Original title: " WTF is a Blob?" 》

Written by: 563, bankless

Compiled by: Kate, MarsBit

We've been discussing more and more Blobs here on Bankless lately, and we wouldn't blame you if you're still a little confused about them. Well, we’re here today to refresh you on Ethereum’s near-term roadmap. Today, 563 is going to dive headfirst into blobspace and show us that it's not a big deal. ——Bankless team

If you've been paying attention to cryptocurrencies throughout the bear market, you may have heard about Ethereum's "rollup-based" roadmap. With EIP-4844, the Ethereum mainnet facilitates these scaling solutions by introducing the new concept of blobs.

Yes, blobs.

But what does a “blob” mean, and how does this help Ethereum’s long-term plans to scale via rollups? let's start.

From fully performing sharding to rollup

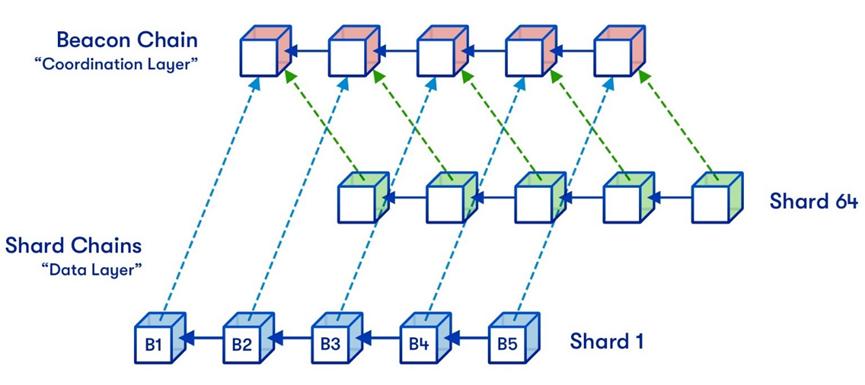

Sharding therefore involves randomly rotating validators among different shards (subgroups) of the blockchain, with each shard essentially being its own mini-blockchain, running in parallel with the beacon chain.

This is not a new idea in network design, running a bunch of parallel processes has been the plan for Ethereum for a long time.

The only problem? It was a complicated change and took too long. As Ethereum developers and researchers are strategizing how best to implement sharding, a new challenger has emerged - rollup.

Rather than breaking the main Ethereum chain into its own mini-blockchain, Rollup acts as a mini-blockchain that runs “on top” of Ethereum’s Layer 1 (hence Layer 2). When Vitalik wrote his "Rollup-centric Ethereum Roadmap" in 2020, it was already written on it:

"It seems to me that when (fully enforced sharding) finally arrives, basically no one will care about it. Whether we like it or not, everyone has adapted to a scroll-centric world, and by then, continue along the way. It’s easier to go down this path than to try to get everyone back to the base chain because there are no obvious benefits and the scalability is reduced by 20-100 times.”

Why EIP-4844 is a game changer

Now that the Ethereum community has overwhelmingly accepted rollups as the future, which improvements could have the biggest impact on mainnet?

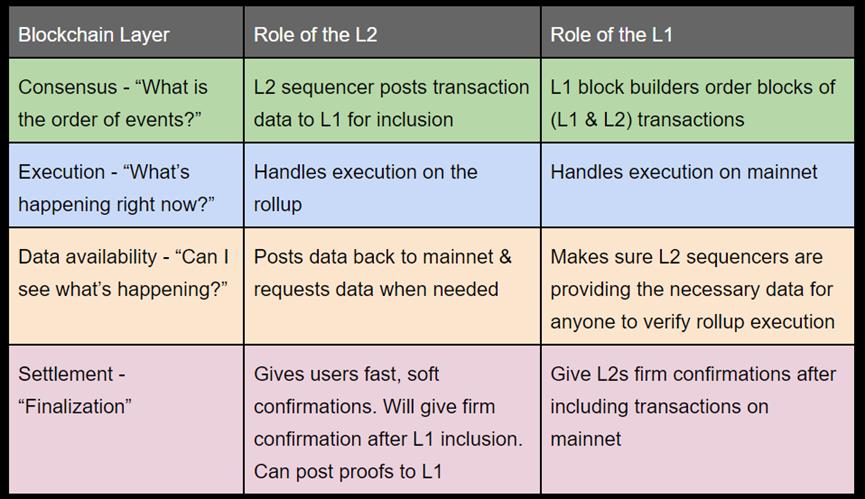

First, let’s briefly introduce the blockchain’s responsibilities in the Ethereum-rollup relationship.

Ethereum’s original sharding-centric vision was to scale execution on mainnet. Now, as execution scales by rollup, this is no longer a priority.

How Ethereum and rollup function in a modular blockchain architecture.

Any questions today? Data availability.

The rollup still needs to publish transaction data (and proof of fraud/validity for settlement verification) back to L1 so that everyone has a complete picture of what is happening across the network. For now, it's a costly venture.

So while rollup helps scale execution, Proto-Danksharding (PDS with EIP-4844) is expected to help scale data availability through blobs.

Think of blobs as a new type of tool where rollups can efficiently store transaction and proof data, thereby saving gas when sending this information to the mainnet. This new type of transaction provides a better way for L2 to interact with L1 block space.

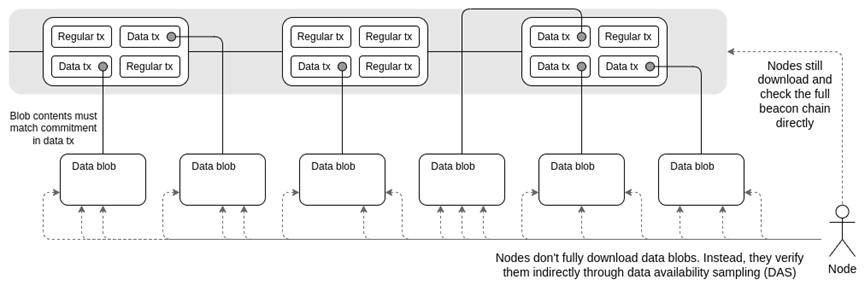

Schematic overview of transactions with blobs introduced in EIP-4844. Note that DAS is not available until full Danksharding.

While the actual gas savings achieved by EIP-4844 will depend on the extent of blobs adoption, rough initial estimates suggest a 10-100x increase in cumulative transaction costs.

How many cents does it cost to trade on Ethereum L2? Yes, please.

In fact, these fees can be so cheap that they can be completely subsidized by L2 orderers looking to create some buzz in their network. Given that both Arbitrum and Optimism are already running token incentive programs, this isn’t a crazy idea. Who doesn’t want to trade for free?

The great decoupling

After the PDS update in EIP-4844, validators on the Ethereum mainnet will be able to handle L1 execution and blobs (containing L2 data and settlement/proof). The best part? For the first time, we will be able to have separate charging markets for these two sets of data.

- Before EIP-4844, the gas cost of L1 directly affected the gas cost of rollup.

- After EIP-4844 = L2 blob and L1 execution fee markets completely decoupled

The decoupling of the fee market was the main reason why Visa chose Solana when choosing a network for stablecoin payments.

The over-hyped NFT minting on the Ethereum mainnet will no longer impact DeFi users’ favorite rollup. Thanks to an independent toll market, these unnecessary entanglements will be a thing of the past.

The blobs will also inherit a "target allocation", which at this stage is three blobs per block. Like EIP-1559, blob charges are saved via a run count to ensure blobs don't clog the network. In this way, blob and L1 executed transactions can coexist harmoniously on the underlying chain.

what happens

EIP-4844 is expected to go live with Ethereum’s next upgrade, Dencun, possibly in January. After the mainnet update, rollups will have to undergo some upgrades so that they can properly build blobs and send them to mainnet.

Due to its complexity, Fully Sharding (FDS) is further down the Ethereum roadmap, but a massive upgrade will be rolled out:

- Data Availability Sampling (DAS) - Nodes do not have to download the entire data set to confirm the presence of data. They just require random sampling (called a "data availability check").

- Chunks will be able to contain more blobs, and blobs can be larger, thanks to DAS.

The best part? Once FDS arrives, rollups won't need an upgrade to support it - they'll just need an upgrade to EIP-4844.

With the launch of proto-danksharding, the rollup-centered roadmap officially begins, laying the foundation for the next chapter of Ethereum. So when you're enjoying basically free deals on your favorite L2 next summer, remember to thank your friendly neighbors for it.