Yesterday we mentioned the short-selling idea, and also fulfilled the plan and opened a short order for Bitcoin. Today, we look at the current Bitcoin market from another perspective.

The logic of short yesterday is that the price fell back to the shock range, and there was a pin at the bottom of the range during the day. When the price fell again, it meant that the short position was strong, so we chose to short on the right side.

However, the price did not directly start a downward trend, but continued to fluctuate.

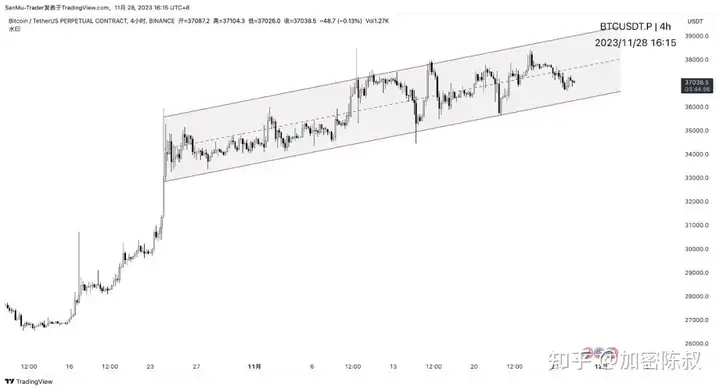

We can see in the 4H cycle that Bitcoin is taking an upward channel and it has lasted for 1 month.

The rising channel definitely means that bulls are stronger at this stage, so should we choose to long instead of short?

There is a concept here that the cyclical nature is different, and it is normal for different cyclical trading ideas to have conflicts. We should follow the general trend, but we need to remain sensitive to small cycles, because changes in the small cycle market will destroy the original structure of the large cycle.

Therefore, we need to pay attention to the rising channel in the 4H cycle, but it does not directly affect our judgment. In another perspective of the 4H cycle, we also mentioned the market’s peak signal and the behavior of the main players to obtain liquidity.

The 4H-level passage is a current fact, not a speculation about the future.

The 4H peak signal and access to liquidity are expectations for future market conditions.

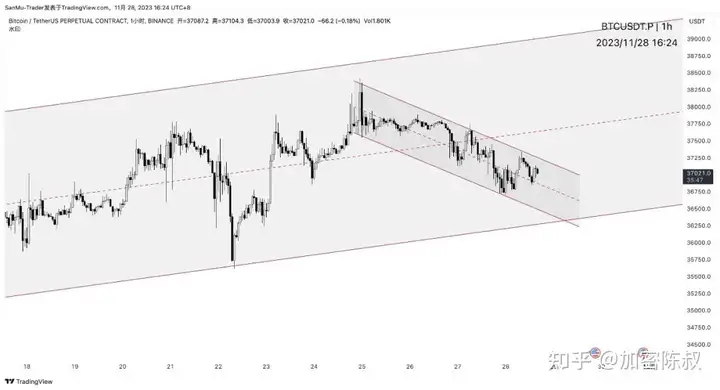

We are coming to the 1H cycle

We have observed that there are also channels within channels. After the 1H level gained liquidity and reached a new high that day, the market began to fluctuate and fall. At this time, a downward channel was also formed.

This short with our short selling in the 1H cycle, so our transactions and plans for the market outlook should revolve around these two channels.

At present, the price is still in a small channel. I think there is no problem in continuing to hold short orders. However, if the small channel is reversed and starts to break upward, the pattern will be changed. At this time, short orders may have to consider leaving the market temporarily. At the same time, pay attention to today's intraday high near 37350. The breakthrough here confirms the downward reversal of the small cycle. There is a possibility that the market will strengthen and move upward again.

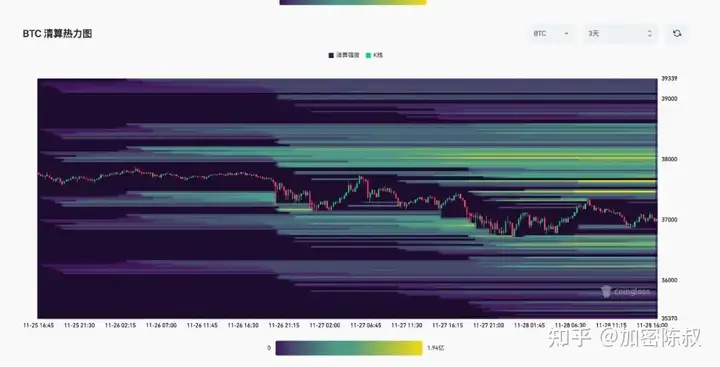

We can actually see from the liquidation chart that the liquidity above is still good, and the high point has reached around 38,000. If the small cycle reverses here, the market may test upward again according to the second plan in our video yesterday. trend.

So the short-term core revolves around these points.

If the market starts to continue to fall as expected, what we need to pay attention to is the situation at the lower edge of the 4H level channel. If it is broken by a strong force, it will basically confirm the end of the strong short and long market. I should consider this situation Add to position.

If you reach the lower edge of a large channel many times and receive support, then exiting the market with a short order in advance is also one of the strategies.

This is my view on the current Bitcoin market and future plans.

Can ETH and SQL maintain their upward trend?

Ethereum (ETH): Navigating Market Volatility and Network Growth

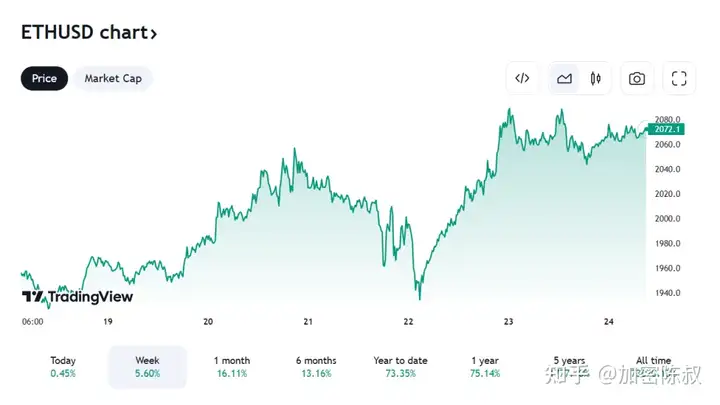

Ethereum (ETH) recently regained an important price point, crossing the $2,000 threshold, indicating a strong surge in network activity. This resurgence reflects the network’s strong fundamentals, including the growth of decentralized applications (DApps) and Ethereum’s (ETH) dominance in the NFT market. Ethereum (ETH) has shown resilience despite regulatory challenges.

Ethereum (ETH) price has been trading between $1,603 and $1,946. The 10-day moving average is at $2,012 and the 100-day moving average is at $1,724, indicating a bullish short-term trend. Support levels are currently identified at $1,047 and $1,390, providing a buffer against potential downturns. On the other hand, the resistance levels at $2,077 and $2,421 constitute important thresholds that the price needs to overcome to maintain its upward trajectory.

The future outlook for Ethereum (ETH) remains positive, driven by the potential of an Ethereum spot ETF and reduced regulatory concerns. However, the path forward is not without challenges. The key resistance levels at $2,077 and $2,421 will be crucial in determining Ethereum’s (ETH) ability to sustain the bullish momentum. Additionally, the changing regulatory environment and its impact on key stakeholders and stablecoin providers may impact Ethereum (ETH) market dynamics.

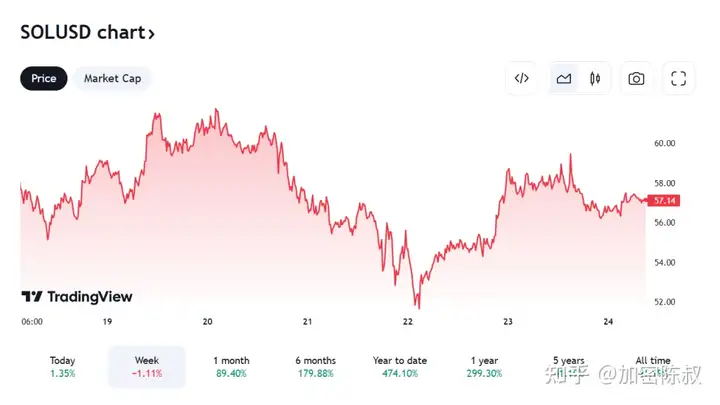

Solana (SOL): Seizing the momentum of decentralized exchange growth

Solana (SOL) has been making significant progress, especially in the decentralized exchange (DEX) space. The ecosystem’s transaction volume surged to an all-time high of over $3 billion. The surge was driven by top DEXs such as Orca and Raydium, which saw a 70% increase in trading volume.

Solana (SOL)'s current price range fluctuates between $26.75 and $44.35. The 10-day moving average is significantly higher at $58.12, indicating a near-term bullish trend, while the 100-day moving average at $29.53 reflects a more stable long-term growth trajectory. The main support level is identified at $15.05, providing a safety net against a significant price drop. On the resistance front, Solana faces the key levels of $50.27 and $67.87, which will be crucial in determining its ability to sustain and extend its upward momentum.

Looking ahead, Solana (SOL) is hopeful, especially given its strong performance in the DEX space and the overall upward trend in its price. The challenge will be to break the $50.27 and $67.87 resistance levels, which will be crucial to sustain the bullish trend. Solana’s (SOL) ability to capitalize on its growing DEX activity and maintain its price above key support levels will be key in shaping its market trajectory.

Create a high-quality circle

Mainly spot goods

That’s it for the article. Welcome to find me~!