Original source: Silicon Research Laboratory

Image source: Generated by Unbounded AI

With the popularity of large AI models, China's major technology companies are setting off a storm of "running AI". From top-level strategy to business line reconstruction, AI has undoubtedly become a new story for major manufacturers to bet on the future.

Since the birth of "Miaoya", Alibaba has sounded the clarion call to use AI to comprehensively upgrade its products. The "Silicon Research Laboratory" has observed that many of Alibaba's business lines have accessed or upgraded generative systems based on large models. AI applications and tools include "Taobao Asking", digital human video generation tool Live Portait, the latest AI-driven "Future Wizard", Quark Scanner, etc.

Tencent, on the other hand, starts from its advantageous pan-entertainment position and places heavy bets on "AIGC+Social" and "AIGC+Music". Baidu is an early major company that announced that all its businesses will be reconstructed based on AI, and internally emphasizes "AI native" idea.

To sum up, the main strategies of major manufacturers can be divided into two categories: one is the upgrading and reconstruction of old markets and old businesses. Among them, there are three main actions: using AI to consolidate the entry value, and integrating AI into the whole family of products. Tonghe will combine its cloud business with AI and use AI to better “sell cloud”.

The other category is the creation of new markets and new scenarios, with two main lines. The bright line is that major manufacturers are exploring AI native applications in head-end scenarios (such as AI painting, digital people, social networking and office) and long-tail scenarios through internal horse racing. The hidden line is the same as that of overseas technology companies such as Microsoft and Amazon. , expanding the boundaries of its capabilities by betting on potential AI star unicorns.

An analyst in the Internet media field previously analyzed to the "Silicon Research Laboratory" that whether it is to B or to C, the development speed of the large model application layer is faster than imagined. "The scenarios and applications that Chinese technology companies are best at, in the mobile Internet era, are already existing games, all tinkering. Under the large model ecosystem, there are many giants, and it is still difficult to create a popular application." According to the prediction of the above-mentioned analyst. , the industry boom period will be in 2024.

Although the turning point has not yet arrived, this does not affect the new competition among major manufacturers. The speed of time, the division of product paths and the differences in AI ecology may all determine their position in the subsequent competition.

Seize advantageous areas and "combine" and "divide" product paths

In the past half year since the big model boom, from the model end to the application end, there is a consensus that the large model craze initially brought by chatGPT has gradually passed the exciting surprise period. With a large number of AI native applications entering the diffusion stage and Large models are flowing into mainstream developers, and as Sequoia Capital defines in its report , "Generative AI is undergoing a process of transformation from technology-driven to customer-driven."

For China's major technology companies, during the cooling-off period, the transition from grabbing technology to grabbing customers is reflected in various specific actions.

We have mentioned above that one of the strategies of major manufacturers is to upgrade and reconstruct old markets and businesses. However, in terms of product paths, there are also subtle similarities and differences.

The similarity is that major manufacturers are using AI to consolidate business entry value, but the difference lies in the different paths to realize entry value.

The actions of Alibaba, Tencent and Byte are mainly to "fix" existing advantageous businesses. For example, in Tencent's advantageous position in the social and pan-entertainment fields, Tencent Music has launched the AI social product "Weiban" and robot-assisted creation functions, and simultaneously tested "AI Listen Together" and AI companion "Xiaoqin".

Alibaba is the first to use AI to reshape its business in e-commerce and productivity scenarios. For example, Taobao's AI-native application "Taobao Wenqi" currently in internal testing essentially uses AI to improve the efficiency of user search behavior and realize the function of AI shopping guide. In the learning office scenario, the previous AI PaaS-based solutions of DingTalk and Quark’s AI-based solutions also show that Alibaba’s multiple business lines are fully integrating AI capabilities.

ByteDance also quietly launched two "AI artifacts" - Xiao Wukong (formerly Wukong Search), which provides AI tools, and the AI conversation product "Doubao". It also released two AI video projects on Github, one One is MagicAvatar, which generates multi-modal animations, and the other is MagicEdit, which focuses on text-oriented video editing.

Baidu has greater ambitions. Similar to the ideas of OpenAI and Microsoft, it builds an ecosystem through plug-ins and creates a super traffic portal.

Not long ago, Baidu released the Wenxinyiyan plug-in ecological platform "Lingjing Matrix". He Junjie, senior vice president of Baidu Group and general manager of Baidu Mobile Ecological Business Group (MEG), defined the relationship between large models and plug-ins as "brain and hands and feet" : "If the big model is a smart brain, then the plug-in is the hands and feet of the big model. With the plug-in, the big model can not only answer general questions, but also be proficient in professional questions. It is both a generalist and a specialist."

It is not difficult to see that whether it is using AI to consolidate the entrance value based on the original business, or creating a super traffic entrance through large model plug-ins, major manufacturers have integrated large model capabilities and lowered the threshold for using AI under the original huge user base. Prepare for subsequent large-scale applications.

Another similarity is the "product family bucket" that integrates AI into front-end business. For example, Baidu has upgraded its front-end products, including Baidu Search, Baidu Library, Baidu Input Method and Wenxin Yiyan APP. Alibaba has also implemented AI on its business line products such as travel, entertainment, life, office, and search. of empowerment.

At the same time, major manufacturers are also integrating their cloud business with AI and using AI to better “sell cloud”. The Internet cloud has changed from being an "integrator" in the early days to being "integrated" each performing its own duties. Its own superior technology products and role positioning have become increasingly clear. With the implementation of large models, cloud vendors can use the MaaS (Model as a Service) model to not only standardize products in one stop and better implement them in the industry, but also export AI capabilities and AI computing power to improve profit health. Performance.

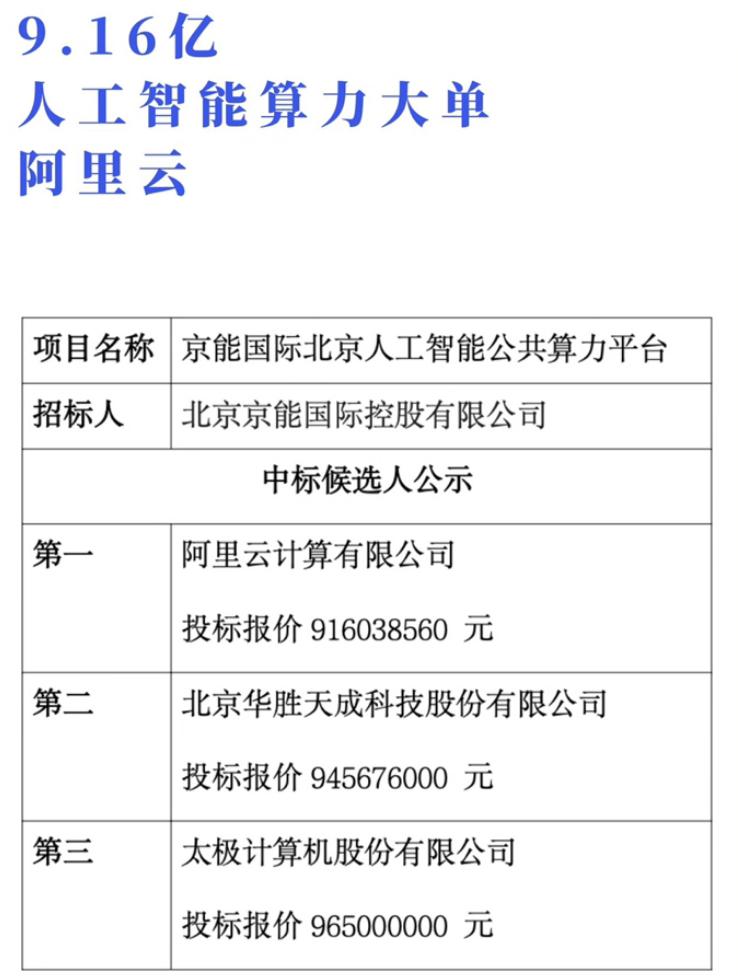

According to incomplete statistics from the "Silicon Research Laboratory", from August this year to the present, Alibaba Cloud and Tencent Cloud have received multiple large orders in the fields of government affairs, finance and other fields, showing a strong posture. Among them, Alibaba Cloud won the largest project on the market in August - the Zhejiang Provincial Big Data Development Administration Government Cloud Resource Leasing-Cloud Service Project. The project amount reached 268 million yuan. In October, Alibaba Cloud won the bid for Beijing Energy International’s 900 million AI computing power order.

A Baidu Intelligent Cloud person also mentioned in an interview with "Financial Eleven" that Baidu pursues the sale of standard products and hopes to integrate more intelligently. Therefore, we will help some customers provide necessary integration services based on the actual needs of the industry and scenarios.

What is certain is that there is no obvious difference in the specific implementation paths of major manufacturers running towards AI. The reason is that AI's current business reconstruction is not a static process, but requires a certain cycle.

The depth and breadth of AI applications depend on the allocation of internal computing power and other resources of major manufacturers, as well as business priorities. There are many uncertain factors in this process. A typical example is Jing Kun, vice president of Baidu and former CEO of Xiaodu, who recently announced his resignation to start a business. As one of the important players in the implementation of Baidu's AI ecosystem, the departure of the key figure "Father of Xiaodu" has also added more uncertainty to the future direction of this unicorn.

Competing for AI’s native fire, major manufacturers launch “horse racing game”

In addition to faster and better comprehensive integration of AI capabilities, and the rise of the "AI native" concept, major manufacturers have also taken advantage of the trend to start a new round of horse racing games.

The so-called "AI native" applications actually refer to applications that rely entirely on large model capabilities. Kai-fu Lee, Chairman of Sinovation Ventures, gave WeChat, the most successful product in the mobile Internet era, as an example. In his view, the reason why WeChat was able to win in the mobile Internet era was that it gave up the compatibility emphasized in the PC era and bet 100% on new platforms. Focus on the characteristics of mobile Internet. In other words, without mobile Internet, there would be no chance for WeChat to exist.

Returning to the current AI big model era, although the exploration of native AI applications by major manufacturers is still in its early stages, at present, there are mainly two approaches: internal horse racing and external alliances.

First, in internal horse racing, those who run well will have more resources. Baidu has determined a "horse racing mechanism" internally. All large-model related applications will conduct internal horse racing. Only if they run well can they get resource tilt.

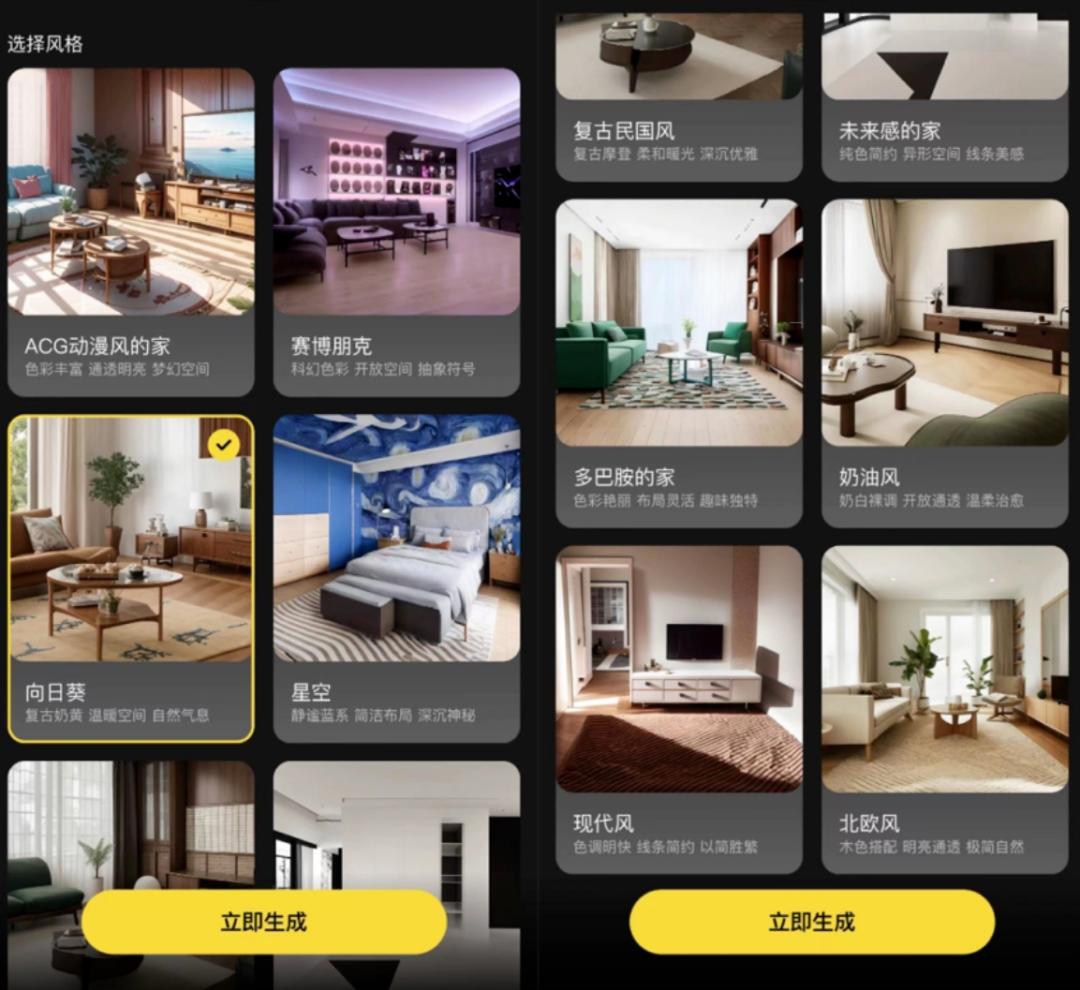

The AI native applications emerging from Alibaba also show the same characteristics. The previously popular "Miaoya" was created by the entrepreneurial team behind Alibaba Entertainment. The "True Nengzhuang" AI home design product launched in the Taobao zone is behind the Taobao Jiyoujia technical team.

"Horse racing mechanism" is not uncommon among major Internet companies. An Internet product manager told "Silicon Research Laboratory" that on the one hand, internal horse racing can create samples and encourage innovation. Only when one product is released, more products will appear. On the other hand, it is about discovering potential talents. "Many teams that win from the horse racing mechanism will be seen and receive more resources."

The second is to form external alliances and bet on potential star unicorns.

The cases of OpenAI, Microsoft, and Amazon investing in Anthropic have proven that technology giants and start-ups can gain greater competitive advantages through early alliances. When sorting out the star AI start-ups currently emerging in China, there is also a collaboration between major manufacturers.

For example, Zhipu AI, a large AI model startup that recently completed its B-4 round of financing, is backed by Tencent Venture Capital and Alibaba Cloud Venture Capital. Previously, Zhipu AI’s B-2 round was exclusively invested by Meituan Venture Capital. Another star startup, MiniMax, has invested US$40 million in a new round of financing of US$250 million.

Previously, the star companies that could attract the two kings of Tencent and Alibaba were Didi and Xiaohongshu. Today, both have become behemoths in the industry. This time, the joint action between major manufacturers also announced from a strategic level the importance of alliances between major technology manufacturers and star startups in the era of large models.

To turn running into AI, major technology companies have to overcome three hurdles

Under this AI native storm, although major manufacturers have shown their determination to "all in AI" or "all in large models", objectively speaking, if you want to win this game and become the final winner, There are three more visible levels in front of you.

First, there is the myth of user value at the product level. Yu Jun, a legendary product manager in the Internet era, once proposed a formula about user value: user value = new experience – old experience – replacement cost.

Under the above formula, there are three main ways to improve user value: maximizing new experiences, minimizing old experiences and reducing replacement costs.

Maximizing new experiences relies on accurate insight into user needs and an open mind (whether it is fragmented integration of long-tail needs or focusing on head areas such as pan-entertainment and social networking). Minimizing the old experience actually requires breaking the old product design form. For example, in the interactive interface, Baidu founder Robin Li once emphasized that "the interaction of each AI native application cannot exceed a two-level menu." The replacement cost is the replacement requirement and migration cost from old applications to new applications, which depends on the education of user behavior.

From the perspective of the current AI application layer, there is an obvious tendency of homogeneity. How to innovate the experience requires major manufacturers to think and innovate new generative interfaces and editing experiences, and use technologies such as complex proxy systems to further improve user satisfaction and retention rates.

Secondly, rethink AI nativeness. As mentioned above, Kai-Fu Lee's understanding of AI nativeness, currently many of the application layer re-engineering of major manufacturers is just under the banner of AI nativeness. How to further build on the understanding, generation, reasoning, memory and other capabilities of large language models to truly form breakthrough AI native applications depends on a more powerful model development stack and a more unique product blueprint.

Finally, it is a common topic that major manufacturers need to reconsider their role positioning and capability boundaries. Whether it is internal horse racing or external alliances, the essence is still "both and want", which is understandable in early development. But the complicated relationship between Microsoft and OpenAI’s “different bedfellows” on the other side of the ocean has proven that in the process of technological history, there are no permanent friends.

What is certain is that in the era of large models, the story of alliances between major manufacturers and strange dreams will be repeated again in the future. But unlike the mobile Internet era, this round of competition is iterating faster and the competition is more brutal. How to take advantage of uncertainty as much as possible, seize the first-mover advantage, lower the threshold for AI use, and achieve large-scale expansion are new topics left to major manufacturers.

References:

1. Founder Park: "What do you think of the domestic top model layer and middle layer? How do you see the application of large models?" 》

2. Sequoia Capital: "Generative AI's Act Two"

3. Guotai Junan Securities Research: "Microsoft AI Application Development History (In-Depth)"

4. Yu Jun: "Yu Jun Product Methodology"