Written by: TechFlow TechFlow

introduce

Chainflip , a decentralized, trustless protocol that allows seamless value transfer between any blockchain, including BTC, EVM, and the underlying network. According to TechFlow TechFlow, on November 23, Chainflip announced the official launch of its token $FLIP .

Chainflip’s JIT (Just In Time) AMM design solves cross-chain challenges by minimizing slippage and providing precise pricing. Through it, users can exchange assets between chains without wrapping tokens, using traditional cross-chain bridges, or going through centralized exchanges.

Listening to the above description of Chainflip, does it remind you of another full-chain trading platform-THORChain?

Yes, Chainflip is a direct competitor of THORChain. It also focuses on heterogeneous polymer chains, but there are many differences between the two in terms of design:

1) THORChain is built based on Cosmos SDK, and Chainflip is Substrate;

2) THORChain requires a separate multi-chain wallet, Chainflip does not. Users do not need to back up key files, download new browser wallets or install some special software. They only need the network, browser and target address, send Token and provide a compatible address. Ability to swap across chains in a trustless manner;

3) Each fund pool on THORChain requires RUNE to be established, but Chainflip does not.

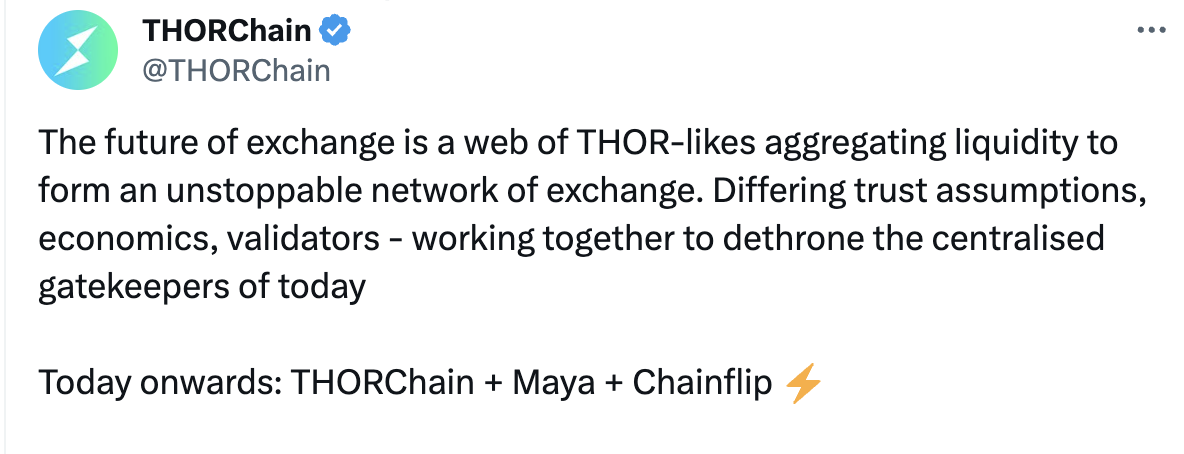

But it seems that THORChain does not regard Chainflip as a competitor, but more as a "brother" who shares the same trenches. A tweet released by THORChain on November 24 stated: THORChain + Maya + Chainflip will jointly challenge today’s centralized portals.

This kind of friendly attitude is not common in the Crypto/Web3 community, as one community member said: It is like a street with only one restaurant. If a new restaurant opens across the street, more people will come to these two.

Tokenomics

Token economics plays a crucial role in DeFi projects. In terms of market performance this year, THORChain’s token Rune has performed well. Although THORChain has a friendly attitude towards Chainflip, investors still unconsciously compare the token performance of the two.

Rune is designed to the extreme in value capture. Rune is required for almost all operations. Rune is required for adding liquidity, pledging Rune is required for nodes, and Rune is required for synthetic assets. The greater the transaction volume of Rune, the more fees are captured, and the greater the demand for Rune. This is why everyone thinks that Rune is a little Luna.

What about Chainflip?

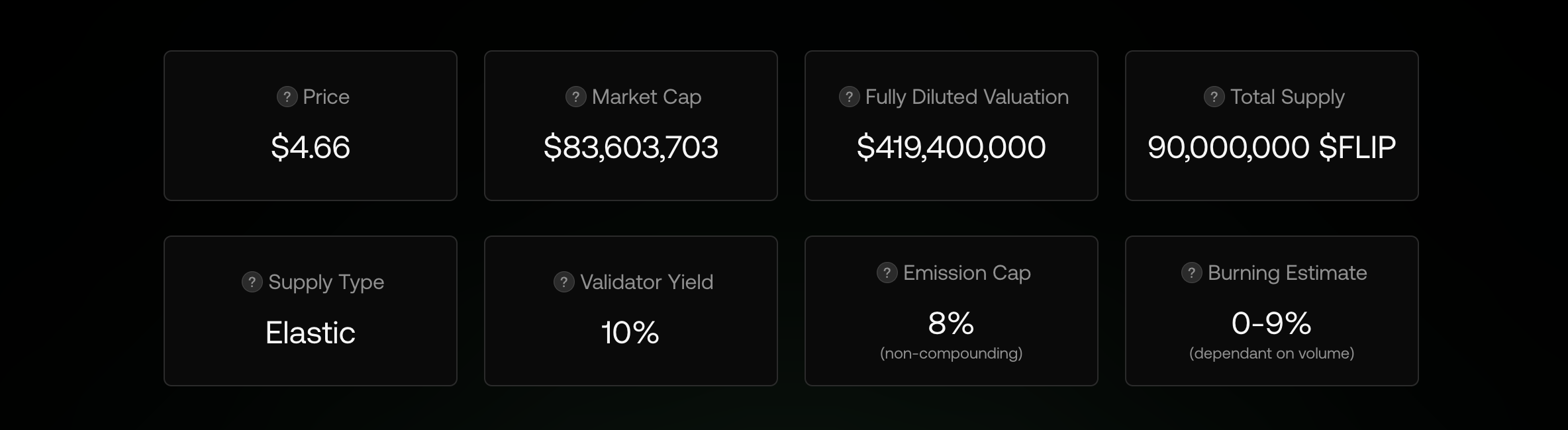

FLIP is Chainflip's ERC-20 native token. The initial supply of this token is 90 million, with an annual inflation rate of 8%, following the inflation (Token issuance) and deflation (Token burning) model. This means that the protocol does not have a fixed or final token supply, and the project may change its token model in the future.

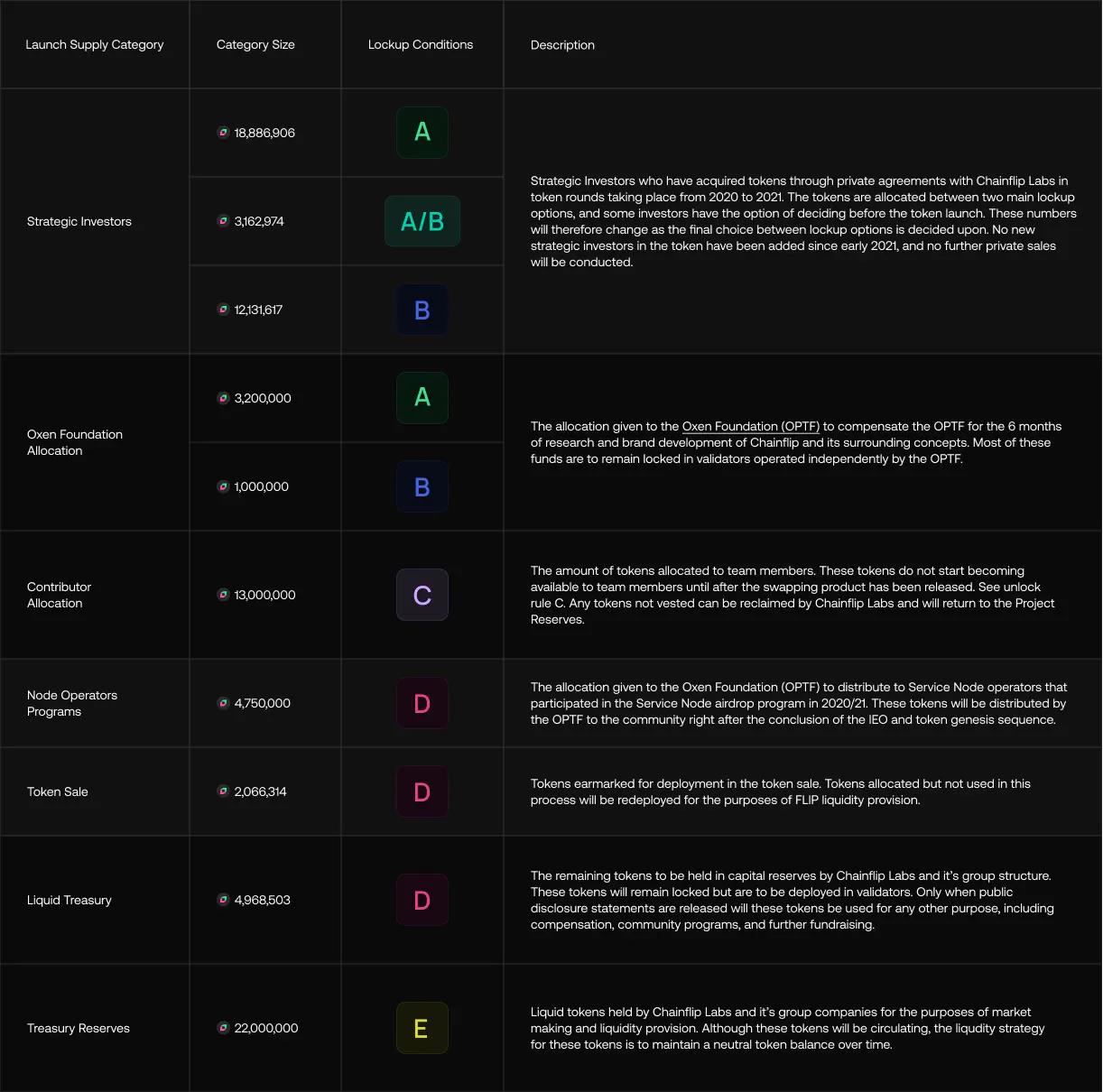

The currently known initial allocation plan is as follows:

(1) 4.75 million FLIP will be airdropped to the community and distributed to service node operators participating in the Service Node airdrop plan in 2020 and 2021;

(2) 6.9 million FLIP for token sale;

(3) 13 million FLIPs are distributed to contributors;

(4) About 34 million FLIPs are allocated to strategic investors;

(5) 4.2 million FLIPs are allocated to the Oxen Foundation;

(6) 4,968,503 FLIPs as liquidity;

(7) 22 million FLIP as reserve funds.

Chainflip also connects chains by deploying wallets on each chain. Unlike CEX’s centralized database, in Chainflips, the state chain (State Chain) plays this role, and all protocol events are recorded, executed or triggered by the state chain. .

To ensure the security of each wallet, each supported blockchain has a vault, which is operated by a validator, so the validator network forms the key infrastructure of Chainflip, and the number of validators at the launch of Chainflip will be 150.

Obviously in this system, the verifier’s honesty is crucial. Validators must lock a large amount of $FLIP tokens as collateral, and the keys held by the validators cannot be used to transfer protocol funds. If a validator behaves maliciously or fails to perform their duties effectively, their stake is at risk.

How to effectively incentivize and punish validators is a difficult problem in this system. Chainflip also stated that the penalty rules will soon receive a major update to ensure the long-term stable operation of the system.

The number of tokens provided to validators as rewards does not depend on the amount staked, and the actual benefits received by validators will be determined by competition in the auction market. In order to gain the right to validate transactions and earn rewards, validators need to constantly bid for the use of their $FLIP tokens.

For every transaction through the Chainflip system, users are charged a small fee (in the form of USDC) to purchase $FLIP tokens in the built-in USD/FLIP pool. Purchases of $FLIP are automatically burned and removed from the supply.

The Gas generated by the state chain will also be burned automatically, and these fees will be incurred when interacting with the state chain, including liquidity provider updates, deposit channel requests, validator external fees, etc.

future goals

After the token launch and mainnet launch, DEX products and continued expansion of supported chains are the next steps for Chainflip. Just like Chainflip's vision: Our mission is to replace centralized exchanges, Chainflip is currently becoming a qualified challenger to CEX step by step.

The future is multi-chain, and the ecology on each chain will inevitably flourish; and if they want to participate in different ecological projects, users now need a decentralized exchange that meets expectations more than ever before to bear the burden that centralized exchanges cannot things to do.

Let us wait and see whether Chainflip can affect the outcome of CEX.