Celestia is a modular blockchain project focusing on data availability. In terms of architecture, it mainly assumes the functions of the consensus layer and the data availability layer, and proposes the Sovereign Rollup solution to assume the functions of the execution layer and settlement layer. Benefiting from the development of Ethereum technology and the practice of Rollup, the current concept of modular blockchain is gradually becoming possible, and represents one of the important development directions of the future public chain track. At the same time, the project team itself has an excellent background and solid technology. The project is about to be launched on the mainnet, so we choose to focus on Celestia.

Investment Summary

Celestia is a modular blockchain project focusing on data availability. In terms of architecture, it mainly assumes the functions of the consensus layer and the data availability layer, and proposes the Sovereign Rollup solution to assume the functions of the execution layer and settlement layer.

From the perspective of team and funding, Celestia has a good technical background and development capabilities, and has maintained a stable development rhythm. And compared with the first research report (first published on the official website of First Class Warehouse on March 2, 2022), Celestia has significantly increased both its financing amount and the number of team members. In the medium and long term, it can still maintain good development. momentum.

From the perspective of products and technologies, data availability sampling and namespace Merkle trees ensure Celestia's breakthrough in decentralization and security as a consensus layer and data availability layer, while Sovereign Rollup ensures the execution of Celestia. The scalability of the layer and settlement layer allows Celestia as a modular blockchain to well cope with the Blockchain Trilemma problem of the blockchain, so it will have good development prospects and development potential in the future.

From the perspective of project development, Celestia is still in the test network stage, and the mainnet is expected to be launched soon. The test network currently has relatively centralized nodes, but thanks to Celestia's network architecture and data availability implementation solutions, the hardware requirements for operating various Celestia nodes are relatively low. The number of nodes is likely to increase significantly after the main network is launched in the future, which will further Improve network throughput and increase network decentralization and security. In addition, Celestia's social media currently has a large number of followers and the community is relatively active, which can provide certain assistance for the future development of the project ecology. Judging from the layout of the ecosystem, the Celestia ecosystem is still in a very early stage. Ecological projects are mainly technology-related infrastructure, which is far from the point where users can actually experience the ecosystem.

Application projects still take a very long time.

From the perspective of token economics, Celestia’s token allocation is relatively average. Investors and the team collectively receive more than half of the tokens, and 33% of these tokens will be unlocked after one year. Celestia’s token demand is basically in line with the design ideas of a normal public chain token. TIA will assume the functions of consensus, fees and governance, and will also issue additional tokens in the form of inflation. At present, it seems that the design of this token is relatively neutral. The token itself cannot provide more empowerment for the network. Instead, the token needs to rely on the development of the network to promote a virtuous cycle of the economic model.

From the perspective of the track, benefiting from the successful practice of Rollup and the technological development of Ethereum, modular blockchain will be one of the main trends in the development of future blockchain architecture, and Celestia will play a relatively important role in this. . Compared with current competing projects, Celestia's data availability implementation solution has a lower threshold and faster development progress, but the upper limit may not be as good as other solutions using KZG polynomial commitment. In the future, we still need to continue to pay attention to the development progress of the project itself and the Cancun upgrade of Ethereum.

and the development of upstream and downstream tracks including Rollup. In addition, due to the continuation of the bear market in the short term, the release of the project's potential still awaits the recovery of the market and the accumulation of underlying technology.

In summary, the Celestia project deserves attention.

1. Basic overview

1.1 Project Introduction

Celestia is a modular blockchain project focusing on data availability. In terms of architecture, it mainly assumes the functions of the consensus layer and the data availability layer, and proposes the Sovereign Rollup solution to assume the functions of the execution layer and settlement layer. The project development is currently progressing well and will be launched on the mainnet soon.

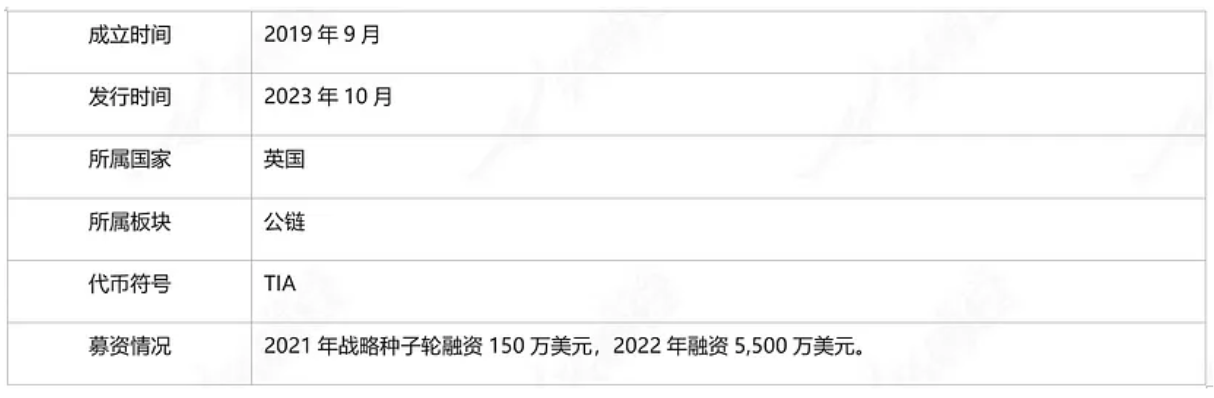

1.2 Basic information [1]

2. Project details

2.1 Team

Celestia's team is located in the United Kingdom. There are currently 40 people in the team disclosed on LinkedIn and a total of 46 [2] people on the official website. Details of the background information of the main members are as follows:

Mustafa Al-Bassam — Co-founder and CEO , holds a bachelor's degree in computer science from King's College London and a PhD in computer science from University College London. Al-Bassam was the founder and core member of the famous hacker organization LulzSec when he was 16 years old, and has been engaged in hacking activities for a long time. In August 2018, Al-Bassam participated in the founding of Chainspace, a blockchain expansion research team. In 2019, the team was acquired by Facebook. In May 2019, Al-Bassam published the LazyLedger paper, and in September of the same year participated in the founding of LazyLedger (later renamed Celestia) and has served as CEO to this day.

Ismail Khoffi — Co-founder and CTO , Master's degree in Mathematics and Computer Science from the University of Bonn. After graduation, he has been engaged in software development and computer technology research for a long time. In 2018, Ismail Khoffi joined Tendermint to engage in software development. In 2019, Ismail Khoffi joined the Interchain Foundation as a senior software development engineer. In September of the same year, he participated in the founding of LazyLedger (later renamed Celestia) and has served as CTO to this day.

John Adler — Co-founder and CRO , Bachelor of Engineering Science, Master of Electrical and Computer Engineering, PhD from the University of Toronto. After graduation, he joined Consensys as a researcher and development engineer, engaged in research on second-layer scalability. In 2020, John Adler co-founded Fuel Labs and serves as chief scientist. In the same year, John Adler also co-founded LazyLedger and serves as the chief research officer (CRO) to this day.

Nick White — COO , holds a bachelor's degree and a master's degree in electrical engineering from Stanford University. Co-founder of Harmony Protocol. Joined Celestia in 2021 and serves as chief operating officer until now.

From a team perspective, the core team members all have deep technical and industry backgrounds. Compared with the time of our first research report, Celestia’s team size has increased significantly, especially the software development team, which currently has more than 20 people. Software development engineer, so the project currently has good development capabilities.

2.2 Funds

So far, Celestia has disclosed two rounds of financing, raising a total of US$56.5 million. Investment institutions include Binance Labs, Polychain Capital, Protocol Labs and Delphi Digital, etc. Taken together, Celestia has a good capital background, and the total amount can support the project for longer-term development.

2.3 Code

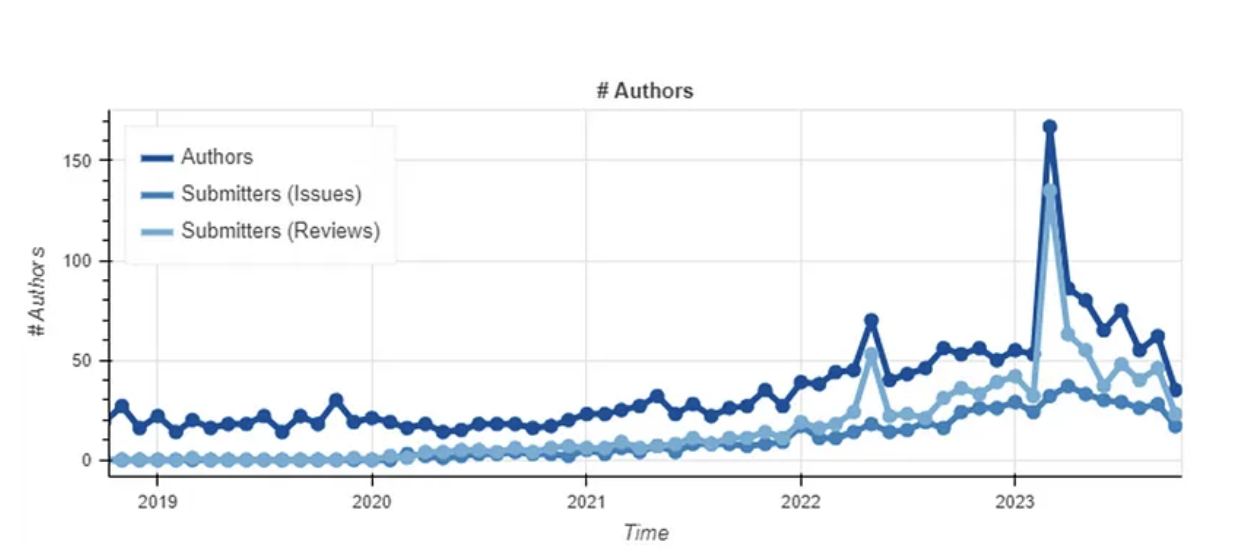

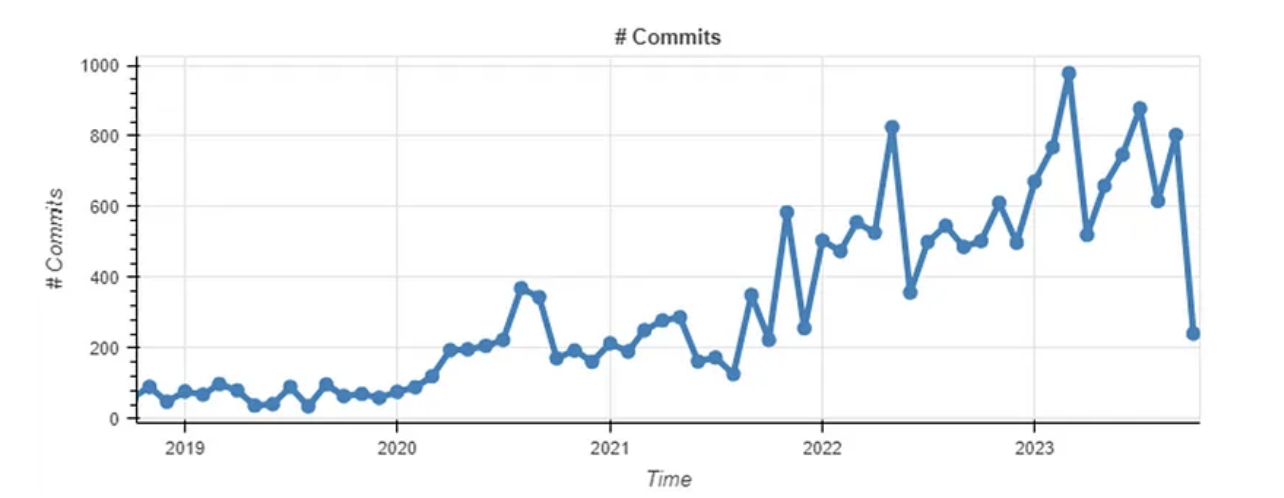

Figure 2–1 Celestia code submission status [3]

Figure 2–1 Celestia code submission status [3]

Figure 2–2 Celestia code contributors

Celestia's source code is open source on GitHub. Judging from the development situation, Celestia's code development is in good condition. A total of 25,707 code submissions were made. In the past year, 8,410 code submissions were made. The current average number of developers per month is hundreds. up and down. Judging from the image, the number of code submissions and developers of Celestia has been showing an upward trend. In the past few years, there have been two development peaks, one in May 2022, corresponding to the development of the Mamaki test network, and the other It will be in March 2023, corresponding to the development of modular Rollup Rollkit and incentivized testnet. Overall, Celestia's current code development is in good progress and is being continuously updated.

2.4 Products and Technology

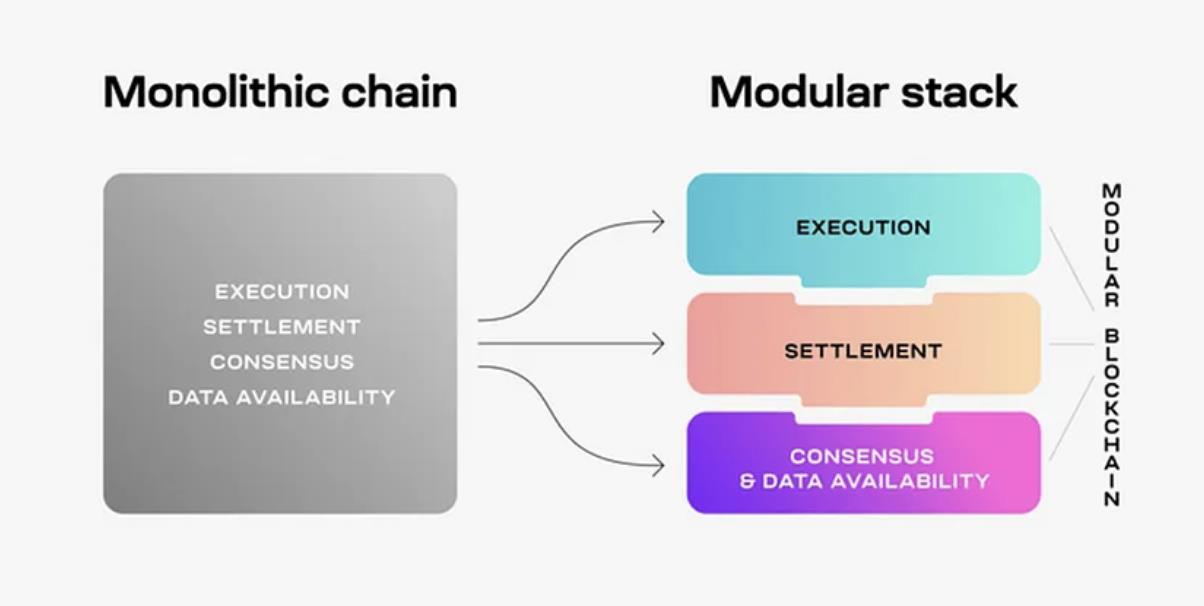

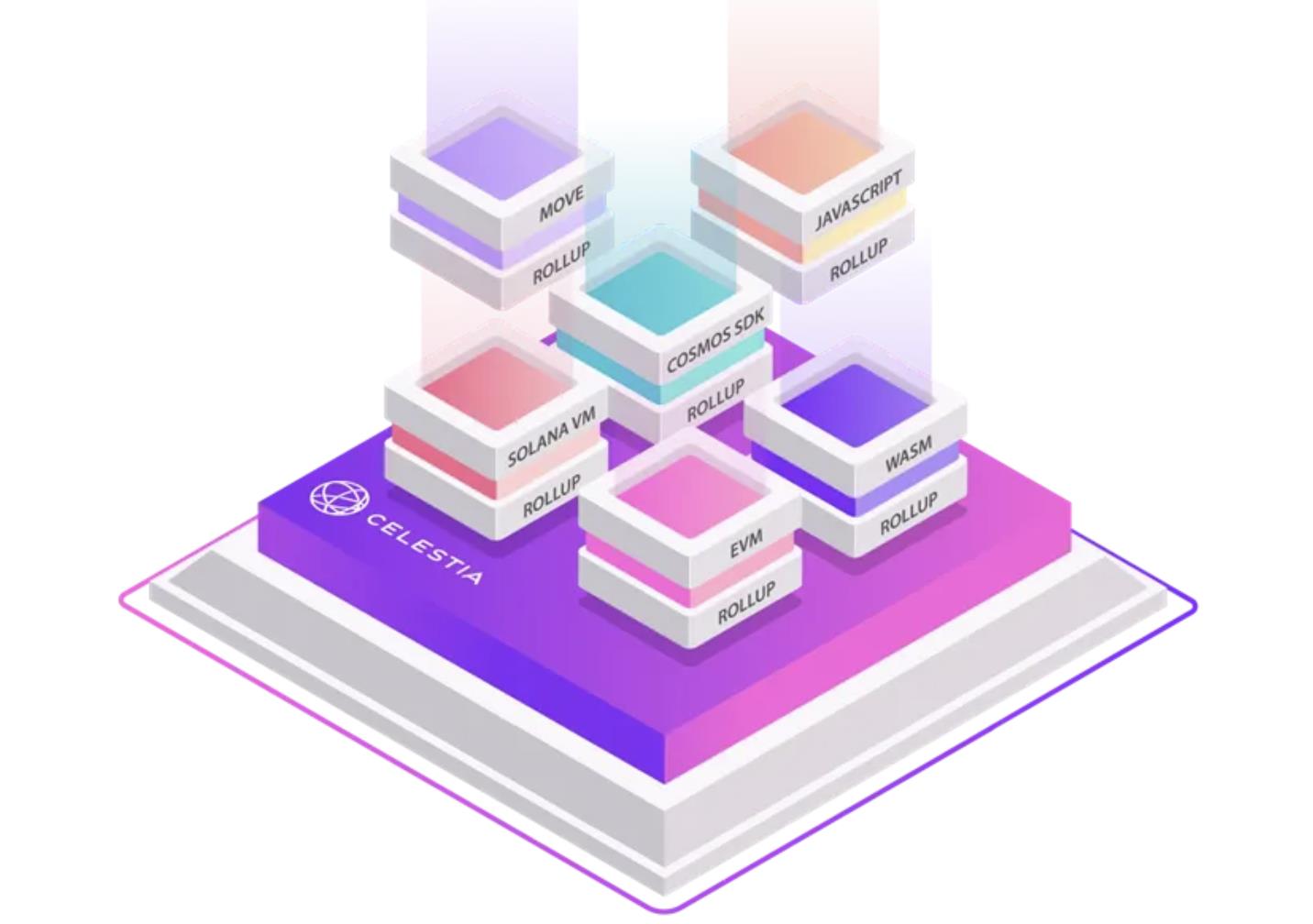

Celestia is a modular blockchain. The so-called modularization, from a functional point of view, the modular blockchain itself will no longer complete all on-chain work (execution, settlement, consensus and data availability) independently, but will perform specialized optimization to adapt to specific functions.

Figure 2-3 The difference between monolithic blockchain and modular blockchain [4]

In terms of scalability, modular blockchains will have better composability. Multiple modular blockchains can be combined like building blocks to perform all functions that a monolithic blockchain can perform, thus enabling Better cross-chain and multi-chain collaboration.

Figure 2–4 Monolithic blockchain versus modular stack

Modular blockchain has three overarching principles:

1) Modular blockchain will decentralize the network in a way that reduces the cost for users to run nodes and verify the network.

2) Modular blockchain will increase the scalability of the blockchain without increasing the cost of user verification and protecting the network.

3) The modular blockchain will rely on a decentralized user network to be responsible for the security of the blockchain network.

The above three principles respectively correspond to decentralization, scalability and security in the Blockchain Trilemma of blockchain.

Theoretically speaking, Rollups is also a practice guided by the modular blockchain idea. Both Optimistic-Rollup and ZK Rollup specialize the execution of the network on the basis of using Ethereum as the consensus layer to ensure security. layer capabilities, thereby promoting the development of Layer1 and Layer2 networks at the same time. And in the future, with the Cancun upgrade and the implementation of EIP-4844 Proto-Danksharding, Ethereum will introduce a new transaction type. Users can store data in a space called Blob instead of directly storing it in Layer1 as before. For Layer 2, this will greatly reduce its transaction costs, and the form of Ethereum itself will be closer to a modular blockchain.

As a modular blockchain designed with modularity in mind from the beginning, Celestia has taken a different direction from most monolithic public chains in terms of functionality, choosing to focus on consensus and data availability. , focusing on becoming a Data Availability (DA) Layer, while relying on Rollup to provide execution layer functions for the network. In short, the Celestia network is only responsible for two things. One is responsible for sorting transactions to ensure data availability of transactions, and the other is providing an effective solution to data availability problems. Light nodes only require a small amount of resources. Verifiable blocks prove data availability.

Figure 2–5 Celestia network architecture

Acts as a data availability layer. Celestia adopts the PoS consensus mechanism and uses the Cosmos SDK for development, but it has made some modifications to Tendermint's consensus algorithm. The modified Tendermint consensus algorithm-Celestia Core includes two key points of Celestia's solution to data availability issues: Data Availability Sampling (DAS) and Namespaced Merkle Trees (NMTs).

2.4.1 Data Availability Sampling (DAS)

Generally speaking, light nodes in the blockchain network will only download the block header containing the block data (i.e. transaction list) commitment (i.e. Merkle root), which makes the light node unable to know the actual content of the block data, thus Unable to verify data availability.

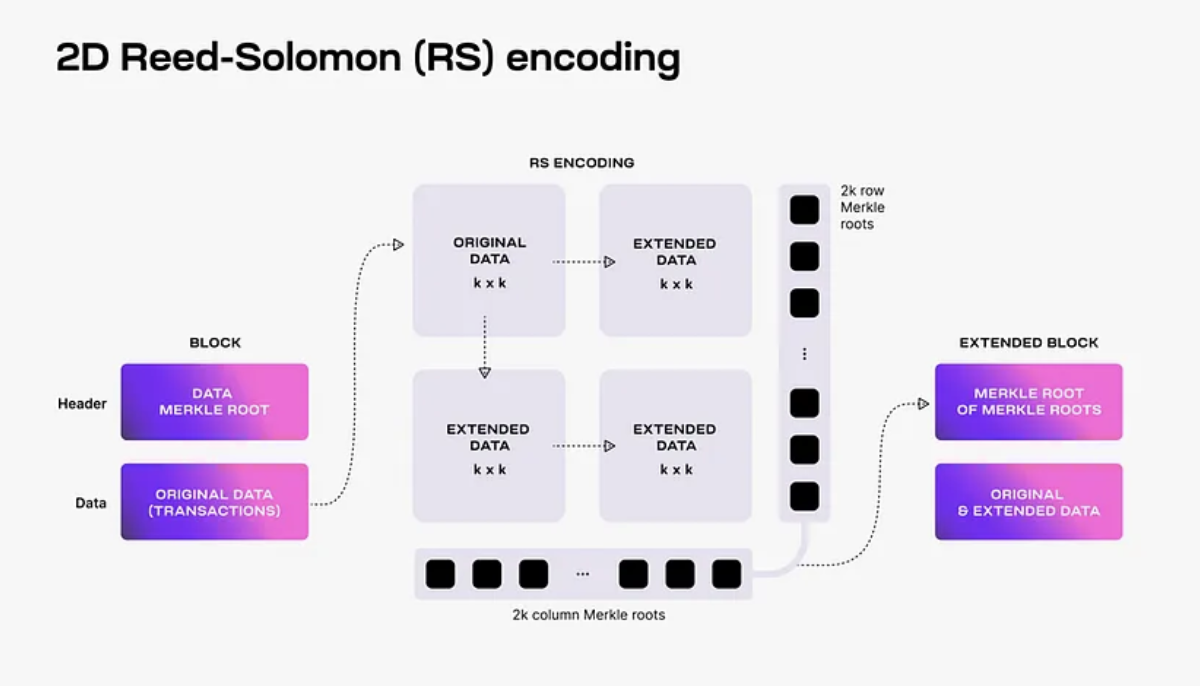

However, after applying the 2-dimensional Reed-Solomon encoding scheme (2-dimensional Reed-Solomon encoding scheme) , it becomes possible to use light nodes for data availability sampling:

1) First, the data of each block will be divided into k*k blocks and arranged in a k*k matrix. Then, by applying RS erasure code multiple times, such a k*k matrix containing block data can be converted into Expand it into a 2k*2k matrix.

2) Then Celestia will calculate 4k individual Merkle roots for the rows and columns of this 2k*2k matrix as the block data commitment in the block header.

3) Finally, during the process of verifying data availability, Celestia's light node will sample 2k*2k data blocks. Each light node will randomly select a set of unique coordinates in this matrix and query the data in all nodes. The block content and the corresponding Merkle proof at the coordinates indicate that if the node receives a valid response to each sampling query, it proves that the block has a high probability of data availability.

In addition, every data block that receives a correct Merkle root proof will be propagated to the network, so as long as the light nodes can sample enough data blocks together (i.e., at least k*k unique data blocks), the complete block The data can be restored by honest full nodes.

Figure 2-6 Two-dimensional RS erasure coding scheme [5]

The implementation of data availability sampling ensures the scalability of Celestia as a data availability layer. Because each light node will only need to sample a portion of the block data, this reduces the cost of running the light node and the entire network. The more light nodes that participate in sampling at the same time, the more data they can download and store together, which means that the TPS of the entire network will also increase as the number of light nodes increases.

2.4.2 Namespace Merkle Tree (NMT)

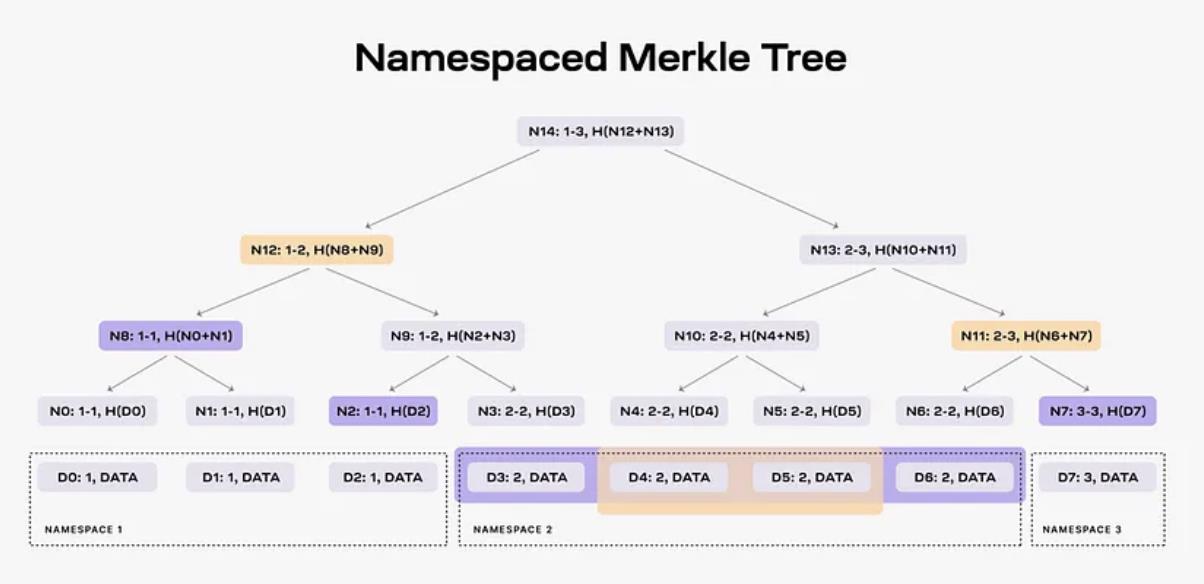

Data availability can only solve the verification problem of data availability, while reducing the cost of the execution layer and settlement layer will be left to the namespace Merkel tree solution.

Celestia divides the data in the block into multiple namespaces. Each namespace corresponds to the execution layer and settlement layer that are using Celestia as the data availability layer. In this way, each execution layer and settlement layer only need to download the data related to themselves. Data can realize the functions of the network. To put it bluntly, Celestia creates a separate folder for each user who uses it as the underlying layer, and then uses Merkle trees to index folders for these users to help these users find and use their own files.

This kind of Merkle tree that can return all data in a given namespace is called a namespace Merkle tree. The leaves of this Merkle tree are sorted by namespace identifiers, and the hash function is modified so that each node in the tree contains the namespace scope of all its descendants.

Figure 2–7 Namespace Merkle tree example

Taking the namespace Merkle tree example in Figure 2-7, the Merkle tree containing eight data blocks is divided into three namespaces.

When data in namespace 2 is requested, the data availability layer, that is, Celestia, will submit the D3, D4, D5, and D6 data blocks to it, and let nodes N2, N7, and N8 submit the corresponding certificates to ensure Data availability for requested data. In addition, the application can also verify that all data in namespace 2 has been received. Since the data block must correspond to the node's attestation, it can identify the integrity of the data by checking the namespace scope of the corresponding node.

After relying on data availability sampling and namespace Merkle trees to solve data availability problems, Celestia focused on the application of the execution layer above the data availability layer and proposed the concept of Sovereign Rollups.

2.4.3 Sovereign Rollups

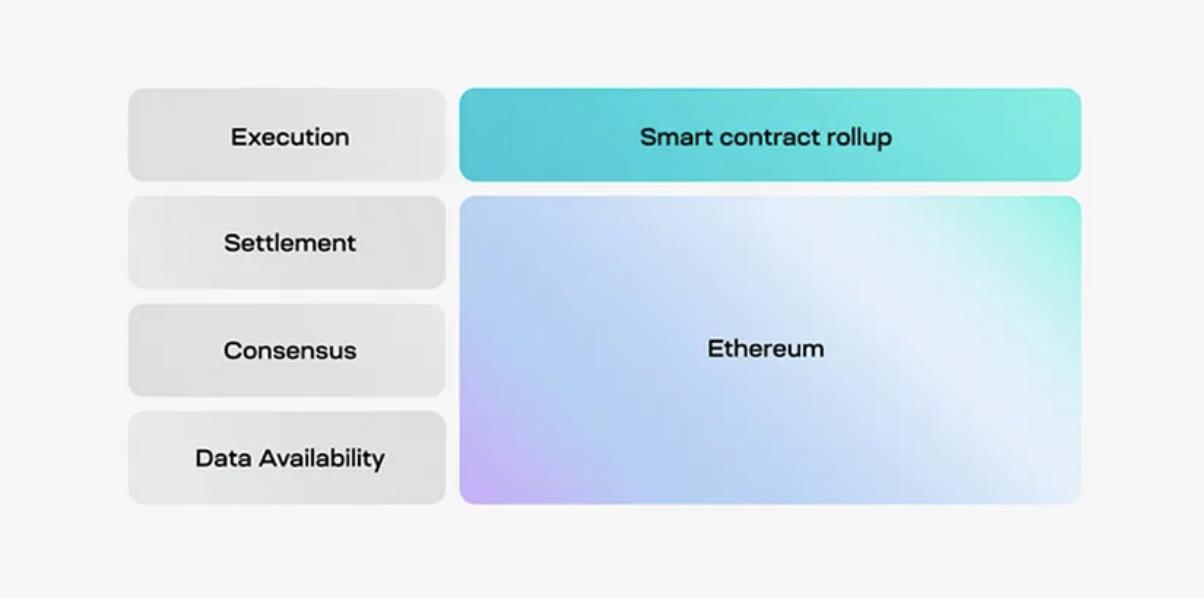

The Sovereign Rollup proposed by Celestia is not exactly the same as the current Rollup on Ethereum.

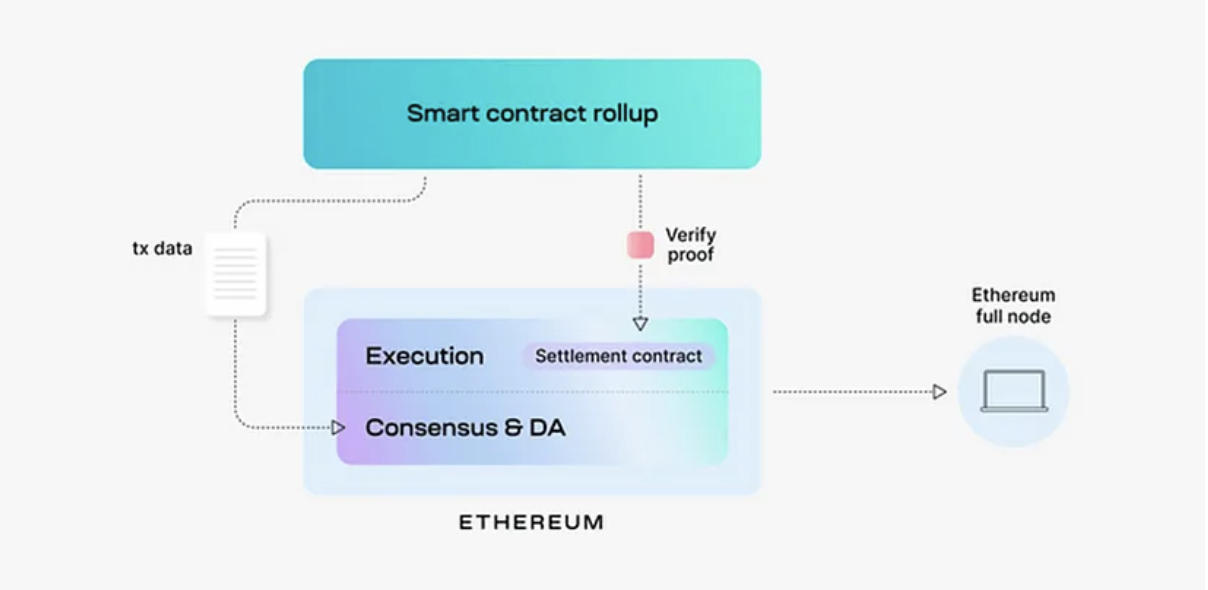

The common rollup on Ethereum is called Smart Contract Rollup by Celestia, which publishes the entire block to the settlement layer, and then lets the settlement layer sort the blocks, check the availability of data, and verify the correctness of the transaction. The above actions on the settlement layer will all depend on a set of smart contracts on the settlement layer. In other words, the smart contracts on the settlement layer will determine whether these Smart Contract Rollups can operate normally.

Figure 2–8 Ethereum and Smart Contract Rollup architecture 1

Figure 2–8 Ethereum and Smart Contract Rollup architecture 2

This architecture of Smart Contract Rollup makes it almost unfeasible for Layer 1 nodes to independently verify each transaction. Because the proof submitted by either Optimistic Rollup or ZK Rollup can only verify whether the block itself is valid, and if the verification node of Layer1 wants to investigate the specific transaction, it needs to rely on a native trust minimization bridge, which makes the Layer1 network only The security of the network can be ensured by relying on the honest behavior of a small number of participants.

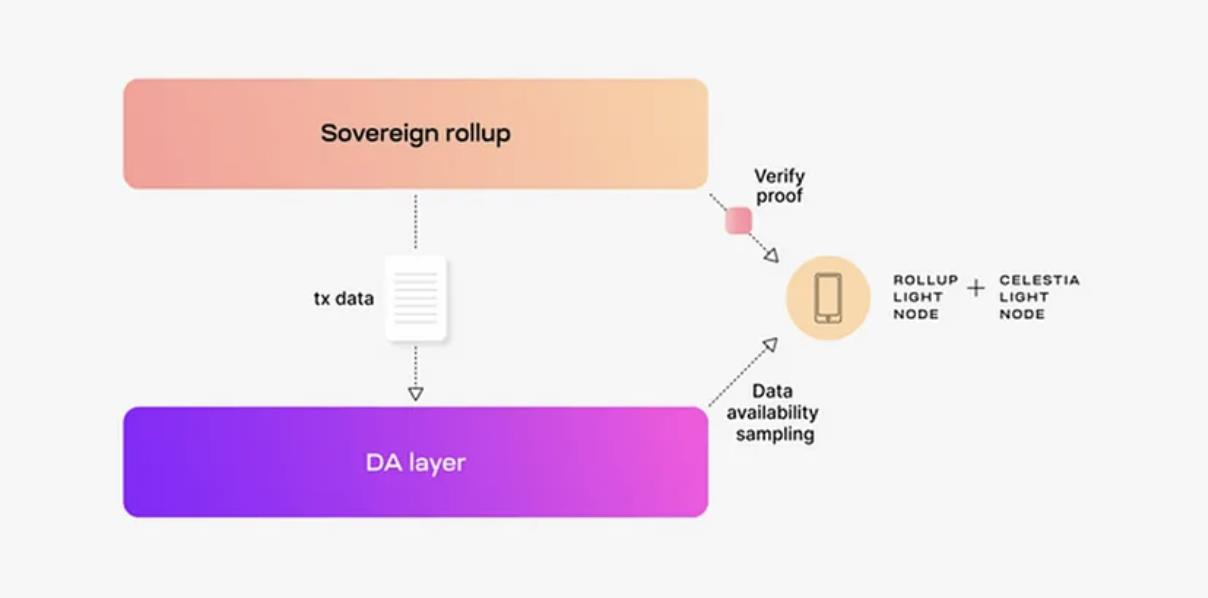

In order to solve the above problems, unlike Smart Contract Rollup, Sovereign Rollups includes the settlement layer in Rollups. [6]

Figure 2–9 Sovereign Rollup architecture 1

Figure 2–10 Sovereign Rollup architecture 2

In the architecture of Sovereign Rollup, Sovereign Rollup is responsible for execution and settlement, and the data availability layer (ie Celestia) is responsible for handling consensus and data availability. On this basis, Celestia will no longer verify whether Sovereign Rollup's transactions are correct, but will return the power to verify transactions to Sovereign Rollup's verification nodes. These verification nodes will review the correctness of the transaction and choose to accept or reject the transaction. transactions, which eliminates the need for native trust-minimized bridges between Sovereign Rollup and its data availability layer.

So in summary, the biggest difference between Sovereign Rollup and Smart Contract Rollup is who verifies the correctness of the transaction. In the Smart Contract Rollup architecture, the smart contract of the settlement layer will perform this function in the future, but in the Sovereign Rollup architecture, Sovereign Rollup’s own verification nodes will assume this function.

On this basis, Sovereign Rollup can have a higher degree of freedom than Smart Contract Rollup. For example, the upgrade of Smart Contract Rollup involves changes to the smart contract, so it needs to be constrained by the consensus of the settlement layer. However, Sovereign Rollup does not have this concern. It can use forks to upgrade like the Layer1 blockchain, which allows nodes to have more autonomy.

Summarize

From the perspective of team and funding, Celestia has a good technical background and development capabilities, and has maintained a stable development rhythm. Compared with the first research report, Celestia has significantly increased both its financing amount and team size. In the medium to long term, it can still maintain a good development momentum.

From the perspective of products and technologies, data availability sampling and namespace Merkle trees ensure Celestia's breakthrough in decentralization and security as a consensus layer and data availability layer, while Sovereign Rollup ensures the execution of Celestia. The scalability of the layer and settlement layer allows Celestia as a modular blockchain to well cope with the Blockchain Trilemma problem of the blockchain, so it will have good development prospects and development potential in the future.

3. Development

3.1 History

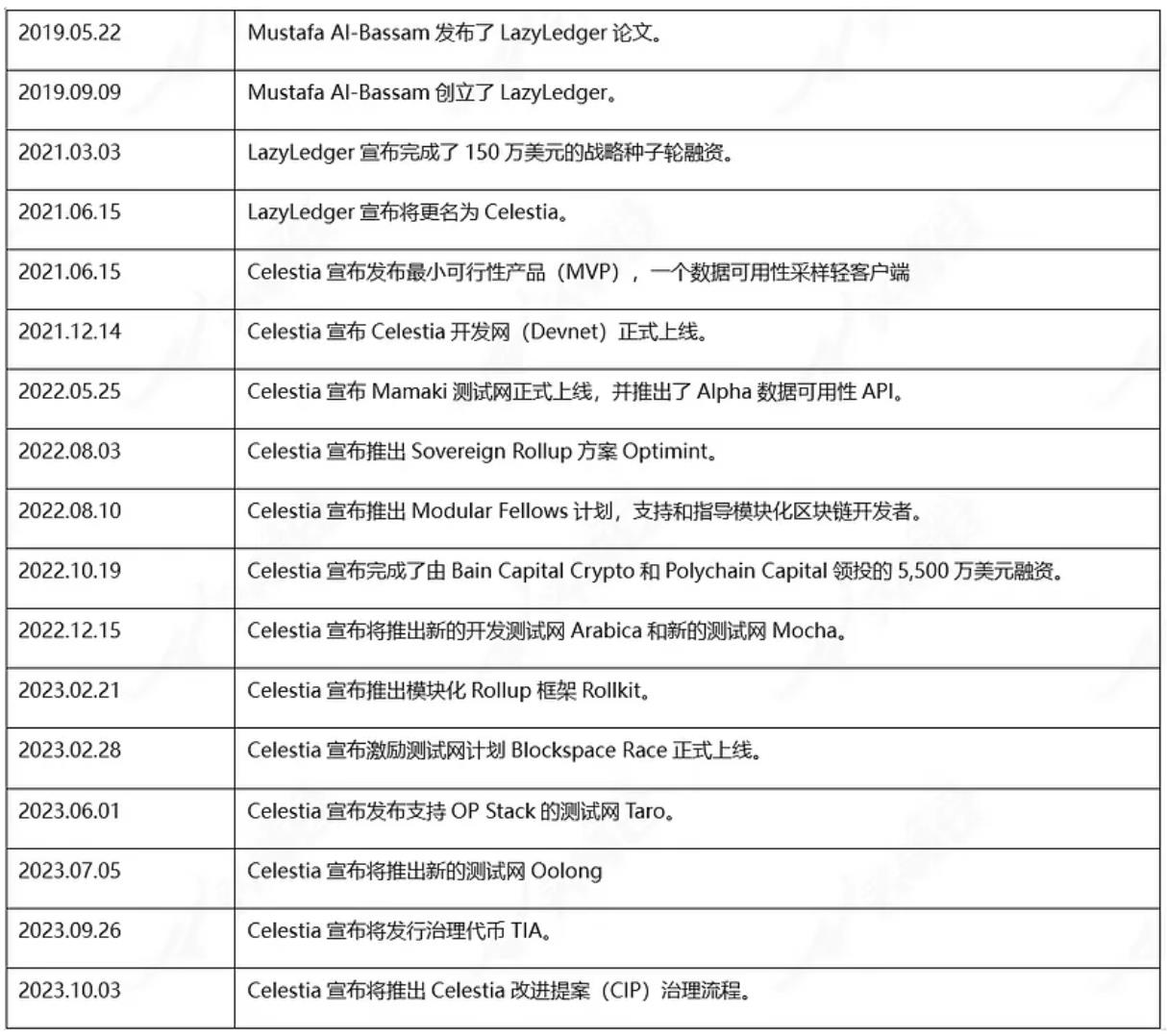

Table 3–1 Major events in Celestia

3.2 Current situation

3.2.1 Operational data

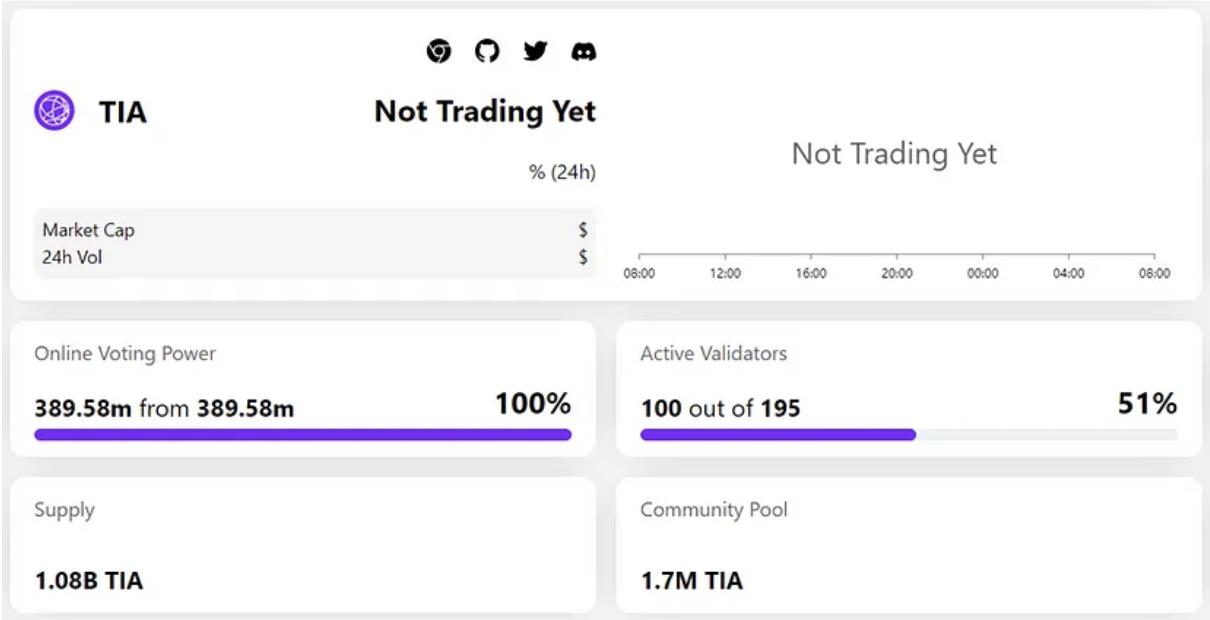

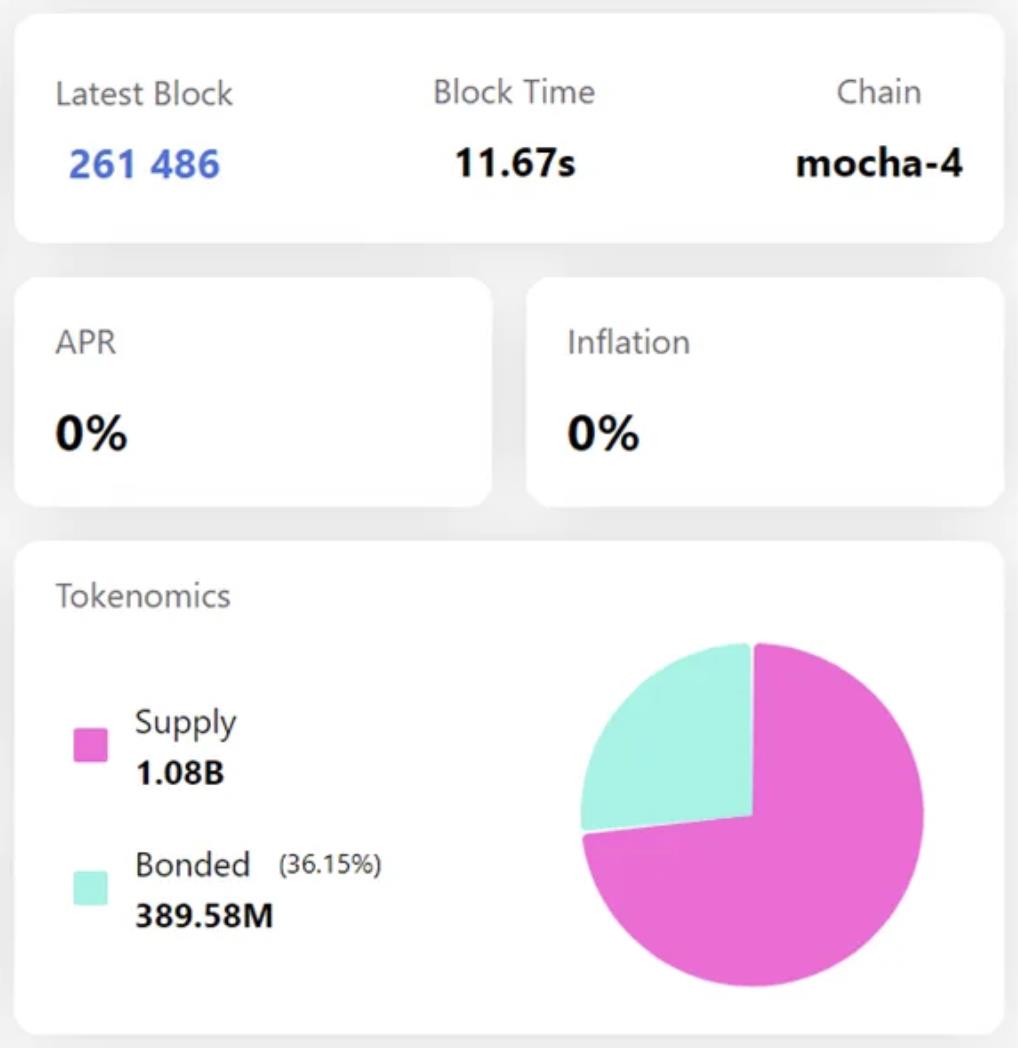

Figure 3–1 Celestia testnet status 1 [7]

Figure 3–2 Celestia testnet status 2

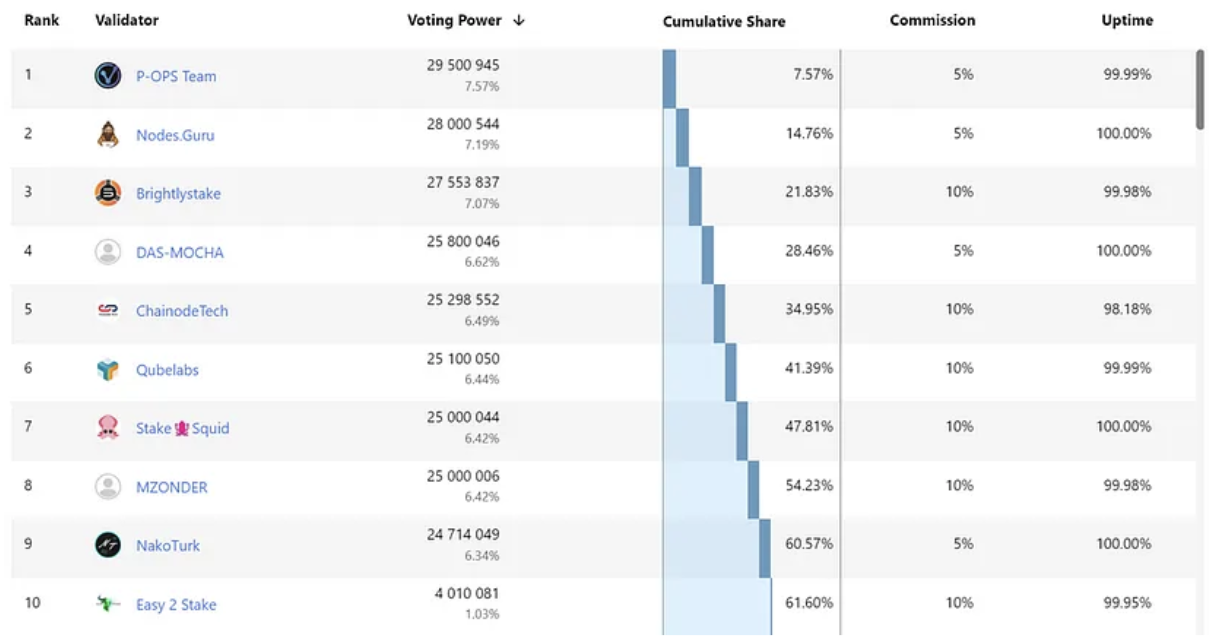

Celestia is still in the testnet stage, and the mainnet is expected to be launched in the near future. At present, the test network is still running stably, with a total of 261,495 blocks produced, and the total pledged token amount is approximately 389,580,000 TIA. There are 100 initial validator nodes, of which the top 9 nodes account for 60.57% of the network share. The test network center The degree of culturalization is relatively high.

Figure 3–3 Celestia testnet node ranking

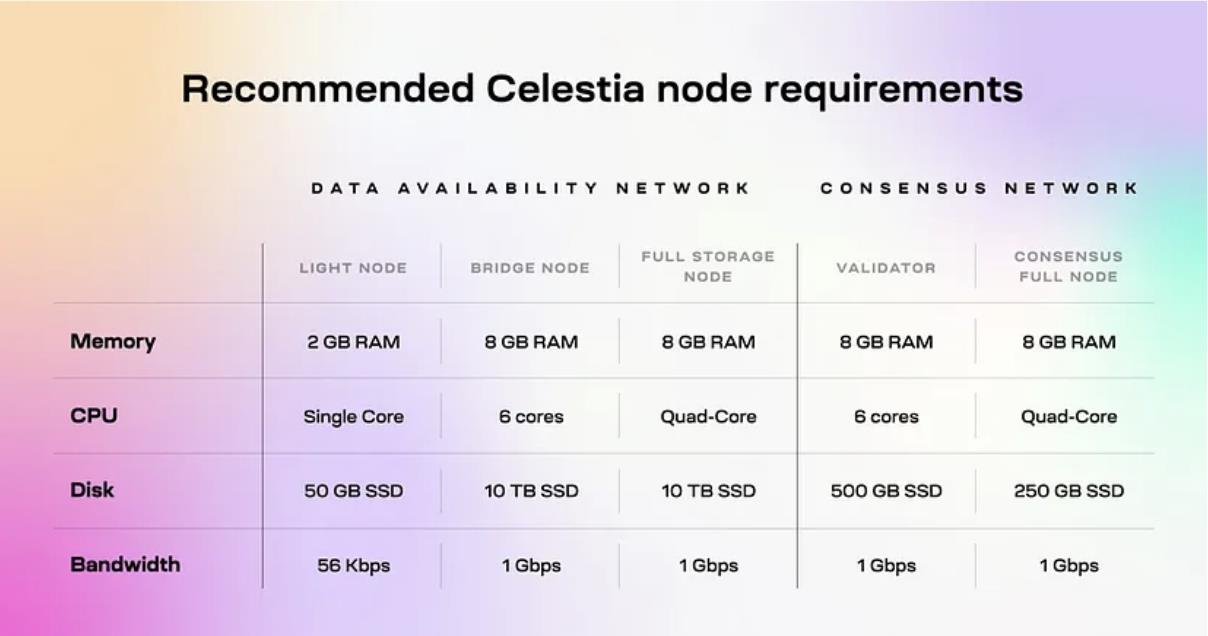

Benefiting from Celestia's network architecture, Celestia's light node operation hardware requirements are low, requiring at least a 2GB RAM memory, a single-core CPU, an SSD hard drive of more than 25GB, and an upload and download bandwidth of 56 Kbps. In addition to light nodes, Celestia's requirements for bridge nodes, full nodes, verification nodes and consensus nodes are not high compared to other public chains. Therefore, after the Celestia mainnet is launched in the future, it is expected that the number of nodes of various types in the network will further increase, and the degree of decentralization of the network will also be further improved.

Figure 3–4 Celestia node operation requirements [8]

There are currently 50 [9] projects announced to be deployed or planned to be deployed on Celestia: including 5 Rollups as a Service (RaaS) projects; 3 sequencer network projects; 5 settlement layer network projects; 5 Rollup frameworks Projects (including Cosmos SDK, OP Stack, Rollkit, Sovereign and Stackr developed by Celestia); 3 virtual machine projects; 6 cross-chain projects; 3 wallet projects; 5 DeFi projects; 5 game projects and 10 basic projects Facility projects.

It can be seen that the projects on Celestia are still mainly technical infrastructure projects, and there are not many actual user-oriented application Dapps.

3.2.2 Social media scale

Table 3–2 Celestia social media data

As of October 12, 2023, Celestia has a large number of social media followers, active interactions, and a large number of official community discussions, and the content is mainly related to technology development and token airdrops.

3.3 Future

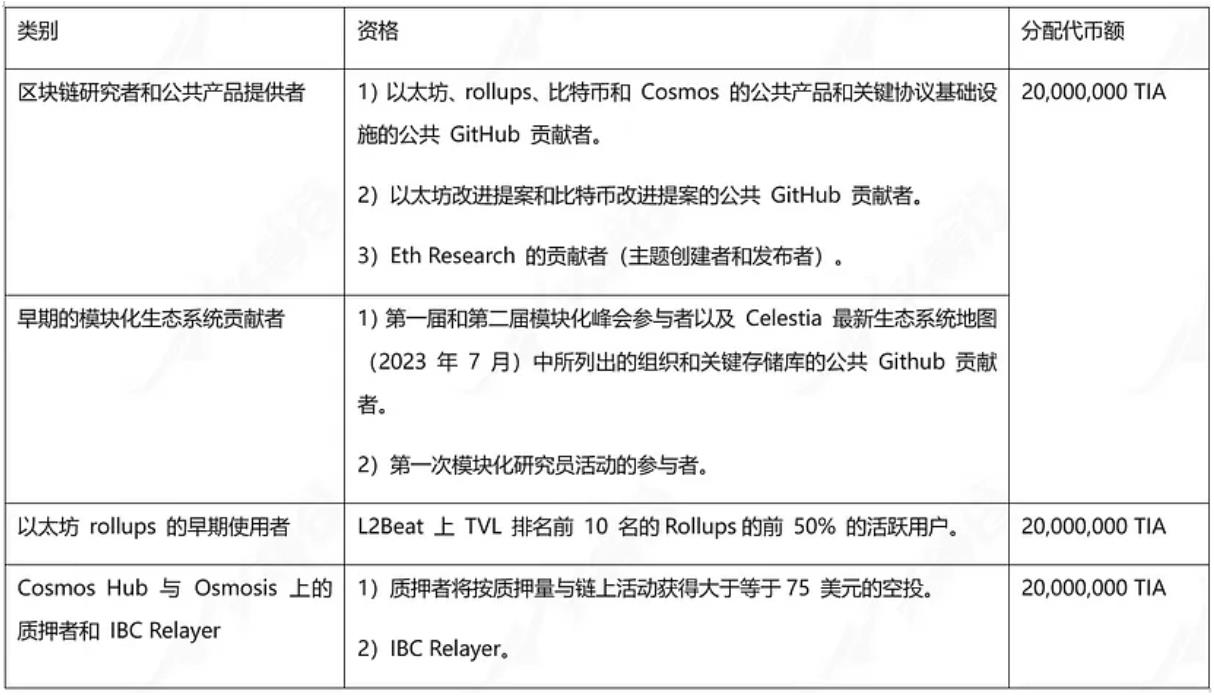

Celestia has not announced its next roadmap plan, but according to the currently known information, Celestia will end the airdrop of TIA tokens at 12:00 UTC on October 17 and launch the mainnet soon. The currently known airdrop plans for 60 million TIA tokens are as follows:

(Airdrop snapshot as of January 1, 2023, includes a total of 576,653 on-chain addresses on Ethereum, rollups, Cosmos Hub and Osmosis)

Table 3–2 Celestia TIA Token Airdrop Plan

Summarize:

From the perspective of project development, Celestia is still in the test network stage, and the mainnet is expected to be launched soon. The test network currently has relatively centralized nodes, but thanks to Celestia's network architecture and data availability implementation solutions, the hardware requirements for operating various Celestia nodes are relatively low. The number of nodes is likely to increase significantly after the main network is launched in the future, which will further Improve network throughput and increase network decentralization and security. In addition, Celestia's social media currently has a large number of followers and the community is relatively active, which can provide certain assistance for the future development of the project ecology. Judging from the layout of the ecosystem, the Celestia ecosystem is still in a very early stage. Ecological projects are mainly technology-related infrastructure. It will still take a very long time before users can actually experience application projects in the ecosystem.

4. Economic Model

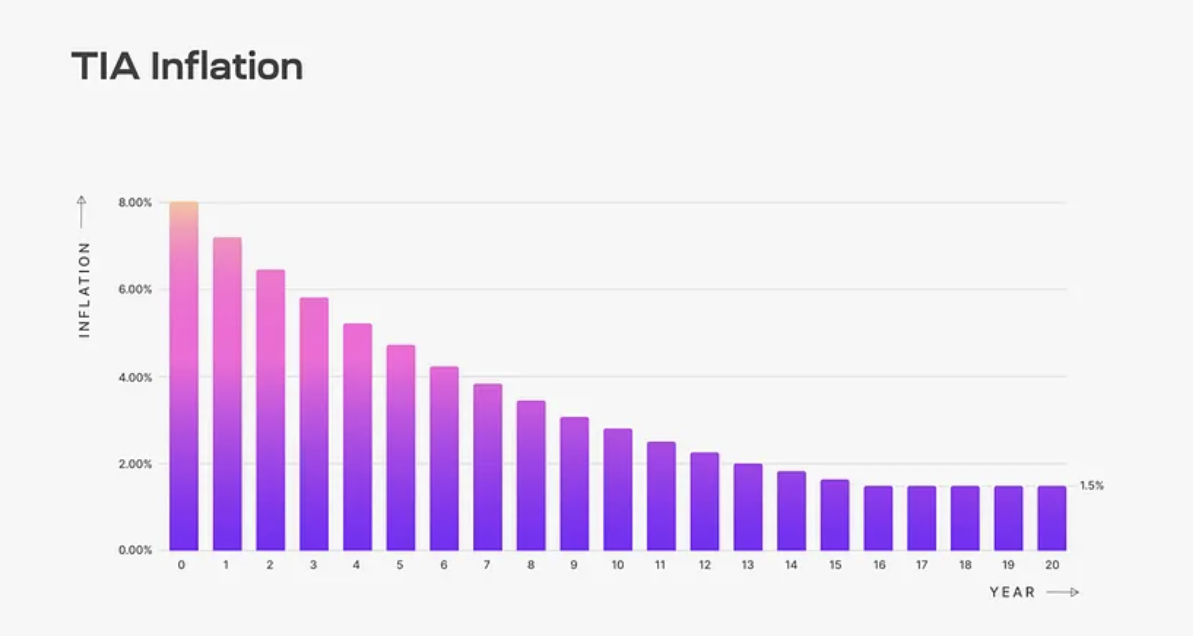

Celestia’s native token is TIA , with an initial total supply of 1,000,000,000 . TIA tokens have not yet entered circulation, and the airdrop will be carried out on October 17, 2023. In the future, TIA tokens will be issued in the form of inflation. The inflation rate starts from 8% per year and decreases by 10% year by year until it reaches an annual inflation rate of 1.5%.

4.1 Supply

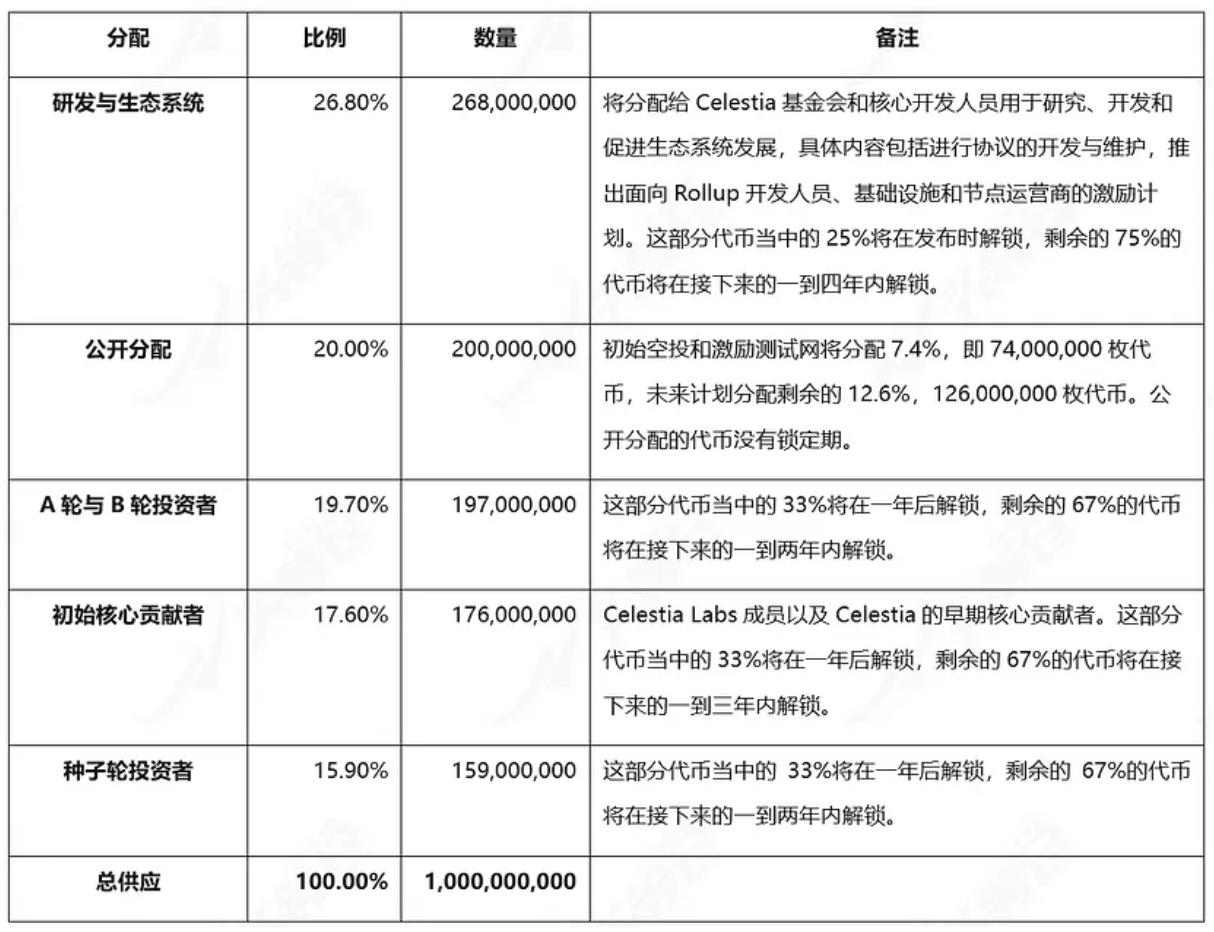

4.1.1 TIA token distribution [10]

Table 4–1 TIA token distribution

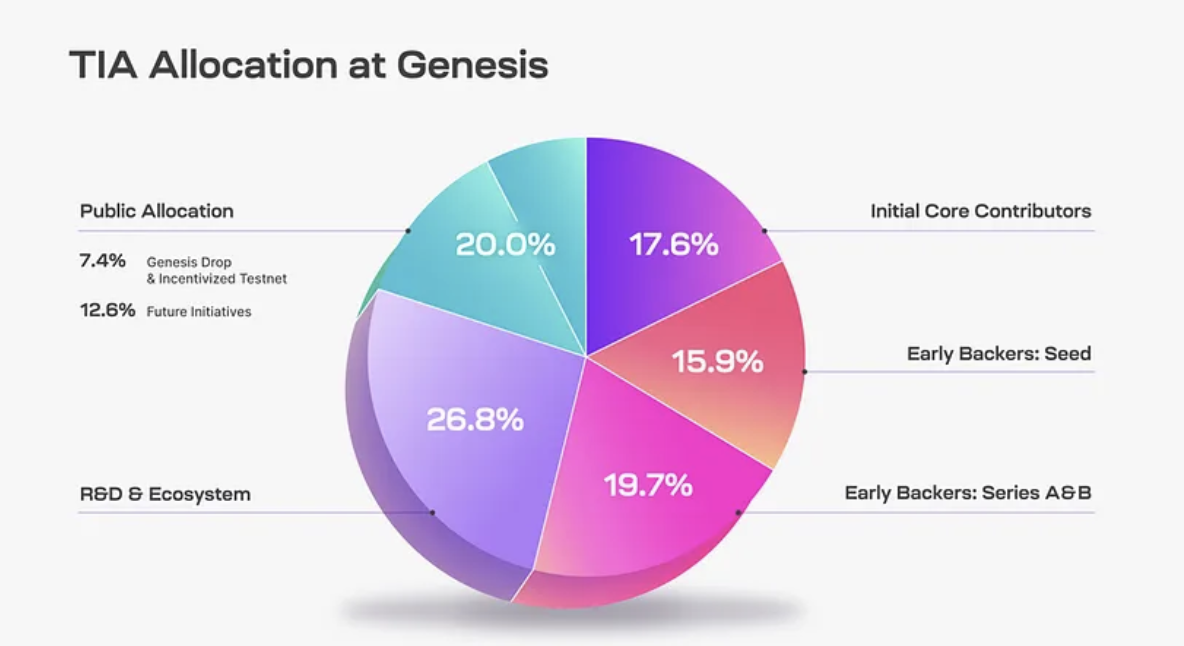

Figure 4–1 TIA Token Allocation Chart

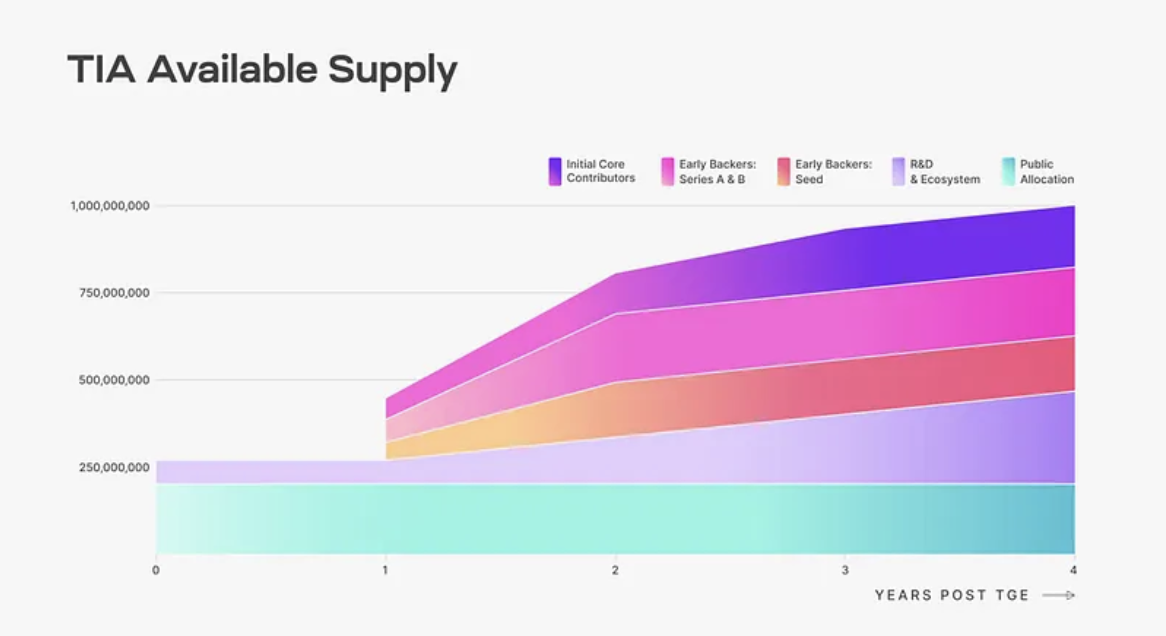

Figure 4–2 TIA token unlocking time chart

From the perspective of token allocation, TIA tokens will be mainly allocated to investors and teams, followed by treasury, and finally the ecosystem, and all tokens will be fully unlocked in 4 years, which means that after the tokens go online , especially after investors and team tokens begin to be unlocked one year later, TIA may face relatively heavy selling pressure. Estimated from the current token distribution rules, TIA's initial token circulation is 141,000,000, including 74,000,000 tokens airdropped and 67,000,000 tokens unlocked from the treasury.

4.2 Requirements

From the perspective of demand, the main functions of TIA tokens are: first, to maintain the shape of the network and stimulate the operation of nodes; second, to serve as application tokens to bill network services; and third, to carry out decentralized governance.

Specifically, Celestia adopts the PoS consensus mechanism, and the number of verification nodes is initially 100. Therefore, nodes need to pledge TIA tokens to participate in the consensus of the network and obtain the staking rewards given by the network. At the same time, users can also entrust their TIA to the corresponding nodes to share the staking rewards obtained by the nodes, thereby protecting the security of the network.

Figure 4–3 TIA Token Inflation Chart

As for the staking rewards, TIA tokens will be issued in the form of inflation. The inflation rate starts from 8% per year and decreases by 10% year by year until it reaches the annual inflation rate of 1.5%. The annual inflation reserve will be calculated based on the total TIA supply at the beginning of each year. Celestia will use block timestamps rather than block heights to define this time, and since the time between blocks will vary, the actual issuance amount will vary. It may be slightly higher than the target value.

After the network is formed, every Rollup project that needs to use Celestia as the data availability layer will need to submit a PayForBlobs transaction on the network. This transaction will be billed by TIA, which is equivalent to levying a network usage fee from developers. In addition, Celestia’s Gas fees will also be calculated in the form of TIA, and Celestia will use a standard Gas price priority memory pool, and validators will give priority to transactions with higher packaging fees. The total payout fee per transaction will include a fixed gas fee and a variable fee based on the size of each blob in the transaction.

Finally, Celestia will move to community decentralized governance. The community will be able to vote on important parameters of the network through governance proposals. In addition, the community will have an additional fund pool that will be allocated to 2% of the blocks. award.

Summarize

From the perspective of token economics, Celestia’s token distribution is relatively general. Investors and the team will receive more than half of the tokens, and 33% of these tokens will be unlocked after one year. Celestia’s token demand is basically in line with the design ideas of a normal public chain token. TIA will assume the functions of consensus, fees and governance, and will also issue additional tokens in the form of inflation. At present, it seems that the design of this token is relatively neutral. The token itself cannot provide more empowerment for the network. Instead, the token needs to rely on the development of the network to promote a virtuous cycle of the economic model.

5. Track

5.1 Track Overview

From a track perspective, Celestia should be incorporated into the public chain track, but Celestia is quite different from the previous monolithic public chains, so it can be separately subdivided into modules focusing on the consensus layer and data availability layer. For public chains, this subdivision is still in a very early stage.

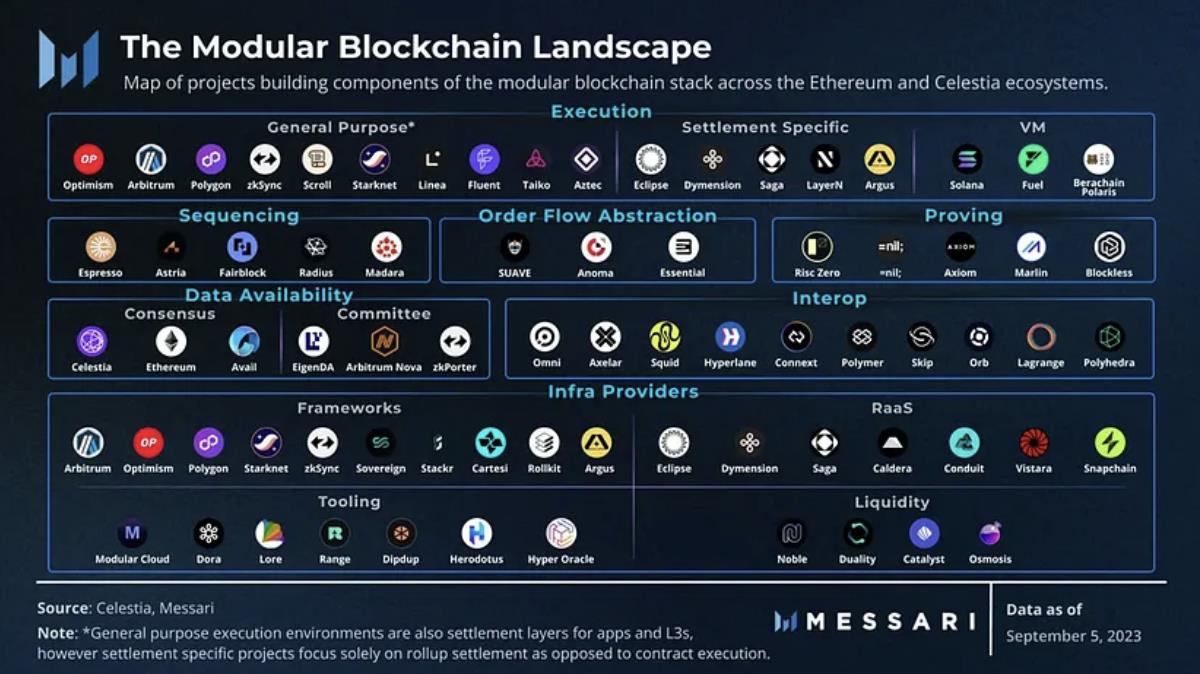

Figure 5–1 Panoramic view of the modular blockchain track [11]

From the track panorama produced by Messari, we can see that the modular blockchain track basically includes the main projects currently related to the second-tier track and related tracks, including Optimism, Arbitrum, Polygon, zkSync, StarkNet, etc. , this is mainly because the successful practice of second-layer Rollup provides a lot of possibilities for the concept of modular blockchain, because Rollup is not only applicable to Ethereum, but currently only Ethereum provides the capabilities that allow Rollup to thrive. In the future, when the entire market develops further, Rollup can be deployed on modular blockchains such as Celestia to pursue higher freedom, faster efficiency and lower costs. Therefore, in the future, we not only need to pay attention to the development of Celestia itself, but also to the related tracks, especially the role of the development of the Rollup track in promoting the realization of Celestia's modular blockchain concept.

5.2 Competitive products on the track

From the perspective of competing products, Celestia’s main competing products are currently Ethereum, Polygon Avail, EigenDA, Arbitrum Nova and zkPorter after completing Proto-Danksharding.

There are slight differences between these competing products in terms of how data availability is implemented. The differences are mainly reflected in the data recovery method and data sampling method .

Celestia uses a data availability sampling scheme, a two-dimensional RS erasure coding scheme to ensure data recoverability, and allows light nodes to obtain block data through random sampling, and submit proof of data availability in an Optimistic manner. . At present, the practice of both RS erasure coding and Optimistic proof has reached a good level of maturity.

Ethereum's Proto-Danksharding also uses the Data Availability Sampling (DAS) scheme. It also uses the RS erasure coding scheme to ensure the recoverability of data. However, unlike Celestia, Ethereum will use the KZG commitment to prove data availability. Solution, KZG (Kate Zaverucha Goldberg) polynomial commitment is a zero-knowledge proof system. It is similar to the difference between Optimistic Rollup and ZK Rollup. The technical threshold for the implementation of Optimistic proof is lower. Although the technical threshold for KZG polynomial commitment is higher, the submission of the proof is faster. Proto-Danksharding for Ethereum is expected to be deployed at the Cancun upgrade in Q4 2023.

Polygon Avail has now become an independent project from Polygon. It also uses a data availability sampling scheme. The specific implementation method is similar to Proto-Danksharding. It is also an RS erasure coding scheme plus KZG polynomial commitment. Avail is still in the testnet stage, but will soon release important information about incentivized testnets and token economics.

EigenDA is the flagship product of Eigenlayer. Its solution is derived from the same lineage as Ethereum's Proto-Danksharding. It also uses the RS erasure coding scheme plus KZG polynomial commitment. EigenDA is still in the testnet stage. The testnet will be launched at the end of August 2023, so it will take some time before the mainnet is launched.

Arbitrum Nova is completely different from the above four projects in terms of how it implements data availability. It adopts the Data Availability Committee model, in which an external Data Availability Committee stores and provides transaction data and is composed of at least 6 people. Committee members (the total number of members is 7) submit BLS signatures to ensure the reliability of the data. Compared with the Data Availability Sampling (DAS) method, the Data Availability Committee method is lower in cost, but relatively speaking, it sacrifices decentralization and security. Arbitrum Nova has now been launched on the mainnet, but it does not compete with the above-mentioned projects and only represents a data availability solution.

zkPorter proposed by zkSync is more complex than other data availability implementation methods. Its design combines ZK Rollup and sharding to solve data availability problems. It can support any number of shards, and each Each shard can choose and set up its own data availability scheme, which ensures a higher degree of freedom in the construction of smart contracts. zkPorter has been launched on the mainnet together with zkSync Era, but it does not compete with the above-mentioned projects and only represents a data availability solution.

Currently, among all data availability implementation solutions, data availability sampling plus KZG polynomial commitment is the most mainstream solution, which can reduce node costs and improve proof efficiency while ensuring data availability. The implementation threshold of the Optimistic proof chosen by Celestia is lower than the KZG polynomial commitment, and the technology maturity is higher. However, the future technical limit is not as good as the KZG polynomial commitment. Compared with the same type of Avail and EigenDA, Celestia's development progress is currently Faster, it will land on the mainnet earlier, but Celestia will also face direct competition from Ethereum after the Cancun upgrade.

Summarize

From the perspective of the track, benefiting from the successful practice of Rollup and the technological development of Ethereum, modular blockchain will be one of the main trends in the development of future blockchain architecture, and Celestia will play a relatively important role in this. . Compared with current competing projects, Celestia's data availability implementation solution has a lower threshold and faster development progress, but the upper limit may not be as good as other solutions using KZG polynomial commitment. In the future, we still need to continue to pay attention to the development progress of the project itself, Ethereum's Cancun upgrade, and the development of upstream and downstream tracks including Rollup. In addition, due to the continuation of the bear market in the short term, the release of the project's potential still awaits the recovery of the market and the accumulation of underlying technology.

6. Risks

1) Code risk: Currently, Celestia has not published any audit report, so there may be code risks.

2) Technology maturity risk: Currently, Celestia is still in the test network stage, and it still requires a lot of practice to improve technology maturity before the main network goes online and is put into production.

3) Market risk: At present, the modular blockchain track is still not one of the most mainstream tracks, and the technology development of the project still requires a lot of practice. Therefore, there is still relatively large market uncertainty before the technology can be truly implemented. sex.

References

Celestia Learn, https://celestia.org/learn

"Celestia Project Research Report", first-class warehouse

Celestia documentation, https://docs.celestia.org/

[1] https://www.coingecko.com/zh/%E6%95%B0%E5%AD%97%E8%B4%A7%E5%B8%81/mcdex#markets, data deadline is May 2021 March 20

[2] https://celestia.org/team/

[3] Figures 2–2 2–3 are all from https://cauldron.io/

[4] https://celestia.org/learn/beginners/modular-blockchains-for-beginners/

[5] https://docs.celestia.org/learn/how-celestia-works/data-availability-layer/

[7] https://celestia.explorers.guru/

[8] https://docs.celestia.org/nodes/overview/

[9] https://celestia.org/ecosystem

[10] https://docs.celestia.org/learn/staking-governance-supply/

[11] https://twitter.com/MessariCrypto/status/1699066238490804415