Advertising slogans are often catchy and hard to forget. However, only a few have achieved iconic status, including those that failed miserably when they first came out.

After being outclassed by Japan's Big Three automakers (Honda, Nissan and Toyota) in the 1980s, by 1988 General Motors (GM) realized they needed a massive transformation. The company focuses on its Oldsmobile cars, which are considered to be built for retirees. So in 1988, the company revamped the car in an attempt to attract younger customers.

But GM also knew that in order to breathe new life into the new car, it needed to completely rebrand.

So it came up with a new advertising slogan: " This is not your father's Oldsmobile. "

The ads are funky and energetic. Oldsmobile even hired music icon Tina Turner to sing the theme song in an attempt to shed the old, stuffy image that has associated Oldsmobile with nursing homes and country clubs.

But all to no avail. Oldsmobile's sales figures are still falling, lagging far behind its Japanese rivals. The redesigned car still rides like a boat and the build quality is nowhere near as good as its Japanese counterpart. Additionally, the advertising campaign alienated an older customer base while failing to attract younger demographics.

But the slogan stuck and evolved into a universal, descriptive slogan that took on a life of its own.

Whenever someone wants to describe a product, a situation, or anything that is radically different from its predecessor, you'll often hear, "It's not your father's _____________" (just fill in the blank).

As 2023 comes to an end, it's time to take a step back and examine how the U.S. economy has changed compared to the past few decades, and what's lurking beneath the surface in 2024.

After all, "This isn't your father's economy."

But whether it will be more successful than Oldsmobile's rebrand remains to be seen.

fasten your seatbelt. Let's go for a ride.

Can the government continue to pay its bills?

In 2020, the liability side of the U.S. government's balance sheet did increase because of all the COVID-19 programs and financial stimulus packages.

Although COVID-19 is largely behind us, this trend continues today. The first is Russia’s financial support for Ukraine after its invasion of Ukraine. Now, let’s look at the military spending of the Gaza war. The size of U.S. government debt is not going to decrease anytime soon.

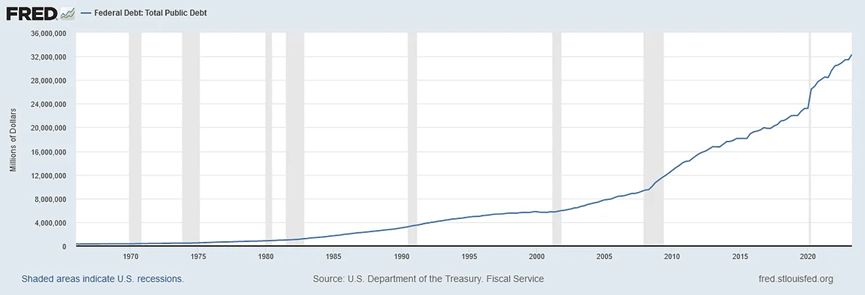

Source: St. Louis Fed

The current debt is $32.22 trillion.

With the war dragging on and all large government projects being funded, the government does not appear to be showing any inclination to curb spending. Debt is expected to continue to balloon over the coming decades.

So the question now is: how to fund this debt?

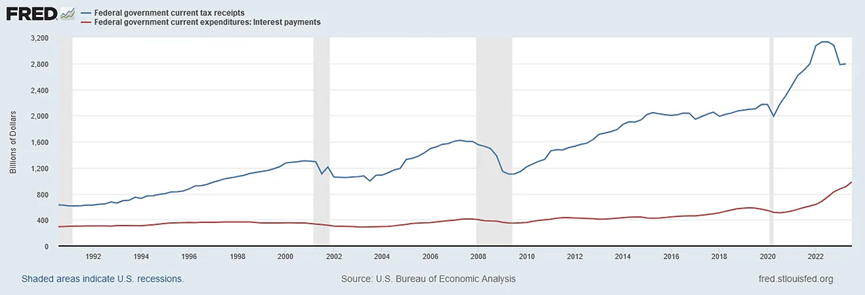

The blue line in the chart below is the revenue the government collects from taxes. The red line is the interest paid to repay the debt.

Source: St. Louis Fed

Currently, tax revenue covers the government's interest payments, leaving about $1.8 trillion. But notice that the red line is trending high, while the blue line is trending low.

The Fed may have paused raising interest rates, but regardless, expanding government debt means interest payments will continue to rise as funding rates rise.

american game of thrones

Just like in the days of our fathers, the US dollar (USD) remains the de facto global reserve currency.

Everything is priced in U.S. dollars, and countries will accept U.S. dollars as a trading currency and purchase U.S. Treasury bonds.

But for the first time since World War II, we are witnessing a powerful attempt by other countries to move away from the dollar.

We discussed the implications of this issue in November last year .

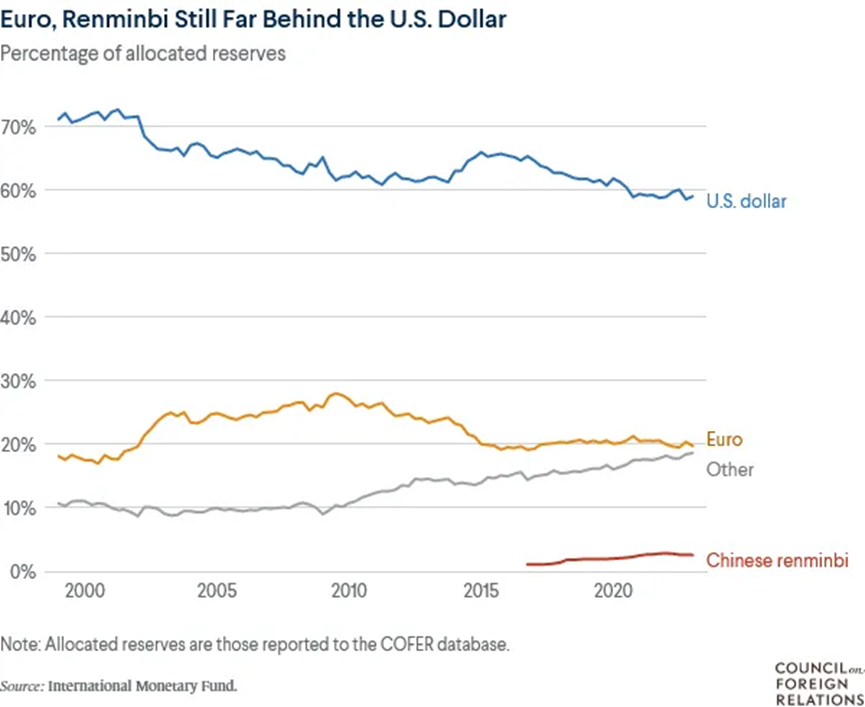

The chart below shows that as countries reduce the U.S. dollar in their foreign exchange reserves, other currencies such as the yuan are gradually adopted by more and more people.

Source: Council on Foreign Relations

But this shift away from the dollar will not be easy. As we mentioned last November, the U.S. dollar is still king. Replacing it would be a massive effort that would require significant resources and cooperation from other countries to accomplish—assuming it can be accomplished at all.

As a perfect example, look at the recent conflict among the BRICS countries (Brazil, Russia, India, China and South Africa), which are trying to overthrow the dominance of the dollar. The two countries reached an agreement that Russia would sell oil in yuan. But that didn't last long. Just last month, India protested and rejected Russia's demand to pay for its oil exports in yuan .

The BRICS countries cannot even agree on a common currency.

Going forward, the most likely scenario is that the rest of the world may reduce its dollar holdings and stop buying as many U.S. Treasuries. However, as long as goods remain denominated in dollars (and I think they will take into account that the dollar is the cleanest dirty shirt in the basket), other countries' foreign exchange reserve portfolios will still be tilted towards the dollar.

High inflation will continue

This week, the Fed further confirmed that inflation is slowing, as October's CPI and PPI data were lower than expected.

But make no mistake: We may well be in the lull before the next wave of inflation.

A growing global population means increasing demand for energy – and not just any energy, but energy that is cheap, efficient, stable and reliable. For governments around the world, this can be a daunting task.

Attention is focused on green energy, which has not yet proven that it can meet the above criteria, and it certainly remains a distraction that also undermines the development and enhancement of the traditional energy industry.

Current energy policy is dysfunctional. They could devote energy and resources to a parallel program in which green energy sources continually improve their technologies and traditional energy suppliers gain access to more efficient and less polluting resources.

Instead, governments around the world are forcing people to switch to green energy and abandon traditional energy sources regardless of the economic cost - even though green technology is immature and supply is unstable.

We have mentioned in several articles how a lack of infrastructure investment and the direction of government policy have shaped the current energy market landscape.

Energy prices will be a key driver of the inflation narrative going forward.

Nowhere to hide anymore

The global economy is more intertwined and interconnected than ever before. This means no more firewalls against harsh conditions in other countries.

A few decades ago, hedging options and protections were available. But now, every economy in the world is interconnected like dominoes. If one piece falls off, other parts are likely to be affected.

A typical example is: while the West is implementing quantitative tightening policies and raising interest rates, China and Japan are still printing money and keeping interest rates low in the hope of stimulating and revitalizing their economies.

While the West is trying to reduce liquidity, the East is still providing ample liquidity to risk asset markets.

We do live in a global economy. If there is a problem in one country or region in the G7, the global economy is likely to decline.

The Japanese Yen (JPY) carry trade is a good example. As we explain here, over the past few decades, investors and institutions have borrowed cheap yen at almost no cost to invest in other risky assets or real estate. But Japan has recently begun signaling that it may end its yield curve control (YCC) program and allow borrowing costs to rise.

If the yen also appreciates, liquidity will fall, and with it, risk assets.

Here's an example from our chart from a few months ago:

This is a daily chart of the S&P 500 Index. The yellow arrow points to the long red candle recorded on July 27, 2023 - the same day the Bank of Japan announced the YCC "adjustment".

As one can see, the S&P 500 dropped like an anchor on the day. In fact, it peaked in 2023 at 4607.07.

With the global economy becoming more complex than ever before, we can expect more cooperation between central banks in the future. But this is not enough to solve the financial collapse caused by decades of bad political, fiscal and monetary policies.

Brave New World Economy

High public and private debt. High interest rates. Global geopolitical tensions have increased. There are no hedging options in a highly interconnected global economy. Commodity, food and energy prices continue to rise. The only thing that's down right now is people's morale and trust in government.

This is not your father's economy. I am very sure of that.

Yes, we experienced this decades ago when the United States had high inflation and geopolitical instability. But when former Fed Chairman Paul Volcker stamped out the inflationary beast in the 1980s, he didn't have to deal with the U.S. government's high debt burden.

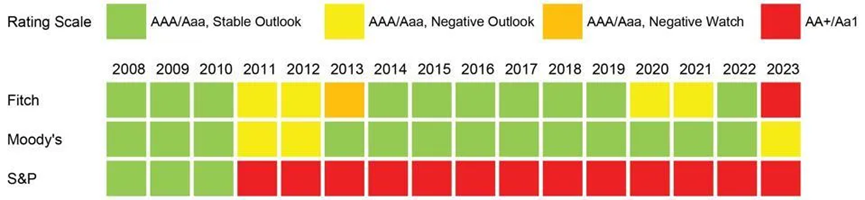

On November 10, Moody's stated that it planned to downgrade the U.S. sovereign rating from "stable" to "negative" , which caused quite a stir and panic in Washington.

The rating agency believes that the U.S. government currently faces a higher risk of default as uncontrolled spending and rising interest rates further exacerbate U.S. debt. Moody's is the only agency that still maintains the US credit rating at AAA/Aaa, while the other two agencies - Standard & Poor's and Fitch - have downgraded the US credit rating to AA+/Aa1.

Source: Moody's, S&P, Fitch Ratings. Chart by Hanlon Research. – Via Forbes

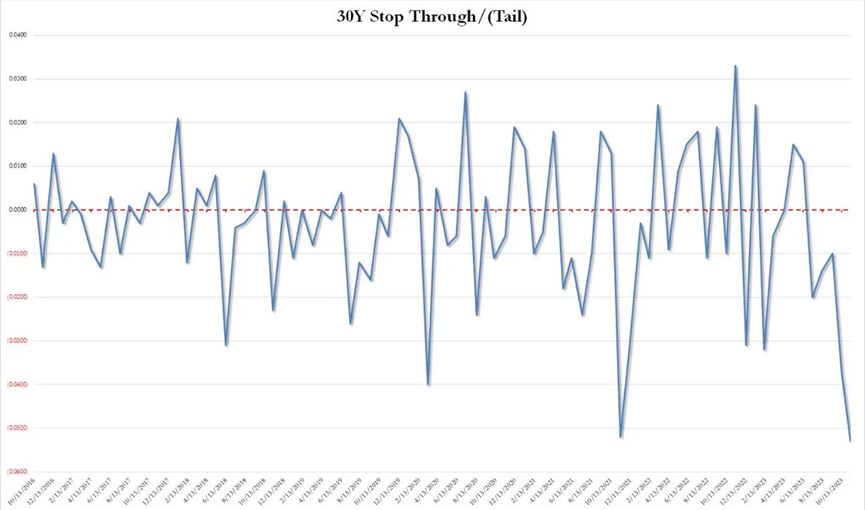

U.S. Treasury Secretary Janet Yellen was the first to jump out and publicly stated that she disagreed with the downgrade . But on the same day, there was a disastrous auction of U.S. Treasury bonds, and the yield on the 30-year Treasury note had to jump 5.3 basis points from pre-auction trading levels to attract investors to buy. The larger the “tail” (the difference between the two bond yields), the weaker the auction effect. This is the largest tail since 2016.

Source: ZeroHedge

This mismatch resulted in no buyers showing up at the auction. Primary dealers (investment banks such as Goldman Sachs and JPMorgan) were forced to absorb all unsold bonds, which was about 24.7%, well above the normal average of 11% in a lackluster Treasury auction.

On June 1, when Congress passed a bill to raise the debt ceiling through 2025, the U.S. government’s checking account, the Treasury General Account, was nearly empty. After the bill passed, the Treasury Department had to start issuing Treasury bonds to replenish the TGA so that the government could pay its bills and operate normally.

Is there an oversupply of government bonds in the market now?

Maybe.

But by the same token, foreign bidder participation dropped from 65% to 60% in the disastrous auction.

So perhaps the market is quietly agreeing with the ratings agencies.

Market confidence in U.S. Treasuries is slowly waning as the U.S. government continues to spend like a drunken sailor.

If things continue on this track, one has to ask, who will buy the Treasuries and leave the primary dealers unscathed?

In the past, this was the Fed's job. But this time, not only will the Fed lose credibility, but buying Treasuries means more quantitative easing (QE) and higher inflation.

If this happens, central banks will have to raise interest rates again, which means credit markets are at risk. The whole cycle begins again.

Sounds like the perfect storm to kick off a second wave of inflation.

What a conundrum.

And there is no easy solution to this problem.