Written by: Catrina Wang, Investment Partner at Portal Ventures Compiled by: Luffy, Foresight News

We all love pandas, they are so cute. But their numbers are sparse due to breeding problems. As one of the world's most precious animals, they're also an excellent store of value (each panda generates $1 million in rental "yield" per year).

We keep pandas in the zoo mainly to appreciate their cute appearance. Due to their biological characteristics, they repeat this life every day: eat bamboo, sleep, defecate, and then repeat the cycle. One day, someone came up with an idea: What if we trained or genetically modified pandas to make them more useful to our society? Hmm, an interesting idea. In fact, having pandas contribute more of their labor would increase world GDP.

By now, probably most readers understand what I'm going to say.

Panda = Bitcoin

Panda’s popularity = Bitcoin’s appeal as a store of value

Make Panda more "useful" = make Bitcoin as programmable as EVM

In this article, we will explore the unexpected similarities between Bitcoin and Panda to express our interest in the Bitcoin ecosystem.

1. Why are you optimistic about the Bitcoin ecosystem?

Attempts to make Bitcoin more useful rather than just sitting in a hardware wallet are nothing new. Bitcoin’s dominance of the crypto market has sparked curiosity and effort, and we are currently in the most eventful period of that journey.

First, let’s review the main arguments against increasing Bitcoin productivity

1. Bitcoin is supposed to be a store of value. This is the most commonly held belief among some of the noisy and unyielding “BTC OGs,” but community sentiment has undergone a major shift recently due to the emergence of catalysts that will be discussed later.

2. The product-market fit of Wrapped BTC (WBTC) is not high: WBTC is an ERC-20 token on Ethereum that represents Bitcoin and is backed by Bitcoin held by the custodian BitGo at a 1:1 ratio. The market value of WBTC is currently about US$5 billion and peaked at about US$15 billion, accounting for only a small part of the market value of Bitcoin. However, we believe that subdued WBTC activity levels are far from indicative of public interest in improving BTC productivity. Rather, it just shows that the centralized + EVM-centric approach to BTC may not be enough.

Bitcoin was not designed for programmability: Bitcoin’s smart contracts are implemented using Script, a non-Turing-complete programming language that maximizes network security by limiting attacks. Design choices (e.g., using a scripting language that does not allow reentrancy attacks).

Contrary to popular belief, Bitcoin does support smart contracts, although its functionality is very simple compared to other blockchains such as Ethereum or Solana. The types of smart contracts currently available on Bitcoin include:

Pay-to-Public-Key-Hash (P2PKH)

Multi-Signature Scripts

Time-Locked Bitcoin Transactions

Pay-to-Script-Hash (P2SH)

Pay-to-Taproot (P2TR)

But why can’t we just let Bitcoin be the store of value it was meant to be?

The reasons can be summarized as follows:

1. The temptation of Bitcoin liquidity pouring into DeFi

Bitcoin has dominated the cryptocurrency market over the past five years, with market share fluctuating between 40% and 70%. In comparison, although both L2 and DApp are booming, Ethereum's market share was only 20% at its peak. Let’s look at a simple mathematical calculation: if one-third of Bitcoin’s potential liquidity is released, we can theoretically double the current scale of DeFi liquidity. Of course, we shouldn't assume that the liquidity injected into DeFi will be commensurate with the market size of BTC - after all, most Bitcoin holdings belong to institutions, and institutions will never "degen". These nuances are discussed later in this article.

2. Offset the erosion of network security caused by each Bitcoin halving

Bitcoin halving refers to the reduction in rewards for miners to verify transactions on the network every four years. Currently, the block reward is 6.25 BTC per block, and the next halving will occur in April 2024. While halving is an integral part of Bitcoin’s design to control its supply, it could impact network security in two ways:

Reduction in the number of miners: The halving directly reduces the profitability of miners, causing some miners to shut down their mining machines when the cost of mining exceeds the return.

Reducing the cost of 51% attacks: With each halving, the cost of bribing miners to conduct a 51% attack is also reduced by half.

Bitcoin has two ways to deal with network security wear and tear:

The first (less reliable) way: Scarcity in the total supply of Bitcoin drives up the price of the token. However, Bitcoin’s maximum supply of approximately 21 million coins is known and priced in, and Bitcoin’s real-time price is driven more by macro and cryptocurrency market sentiment.

The second way (the main point of the discussion here): assumes that fees generated by increasing on-chain activity on the Bitcoin network will grow over time to compensate for decreasing block rewards. Outside of the Ordinal craze earlier this year, this approach hasn't worked yet, but that's about to change.

Increasing the demand for Bitcoin block space to increase miner fees is a non-negotiable pursuit of the vitality and security of the Bitcoin network.

3. Imminent Catalyst

a. 12 spot Bitcoin ETF applications: BlackRock, the world’s largest asset management company, submitted a spot Bitcoin ETF application in June. It was followed by a series of similar ETF applications from Fidelity Investments, Invesco and WisdomTree, among others. The meanings behind these behaviors are multiple:

Market access: 80-90% of wealth in the United States is controlled by financial advisors or institutions, and today their main way to access the market is through ETFs. The approval of spot ETFs will have a significant impact on market demand, more than doubling the increase.

Price impact: Spot ETFs actually require financial institutions to buy and hold the underlying assets, while Bitcoin futures ETFs are based on contracts.

Regulatory Comfort: The ETF will be subject to SEC regulation, which may enhance investor confidence and market stability.

Industry Signal: The launch of a spot Bitcoin ETF marks an important step in the legalization and integration of cryptocurrencies into traditional finance

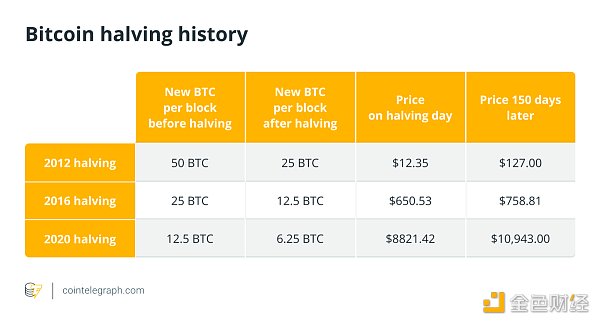

b. Impact of the next halving that will occur in April 2023: Historically, Bitcoin halving events have been associated with significant price increases, as shown in the chart below (provided by Cointeleprah).

4. Bitcoin’s UTXO model is more suitable for certain use cases/functions

Privacy: The UTXO model enhances privacy by making each UTXO different, which makes tracking transaction history more challenging than on Ethereum.

Simplified verification: Using UTXO, verifying transactions is simpler. Each transaction references specific UTXOs as inputs and outputs, making it easier for nodes to verify transactions without having to calculate the entire state of the network.

Security: The UTXO model has certain security advantages. In the event of network compromise or attack, the UTXO model may cause damage to specific UTXOs, while the account-based model may expose a wider range of accounts and their related assets.

Atomic swaps and smart contracts: The UTXO model is also suitable for atomic swaps, where transactions on different blockchains can be executed simultaneously. Additionally, while Ethereum’s account model is more conducive to complex smart contracts due to its Turing-complete language, Bitcoin’s UTXO model can still effectively execute simpler, more deterministic smart contracts.

5. The demand for Bitcoin block space cannot be met, and the current status of the Bitcoin blockchain simply cannot support it.

During the Ordinals craze, Binance had to integrate with the Lightning Network to reduce transfer costs. Users in places like El Salvador said on crypto Twitter that transaction fees for $100 were closer to $20. Interestingly, the gas fee for my experimental BRC-20 casting a few months ago was $800. These circumstances must change.

The bottom line: the Bitcoin community is in the midst of a renaissance…

1.Taproot upgrade (not so new “news”, but recently achieved results)

The Taproot upgrade was activated on-chain in November 2021, making Bitcoin more private and secure through Schnorr signatures (BIP 340). By introducing BIP341's Pay-to-Taproot (P2TR) and Merklized Alternative Script Trees (MAST), it is more scalable; and by modifying Bitcoin's scripting language to read Schnorr signatures, it is more programmable. Our analyst Vikramaditya Singh summarizes the Taproot upgrade.

2.Ordinals, BRC-20 and new standards

Ordinals are implemented through two updates to the Bitcoin protocol: Segregated Witness (SegWit) in 2017 and Taproot in 2021. These updates expanded the data stored on the blockchain, allowing for the storage of images, videos, and other media, giving rise to Ordinals. This was followed by DOMO's invention of the BRC-20 token standard, bringing JSON to Ordinals - as a thought experiment.

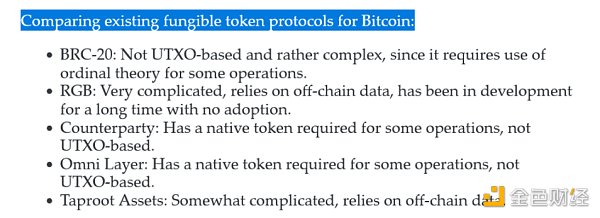

BRC-20 has little fundamental value: it doesn’t have the smart contract functionality, programmability or interoperability you’d expect from Ethereum’s ERC-20. The new token standard alternative is a hot ongoing effort in the community, spearheaded by Casey Rodarmor (the inventor of Ordinals).

Rodarmor’s questions about Bitcoin’s existing fungible token protocol. Source: Casey Rodarmor

Regardless, the rapid rise of BRC-20 and Ordinals in early 2023 increased miners' Bitcoin fee income by 128 times, totaling up to $44.5 million (note: the statistical range is from January to June this year).

3.BitVM

BitVM is the first step towards implementing Turing-complete Bitcoin contracts without changing the operating code. The key innovations of BitVM are:

Introduce state between different UTXO or different scripts through Bit Commitments.

Verifiability via logic gates: Execution can be verified by deconstructing any program in question in a virtual machine, and the validity of the execution verified by a prover. This ensures that any false claims can quickly be proven wrong.

Keeping the Bitcoin network lightweight: Similar to Optimistic Rollup on Ethereum, BitVM does not perform a large number of calculations on Bitcoin. Instead, it minimizes on-chain activity and only refutes incorrect executions, acting more as a solver and validator. Only the output of the BitVM program is used in Bitcoin transactions.

While BitVM's functionality today is extremely limited, with only one viable feature called a zero-check function, potential future use cases include two-way hooks with sidechains for scalability. If the ZK validator could be built in BitVM, then Rollup on Bitcoin could be enabled without a soft fork. For more information, check out Stephan Livera's podcast.

4. Urbit architecture for Bitcoin expansion

Bitcoin’s shared UTXO and client-side verification model fit naturally with Zorp’s Nockchain

Volt: Lightning Network Implementation on Urbit

Implementing an L2 scaling solution on Bitcoin using Urbit’s built-in identity

5. New thinking around capacity expansion

The Bitcoin community has proposed and tested a variety of experimental methods, including:

Taproot Assets: A protocol powered by Taproot for issuance of assets on the Bitcoin blockchain and works with the Lightning Network to enable fast and low-cost transactions.

RGB: A client-side verification state and smart contract system running on Layer 2 and Layer 3 of the Bitcoin ecosystem, also works with the Lightning Network.

Spiderchain: PoS Layer 2 for Bitcoin, using a distributed multi-signature network to secure all actual Bitcoins on Botanix.

STX’s sBTC and Nakamoto upgrades: An important milestone for STX, officially becoming Bitcoin’s L2 and ensuring BTC is 100% secure. sBTC aims to be a trust-minimized anchor token for BTC.

Various ecosystem integrations with Lightning Network: SOLightening (Solana integration with Lightning Network), Binance, Coinbase, Cash App, etc.

Surge in Builder Interest and Incubators: There are also exciting times in the Bitcoin community to foster developer ecosystems and new ideas, namely Bitcoin Startup Labs, Bitcoin Frontier Fund, Outlier Venture’s BTC base camp, Wolf Incubator, and others.

2. Our view: Bitcoin capital efficiency is better than programmability

Contrary to Ethereum’s stated mission to be a programmable Internet computer, Bitcoin’s mission has been the subject of intense debate. What will be the position of Bitcoin in the future: "inert" digital gold as a store of value, a payment currency in emerging markets, or a programmable and high-performance Layer 1 currency?

Bitcoin’s role has long been the subject of heated debate: institutional-grade asset, global remittance system or programmable blockchain network? While Bitcoin has always been a de facto store of value, numerous technical, institutional and market catalysts have pushed it in a more productive direction than "lazy" digital gold. In this article, Catrina introduces her research on the history of Bitcoin innovation, the catalysts of the new movement, and proves the conclusion: Bitcoin’s capital efficiency is more important than programmability.

In our view, this ambiguity is a feature rather than a bug. Disagreement over what Bitcoin should be is exactly the catalyst we need to build a diverse and vibrant ecosystem around Bitcoin.

We see two overlapping but distinct streams of innovation: “programmability” and “capital efficiency.”

The “programmable” school develops Bitcoin into an Ethereum-like ecosystem by solving its lack of native smart contracts and scalability (speed and cost-effectiveness). Its scope covers various vertical fields, including

Interoperability with other chains, such as EVM integration.

Sophisticated DeFi and trading features, including Swap, various DEX platforms, synthetic assets and LSD.

Supports Ordinals, BRC-20 and further token standards

The ability to issue new assets on the Bitcoin chain using specific token standards.

Layer 2 solutions that leverage Bitcoin as the data availability layer, such as VMs, Rollup, and other scaling solutions.

The “capital efficiency” school views Bitcoin as a store-of-value asset and creates basic financial products on top of it. They do not prioritize the scalability or versatility of the Bitcoin chain. Instead, they focus solely on financializing Bitcoin to achieve stable yields and improve Bitcoin’s capital efficiency while balancing risks. This approach is a gradual extension of the spirit of “Bitcoin as a store of value”:

Trustless Bitcoin staking and earnings.

Native Bitcoin stablecoin.

A Bitcoin-backed stablecoin.

Bitcoin insurance, both on-chain and off-chain.

Solutions to Bitcoin’s MEV (Miner Extractable Value) Problem

Layer 2 solutions, defined in this context as any scaling solution that speeds up transactions and reduces fees on the Bitcoin network (may include virtual machines, rollups, using Bitcoin as DA, etc.).

The L2 scaling solution falls into both categories because it serves as infrastructure to make Bitcoin more programmable and capital efficient. This is our area of interest.

We believe that enhancing Bitcoin’s capital efficiency is even more important, and here’s why.

Bitcoin’s clear product-market fit as a store of value

Who has the clearest product-market fit in the entire crypto industry? For native DeFi users, the answer may be Ethereum. But for the non-crypto crowd, Bitcoin is a store of value.

Why not leverage and extend this proven PMF as the only digital gold, but instead use what others are good at? After all, there are tons of use-case-specific solutions outside the Bitcoin ecosystem (Solana, ETH L2, new EVMs like Monad) that are “genetically” designed to be better suited for speed and scalability than the Bitcoin chain .

Net new demand sources are not degens

As we get excited about the prospect of Bitcoin unlocking liquidity, an important question we need to ask ourselves is: Where will the new liquidity come from? I think it's institutional Bitcoin holders and non-native cryptocurrency retail holders. Unlike skilled DeFi users (or “degens”), both institutional and retail investors have similar low risk appetite and tolerance for complexity. What appeals to this new group of customers is the simplicity of Bitcoin products, which make their Bitcoin more "capital efficient," generating sustainable and reliable returns without complex operations and counterparty risks.

The psychology of spending and using Bitcoin

Due to their different cognitions and characteristics, the transfer psychology of BTC and ETH is very different. Practically speaking, what does a person need most to transfer Bitcoin out of a hardware wallet? The most important consideration is safety. Enhanced programmability comes with the cost of vulnerability amplification, which may deter risk-averse institutional miners and holders from participating.

To summarize with the panda analogy, our focus is on finding projects that will help breed more panda babies, not on changing the panda's DNA.

3. Different attempts to improve Bitcoin

Overall, we have yet to see a fully trustless two-way peg solution that does not require a BIP (Bitcoin Improvement Proposal) to pass. BitVM seems to be the most promising solution right now, but it's still in its infancy and there's still a long road ahead.

Older generation explorers

A long-term and sustained innovator in the Bitcoin field, with the following first-mover advantages:

community support

fluidity

code.

Stacks

Our summer intern Vikram wrote an in-depth look at STX. I have been personally tracking the STX ecosystem since February 2022, and some common criticisms of its design approach are that the language is new, that it is not Turing complete, that the sBTC-BTC peg is not completely trustless, and that it lacks EVM compatibility. However, the project still has many advantages:

First, staking STX can earn you BTC, making it a very unique and valuable asset.

Two ecosystem catalysts (Nakamoto Upgrade and sBTC) are planned to be launched in early 2024.

There are future plans for a L3/subnet that combines EVM and RustVM.

In terms of token economics, a large portion (~78%) is locked.

Stacks is one of the largest general-purpose L2 ecosystems on Bitcoin, unlike the Lightning Network, which is more focused on payments.

Rootstock

Rootstock (RSK) is a Bitcoin sidechain that introduces smart contracts compatible with the Ethereum Virtual Machine (EVM) to the Bitcoin network, increasing the speed of Bitcoin transactions. Unlike the Lightning Network, which uses native BTC to run within the Bitcoin blockchain, RSK utilizes a two-way peg to cross-chain BTC to RSK’s derivative asset, smartBTC (or RBTC). RBTC maintains a 1:1 peg to BTC but is not trustless and relies on a centralized custodian as its security is based on merged mining.

Threshold Network

Use threshold ECDSA signatures to bridge the Ethereum and Bitcoin networks. It mints ERC-20 tBTC with BTC as a reserve and implements the BTC-tBTC peg through a multi-signature scheme between validators with an honest majority assumption.

The Liquid Network is a Bitcoin sidechain that allows users to anchor their BTC to the Liquid Network, where it is converted into the corresponding token (L-BTC) and can be used for faster and more confidential transactions. However, similar to RSK, it has similar trust assumptions in “functional institutions” such as reputable cryptocurrency exchanges and service providers.

Lightning Network

A layer 2 scaling solution on Bitcoin that uses payment channels to mix on-chain settlement and off-chain processing to speed up and reduce transaction costs. Although I think Lightning Network is more of an "application" chain specifically targeted at payment use cases, rather than an Ethereum Layer 2 like Arbitrum that aims to be its own multifunctional ecosystem.

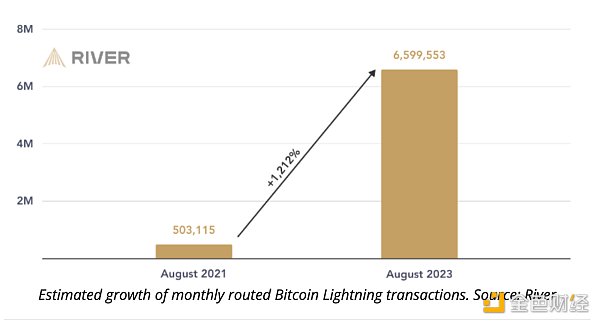

The network has grown 1,212% over the past two years and has approximately $160 million in TVL as of this writing. However, off-chain components also present unique challenges, such as replacement loop attacks that threaten the network.

Disadvantages: The Lightning Network is not completely trustless, as it requires peer-to-peer payment channels with sufficient liquidity and constant online presence. When a user goes offline, there is a risk of unilateral channel closure, which may result in funds being withheld. Congestion in these channels can expose networks to fraud and attacks.

The use of the Lightning Network also comes with various costs. Network latency results in higher transaction fees for miners due to longer verification times. Additional routing fees set by the node apply to transactions on multiple channels. Any business or exchange using the Lightning Network may also add additional fees. Therefore, even with potential improvements in protocols such as Taproot Asset or Taro, using the Lightning Network for ordinal may still incur unacceptable fees.

A new generation of adventurers

Taproot Assets (formerly Taro) and RGB

New initiatives such as Taproot Assets and RGB aim to enable asset issuance on Bitcoin and work with the Lightning Network. While I haven't had a chance to chat with either team yet, it would be interesting if they enabled a native stablecoin on Bitcoin, leveraged the Lightning Network for secure transfers (assuming no attacks or security issues), and then returned to Bitcoin to leverage its security as data availability layer. Could this potentially lead to the creation of a new ERC-20 equivalent system on Bitcoin?

Rollups/L2 on Bitcoin

Botanix Labs: EVM L2 on Bitcoin using SpiderChain (no BIP required)

Alpen Labs: ZK Rollup on Bitcoin (requires BIP)

BitVM: Making Bitcoin Turing Complete with Fraud Proofs (No BIP Required)

Trust-minimized staking on Bitcoin (one of Portal’s main focuses recently)

Babylon: A Bitcoin staking platform that requires no cross-chain bridges and minimizes trust. Stakeholders can earn revenue through the currency tokens of the PoS chain of their choice. Similar to Bitcoin's Eigenlayer, but with an additional layer of cryptographic innovation that allows for "cutting" on the irreducible Bitcoin chain.

Papaya: A platform for Bitcoin staking using the underlying infrastructure of STX and sBTC.

Atomic Finance: Use DLC to allow users to obtain self-custody income from Bitcoin.

Do you want EVM?

Compatibility with EVM does not affect our view of investment preferences in startups. While compatibility with EVM allows access to liquidity and products in the EVM ecosystem, it also increases risk exposure for Bitcoin holders. Furthermore, focusing on EVM compatibility goes against the “capital efficiency” argument, as the goal is to unlock new liquidity from the Bitcoin ecosystem, not the other way around. Solana has never prioritized EVM compatibility, like Web2 success stories such as Apple to Android or Nvidia to Intel chip standards.

Summarize

Finally, recalling our earlier panda analogy, we believe in technologies that produce more panda babies (i.e., are more "capital efficient"), rather than technologies that take pandas away from their core strength (cuteness). The vertical areas we are particularly focused on are:

Scaling Solutions on Bitcoin (Rollups/L2)

Bitcoin-backed stablecoin

Bitcoin Insurance Products

Solution to Bitcoin MEV Problem

Thanks to the following friends for reviewing my manuscript and providing valuable feedback: Evan Fisher of Portal Ventures, Aleksis Tapper of Token Terminals, Jason Fang of Sora Ventures, Kyle Samani of Multicoin, Kevin Williams and Kyle Ellicott of Bitcoin Frontier Fund, Jian of Amber Group & Sankha Banerjee of Haotian, Babylon.