Machiavellian DAO” guideline for a DAO.

The strategies and tactics I propose are not suitable for all DAOs, as these solutions introduce inefficiencies and frictions into decentralized governance, making them potentially unsuitable for, for example, highly dynamic and evolving systems or systems of a civic nature . However, for those protocols that are in the process of development and focus on economic growth while maintaining trustworthy neutrality , such as the hypothetical Web3 market protocol I used "Blockzaar" as an example in this article, there are benefits to increasing friction. Probably far greater than the cost.

Two steps that need to be implemented before designing a DAO

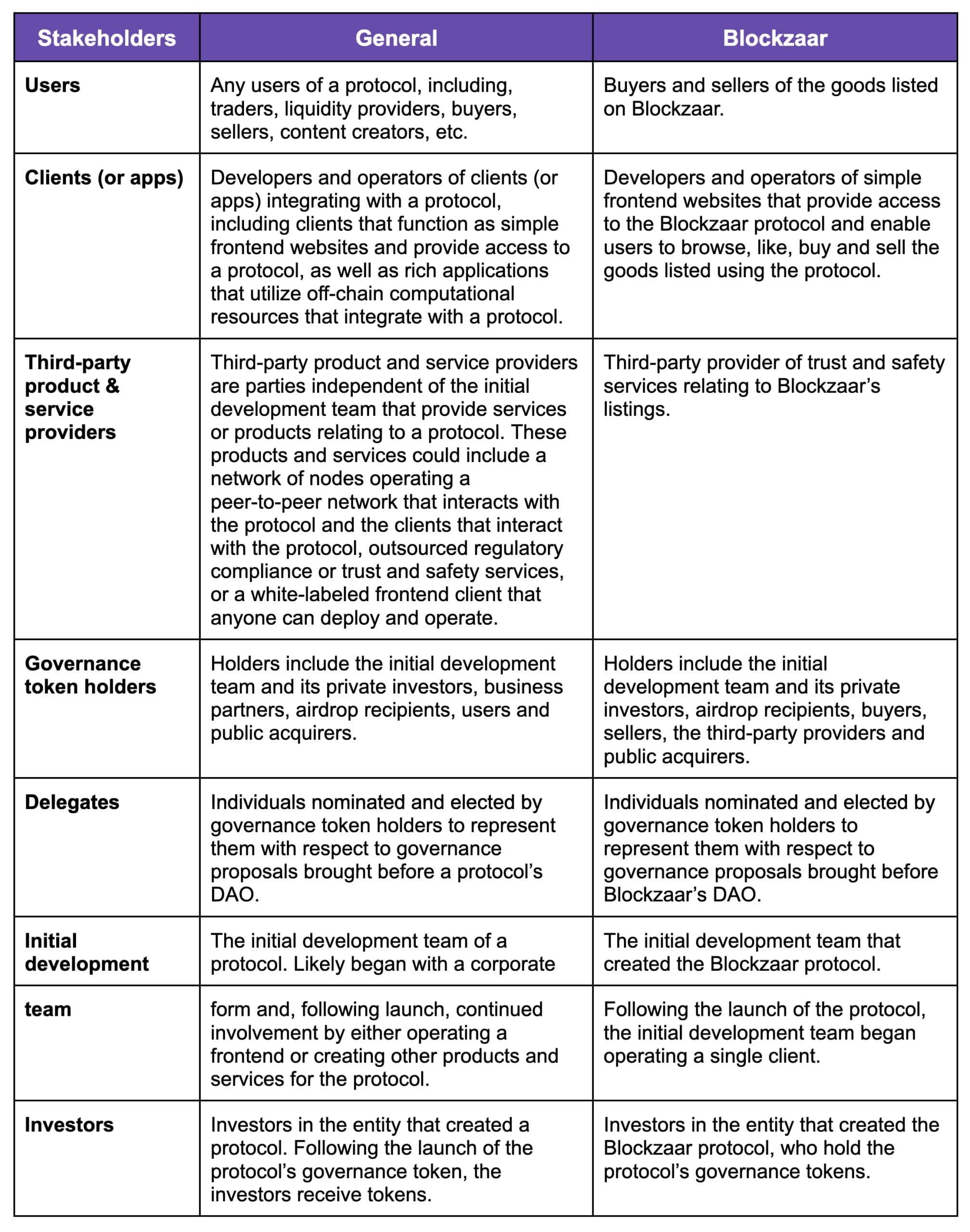

Before sharing design principles, it’s key to identify who the stakeholders are in the ecosystem. After identifying these different stakeholders, the DAO can determine what their intrinsic motivations are, which is a prerequisite for balancing the power of these stakeholders.

After the following two preliminary steps, builders can implement the next four Machiavellian design principles.

Step 1: Identify protocol stakeholders

Stakeholders of the Web3 protocol include many different actors, including users, applications (or clients), third-party product or service providers, governance token holders, representatives, initial development teams, and investors:

Step 2: Understand the incentive structure

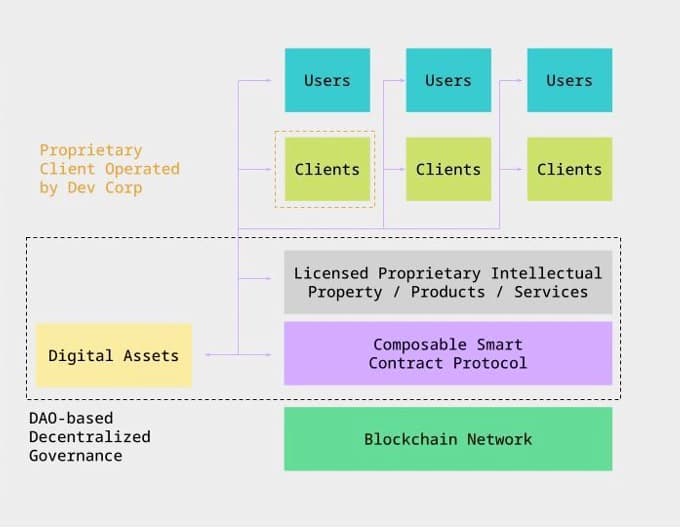

The more active stakeholders (as opposed to passive investors) -- and financially motivated to see the protocol grow and develop -- the more parties will be available to choose from to effectively manage the protocol. This is why it is encouraged to create and run independent clients/applications (client layer) on top of shared smart contracts/blockchain infrastructure (protocol layer) and to encourage independent third parties to create off-chain products for stakeholders within the ecosystem Web3 systems with services (third-party layer) are best suited for leveraging Machiavelli structures. (See the open decentralization model discussed here )

Here is an ecosystem model using these two incentive structures:

The goal of these incentive programs is to make it profitable for independent third parties to both operate clients on top of the protocol as independent business clients and create tools and other shared intellectual property and services for use by protocol clients and users. These elements help enable the protocol's decentralized economy to flourish and provide fertile ground for designing more effective decentralized governance by giving independent participants a vested interest in the success of the decentralized economy.

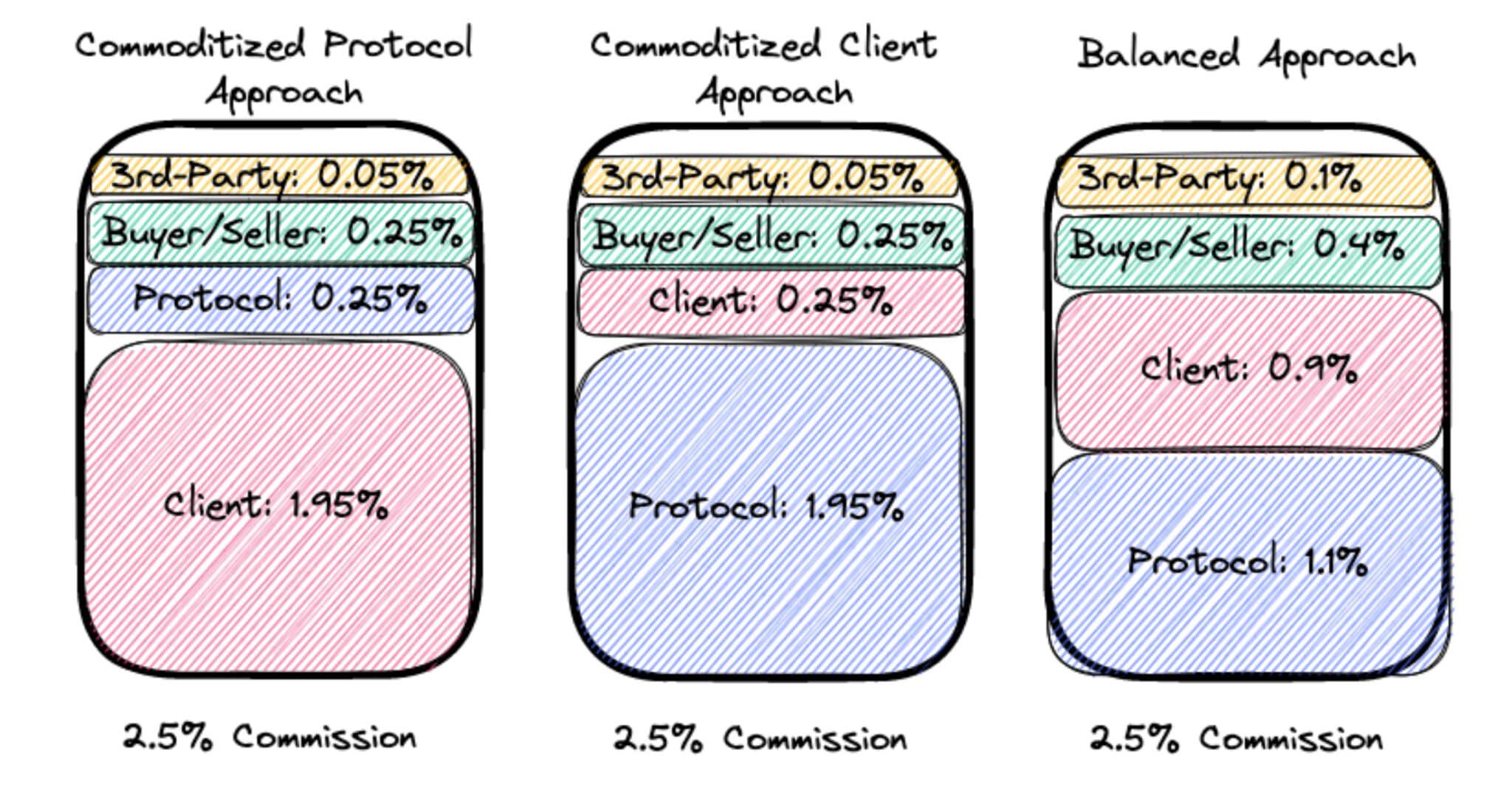

When designing incentives, the DAO must balance the interests of the protocol/DAO (including token holders) with the interests of other stakeholders in the system (users, customer operators, and third-party product and service providers). Token holders of a protocol may not support commoditization of the protocol layer (where all value accrues to users, customers, and third-party product and service providers) as this would deprive them of economic benefits. This commoditization also runs counter to the protocol’s goal of accruing network effects .

At the same time, commoditization of the client layer—where all value is attributed to the protocol (also known as “ fat protocols ”)—is unlikely to result in a rich client ecosystem because builders cannot profit from developing clients . Both extremes will endanger the decentralized economy of the entire system. Therefore, many ecosystems should adopt a more balanced approach; to illustrate this, here is a very simple incentive scheme, using "Blockzaar" as an example, which is a hypothetical Web3 marketplace business:

The purpose of establishing this agreement is to incentivize buyers to purchase products; incentivize sellers to sell products; incentivize customer operators to maintain such customers; incentivize third-party service providers to develop and provide products and services to the ecosystem;

The benefit generated by the protocol is a 2.5% commission on all buy and sell transactions, which can be provided to stakeholders by distributing the proceeds of such transactions or by distributing governance tokens;

Buyers and sellers only gain benefits when they participate in a purchase and sale transaction. Customer operators only receive benefits if the transaction is completed through their customers. And third-party product and service providers only gain benefits when the transaction is completed through a customer using their products or services (in this case, when the customer uses the third-party provider's trusted and secure services).

The benefits represented by the commissions earned by Blockzaar can be distributed among the stakeholders as follows:

As shown in the chart above, of the 2.5% commission, 1.1% goes to the protocol, 0.9% goes to the client who initiated the transaction, 0.4% goes to the buyer or seller, and 0.1% goes to the third-party service provider. Therefore, both token holders (interests generated through the protocol) and other stakeholders are rewarded for the execution of transactions.

Why reward stakeholders? There are two additional considerations:

First, a balanced incentive structure may not only be feasible, it may be necessary for some systems. Regulatory action in the United States has made it clear that systems that facilitate regulated activities need to find ways to comply with regulatory requirements. In the vast majority of cases, it is impossible to design compliance into the protocol itself, so this compliance needs to be implemented at the point of interaction between the user and the protocol, which is the client layer of the protocol. Operators of protocol clients that facilitate regulated activities therefore need to somehow derive revenue from the operation of the clients in order to be able to bear the costs of compliance. And abandoning compliance is undesirable: Not only does it put customer operators at risk, collecting funds from illegal activities also puts the protocol's DAO at legal risk.

Therefore, where the protocol facilitates regulated activity, the “fat protocol theory” will not work and a balanced approach must be taken.

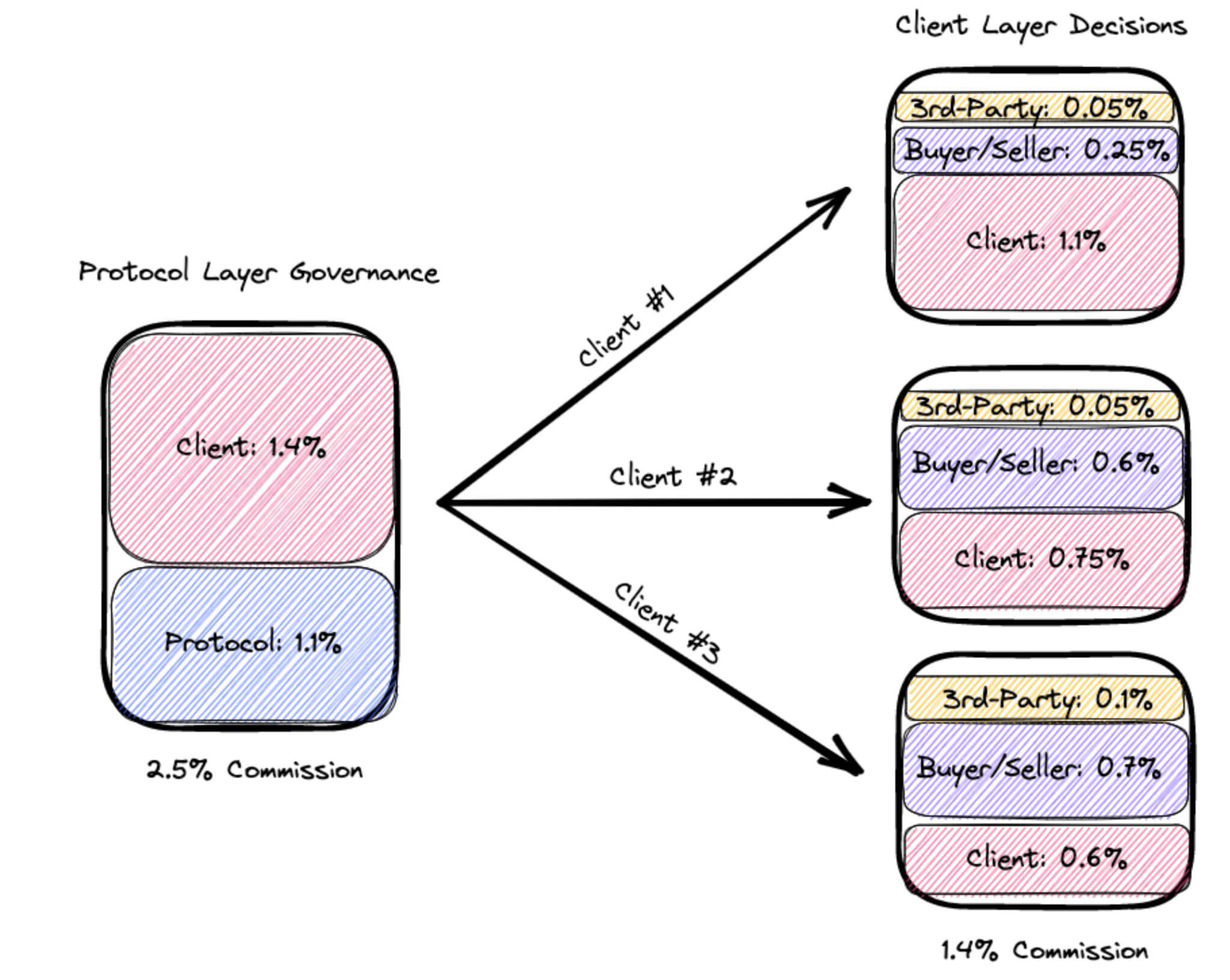

Second, in any decentralized model that incentivizes a strong client layer, a balance of power among clients must be achieved. If a single client is able to capture too many users, its position among clients can jeopardize the decentralization of the system. Therefore, the protocol must be designed to resist the risk of client dominance. To this end, the DAO can implement controls on clients that exceed a predetermined customer dominance threshold (such as 50% of a user's transaction volume). To avoid manipulating such a mechanism to censor certain customers, such a mechanism should be as autonomous as possible, with upper and lower limits on customer dominance thresholds. For Blockzaar, for example, this mechanism will only be triggered when a customer's trading volume exceeds 50%, which will cause its commission allocation to drop from 1.4% to 1.0%, with the 0.4% difference going to the protocol.

Four Principles for Designing a Machiavellian DAO

Now that we understand the interactions between the protocol's stakeholders and the protocol's incentive structure, the protocol's DAO can be designed according to the four guidelines laid out by Machiavellian principles .

Principle 1: Minimize governance

Machiavellians believe that organizations tend toward authoritarian leadership, which ultimately differentiates in order to perpetuate its own privileges and power. This suggests that DAOs should prioritize governance minimization to protect their trusted neutrality as much as possible. In other words, since every human decision affecting the protocol has the potential to discriminate against stakeholders and jeopardize the trustworthy neutrality of the ecosystem, such human subjective decisions should be minimized.

The general consensus on governance minimization is that protocol governance should be reduced to three categories of decisions that have to be implemented:

Complex parameter settings , such as mortgage ratios in DeFi lending protocols;

Fund management , such as fund diversification, grant programs, including financing of public goods;

Maintenance and upgrade of the protocol , including replacement of oracles, deployment of upgraded smart contracts, etc.

The number and scope of decisions a particular DAO makes in any of the above categories will depend heavily on the type of protocol it governs.

To be sure, as the Web3 protocol becomes more complex, the number and scope of decisions will similarly increase. However, this does not necessarily mean that decentralized governance at the protocol level needs to be equally complex. Instead, DAOs can leverage an incentivized decentralized model to counter this trend and further promote governance minimization.

In particular, a DAO can guarantee its trusted neutrality by "pushing" many governance decisions to the client layer and/or third-party layer. For example, decisions that only affect the client-user relationship can be made by the client's sole proprietor. While these operators could use decentralized governance to manage their customers, the inefficiencies of decentralized governance may make it impractical.

Fortunately, the use of decentralized governance at the client layer is most likely not necessary, as users do not directly participate in the governance of the client layer, but can instead accept the decisions of individual client operators and continue to use those clients. Or circumvent these decisions by moving to a different client, thus affecting the client layer. Similarly, third-party product and service providers can also provide products and services with different functions and prices, allowing customers and users to choose according to their preferences.

Therefore, a strong client layer and third-party layer can reduce the need for decentralized management while increasing user choice.

This is similar to the "fork-friendly" environment advocated by Ethereum founder Vitalik Buterin and others. It is a good antidote to the problem of decentralized governance, but it goes beyond the protocol layer. . Essentially, each client is a fork of every other available client; every third-party product and service is a fork of every other available product and service. This dynamic promotes competition, allows for rapid experimentation, and provides users with more diverse choices while maintaining trustworthy neutrality at the protocol layer.

For example, in a Web3 social network, if a client operator wanted to remove all hate speech from their client, users could submit to such censorship by continuing to use that client; alternatively, they could submit to such censorship by switching to a client that did not take such action Measures for clients to circumvent this censorship. But this censorship does not apply to the protocol layer, which will remain neutral to speech. This is preferable to the current approach to content moderation in Web2, where users don't even know what speech is restricted, by whom, or why. The problems with Web2 social media and the arbitrary, subjective decisions of a few people strongly point to a better solution: the Web3 protocol, with minimal governance.

Forking at the client layer and the third-party layer also avoids several key pitfalls that prevent forks at the protocol layer, including the fragmentation of liquidity when forking DeFi protocols; or the fragmentation of user base/audience in Web3 social protocols . Forks at the protocol layer will ultimately consume the network effects generated by the protocol and are therefore undesirable for both protocol developers and early adopters. For Blockzaar, governance minimization and the related concepts I shared can be achieved through a DAO in the following way:

Complex parameter settings. For the simplest version of Blockzaar, the only parameters that can be changed by the DAO may be the commission rate applied to transactions, and the distribution of that commission rate between the protocol layer and the client layer. As shown below, the commission ratio between clients/users/third-party product and service providers can be "pushed" to the client layer, and each client can decide how to share the commissions received from the protocol with its users and third parties. Product and service providers for distribution:

Money management . Blockzaar's simplest governance design might still empower the DAO to participate in fund management activities. This will include the creation of grant programs to fund the development of public goods within the market ecosystem, as well as the provision of other third-party products and services to customers and users.

Protocol maintenance and upgrades . Blockzaar's simplest governance design might still empower the DAO to maintain and upgrade the protocol. This will help keep up with the competition, especially given the speed of Web3 technology iterations.

Overall, if Blockzaar can achieve governance minimization, it can significantly limit the number of decisions that need to go through the decentralized governance process, thereby significantly reducing the protocol's governance burden. Still, the protocol allows for a degree of variability and experimentation by fostering a robust ecosystem of incentivized clients and third-party products and services.

Principle 2: Balance leadership

Given the above and the fact that the complexity of the Web3 protocol continues to increase, even the most extreme minimalist governance is unlikely to eliminate all human factors. Therefore, the DAO must do more to ensure that the decisions it must make are made effectively. For example, taking Blockzaar as an example, if a new version of the protocol is released, the DAO needs to choose to accept it.

Given that most political systems tend toward authoritarian leadership (as Machiavellians have also observed ), DAOs should seek to establish a leadership "hierarchy" for the ecosystem that can more effectively handle the remaining governance matters. But the key is to design checks and balances on the power of any leadership class so that any emerging leader is always likely to be openly opposed.

While DAOs could try to overcome tyranny using non-token-based voting designs (such as proof of personality ), Machiavellian principles drawn from observing contentious politics suggest that such designs are less likely to work in the long run. May succeed. Even if “proof of personality” can eliminate the different rights of token holders arising from owning tokens, token holders of DAOs using this method are likely to be integrated into new ones based on new property rights and new class divisions. group. Therefore, while proof of character can mitigate a DAO's vulnerability to attack, it is impossible to eliminate tyranny.

Creating a system of checks and balances is a better option. Fortunately, incentive decentralization provides fertile ground for exploring other tools for balancing leadership power. Below, I'll share a potential DAO design that employs a bicameral governance layer -- unlike the US Congress, which has a House of Representatives and a Senate.

stakeholder council

If a protocol incentivizes a robust ecosystem of clients and third-party product and service providers that operate independently, then these individuals have a vested stake in the governance of the protocol. The benefits are reasonable. Their livelihoods may depend on the survival of the agreement. Additionally, the most active users of a protocol may also have a vested interest in its governance, especially if their use is related to the business they are running.

Given their vested interests, these stakeholders may be best suited to participate in the protocol’s decentralized governance. However, under the current form of token-based voting, these stakeholders are unlikely to have sufficient agency in decentralized governance, minimizing the ability to promote true stakeholder capitalism in these ecosystems. potential.

This challenge can be overcome by providing stakeholders with their respective stakeholder councils using tokenless voting. In particular, non-transferable NFTs (also known as soul-bound NFTs ) can be granted to certain individuals in each constituency, giving these holders the right to make suggestions and vote on issues facing the DAO.

In designing any such leadership, the DAO should:

Decentralize leadership sufficiently so that no one individual or related group can be said to control the DAO. First, the establishment of leadership can have negative consequences under U.S. securities laws. The authority should be given to a leadership composed of multiple members selected by the DAO from each constituency.

Evaluate the interests of various stakeholders to determine where conflicts and alignments of interests exist . Assessing these benefits, while difficult, is more straightforward than assessing the benefits of anonymous token holders because we can start with on-chain incentives. For Blockzaar, for example, the incentive structure aligns the interests of users, client operators, and third-party product and service providers with the interests of the protocol, involving the distribution of commissions earned. As mentioned above, this is a complex parameter setting determined by the DAO.

At the same time, the interests of these stakeholders may not be aligned when it comes to fund management and/or protocol maintenance and upgrades. For example, users may wish to use DAO funds for products and services that benefit users rather than those that benefit customer operators; third-party product and service providers may object to such expenditures for fear of increased competition.

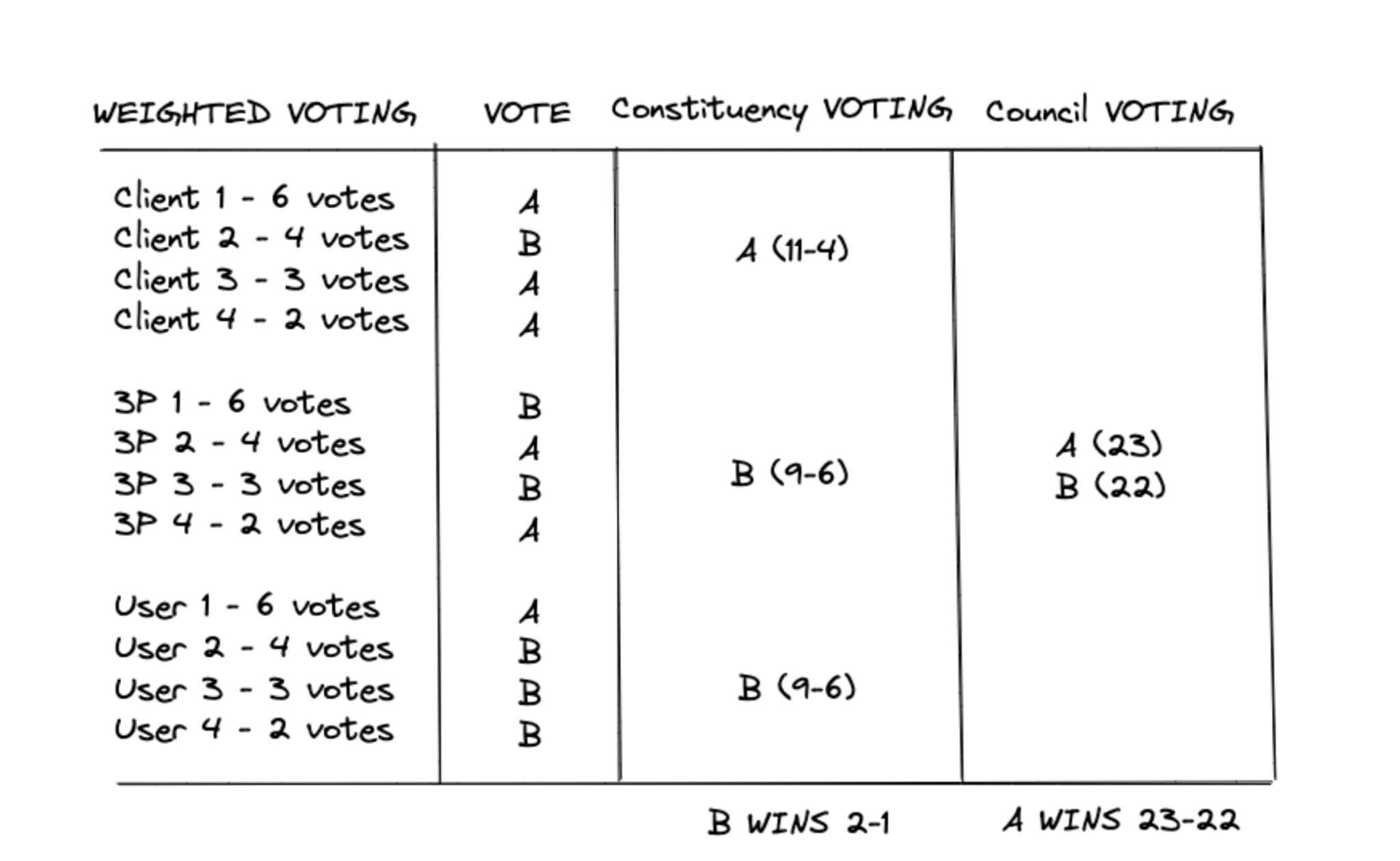

Balance the voting rights of stakeholder representatives according to the interests of each stakeholder . This can be achieved through weighted voting, with the best-performing representative in each constituency receiving the most votes, thus promoting competition and confrontation among stakeholders. In addition, single council voting or separate district voting can also be used, as shown in the figure below:

Any stakeholder council will be exposed to the risk of a "hostile takeover" if the same or related parties control multiple clients and/or third-party product and service providers. However, this risk can be partially addressed by requiring all such parties to have different taxpayer identification numbers in the United States or use some form of personal identification agreement.

representative council

The power of the Stakeholder Council should be checked by token holders, because token holders have a vested interest in the protocol governance, and this interest may be different from the stakeholders represented by the Stakeholder Council. Opposite.

DAOs can control the common problems that come with direct democracy (such as low participation, uninformed voters, etc.) by implementing representative democracy, most likely in the form of delegation. Representatives shall, among other things , be independent from any member of leadership and receive appropriate compensation for the role they play in the administration of the system.

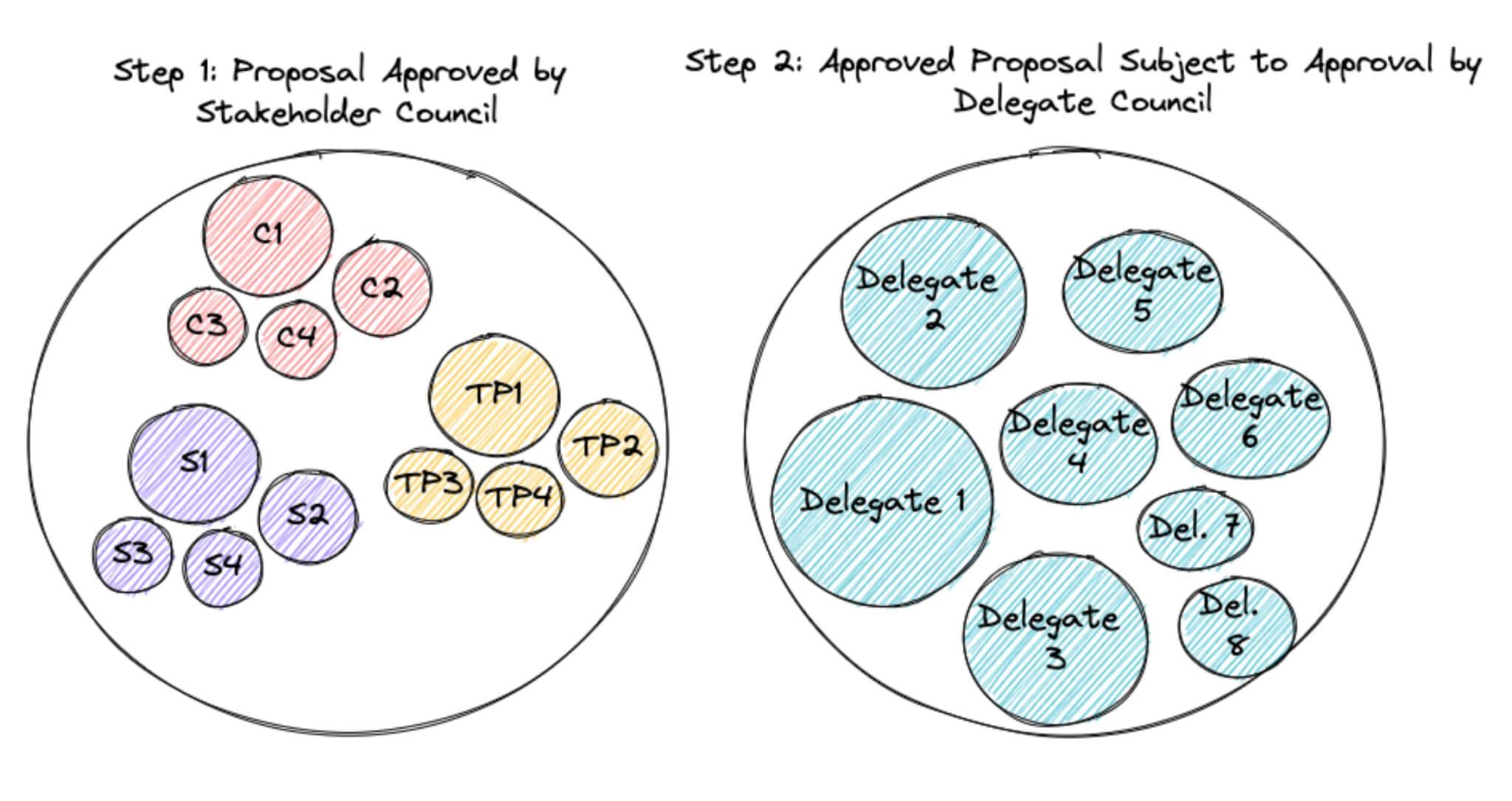

The Stakeholder Council and the Representative Council jointly have the authority to approve proposals submitted to the DAO. One or both of the councils can be the initial governance layer responsible for creating new proposals, while the other governance layer has either negative power (proposals approved by one council will pass unless vetoed by that council) or active Powers (proposals approved by a council will only pass if that council approves).

While this setup is similar to the bi-house structure used by Optimism, the key difference is that Blockzaar DAO's Stakeholder Council (like Optimism's Citizen's House ) will systematically consist of the most productive stakeholders in the system. These stakeholders are more likely to have a vested interest in promoting such systems than elite actors who are not overtly incentivized. Since stakeholders’ livelihoods ultimately depend on the protocol, they are more likely to take the protocol’s governance seriously than good actors who simply participate in decentralized governance out of a spirit of civic duty. Such an arrangement helps make the DAO function more like an industry consortium rather than a homeowners' association.

This notion of relying on self-interest rather than altruistic or noble designers of society has been explored in other areas, including constitutional and international legal systems, with the self-interest becoming the overwhelming winner.

For Blockzaar, the DAO’s leadership and governance structure can be set up as follows:

The Stakeholder Council is composed of: Operators of the top four customers (by transaction volume); Third-party product and service providers who create the top four products and services (by transactions of customers using those products and services) calculated by volume); the top four sellers (calculated by transaction volume).

Leadership votes are weighted by constituency and divided into three separate series (as shown in the chart above). Leadership votes as a single council.

The Representative Council consists of 8 representatives elected and approved by token holders, with voting rights distributed proportionally based on the number of tokens.

The DAO does not undergo governance changes by default, so any proposals approved by the Stakeholder Council will not take effect unless approved by the Representative Council.

An example of Blockzaar’s governance system is as follows:

Principle Three: Continuous Change in Leadership

Machiavellians believe that institutions must not only have constant opposition but also allow new leaders to force their way into the leadership in order to generate instability and avoid a static balance of power. According to the Machiavellian view, such changes must be forced because the leadership will always object in order to maintain their position and privileges.

Broad participation by community members has been a hallmark of the Web3 ethos and often extends to DAO leadership, with community members often becoming formal contributors to the DAO. However, in token-based voting systems, community members' ability to gain real power is often limited - because of the financial barriers to gaining such power.

Nonetheless, those DAOs that wish to embrace the Machiavellian principle of the need for leadership to continually experience turmoil can introduce churn in leadership in a few different ways, including:

Set term limits for stakeholders on the Stakeholder Council. For example, the performance standards set by the DAO for stakeholders promoted to the Stakeholder Council could be periodically remeasured, allowing the Stakeholder Council to re-admit the best-performing stakeholders from the previous period.

Enables token holders to remove representatives at will , otherwise the representative term will periodically end and the representative must be reappointed.

Empowers token holders to directly elect selected stakeholders (customer operators, third-party product and service providers, and users) in the Stakeholder Council , thereby establishing that prior performance alone is not the only basis for promotion to the Stakeholder Council way.

Principle 4: Strengthen leadership’s sense of responsibility

If a large group of people is indeed intrinsically unable to hold their leaders accountable (as Machiavellians predict), then a DAO should seek to take steps to increase accountability throughout its ecosystem.

By implementing the first three principles above, a Machiavellian DAO could have greater accountability than current DAOs, in particular:

Since the number of leadership participants is smaller (compared to the general population of token holders), each member of the leadership is better able to hold other members accountable for their voting history. This is particularly likely to occur between Stakeholder Council members and Representative Council members, given the inherent tensions between Stakeholder Councils and Representative Councils.

If the client ecosystem is too strong, users can simply stop using some clients and switch to others, making client operators (including those promoted to leadership) more accountable to user needs. Likewise, a strong layer of third-party product and service providers also holds users and customer operators accountable to those providers because of their ability to move to other products and services.

Periodic removal of representatives and expiration of terms provide stakeholder class members with an opportunity to lobby token holders, thereby in turn holding representatives accountable for previous votes.

A DAO could also increase the accountability of its stakeholder council and representative council if it requires customer operators, third-party product and service providers, and users to "lock" a certain amount of governance tokens. They can lock them in a smart contract before joining the stakeholder council, and the tokens will only be released after a certain period. However, this mechanism may also be difficult to implement, given that stakeholder council members may not trust their fellow stakeholders to risk their own assets. Therefore, if any locking mechanism is introduced, it may also be necessary to allow stakeholders to "rage quitting", similar to the mechanism implemented by Moloch DAO .

If implemented correctly, the locking mechanism will help promote greater alignment of incentives between the stakeholder council and the broader token holders.

Summarize

A problem often cited by ruling elites in the American corporate system is that a company's shareholders, directors, and officers often have unchecked power. So we see CEOs being paid far more than their employees are being paid, or we're seeing boards of directors implementing stock buyback programs instead of reinvesting those resources in the health of the organization, among a host of other issues.

While this centralized power allowed these companies to sometimes act more effectively, their mistakes and lapses in judgment led to countless failures without recourse for other stakeholders in these organizations. Blockchain, smart contracts and digital assets make the design of Web3 systems unique. DAOs prioritize governance minimization, which will help them maintain trusted neutrality, allowing them to grow an emerging ecosystem of client operators, third-party products, service providers, and users.

Allowing these stakeholders to play a meaningful role in the governance process gives DAO a real opportunity to achieve "stakeholder capitalism" that traditional equity/corporate forms seem unable to achieve. Therefore, we should push for Web3 systems to adopt incentive structures that promote actions to improve their systems to make them more productive and better serve all stakeholders, rather than adopting incentive structures that optimize value only for a few owners.

Again: Web3 should defeat Web2 through decentralization, because decentralization reduces censorship and promotes freedom, which in turn promotes opposition to power, thus promoting greater progress. DAOs can help accelerate this cycle by incentivizing competition, empowering opponents, and leveraging non-token voting.

But only if we accept and adapt to this system.