In the last week of October, Bitcoin reached its yearly high, soaring to an impressive $36,000. The upward move not only recorded a yearly high for BTC but also heralded a momentous occasion as the cryptocurrency successfully closed a large price gap on the CME Bitcoin chart. This is a development that is often closely watched by traders and analysts.

BTC 4-hour chart | Source: Tradingview

CME gaps have Capital become an attractive aspect of Bitcoin's trading model. This gap appears when there is a difference between the closing and opening prices of Bitcoin on the Chicago Mercantile Exchange (CME). Analysts and traders closely monitor this phenomenon because they provide valuable signals about potential price movements.

The importance of CME is not limited to creating such gaps. In fact, it is the world's largest and leading Derivative market, with a history dating back to 1898. CME's managed and cash-settled Futures Contract have long been popular with institutions want exposure to cryptocurrency but don't want to actually own it.

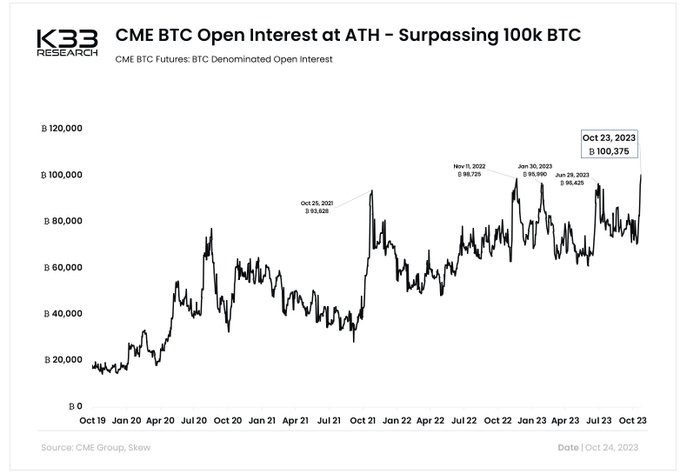

Amid recent Bitcoin price volatility, senior analyst Vetle Lunde at K33 Research presented an interesting statistic. Lunde noted that open interest (OI) for BTC Futures Contract on CME has surpassed 100,000 BTC for the first time. Furthermore, CME's market share has now reached an All-Time-High of 25%, quickly approaching Binance in Futures Contract .

Source: Vetle Lunde

A record rise in BTC Futures Contract statistics on CME signals a new era in which major players (especially traditional institutions) are increasingly embracing Bitcoin trading.

Yesterday, CME Group – the company that operates the Chicago Mercantile Exchange said that the volume and open interest of cryptocurrency Derivative skyrocketed in the third quarter of 2023.

In fact, with the Bitcoin price rally underway, CME Group announced via email that “Monday's trading session marked a CME Group Bitcoin Futures Contract open interest record of 20K contracts.”

OI simply represents the total number of Derivative contracts (futures or options) held by traders. This metric represents how many people in the market are interested in holding a position.

But according to CME Group, Monday's trading day (when BTC skyrocketed from around $30,500 to nearly $35,000) wasn't the only good sign.

The third quarter set a record Medium of 15,800 Bitcoin Futures Contract , an increase of 11% compared to the previous quarter. ETH Futures Contract and options open interest increased by 22% compared to Q2.

Not only that, ETH options actually skyrocketed in Q3 (+75%). OI also increased 55% higher than the previous quarter.

CME Group notes that this Derivative craze occurred despite BTC and ETH prices plummeting during the same period.

Analysts wrote in a news release:

“While volatility and price have remained largely range-bound along with volume this year, CME Group continues to see increased open interest for this crypto duo.”

Clearly, the current environment is different, with BTC and ETH trading at high prices of around $34,200 and $1,800 respectively at the time of writing.

ETH 4-hour price chart | Source: Tradingview

You can XEM the coin prices here.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Home home

According to AZCoin News