Why do we need to know the data on fund entry and exit?

In the investment market, capital (money) is the core and key source of power. For prices to rise, capital inflow must be required. Funds entering the market > funds selling the market. If the demand is greater than the supply, the price can rise, and in turn it will fall. .

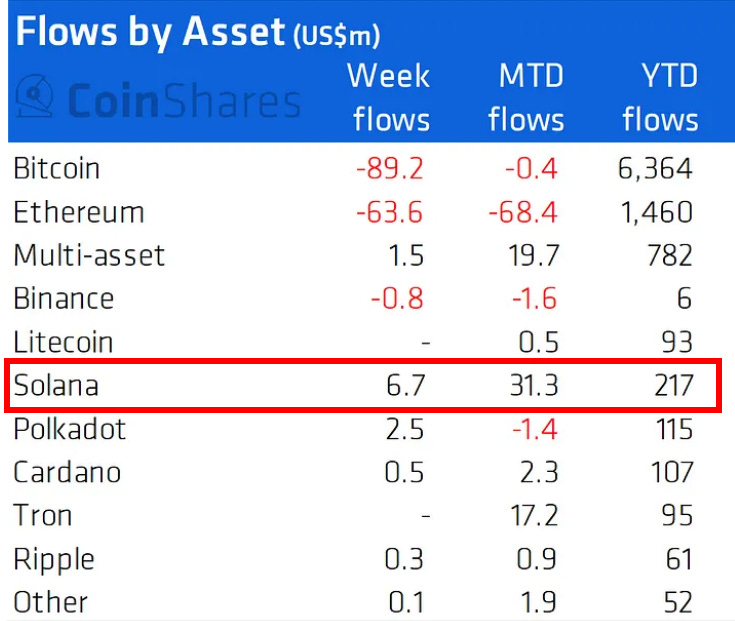

Taking the last bull market in 2021 as an example, excluding Bitcoin and Ethereum, the cryptocurrency with the largest cumulative capital inflow that year was Solana, and $SOL happened to be the cryptocurrency with the best price growth in this table that year, rising more than a hundred times.

In cryptocurrency investment, technology and market development are of course very important. These are biased towards fundamentals and industry development, but just like the financial market, they will pay close attention to various fund indicators, such as the entry and exit of the three major legal entities in the Taiwan stock market: foreign investment/investment/self-investment Funding trends for business, such as the Federal Reserve (FED) raising or lowering interest rates? These are all related to the funding status of the overall market and are variables on the funding side. In the financial market, only with funding can there be momentum for growth. Without funding, it is difficult to achieve large increases, and at most there will be small fluctuations.

Compared with traditional finance, cryptocurrency is still a very early stage market, and the overall market value is not high. Only when more funds enter the market can the overall cryptocurrency market value be increased. Therefore, for cryptocurrency investors, of course they would like to know how much external funds are flowing into the cryptocurrency market, from where, and to which projects?

CoinShares Fund Flow Weekly Report|Provides weekly fund entry and exit data

The data quoted in many related news is "according to CoinShares report/data" . What is this CoinShares? What reports does it provide?

CoinShares - Europe's largest crypto asset management company and European cryptocurrency ETP issuer

CoinShares is an asset management and investment company located in Europe, focusing on crypto assets. It has been investing in this field since 2013 and has launched several innovative products:

The first regulated Bitcoin hedge fund

The first Bitcoin product to be traded on an exchange

The first Ethereum-denominated private equity fund

According to the latest data from the official website, CoinShares currently manages more than US$3 billion in assets. The main product of CoinShares is cryptocurrency ETP. ETP is the abbreviation of Exchange Traded Products. Exchange Traded Products = Exchange Traded Products. Cryptocurrency ETP allows people to buy and sell cryptocurrency-related products at exchanges or banks without the need to manage them themselves. Store cryptocurrency.

What is the difference between ETP and ETF?

Both are traded on exchanges. ETF is a fund, ETP is a product, and a fund is also a product. To put it simply, ETF is a kind of ETP. ETP includes more types, but they are all commodities that can be traded directly on the exchange. .

At the moment of writing, the United States has not yet adopted a Bitcoin spot ETF, but Europe already has many Bitcoin spot ETPs.

Bloomberg Analyst: There are already many spot Bitcoin ETPs in Europe - Juheng

Digital Asset Fund Flows Weekly Report|What does the CoinShares Fund Flows Weekly Report contain?

CoinShares releases the latest Digital Asset Fund Flows Weekly Report every week. The latest issue at the time of writing is published on 2023/11/13:

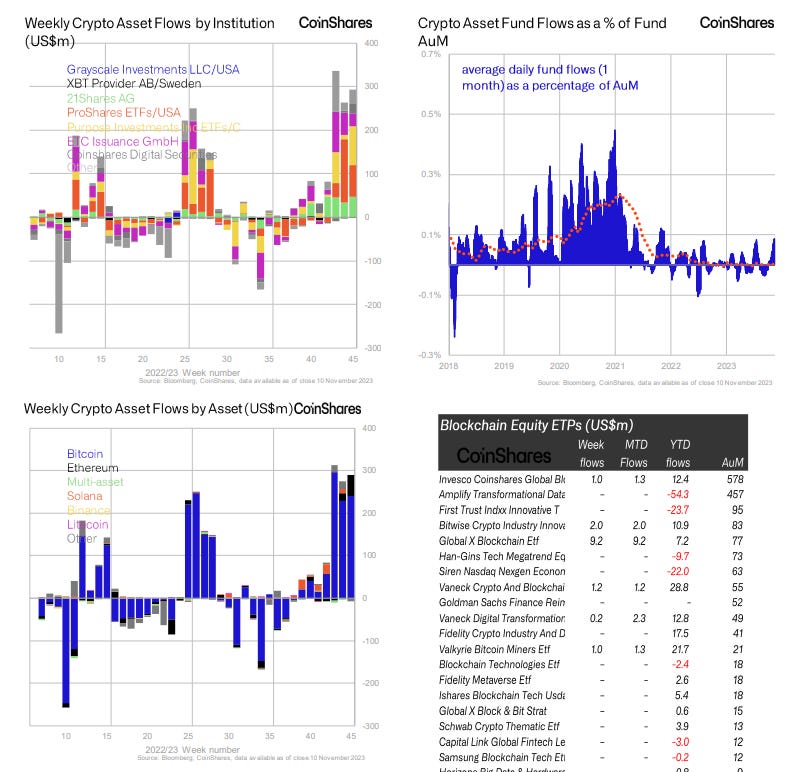

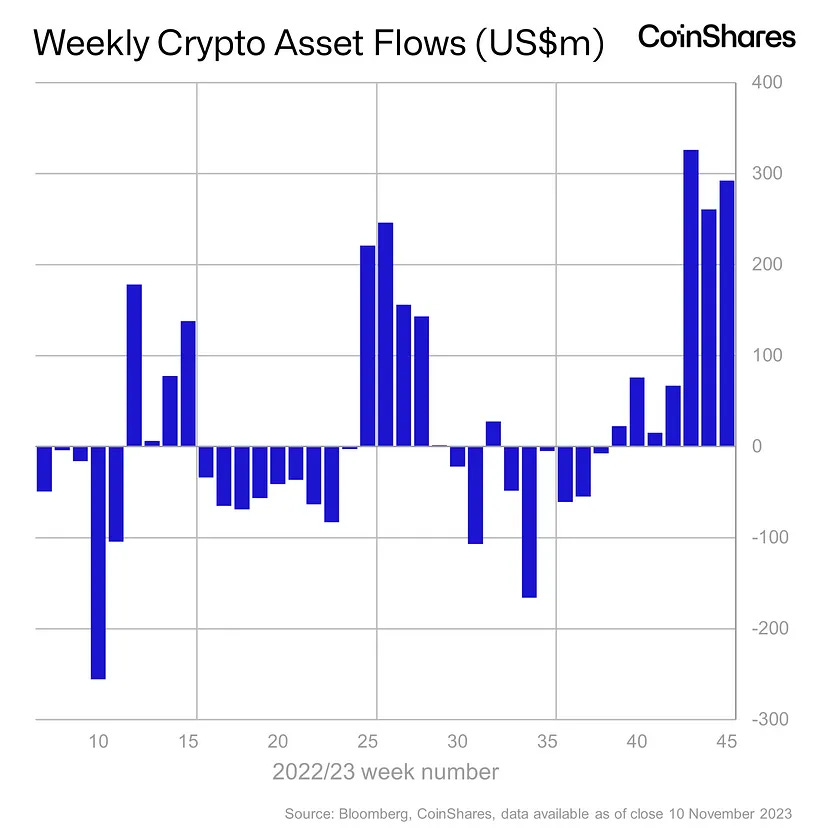

The weekly report mainly provides data on the capital flow of crypto assets. The first is a bar chart, which can directly see the capital inflow and outflow in recent months.

The unit is one million U.S. dollars. The latest one shows nearly 300, which means nearly 300 million U.S. dollars, nearly 300 million U.S. dollars.

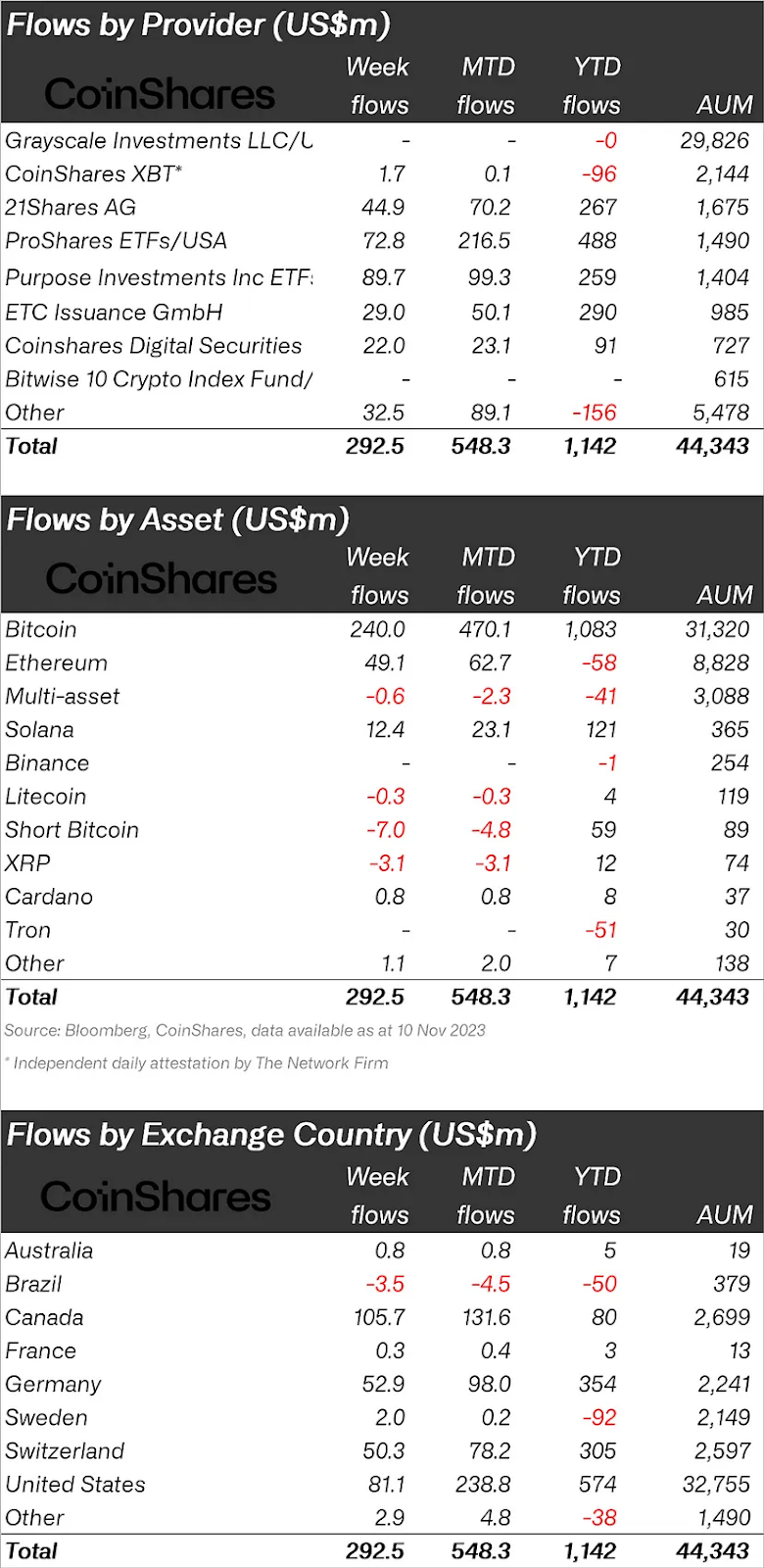

Then there are the details, which are Week flows (week), MTD (month), YTD (year), and AUM (total asset value), and then divided into three directions:

by publisher

By Cryptocurrency

According to country

For ordinary cryptocurrency investors, what they are most concerned about is probably the inflow of individual cryptocurrencies. From the above figure, you can see that the largest inflow of assets is Bitcoin, with a total inflow of 240 million US dollars (240 million US dollars) in a week, and Ethereum. The currency ranks second, and the largest inflow after Bitcoin and Ether is Solana; if you look at the entire year, Solana is the cryptocurrency with the second highest inflow of funds, while Ethereum is outflowing.

Reference reading:Why does Visa exclusively name Solana? From the perspective of global payment status and Sol chain technology

If you look at the picture of countries, you can see that the United States currently accounts for the largest share of funds in the cryptocurrency market. The United States alone accounts for more than 70%. The impact of the United States on cryptocurrency is still huge. This is why Europe Both China and Canada already have Bitcoin spot ETFs, but the adoption of the U.S. Bitcoin ETF continues to affect the price fluctuations of the cryptocurrency market.

Reference reading: Bitcoin spot ETF has a high probability of passing this year! Inventory of approval progress and asset management scale of 7 institutions

CoinShares Digital Asset Fund Flows Weekly Report Fund flow weekly report data source

Data sources indicated on the chart: Bloomberg, CoinShares.

Bloomberg Bloomberg News is the world's largest financial information company, plus CoinShares' own data. According to CoinShares, these data mainly focus on fund flow statistics in markets such as cryptocurrency ETFs, ETPs, mutual funds, and trusted over-the-counter transactions.

Original tweet

Those who use such products are usually not people in the crypto but traditional investors or investment institutions. Unlike the on-chain data of the blockchain, this can be used to evaluate how much external funds have entered the cryptocurrency market.

Some of these products are only open to qualified investors. Qualified investors are usually institutions or professional investors, not ordinary small retail investors, so some people will use this data to judge the entry status of institutions.

If the cryptocurrency market wants to grow, it can’t always be about money being transferred internally.

Requires large amounts of external capital investment

Where can I read the CoinShares Fund Flow Weekly Report?

Three ways to read the latest weekly newsletter:

Official Blog CoinShares Blog

Official blog URL:

This is a blog based on Medium. If you have a Medium account, you can track their publications or report authors.

Click FUND FLOWS REPORT to see several recently published reports

Official website

In Knowledge on the official website

https://etp.coinshares.com/knowledge/market-activity

There are many categories of articles, and the weekly report sections can be filtered individually.

Only the summary of the report will be seen here. The complete content requires an additional download of PDF. PDF provides the most complete information and has more details than the content of the blog article.

Subscribe to newsletter

If you scroll down the weekly report page on the official website, the subscription option will appear. The laziest way is to subscribe directly. The weekly report will be automatically sent to your mailbox every week.

Summary - Key conditions for the cryptocurrency bull market: "Admission of external funds"

After nearly two years of bear market, the entire crypto is looking forward to the arrival of the next bull market. In [ Bitcoin halving countdown! What is Bitcoin Halving? Will it help the bull market return? ] This article has analyzed two starting conditions for the next round of bull market:

Condition 1 for the next bull market to start: New funds enter the cryptocurrency field

Condition 2 for the start of the next bull market: Macroeconomic environment matching and economic data improving

This article also lists the three major narratives of the next bull market:

The key to unlocking the 2024 bull market! Halving, spot ETF, RWA, three major narratives of market capital increase

The focus of the three major narratives is to drive more funds to enter. Only the increase in funds can promote the entire cryptocurrency market and start the overall bull market. Otherwise, it will just be the performance of individual projects.

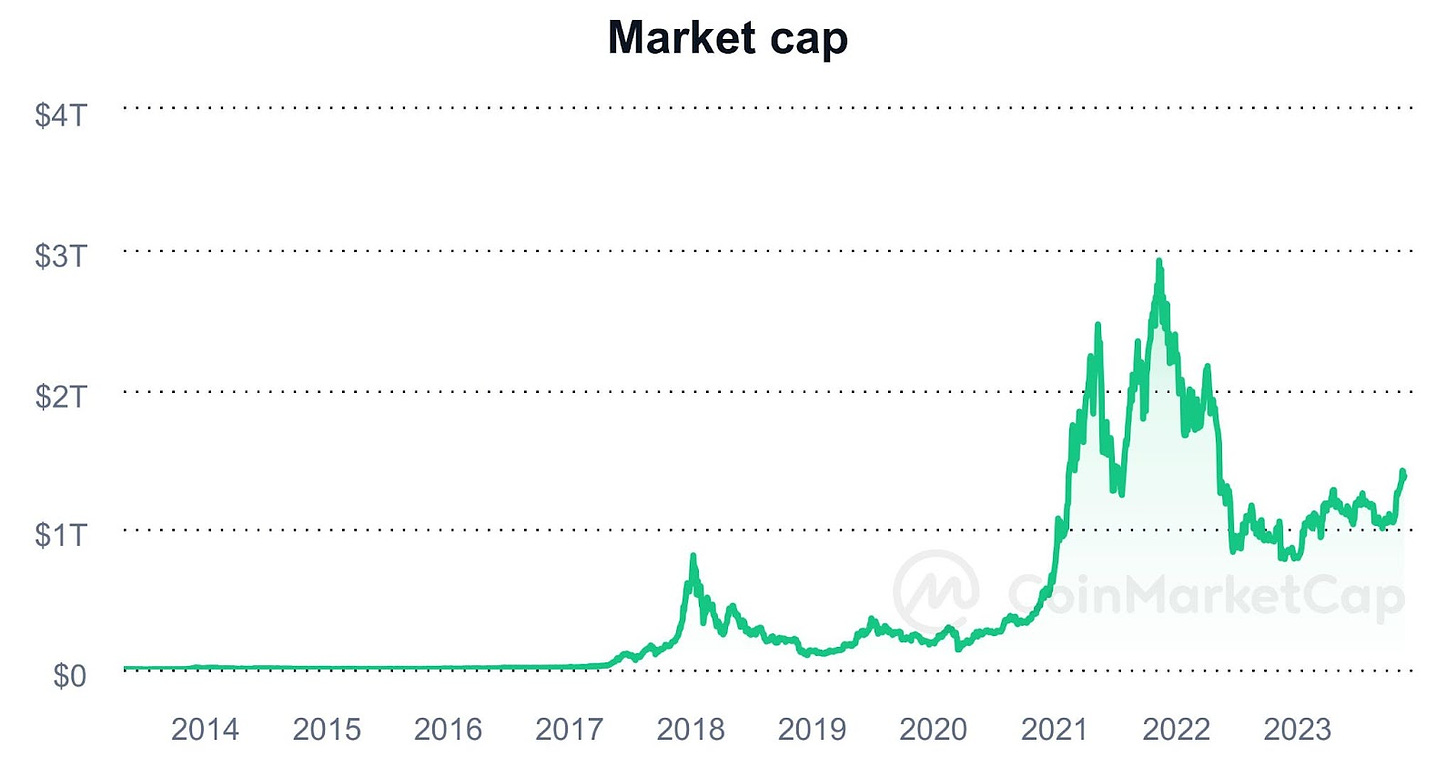

At the time of writing, the total market value of cryptocurrency is approximately US$1.4 trillion. The peak of the last bull market was US$3 trillion, leaving a gap of US$1.6 trillion. If cryptocurrency continues to grow, the next bull market will reach another peak. , how much external capital is needed to enter?

Further reading: