Blockchain technology has reached a certain level of development after a long period of existence. Blockchain will become a popular technology for everyone to use in just one or two cycles. People often call that time the Mass Adoption market period.

With such a long development process, we have witnessed projects begin to develop and then die, and in the end, only quality projects with practical applications remain. Through each major wave of market purification, the market continues to grow and good projects continue to reach new heights.

Among them, the most notable recent development that is the most groundbreaking and can change the face of Blockchain technology is Bridge. Before Bridge was born, each Blockchain only supported a single user in the assets on it, it was not possible to move any assets back and forth between Blockchains or chains. And after Bridge appeared, users easily moved assets from one chain to another. This opens up the possibility of communication between blockchains and users can interact seamlessly on it.

In this article you will understand about Bridge's products, technology and design. Know more information about this field and get more perspectives from yourself to make comments and assessments for future investments.

History of Bridge Development

The development history of Bridge in Blockchain can be divided into three main stages:

First phase (2015-2017)

During this period, the first Bridge projects were developed. These projects mainly use the lock-mint mechanism to transfer assets between different Blockchains.

Some outstanding Bridge projects during this period include:

- Blockchain Bridge (BCB) : Developed by Blockstream, BCB is the first Bridge project that allows Bitcoin transfers between different Blockchains.

- Anyswap : Developed by the Anyswap Foundation, Anyswap is a Bridge project that enables asset transfers between different Blockchains, including Ethereum, Binance Smart Chain, Polygon, Avalanche, and Fantom.

- Wormhole : Developed by Wormhole Labs, Wormhole is a Bridge project that allows asset transfers between different Blockchains, including Ethereum and Solana.

Development period (2018-2022)

During this period, Bridge projects continued to grow and become more popular. These projects started using new mechanisms to improve performance and security.

Some outstanding Bridge projects during this period include:

- Terra Bridge : Developed by Terraform Labs, Terra Bridge is a Bridge project that enables asset transfers between different Blockchains, including Terra, Solana, and Cosmos.

- Solana Wormhole : Developed by Solana Labs, Solana Wormhole is a Bridge project that allows asset transfers between Solana and Ethereum.

- Polygon Bridge : Developed by Polygon Protocol, Polygon Bridge is a Bridge project that allows asset transfers between Polygon and Ethereum.

Modern period (2023-present)

During this phase, Bridge projects continue to grow and become more complex. These projects started supporting more Blockchains and offering new features, such as Cross-chain Liquidity Mining and Cross-chain NFT Bridge.

Some outstanding Bridge projects during this period include:

- Connext : Developed by Connext Labs, Connext is a Bridge project that enables asset transfers between different Blockchains, including Ethereum, Solana, Avalanche, and Binance Smart Chain.

- Optimism Bridge : Developed by Optimism, Optimism Bridge is a Bridge project that allows asset transfers between Ethereum and Optimism.

- Arbitrum Bridge : Developed by Arbitrum, Arbitrum Bridge is a Bridge project that allows asset transfers between Ethereum and Arbitrum.

The Future of Bridge in Blockchain

Bridge plays an important role in the development of the Blockchain ecosystem. Bridge allows users to transfer assets between different Blockchains, which helps expand the usability of digital assets.

In the future, Bridge is expected to continue to grow and become more popular. Bridge projects will continue to improve performance and security, while supporting more Blockchains. Additionally, Bridge can also be used to connect different Blockchain ecosystems, such as DeFi, NFT, and GameFi.

Below are some future development trends of Bridge in Blockchain:

- Improved performance and security: Bridge projects will continue to improve performance and security to provide a better user experience and reduce risk.

- Support more Blockchains: Bridge projects will support more Blockchains to meet user needs.

- Connecting different Blockchain ecosystems: Bridge will be used to connect different Blockchain ecosystems, opening up many new possibilities for users.

Bridge Overview

A bridge is a bridge that can communicate with blockchains, helping to connect these chains together and allowing assets, information, and data to be transferred between these blockchains. The most commonly used function is to swap an asset on one blockchain (source chain) for an asset on another chain (target chain).

However, Bridge can also be used to transmit data or messages from the source chain to the destination chain. As of this writing, more than 110 Bridges are currently being used to transmit information across both Layer 1 and Layer 2 ecosystems.

The increasingly complex landscape makes the field confusing for new entrants. Therefore, it is necessary to develop frameworks to simplify various designs. So I will classify and introduce all Bridge technology in this article.

Bridges can be classified according to several characteristics. These include how information is passed across chains, assumptions about reliability, and types of connection chains. The most important factor is how to transfer data from one chain to another.

Information About Bridge

According to Chainspot statistics, the market currently has about 114 Bridges connecting to 130 different blockchains. Bridges have many different operating mechanisms and structures. In particular, bridges operating under lock-mint and burn-unlock mechanisms are dominating the market, accounting for the majority of TVL in the Bridge segment.

There is an opinion that Wrap Token is not a Bridge, this is an opinion that is not entirely correct because if Wrap Token and liquidity lock are on the same chain then it is not exactly a Bridge (for example: Wrap ETH into WETH for ease of use). used in the DeFi market), but locking liquidity on one chain and minting a Warp version on another chain is a Bridge.

With more than 40 Bridges containing liquidity, the Bridge with the highest TVL is the Wrapped Bitcoin bridge, bringing Bitcoin to the DeFi market on Ethereum and Tron. Next are bridges such as JustCrypto, Polygon Bridge, Arbitrum Bridge,...

Cross-chain communication protocols or multi-chain interactive Blockchains will not contain liquidity, they only help connect chains, allowing information transmission between them. This opens up the possibility of developing Omnichain, an interactive market without blockchain limitations.

Connect ability

Layer 1 to Layer 1

Layer 1 to Layer 1 bridge allows users to transfer funds from one L1 ecosystem to another. For example, the Wormhole bridge allows transferring assets from Solana to Ethereum. By increasing interoperability between Layer 1 ecosystems, web3 users have the freedom to spend time and resources on their preferred chain while maintaining the flexibility to switch chains whenever they choose.

Layer 1 to Layer 2

A Layer 1 to Layer 2 bridge allows an L1 chain, such as Ethereum, to communicate with a layer 2 chain built on top of a layer 1 chain. For example, users may want to connect ETH from the Ethereum mainnet to Arbitrum, Optimism, or ZkSync. They can do this by passing their tokens on each L2's own bridge, or they can use a third-party bridge such as Across. As L2 ecosystems continue to grow, these bridges will play a large role in moving Ethereum's mainnet operations to L2.

Layer 2 to Layer 2

So far, the development of Grade 2 has been clear. Polygon's various Layer 2 solutions (Miden, Hermez, Nightfall), Starkware's ZK-rollup Starknet, and Matter Lab's ZkSync 2.0 will provide the core building blocks needed for developers to build applications. Applications are not affected by high gas fees.

However, these different L2s are not natively compatible so there is a risk that they could become fragmented versions of what we have seen with the L1s. The goal of L2 to L2 bridges is to ensure that L2 ecosystems benefit from high throughput, low gas fees, and strong security while reducing fragmentation between L2s. Some projects that are actively working to accomplish this goal include Hop Protocol and Orbiter Finance.

Bridge's Working Mechanism

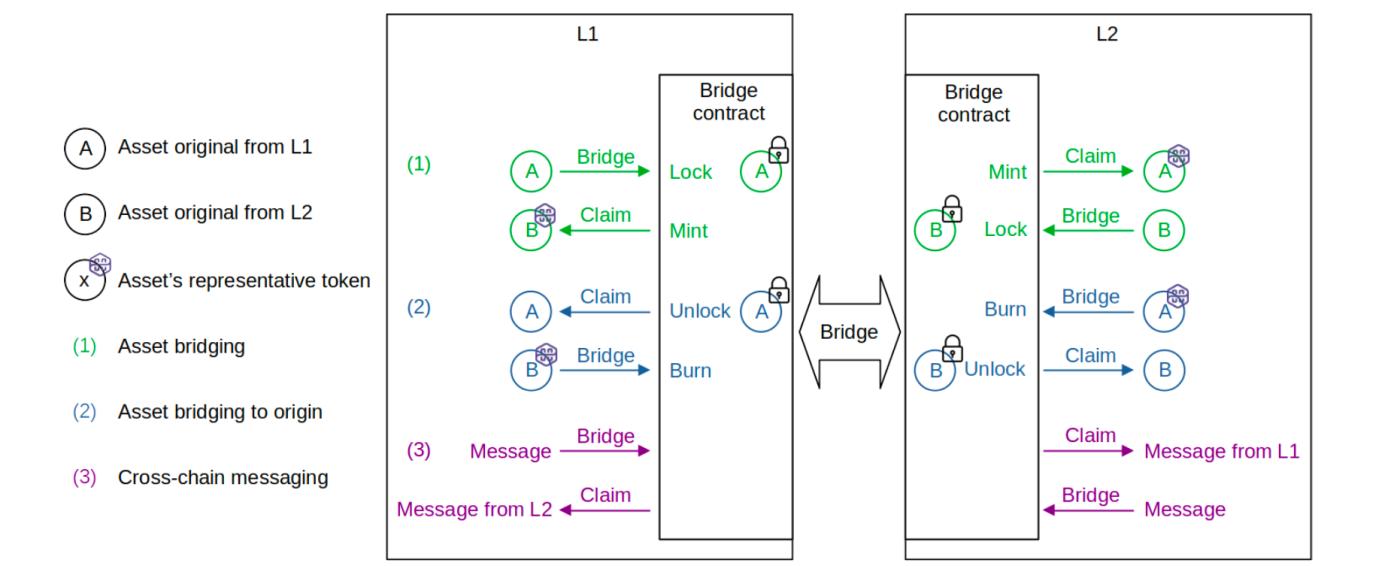

There are hundreds of different bridges on the market, they operate with many different mechanisms. But based on common points, there are 3 main operating mechanisms as follows:

- Mint-Burn: When transferring assets from the source chain to the destination chain, the asset will be burned in the source chain and newly printed in the destination chain.

- Lock-Mint and Burn-Unlock : When transferring assets from the source chain to the destination chain, the asset will be locked in the source chain and the Wrap will be printed in the destination chain.

- Lock-Unlock: When transferring assets from the source chain to the destination chain, that asset will be locked in the source chain and unlocked a similar amount in the Liquidity Pool on the destination chain.

During the process of burning, printing, locking or unlocking assets on the first Bridge, it is supervised by Oracle or the Validator group or Blockchain network. Monitoring and authenticating information is the most important component of a Bridge, and the security of a Bridge also depends on these components.

Bridge Classification

Because the number of Bridges is very large and the way they operate is very diverse, there are many ways to classify them. On the market there are types such as communication protocols, native bridges and cross-chain DEX. But to simplify, I will divide Bridge into two main types: asset transfer and information transmission .

- Asset transfer: As its name suggests, this Bridge is used to transfer assets directly. In this type, Bridge is also divided into many small types based on its operating mechanism and structure. Normally, Bridges that support asset transfer (Token, NFT,...) are built based on communication protocols, networks (original Blockchain and Cross-chain Blockchain), through intermediary assets, third parties. 3 like Orbiter's Maker and Hashflow.

- Messaging: Cross-chain protocols or Blockchain will support the transmission of messages containing information and data to build bridges, Cross-chain dApp or Omnichain dApp.

A/Transfer of assets

1/Through communication protocol

Stargate

Detailed structure of Stargate Finance

Stargate is a cross-chain liquidity transport protocol using LayerZero's messaging technology, a dApp built on the Ethereum original Blockchain by the LayerZero development team. Stargate enables cross-chain asset transfers via Liquidity Pools and messages are transferred using LayerZero.

With Stargate , users can use native assets on all blockchains. Stargate is also the first Omnichain dApp built on LayerZero , opening up future applications and development for Omnichain.

Stargate creates liquidity pools for stablecoins across networks in a unified interface. When a user wants to transfer funds from the source chain to the destination chain, the user must deposit funds into the source chain's Pool. Next, the Endpoint in the source thread will send a message to the Endpoint of the destination thread. After the Endpoint in the destination chain receives news that the user needs to transfer money to the wallet address in the destination chain and is confirmed that the funds are locked in the source chain, the Pool in the destination chain will transfer the assets to the user's destination chain wallet address. send.

In general, Stargate works like cross-chain money transfer through Stablecoin. Stargate also supports asset transfers other than Stablecoins and cross-asset transfers (i.e. transferring asset A in the source chain to asset B in the destination chain). Thanks to the connection to other DEXs on the networks to convert assets to Stablecoins. Then just transfer the correct amount of Stablecoin to another chain and continue using DEX to exchange Stablecoin into the asset the user wants to receive on the destination chain.

Stargate supports cross-transfer of many types of assets, as long as the assets are on the network connected to LayerZero and have liquidity locked in the Pool on that network to transfer money. Stargate stands out with its original asset support, but Stargate's weaknesses are the need for a liquidity pool, high fees due to multiple asset transfers for cross-asset transfers, and users also have to pay penalties due to liquidity differences. between Pools caused.

Aptos Bridge

Aptos Bridge is a cross-chain bridge built by Aptos and LayerZero with the purpose of bringing the Aptos network closer to other blockchains such as BNB Chain, Avalanche, Ethereum, Arbitrum, Polygon, Optimism. This bridge uses LayerZero technology to transmit information and Aptos requires very high security so they trade speed for security for this bridge.

Aptos Bridge works by locking assets on the source chain and minting a Wrap version of that Token on the Aptos network. And the message is passed by LayerZero between the source thread and the destination thread. For example, Nam transfers 100 USDT on the Arbitrum network to Aptos, Nam's 100 USDT will be locked in Aptos Bridge's Pool on Arbitrum and he will receive 100 USDT as the Wrap version at the wallet address on the Aptos network.

With Aptos Bridge, users will be supported to transfer assets without needing a liquidity pool on the destination chain, without being affected by the price slippage of the pools. But users cannot use the original Token. This problem will cause liquidity fragmentation, typically on Aptos there are many versions of a Token such as USDC due to the use of many different bridges such as LayerZero, Wormhole, Celer.

Portal Bridge

Portal Bridge is a cross-chain bridge that uses Wormhole communication protocol technology. Portal Bridge is a bridge built by the Wormhole and Solana development team. It was initially used to bring assets on other blockchains into Solana. But gradually, following the development of the market, Portal Bridge became a common bridge for networks in the market.

Portal Bridge works similarly to Aptos Bridge, allowing users to transfer cross-chain assets with the original asset locked on the source chain and the Wrap mint on the destination chain. The lock-mint and burn-unlock processes operate based on messages being transmitted between the source chain and the destination chain, Wormhole is the protocol that supports the transfer and security of these messages.

Portal Bridge is a bridge widely used in the Crypto market thanks to the support of Jump Crypto and Solana. However, this bridge has been attacked by Hackers and does not support cross-asset transfer, that is, transferring asset A in the source chain to receive asset B in the destination chain. But Wormhole develops a bridge with Circle's CCTP to bring native USDC to chains and combines with DEX to support cross-asset transfers.

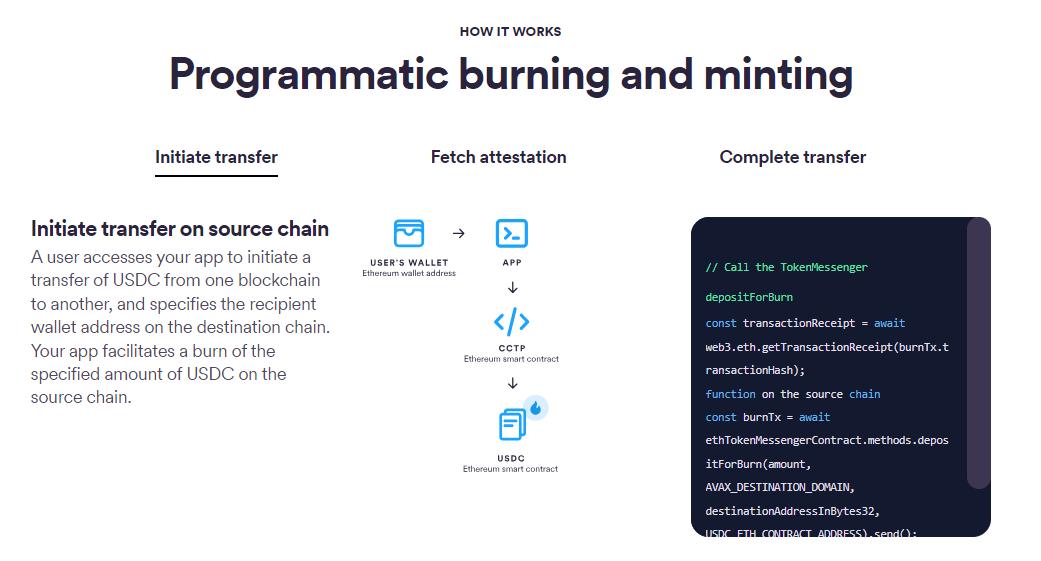

Circle's Cross-chain Transfer Protocol

We know that Circle is the issuer of USDC on many Blockchains. USDC is a Stablecoin collateralized 1:1 with traditional non-dollars. For each block chain of Blockchain, Circle will have a mint contract or USDC printer.

With the introduction of Cross-chain Transfer Protocol, Circle allows printers on chains to communicate with each other through intermediate communication protocols such as LayerZero, Wormhole, LIFI,... With each communication protocol , Circle will develop a separate Bridge used to transfer USDC between chains, specifically Circle and LayerZero build a USDC Bridge and Circle and Wormhole also build a USDC Bridge.

Cross-chain Transfer Protocol supports transferring USDC between blockchains by burning the source chain and minting a new one on the destination chain. The Token Burner and the Token Printer communicate or connect to each other through communication protocols. In addition, Bridge operations are monitored by Circle's Validator system.

Example of how Cross-chain Transfer Protocol works: Mr. Nam transfers 1000 USDC from Ethereum to Optimism, 1000 USDC will be sent to Circle's burning Smart Contract on Ethereum. The communication protocol then sends information about the amount of USDC burned on the source chain and the receiving wallet address to Circle's client application on Optimism. Another application will print 1000 USDC on Optimism when receiving information from the communication protocol. Finally send 1000 USDC to the receiving wallet address on the Optimism network.

This product is very useful for the DeFi market as it allows users to transfer native USDC across the chain with a very cheap fee, no price slippage, and no need for a liquidity pool. But it has the disadvantage that the printers that burn USDC are also controlled by Circle, this transfer method also does not apply well to those who transfer assets other than USDC.

3/Through the original Blockchain

There are bridges built by several blockchains that uniquely support the network. Typically, these networks only support connection to Ethereum, allowing the transfer of assets from Ethereum to the network and the ability to transfer people from the network to Ethereum. Most of these bridges use the network or Validator on that network to authenticate the data transmitted. In addition, these bridges will use a common mechanism of locking on the source chain and new mint on the destination chain for the transfer from Ethereum.

Outstanding bridges in this category include: Polygon Bridge, Arbitrum Bridge, Optimism Bridge, zkSync Bridge, Starkgate,...

Polygon Bridge

Polygon Bridge is the largest bridge among the bridges using the original Blockchain network. This bridge was built by the Polygon team, with the purpose of connecting Polygon with Ethereum, allowing the transfer of assets from Ethereum to Polygon as well as vice versa.

As mentioned above, Polygon Bridge uses lock-mint and burn-unlock mechanisms, typical of bridges using native Blockchain. The Polygon network will participate in validating information, storing data transferred between Ethereum and Polygon, ensuring security of assets on the bridge.

Initially, Polygon Bridge only supported transferring ETH from Ethereum to Polygon and vice versa. But currently, Polygon Bridge supports a lot of assets from Ethereum to Polygon. These assets will be locked in Polygon Bridge's Pool on Ethereum and printed copies or Wrap copies on Polygon. To perform the reverse transfer process will burn the Tokens printed in Polygon and unlock liquidity for locked assets on Ethereum.

Bridges of this type have a very high level of security thanks to the authentication and good security of the root network. However, these bridges usually only support connection between Ethereum and the original Blockchain.

Rainbow Bridge

Rainbow Bridge is a bridge that uses Validator on the original Blockchain for security. Rainbow was built by the Aurora development team. The bridge is used to connect Aurora, Near, and Ethereum. Like Polygon Bridge, Rainbow Bridge operates on a lock-mint and burn-unlock mechanism. The original token will be locked on Ethereum, Aurora and minted copies on the Near network.

But Rainbow has a slightly different structure than bridges using the original Blockchain. Rainbow uses LiteNode to store block headers, significantly reducing the amount of storage required. LiteNode is deployed as a smart contract and specifically there are 2 LiteNodes, one deployed on the Ethereum network, storing NEAR block headers and one deployed on NEAR to store Ethereum block headers.

Since LiteNodes are smart contracts, they cannot run and update themselves. Relays are scripts running on traditional servers that periodically read blocks from one Blockchain and transmit them to LiteNode running on the other Blockchain.

With this structure, the bridge will be updated with information accurately. But having too few Nodes also brings potential risks to the bridge.

4/Through Blockchain Cross-chain

Satellite

Satellite is a cross-chain bridge built by Axelar, a Layer 1 Blockchain built using the Cosmos SDK toolkit. Axelar is a Blockchain created to connect Blockchains, solving cross-chain and security problems with the Axelar network.

The Satellite bridge uses lock-mint and burn-unlock mechanisms to support cross-chain asset transfers. The asset will be locked in the original chain and mint the Wrap version in the destination chain, the Wrap version will be formatted with axl attached to the front (like axlETH, axlUSDC,...).

A special feature of the Satellite bridge is that data will be authenticated and stored using the Axelar Blockchain network, a network of Validators operating based on the PoS consensus mechanism. The fact that the bridge is secured by the entire Blockchain network is very difficult to attack. Although it is similar to the security of the original network of bridges like Polygon Bridge, Blockchain like Axelar was born solely for the purpose of supporting cross-chain communication.

Satellite supports many different assets and blockchains, especially EVM Chains and Cosmos blockchains.

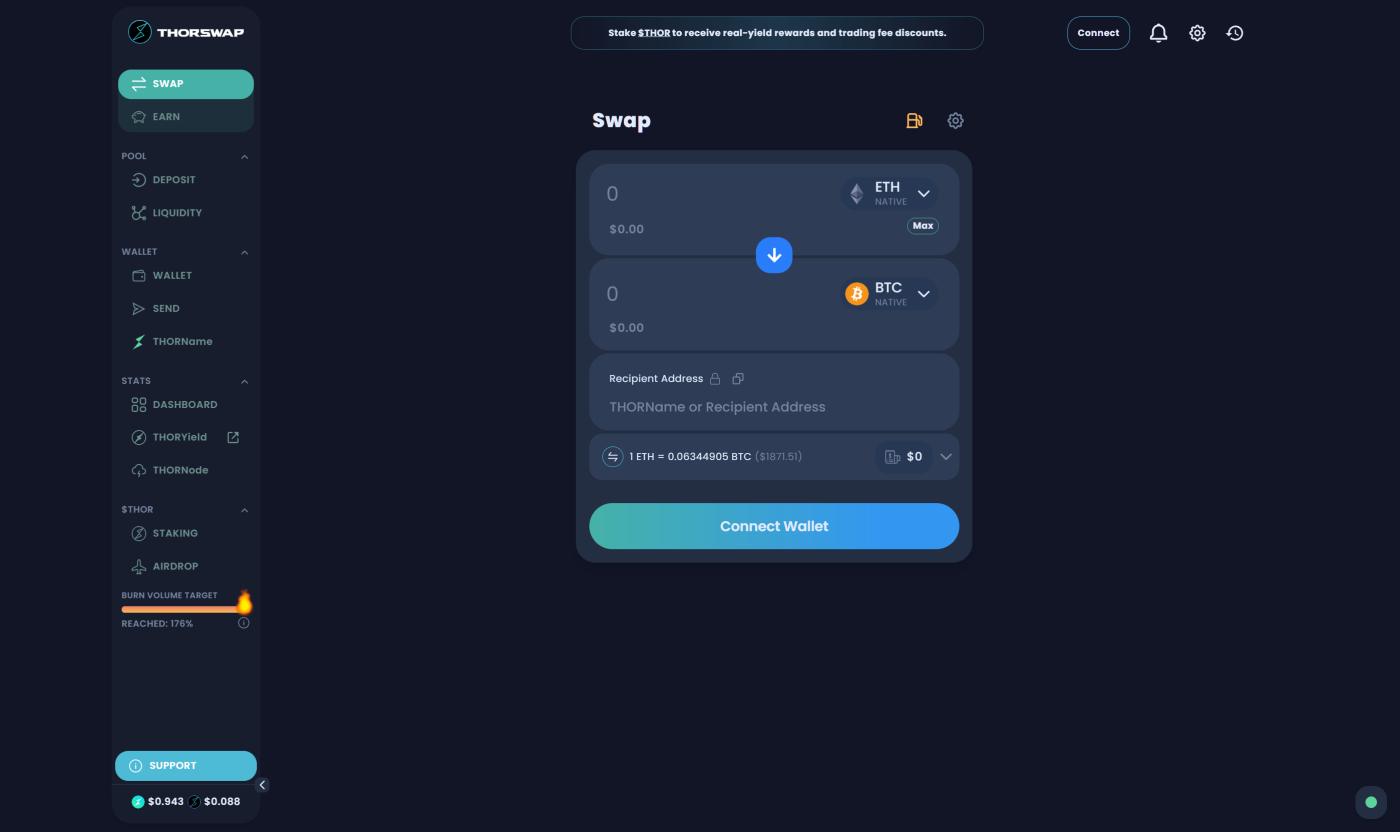

THORSwap

THORSwap is a Cross-chain AMM DEX built on the THORChain network. THORSwap allows for cross-asset exchange between networks without the need for wrappers. Assets used on blockchains are all Native.

THORSwap creates liquidity pools for assets across chains and uses THORChain's Blockchain network to transmit cross-chain messages between pools. The transmitted message contains the AMM formula for calculating cross-chain trading assets.

Specifically, this structure and mechanism are the same as a regular AMM. The difference is that in a regular AMM, the liquidity pair uses 2 single asset pools located on one network, while for THORChain, these 2 pools are located on 2 different networks.

For example: Nam wants to transfer (swap) 100 ETH on Ethereum to USDC on Avalanche via THORSwap. Nam's 100 ETH will be transferred to Pool ETH on Ethereum and THORChain will transfer the message to Pool USDC on Avalanche with the AMM formula to calculate the amount of assets Nam receives. Suppose after calculating, Nam's original 100 ETH can be exchanged for 100,000 USDC on Avalanche. After that, Nam will receive 100,000 USDC at his Avalanche wallet address.

With this mechanism, users can always use Native assets and moreover, THORSwap supports many assets that few bridges or Cross-chain DEXs can support such as BTC, LTC. BCH, DOGE. The weakness of THORSwap is that it introduces AMM to support cross-chain asset transfers, which causes price slippage, costs a lot of fees, and requires a large amount of liquidity.

5/Through intermediary assets

Zetabridge

Zetabridge is a cross-chain bridge built by the Zetachain development team, cross-chain Blockchain or new generation Omnichain. Zetabridge allows the transfer of assets between chains through the intermediary asset ZETA, the main Token of the ZetaChain network.

ZETA is a Token according to the ZRC-20 standard of the Zetachain network. This Token standard is compatible with all Blockchains due to Zetachain's connection to other blockchains. Therefore, it is possible to burn ZETA on one chain and print a new one on the other chain, the data will be authenticated and stored on the Zeta Blockchain network.

Zetabridge supports cross-chain asset transfers using the intermediary asset ZETA. Specifically, the asset on the source chain will be converted into ZETA, then burn this amount of ZETA on the source chain and print the same amount of ZETA on the destination chain, and finally exchange ZETA on the destination chain into the asset that the sender needs. sent to their wallet on the destination chain.

Zetabridge supports cross-transfer of assets between networks and is highly secure. But the limitation is that when using intermediary assets, the bridge needs to use DEX to transfer assets.

6/Through a third party

Orbiter Finance

Orbiter Finance is a bridge created with the purpose of supporting the transfer of assets between Ethereum and Layer 2. On Orbiter, it is possible to transfer 4 types of assets: ETH, USDC, USDT, DAI between chains quickly. and safe.

Unlike regular bridges, Orbiter uses a third party to transfer assets, they are called Makers, which can be considered creators. The sender is called a Sender, who needs to transfer assets between chains that Orbiter supports.

Orbiter's operating mechanism is very simple, Makers provide wallet addresses on the networks they want to support. They then send these wallets to Orbiter's contract for storage and monitoring, and they need to commit an amount of assets to make the transfer to the sender. These Makers can only participate in transferring orders containing assets lower than the amount of assets they previously committed.

Sending orders will be encrypted by Orbiter and have enough data such as destination chain, amount of assets, and receiving wallet address. When transferring each order, Maker will receive a fee. When a dispute occurs, the sender needs to provide data and proof of the transaction and they will be compensated with a value greater than the original transfer. If the Maker cheats, the pledged money will be cut and that money will be used to compensate the Sender. The person who decides this issue is called the referee.

For example: Nam transferred 1000 ETH from Ethereum to Optimism via Orbiter. When initiating a transfer order on Orbiter's interface, Orbiter will select the appropriate Maker to support this order and Nam's 1000 ETH will be transferred to the wallet address that this Maker provides on the Ethereum network. After Maker receives ETH in his wallet, he also receives transaction data including asset amount (1000 ETH), destination chain (Optimism), receiving wallet (sending wallet). Finally, Maker used his Optimism wallet address containing ETH to transfer 1000 ETH to Nam's receiving wallet address.

This type of bridge supports quick asset transfers, no need for users to provide liquidity, and cheap fees. But it does not support cross-network asset transfer and Orbiter only focuses on Layer 2 support.

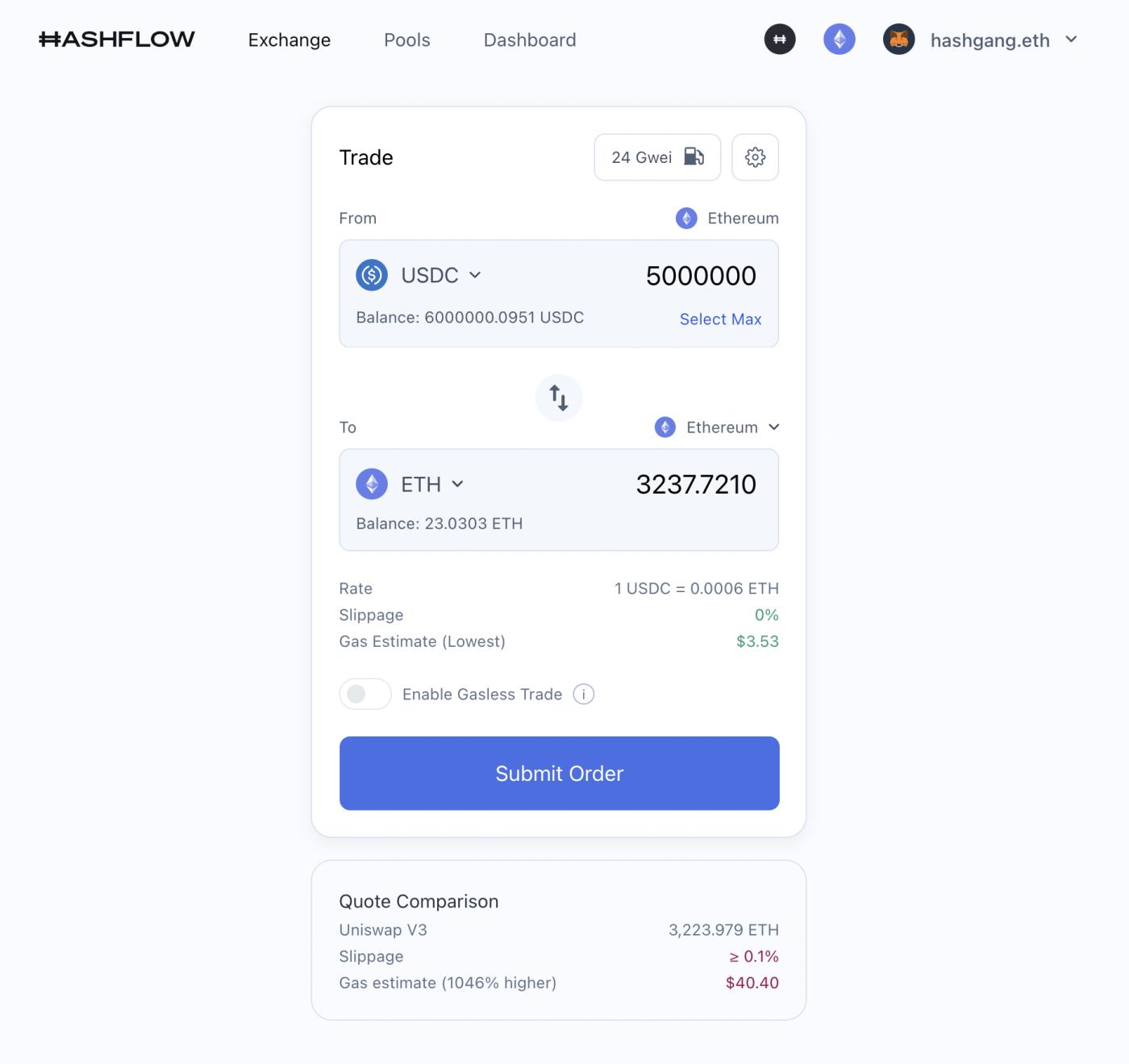

Hashflow

Hashflow is a new generation Cross-chain DEX, allowing cross-chain transfers and supporting a wide variety of assets. Every day, Hashflow processes tens of millions of dollars worth of transaction volume but TVL is only $1 million. Only major blockchains are supported such as Ethereum, Polygon, Avalanche, Optimism, Arbitrum.

Hashflow initially used Pools placed on networks and Maker to support transactions. But after a period of operation, these two mechanisms compete with each other, so in the end only Maker remains active. Maker creates Asset Pool on chains, users deposit assets into source chain Asset Pool and Maker will transfer assets from Pool on destination chain to receiving wallet address.

Hashflow stands out with its native and fast cross-asset transfer support as an exchange. It helps users exchange cross-chain assets with very cheap fees, only Maker fees, Hashflow does not receive any fees.

B/ Information transmission intermediary

1/Protocol

LayerZero

LayerZero is a Cross-chain platform that allows Blockchains to communicate with each other securely and efficiently. LayerZero can also be considered a communication protocol or multi-chain interaction protocol. LayerZero provides a platform to develop bridges, Omnichain dApps or NFTs, Omnichain Tokens.

LayerZero can basically be understood as a layer that connects separate chains in the Blockchain. By attaching Endpoints (ultra-light client applications) to networks to receive and transmit information between Chains, each Chain will be assigned a unique Endpoint. However, Endpoints do not store data, the data will be transferred to the Relayer for Off-chain authentication and storage.

LayerZero is secured through 2 layers: Onchain and Offchain. Messages transferred between Endpoints on the networks will be authenticated Offchain by Relayer and Onchain by Oracle Chainlink. These two entities validate data independently. If either gives an incorrect result, the command or message will not be executed. In recent updates, LayerZero also uses Google Oracle to monitor the operation of the LayerZero system.

Is LayerZero like a bridge? LayerZero is just a protocol for connecting and transmitting information between chains, but it does not directly move assets, so it is not a bridge. But LayerZero is the basis for building bridges such as Aptos Bridge, USDC Bridge, Hop Protocol,...

Does LayerZero support Smart Contracts (i.e. dApp development) on the network? LayerZero is only capable of connecting and interacting with Blockchains, not developing its own Blockchain, so it does not support Smart Contracts. Omnichain dApps are built on a certain root Chain and connect to LayerZero to interact with other Chains.

The most outstanding feature of LayerZero is its friendliness, it is easily integrated into Blockchains and dApps. LayerZero's structure is also very flexible, developers can replace and customize components in it. LayerZero also supports extremely low fees for cross-chain messages.

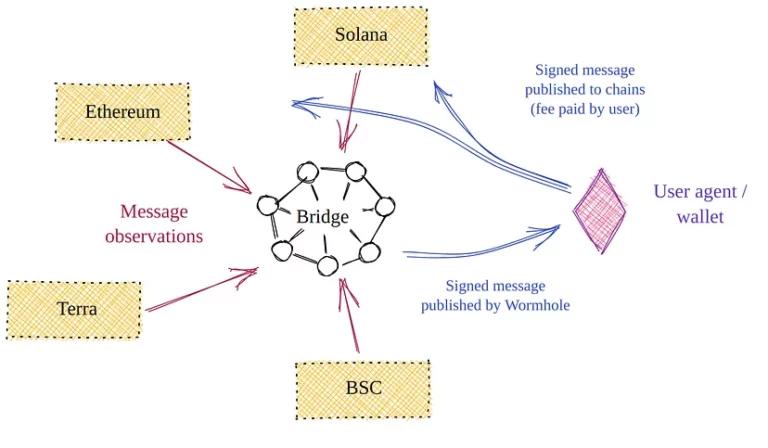

Wormhole

Wormhole is a generic message passing protocol connected to many chains including Ethereum, Solana, BNB Chain, Polygon, Avalanche, Algorand, Fantom, Karura, Celo, Acala, Aptos and Arbitrum.

Wormhole does this through Core Bridge contracts mounted on chains. Emission of messages from a chain is observed by the network of Guardians nodes and verified there. Once verified, this message is sent to the target chain for processing.

Wormhole brings technology to build cross-chain dApps. Thanks to the message forwarding capabilities and toolset provided by Wormhole. dApps that have been built on other chains can also link Wormhole for Multichain development or support multi-chain governance.

On Wormhole users can interact with xDapps (cross-chain decentralized applications) to transfer xAssets (cross-chain assets) between networks or access xData (cross-chain data) to provide services on the network for them .

The most outstanding feature of Wormhole is its ability to transmit information quickly and extremely cheap fees. In particular, Wormhole supports Gas payment with any Token. But a big question for Wormhole is the security issue, the Guardians are too concentrated and easy to attack. In fact, Wormhole's Portal Bridge was attacked by Hackers on February 2, 2022. Hackers exploited a protocol vulnerability to mint 120k ETH encased in Wormhole on the Solana network.

Cross-Chain Interoperability Protocol (CCIP)

Cross-Chain Interoperability Protocol (CCIP), also known as cross-chain interoperability protocol, CCIP can be seen as an infrastructure for transmitting messages or transferring cross-chain tokens according to the mint-burn mechanism and lock mechanism - unlock.

CCIP helps transfer assets or Tokens between chains quickly and according to the mint-burn mechanism, so there is no price slippage or high fees. Just pay the original chain's Gas fee and the order will be completed. Based on data and information updated in real time and Chainlink's own security, CCIP is very secure.

CCIP is supporting the Ethereum, Avalanche, Polygon and Optimism networks. In the future CCIP will continue for most other Blockchains in the market. With CCIP, dApps can be used to build Cross-chain, DEX Cross-chain or Cross-chain Lending protocols,...

CCIP supports fee payments using LINK, the networks' native tokens, or their ERC-20 wrapped versions. Payments made in alternative assets will be charged at a higher rate than payments made in LINK. Paying with LINK will be 10% cheaper and part of the fee will be paid for LINK Staking because it uses Chainlink's Oracle service.

Structure of Cross-Chain Interoperability Protocol:

- Active Risk Management (ARM) Network : Is a separate, independent network that continuously monitors and validates the behavior of the main CCIP network, providing an additional layer of security by independently verifying cross-chain activities to detect erroneous activity.

- Committing : Is the part that receives the task of reading information or messages from OnRamp on the source thread, then transferring the data to OffRamp on the destination thread.

- Executing : Receives the task of ordering OffRamp on the mint destination chain or transferring Tokens in the Pool to the user.

- Ramp : Like a client application placed on networks, when executed on the source chain, it is called OnRamp and on the destination chain, it is called OffRamp. On Ramp, there is a liquidity pool to store assets that support the Lock-Unlock mechanism.

The difference of Cross-Chain Interoperability Protocol is that it is secured by Chainlink's decentralized Oracle network. The protocol can connect to non-traditional infrastructure such as Swift systems. With this ability, Cross-Chain Interoperability Protocol stands out from the rest when no other bridge in the market can do that.

When using Cross-Chain Interoperability Protocol, developers can also make customizations such as security, with high security, the authentication time will be longer. But the limitation of Cross-Chain Interoperability Protocol is its high cost.

2/Blockchain

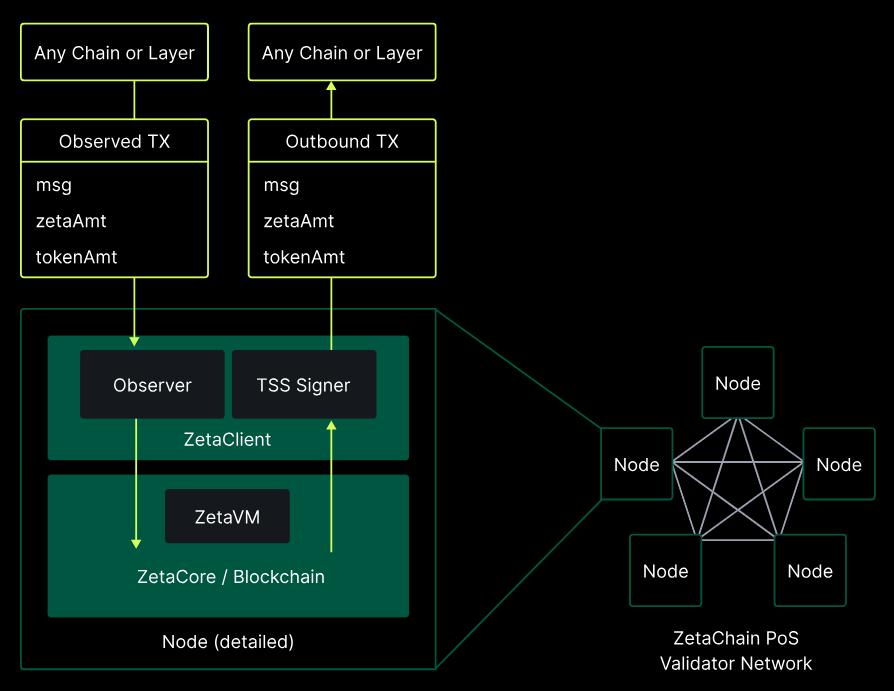

Zetachain

ZetaChain is a Layer 1 Blockchain based on PoS consensus mechanism, built using the Cosmos SDK and Tendermint Consensus toolkit. It is an EVM compatible platform that allows the development of Omnichain dApps (odApps) thanks to the ability to connect and interact with other Blockchains.

ZetaChain is a layer 1 blockchain that does not require wrapped assets to transfer value across the chain and does not require bridges for every pair of blockchains. This is enabled by Zetachain's use of cross-chain messaging, which allows data and value to be sent across chains and layers. Using multi-chain smart contracts, developers can program ZetaChain to listen and act on events on connected blockchains.

ZetaChain relies on the consensus of validator nodes to secure itself and a distributed threshold signature scheme to secure private keys across connected chains to avoid a single point of failure. PoS provides incentives for validators to act correctly.

ZetaChain has fast block generation times (5 seconds) and near-instant confirmations. The Tendermint PBFT consensus engine has shown scalability to 300 Nodes in production. With future upgrades to BLS signatures transaction throughput on ZetaChain could reach 100 TPS.

ZetaChain's PoS network is operated by Validators. Contained within each validator are ZetaCore and ZetaClient. ZetaCore is responsible for producing the blockchain and maintaining the replicated state. ZetaClient is responsible for observing events on the external chain (Observer) and signing outgoing transactions (TSS Signer).

ZetaCore and ZetaClient are grouped together and run by node operators. Anyone can become a node operator to participate in validation provided there are enough bonds staked.

What differentiates Zetachain from other competitors like LayerZero is that even blockchains without smart contracts, such as Bitcoin, can be integrated into Zetachain.

These bridge platforms enable interoperability between chains and enable the building of new ecosystems based on them. This enables new use cases beyond sending tokens from chain A to chain B, opening up a new era for Omnichain development.

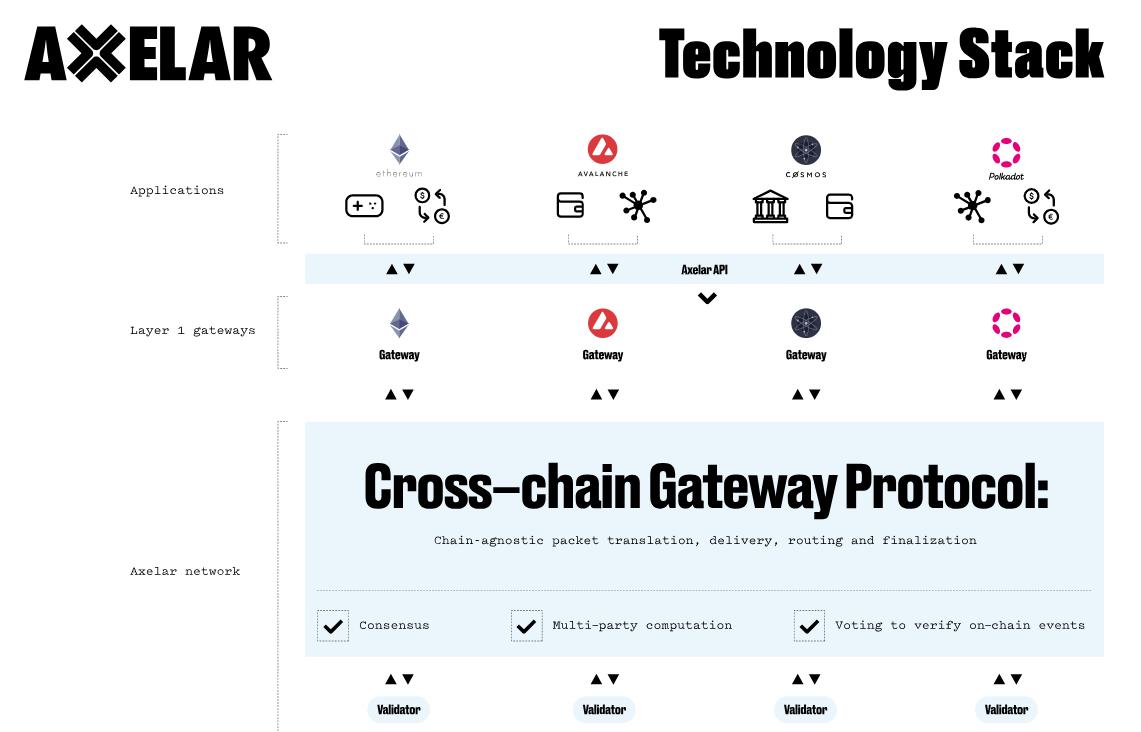

Axelar

Axelar Network is a network built using the Cosmos SDK toolkit. Therefore, Axelar is a Chain connected to Cosmos and can communicate with projects in the Cosmos ecosystem through the IBC bridge. Axelar operates under the same POS consensus mechanism as Cosmos.

Not only is there connectivity within the Cosmos ecosystem, but Axelar also connects other EVM chains to help those EVM Chains communicate with each other. Communication is through messages passed back and forth between EVM Chains. Those messages must be agreed upon by the Validators of the Axelar Blockchain network to reach the destination chain.

Axelar is divided into 3 main parts:

- A Decentralized Network: Powered by a Validator responsible for maintaining the network and executing transactions. It directly operates the cross-chain Gateway, which is a layer on top of Layer1, responsible for performing read and write operations for smart contracts deployed on connected external chains.

- Gateway Smart Contracts: Provides connectivity between the Axelar network and connected Layer1s. The Validator monitors and reads transactions sent from the front-chain Gateway. They then come to an agreement on the validity of that transaction. Once agreed, they transfer the order to the destination chain's Gateway to perform cross-chain transactions. Validator and Gateway are the core infrastructure layer.

- Developer Tools: Sitting on top of the core layer are APIs and SDKs (libraries and tools that allow developers to access the Axelar network easily). This is the application development layer that developers will use to combine on any two chains in a single step, adding universal interoperability to their blockchains and applications.

Commands or messages transferred from the front-chain dApp will go through the Gateway to reach the Axelar network. Here, Validators will authenticate transaction data according to the PoS consensus mechanism. Then pass the message to the destination chain dApp through the destination chain's Gateway.

The biggest limitation of Axelar is that it does not support non-EVM blockchains and cannot connect to networks without an execution environment like Bitcoin. Axelar can only develop the Satellite bridge by locking liquidity in the source chain and then minting the Wrap version, this method will no longer be suitable for the future market.

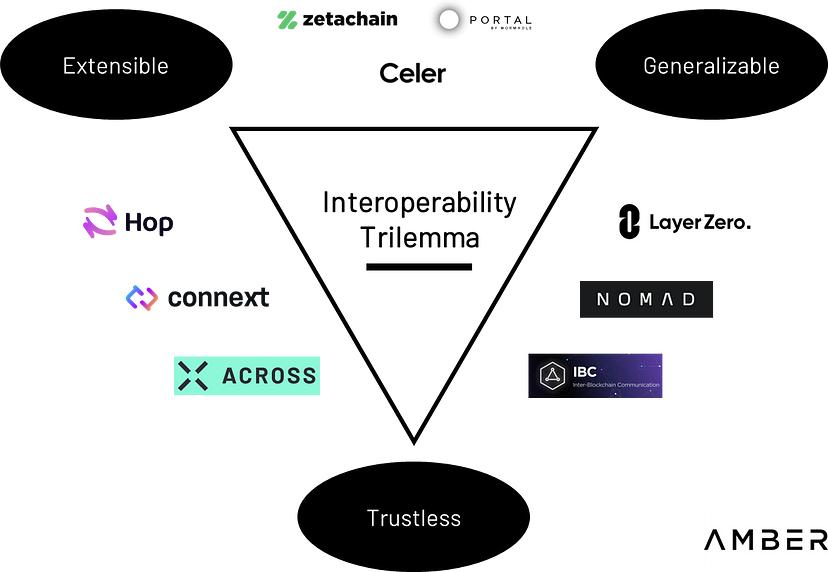

The tradeoff

Although there are many bridges designed in different ways. But no bridge can achieve all three properties of the impossible trinity. The interoperability trilemma, a term coined by Arjun Bhuptani, states that bridges can only possess two of the following three properties: generalizability, extensibility, and trustlessness.

- Generalizability: The ability to transfer arbitrary data between two chains.

- Extensibility: Scalability, rapid deployment on heterogeneous chains.

- Trustlessness: Bridge's reliability and decentralization.

The Interoperability Trilemma

Similar to the scalability trilemma, when a bridge selects two of these properties, the last property will be affected. For example, Connext is a trustless bridge that allows token transfer between two EVM-compatible chains. Currently, it cannot transfer arbitrary data, which implies that it has prioritized scalability properties. Other bridges like ZetaChain prioritize security by requiring an additional layer of trust through the bridge's authenticator.

Since the primary use case for bridges is token transfer between two blockchains, most projects have chosen data transfer and scalability capabilities to quickly deploy across heterogeneous chains and Maintains flexibility to transfer arbitrary data. This has allowed these types of bridges to deploy faster than many of their competitors and meet the market demand for token transfers.

Although many of their users pay a heavy price for this. These types of bridges can expand their use cases from performing simple token transfers to becoming more comprehensive developer platforms.

Source: Amber Group

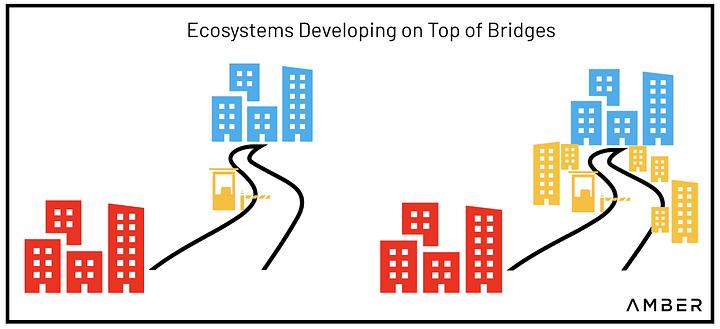

The transition of a bridge from a token transfer mechanism to an application platform can be illustrated by comparing a bridge to a toll road connecting two highly trafficked cities. Every time a user wants to go from city A to city B. Bridges are gradually shifting from this toll road model to a town model where developers build applications on top of the bridge to create a town between city A and city B.

Bridge Development Process

Initially, Bridge was born with a few very primitive projects, but over time this segment has grown stronger thanks to its applicability. Many early bridges were created for the sole purpose of supporting cross-chain Token transfers, but were very vulnerable to attacks. After that, bridges began to offer new security solutions and offer different development directions such as EVM Chain, All Chain, speed, security, scalability, Layer 2, Layer 1, ...

As the NFT market grows, so does the need to transfer NFTs across the chain. From there Bridges for NFTs were born, they also reuse the same mechanism and technology as Bridges for Tokens.

Bridges, whether new or old, show their limitations. Limitations such as decentralization, speed, scalability,... So gradually bridges of this type will switch to Omnichain. Omnichain will obscure the concept of Cross-chain, because with Omnichain we can interact multi-chain and transfer original assets quickly and simply.

With Omnichain, Tokens are issued on all Chains and can move back and forth through the Blockchain or issuance protocol based on messages transmitted across the chain. This application allows users to transfer assets across the chain without worrying about security, liquidity, price slippage or having to use Wrap.

So new communication protocols or Blockchain are the bridge development platform, bringing many practical applications. These projects will also be the final boss for the movie "Where will Bridge go". They help develop the cross-chain ecosystem and look towards the Omnichain future.

Maybe a bridge created to support the transfer of Omnichain Tokens across the chain will attract the market next season. This bridge connects to Omnichain Token issuance platforms to move Tokens through it. In addition, this bridge also incorporates DEX Aggregator to support cross-asset transfers between chains. But with Omnichain, Swap is usually only needed once.

For example: To convert ETH on Ethereum to AVA on Avalanche, the above bridge can burn ETH on Ethereum and mint new ETH on Avalanche (assuming ETH is Omnichain Token), after minting ETH on Avalanche, the bridge uses DEX 3rd party to Swap ETH into AVA on Avalanche.

As in the example above, if in an Omnichain environment, the bridge only needs to burn Tokens in the source chain and new mints in the destination chain, using an additional Swap to support cross-chain asset transfers. This mint-burn is performed by the Omnichain Token issuance platform, a bridge that only provides a user interface.

Risk

Bridge in Blockchain is a technology that allows transferring assets, Tokens, and data between different Blockchains. However, this technology also has some potential risks, including:

- Security risk: The bridge is a central point, so it can be a target for hackers. If hackers can infiltrate the bridge, they can steal users' assets or even take control of the entire Bridge.

- Compatibility Risk: Different Blockchains may have different rules and standards. If the Bridge is not compatible with these Blockchains, it can lead to problems such as lost or locked assets.

- Transaction fee risk: Bridges often have higher transaction fees than direct transactions on the Blockchain. This can cause difficulties for users, especially those with small amounts of assets.

Summary

Bridge is an area with a lot of potential for development, it connects Blockchains to create a superior, seamless user experience in the Blockchain space. But because Bridge is still in the development stage, the technology still has many weaknesses, especially security risks.

The Bridge segment up to this point has been attacked for billions of dollars, the most prominent of which was the Ronin Bridge attack, PolyNetwork caused more than 1.2 billion dollars in damage. So we need to choose bridges that are secure and safe for assets. Usually, bridges using the original Blockchain network such as Polygon Bridge, Arbitrum Bridge, Optimism Bridge,... have very high security. But in return, the transfer speed will be very slow, can last more than 24 hours.

Bridge is also in the process of development, especially communication protocols or cross-chain Blockchain. They become a reliable foundation for building Bridges. Especially being able to develop towards Omnichain, the appearance of Omnichain will solve all the limited problems of the bridge. Many of those bridges will die due to our own weakness.

The post Panorama About Bridge, Where Blockchains Trade With Each Other appeared first on HakResearch .