What are carbon rights?

Carbon Credits is a financial concept derived from environmental protection. It is a currency issued by environmental protection agencies or government agencies. The value anchored behind the currency is the " right to emit carbon ." When an entity or institution successfully reduces its greenhouse gas emissions, it can obtain a corresponding number of carbon rights, which can be sold, transferred or stored for future use , thus achieving the goal of encouraging countries or enterprises to reduce greenhouse gas emissions.

Carbon rights are typically measured in terms of carbon dioxide, one of the most dominant greenhouse gases, and are traded in units of one metric ton . Institutions whose emissions are lower than the prescribed quota can convert the remaining quota into carbon rights tokens; institutions whose emissions exceed the prescribed quota must purchase carbon rights, otherwise they may face higher taxes or penalties.

Carbon rights are usually divided into two types : the regulated compliance carbon market (CCM) and the unregulated voluntary carbon market (VCM) :

Compliance Carbon Credits

Such carbon rights are issued by governments or environmental protection agencies to meet international or national legal and regulatory requirements. Companies or countries must purchase these carbon rights to comply with emissions limits.

Voluntary Carbon Credits

These carbon rights are voluntarily purchased by companies or individuals to offset their own greenhouse gas emissions. They have nothing to do with emission reduction restrictions and are usually used to meet corporate social responsibility (CSR) plans or personal environmental protection behaviors. For example, companies make purchases based on social responsibility or public relations pressure, or flight customers pay extra to purchase carbon emission credits to achieve net-zero travel.

From the above definition, we can see that the concept of carbon rights itself has been highly tokenized . At present, the carbon rights market operates in different ways in each country or region. Many countries are establishing their own carbon rights exchanges. Because of the decentralized and transparent characteristics of blockchain, many people believe that it is the only way to trade carbon rights. Great tool.

Current status of global carbon rights market

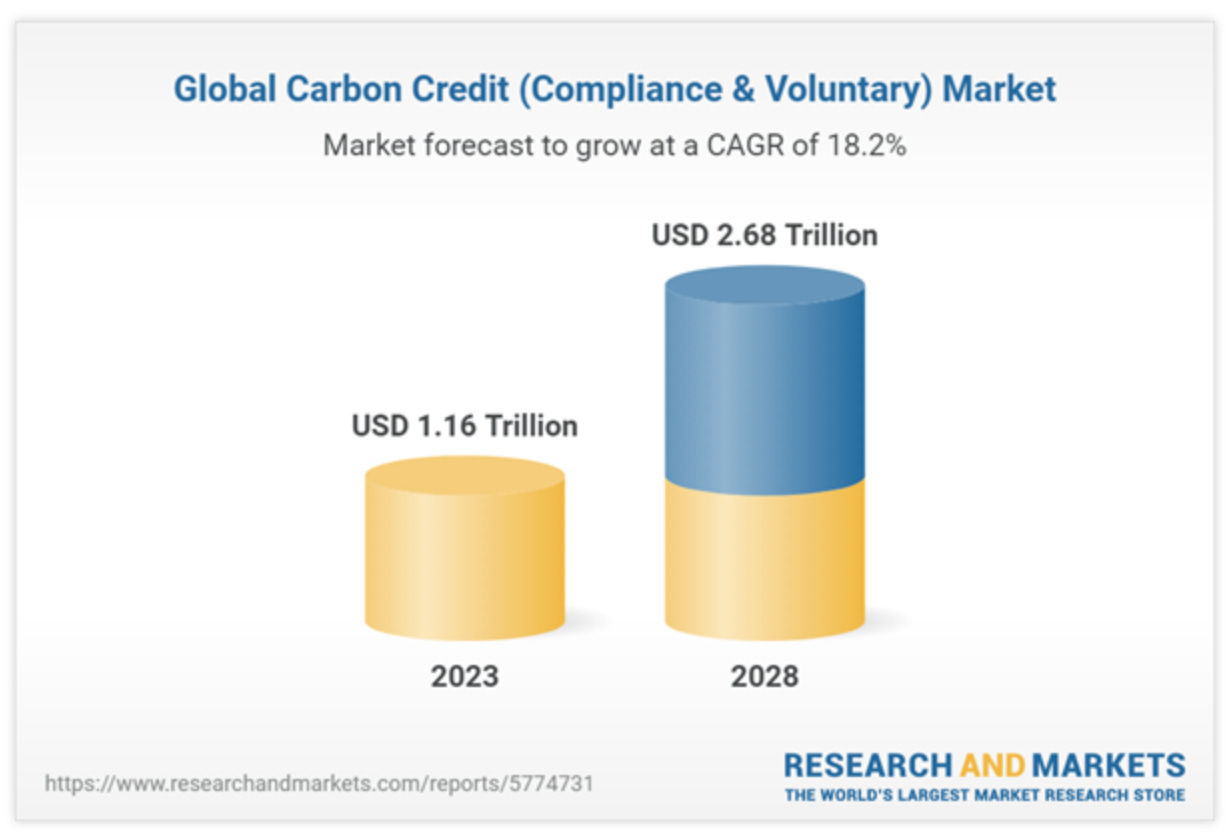

According to research report statistics from Research and Market , the global carbon credit market transaction volume in 2022 will be US$978.5 billion. The market is expected to reach US$2.68 trillion by 2028, and is expected to grow nearly 2.5 times in five years. With 2050 net-zero emissions, the global climate goal of achieving carbon neutrality is approaching. In recent years, the demand for climate solutions from governments and enterprises has increased significantly.

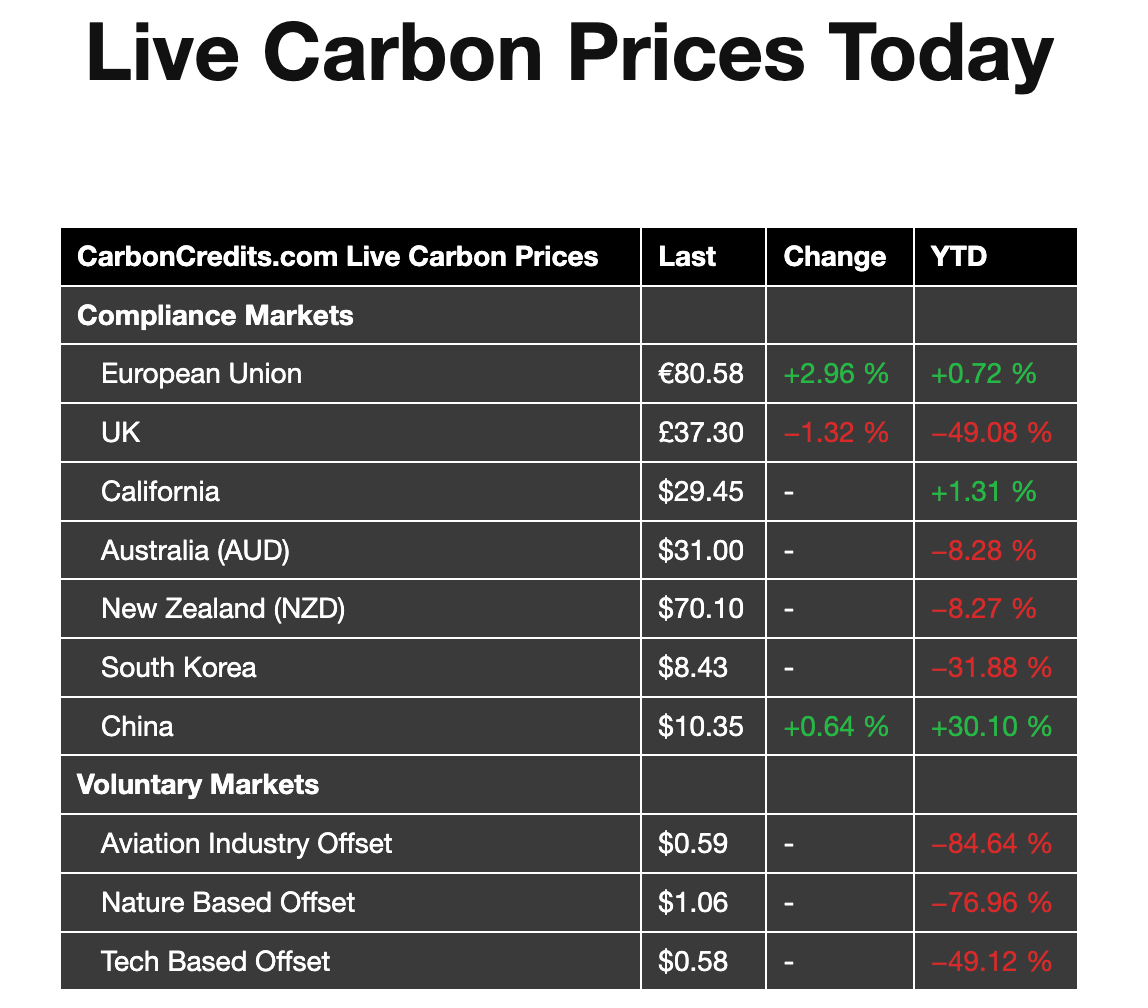

The global compliant and regulated carbon market (CCM) can be further segmented into Europe, North America, UK, New Zealand, South Korea, China and Certified Emission Reductions (CER). Judging from market transaction value and volume, Europe, which has vowed to reduce emissions by 55% by 2030, dominates the market . The Voluntary Carbon Market (VCM) is divided into six regions: Asia, Latin America, Africa, North America, Europe and Oceania. In 2022, Asia will account for the largest share of the global carbon market .

In July 2022, the Hong Kong Exchange announced the establishment of the Hong Kong International Carbon Market Council, intending to develop Hong Kong into an international carbon market and an Asian hub; and Taiwan also established its first "Taiwan Carbon Exchange" in August 2023, hoping to It can be in line with international standards, and with the new carbon fee in 2025 about to be launched, it is expected that no matter which carbon market it is, the demand for transactions will continue to increase.

The dilemma of the global carbon rights market: opaque transactions, rife with fraud, and inconsistent credit standards

However, although it sounds like a good vision to encourage emission reductions and achieve carbon emission neutrality through carbon rights trading, in practice, many transactions in the emerging market of carbon rights are conducted privately in an OTC manner, which is full of problems. Problems of lag and fraud have caused the pace of global carbon trading to continue to slow down and face shrinkage in 2023. As a result, both Gucci and Nestlé have withdrawn carbon neutrality statements from their products. Among them, the most criticized ones are:

・Market opacity: The current carbon market is full of opacity, including unclear market rules and information about carbon rights holders, or the company selling carbon rights is actually unable to achieve the emission reductions originally promised, leading to companies' trust in purchasing carbon rights. There is a decline in the degree and willingness, and there is also the risk of unfair transactions and market manipulation.

・Fraud and legality issues: The carbon market faces problems including unclear calculation methods of carbon rights, carbon offset plans being criticized for false carbon reductions, or malicious greenwashing. Stronger regulatory mechanisms are needed to ensure that Compliance and honesty in transactions.

・Multi-standards and multi-jurisdictions: Different countries and regions around the world use different carbon market standards and different regulatory mechanisms, which leads to the fragmentation of the carbon rights market and the difficulty in operating across borders. The international community is seeking more cooperation and coordination to establish unified standards, agreements and carbon trading methods.

How blockchain can improve carbon rights trading

The World Economic Forum published a white paper in March this year, sharing how the "Cryptocurrency Sustainability Alliance Blockchain Carbon Credit Working Group" attempts to use distributed ledger technology (DLT) to solve the challenges facing the carbon market. Of course, in the face of complex problems involving judges and the development progress of carbon trading systems in various countries, blockchain technology cannot solve all problems in the carbon trading market, but it can solve some obvious problems through technical advantages. Pain points:

・Improve transparency: Because each carbon rights transaction is recorded on an immutable blockchain, the blockchain allows participants to view and verify transactions, reducing the risk of fraud and increasing the trust of both parties in the market.

・Reducing transaction costs: The decentralized nature of blockchain technology can reduce transaction costs, reduce reliance on middlemen, and eliminate fees for intermediaries, helping to make the market more open and inclusive. Overall, it can improve the efficiency of the market and lower the threshold for participation.

・Assist regulatory compliance: The verifiability of blockchain can also be a tool to promote carbon market compliance. All transactions and records can be reviewed and verified on the blockchain by regulatory agencies to ensure the legality of carbon rights transactions. and honesty.

・Promote international transactions: The carbon rights market usually involves multiple countries and regions. Blockchain technology provides a cross-border way to record and verify carbon rights transactions, build consensus or units to simplify international carbon rights transactions, and reduce cross-border transactions. complexity.

Precisely because they see the potential of blockchain in carbon trading, in recent years, companies such as Ripple , Xange or Crypto Climate Accord have been committed to advocating blockchain carbon neutrality. They firmly believe that cryptocurrencies that have been criticized for many years as not environmentally friendly will not compete with conflict with sustainability, but can play a catalytic role in combating climate change, promoting financial inclusion and efficiency.

Next, we will introduce several current carbon rights-related projects on the blockchain.

Projects related to carbon rights on the blockchain: Toucan, Senken

Toucan Protocol : Tokenization solution for voluntary carbon markets

Toucan Protocol is a Swiss company founded in 2021, a team derived from CO2ken, the prototype of the Ethereum climate action system in 2020. Toucan received an undisclosed amount of seed round financing from 9 institutions including Earthshot Ventures and Speedinvest in 2022. Its main business is trying to help the Voluntary Carbon Market (VCM) become more efficient by tokenizing carbon credits (RWA). Develop with transparency and integrity to combat climate change.

Toucan has established a bridge specifically to put carbon rights on the chain, allowing companies to transfer off-chain Co2 removal certificates (CORC) verified by trusted institutions such as Puro.earth , or carbon rights endorsed by Verra and Gold Standard. on-chain and conduct transactions. The entire process, as well as carbon rights information, is recorded in an open, blockchain-powered database. Everyone can independently view the attributes, transaction history and price data of any credit at any given time. Carbon rights trading services are currently provided through two public chains, Celo and Polygon .

Once the carbon credit is transferred to Metaregistry (a process of tokenization), it becomes a TCO2 Carbon NFT with NFT attributes . TCO2 NFT comes with all carbon credit information: project, year of climate impact, issuer and other information. This kind of carbon credit with system guarantee has additional certification and has specific attributes is more popular than other carbon credits. In the voluntary market for carbon credits The transaction prices are completely different.

Once on-chain is completed, users holding TCO2 NFT can lock and pledge the NFT into the carbon pool to obtain the corresponding carbon token $BCT representing a meal of carbon (all carbon credit tokens certified by Verra after 2008 are accepted ) or $NCT (only carbon tokens created using nature-based methods after 2012 will be accepted) and sold via trade on the blockchain. After the buyer purchases, he can redeem and destroy it to offset a specific amount of carbon footprint.

How to Buy Carbon Token$BCT and $NCT

Decentralized exchanges: Currently $BCT and $NCT tokens can only be purchased on SushiSwap and UniSwap, the decentralized exchanges that support Polygon and Celo.

Senken : an intermediary trading platform for the voluntary carbon market

Senken is a German company founded by Adrian Wons in 2022. In three rounds of financing between 2022 and 2023, it received US$7.5 million in funding from Obvious Ventures, with participation from institutions such as Kraken Ventures and w3.fund.

Senken is the world's first and currently largest decentralized digital carbon market (digital VCM). It focuses on using verifiable blockchain technology to strengthen the transparency of the voluntary carbon market and connect climate project developers with carbon credit buyers. The two companies are connected to provide verified carbon credits to businesses who want to offset their remaining carbon emissions, achieving net zero goals in a transparent and traceable way.

Users with relevant needs can easily search and compare carbon offset projects on the Senken website, and purchase 100 verified climate projects from different countries, years, types, and a total of 40 million carbon credits, without any payment. Intermediary fees are charged, and carbon credits can be purchased and traded with one click.

In addition to providing transactions, Senken has partnered with Toucan to launch a new type of climate financial instrument: carbon forward contracts. Carbon forward contracts are a way for investors to pre-fund climate action. Climate project developers commit to providing carbon credits to buyers at a predetermined price and time in the future to obtain project start-up and execution funds, while investors can obtain future high-quality carbon credits at a price lower than the market price for similar projects.

Forwards are similar to futures in that both allow hedging against future price changes in a financial asset, but forwards are the purchase of letters of credit issued in the future (e.g. 2025 letters of credit), whereas futures are the purchase of any financial asset at a predetermined price The price for future delivery at a specified time. Carbon forwards have the opportunity to become a tool for risk management and capital planning for a generation of companies that are increasingly concerned about carbon emissions.

Currently, Senken does not have any plans to issue tokens, and carbon credits on the platform can only be purchased by transfer and credit card.

summary:

Seeing this, if you are a player who has been in contact with the crypto in 2021, you may wonder why KlimaDao, which was forked from the controversial 3,3 OlympusDAO, is missing. The KLIMA of that year used a special economic model to replace KlimaDao. The coin hit $3,700 per coin and is now worth around $0.66. KlimaDao originally wanted to encourage the carbon credit market to adopt blockchain, but during the implementation process, it was involved in many controversies related to Ponzi schemes. Although it seemed that it would actively return to its original industry and launch the carbon credit trading market Carbonmark in 2022 and 2023, the project It remains to be seen how stable it will be, and whether it is still worth investing in the underlying token.

As for other projects, the author has observed that the current pricing method of the voluntary carbon market is relatively confusing, resulting in a significant gap between the relevant tokens representing one ton of carbon on the blockchain and the price of one ton of carbon on the actual carbon exchange ( The current price of $BCT is 0.21, and the current price of $NCT is 1.35). The price of carbon credits is also different between different projects. In the future, as relevant agreements and markets gradually mature, there may be a short window in which people can take advantage of multilateral price differences, and it may be a good arbitrage opportunity.

In particular, blockchain is a market that loves hype narratives. How will a new market like carbon rights, which focuses on environmental protection concepts that will be the mainstream narrative in the next few years, combine with blockchain to develop various financial markets? The product is worth noting.