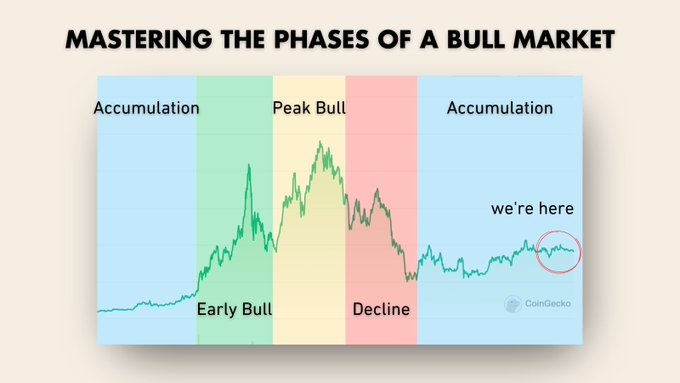

There are four stages of a bull market.

It is currently at the end of the first stage of the bull market (note: this article was written a few months ago, and the author currently believes that it has reached the second stage of the bull market) . Here are some guidelines and suggestions on how to navigate market cycles and avoid missing out on big profits.

The following are operational suggestions for you:

- Grasp every stage of the bull market

- Maximize profits

- Avoid the most common pitfalls

The first stage: accumulation stage

The accumulation phase is where the market is right now and where we've been over the past year. Cryptocurrency markets hit bottom after the Terra crash, the FTX collapse, and the scare of USDC de-anchoring.

The most difficult stage of the market has passed (unless there is a major crisis in Binance or USDT that can affect the entire industry).

At present, the market maintains its current price fluctuations. Important news in the industry has almost no impact on the broader market (such as Paypal launching a stable currency). At present, OTC funds have not injected new liquidity into the crypto. On-market funds are competing with each other, and various Altcoin sectors are subject to the rotation of funds.

Now is the accumulation stage. We can start deploying funds in the market to make profits in a bull market.

Operation suggestions:

-Find quality projects . Look for projects that you think will explode in the coming bull market. High-quality projects mainly have the following characteristics: high product/market fit, competitive advantages among similar products, active project teams, clear development routes, and financial health.

-Save money . Many investors want to buy the dips the coins of the last bull market projects because the token prices of these projects are 90% lower than the historical high price. But the problem is that most of the best-performing projects in the next cycle are not yet on the market. Compared with projects in the past bull markets, investors will be more inclined to plan new projects in advance.

-Control transaction frequency . Although the current market conditions are boring, don't let boredom stop you from wanting to trade. You must survive in the crypto first, and then you can discuss profitability. Wait for better trading opportunities instead of trading casually because the market is boring.

-Learning in a bear market . The bull market is not a good time to learn, but a good time to make money. Now in the bear market, it is a good time to learn.

-Monitor liquidity. Always pay attention to the capital inflow of CEX, the minting of stable coins, the TVL of DeFi protocols, and the overall market value of cryptocurrency. Changes in the above factors can represent changes in the liquidity of the crypto. More liquidity means market conditions are improving.

The second stage: the early stage of the bull market

When the market starts to pick up and the market starts to rise, people will not believe that the bull market is coming.

The most difficult thing to accept is not believing that the bull market is coming. After all, investors' psychology after losses in a bear market will prevent them from gaining profits in a bull market. Many people will worry about gains and losses, thinking that the market will fall further. If you want to get excess returns in a bull market, the earlier the bull market, the more you should place your bet before others enter the market!

What causes a bull market?

-Major industry events, such as a BTC or ETH ETF being approved, or a new country adopting BTC as legal tender.

- The BTC halving is coming in 2024. Of course, the rise in Bitcoin’s halving in the past does not mean that it will definitely rise after next year’s halving. But if enough people believe that the halving will increase, then the market consensus formed will also push the price higher.

-New narrative. In the last bull market, the crypto had two major narratives: DeFi and NFT. What about this bull market? GambleFi? TelegramBots? RWA? GameFi? Or will NFT re-ignite the market? Of course, most likely it will be in areas where the market is not very popular, such as games like Axies Infinity or Stepn, but there will be better token models and game mechanics.

- Macroeconomic conditions are getting better . For example, the Federal Reserve stopped raising interest rates, allowing more liquidity to enter the crypto.

- Regulatory changes . The United States and other countries are providing more transparent and effective regulation of cryptocurrency markets.

- More convenient . There are still many difficulties for ordinary people to enter the crypto. More convenient wallets and more dapps that are convenient for novices will also promote the bull market.

- Oriental Market . Cryptocurrency investors and builders on Twitter have regional pride, favoring Western markets. This is also the reason why most people cannot understand why Tron is so popular (Tron has a large number of customers in the Asian market). South Korea, Hong Kong, China and other places have also had a great impact on cryptocurrency.

In fact, it only takes the occurrence of one major factor to trigger a chain effect.

Some people in the crypto began to make money because of the improvement in the market. They improve their quality of life, and then tell the people around them that they are likely to be attracted by Fomo, which will bring more off-market funds, further boost market prices, and form a positive cycle.

Operation suggestions:

1. Reduce the position of coins that make you lose money, and increase the position of coins that make you profit. Be sure to stop losses in time and don't worry about gains and losses. Just because a coin or protocol has given you 5 times the benefits, it doesn’t mean that it can’t get 10 times the benefits again. Whether prices can continue to rise depends on indicators and market sentiment. As for those investments that make you lose money, you should reduce your positions in time.

2. Profit from rising prices and stop profits in a timely manner . No one can sell at the top, set up your take profit system and stick to it.

3. Control the positions of Altcoin and native coins . Do not use home equity, retirement funds, or sell BTC and ETH to take large positions in Altcoin. You can buy Altcoin and altcoins, but don't take a cross margin or use high leverage because the risk is too high.

4. Intelligent investment . Past history has proven that the fundamentals and token economic models of some crazy coins are average. Remember: only when the market is hot and investors buy the coin, the price will rise. Most investors will not understand the operating logic and economic model behind a project, but where there is market consensus, tokens will rise.

5. Pay attention to Pond's . In a bull market, there will be Ponzi projects, and the project owners know how to influence market sentiment and pull the market. But it is inevitable that Pond's will eventually die. You can embrace Ponzi, but you must make profits and leave before the market crashes. Of course, you can also choose not to touch the Ponzi project.

6. Don’t ignore the voice of retail investors . It’s easy to get caught up in some of the cryptocurrency podcasts and conferences where everyone discusses various emerging technologies. Ordinary investors simply do not understand these professional terms. But you need to get in touch with ordinary investors and understand their movements. For example, go to Reddit and YouTube to see what they are paying attention to recently.

7. Focus on certain areas . Find a few areas of expertise that are your own. In the crypto, it is impossible to keep up with all the hot spots, and it is impossible to take advantage of all the rises. It is acceptable to miss a few good projects and a few currencies that have doubled. From now on, focus on the areas you know best. When the opportunity comes, be sure to seize it!

Stage Three: Bull Market High

This is the stage when retail investors from the sidelines begin to pour in. The period they entered was the high point of the bull market, but in their hearts they believed that they entered the market at the beginning of the bull market.

The arrival of the bull market has a positive cycle. As prices rise, this will drive FOMO among investors in the market. This is a positive feedback loop. If they are FOMO, they will buy, which will continue to push the price up.

All currencies will rise. 10,000 US dollars of Altcoin can bring huge benefits to your life. Maybe you will hear people on the road discussing cryptocurrency-related things when you go out for a walk.

The market will become increasingly FOMO. Some may even quit their jobs and want to become cryptocurrency traders full-time. There will also be people who sell their houses to invest in the crypto.

So, how to detect whether the market has reached its top?

- Mainstream media started covering cryptocurrencies . You’ll hear this over and over in the news: someone trying to find a cold wallet with 8,000 Bitcoins in it, or that he bought two pizzas for 10,000 Bitcoins.

- Financial Youtubers like MeetKevin, Max Maher and Graham Stephen upload more than one cryptocurrency video every day.

- Mainstream brands like Pepsi and McDonald's will start mentioning cryptocurrencies to expand their brand's reach. Celebrities are trying to make money by sponsoring or launching their own collections of NFTs.

- Everyone is showing off their orders . When KOLs on Twitter or other investors frantically post orders and profits, you should be alert - the market may have reached its peak.

Everyone will try to convince you that this time is different. You have to fight your instincts.

At this stage, most people in the market will believe that the bull market will continue and prices will continue to rise, but the most important thing at this time is when to leave the market. At this stage, you must keep a cool head and realize that there is no market that will rise forever.

To turn floating profits into profits, settling down is the most important thing!

The fourth stage: the decline stage

It rises fast and falls fast. The high point of the bull market has passed. At this stage, everyone will guess whether this is the high point of the bull market and whether there will be a wave of rising prices.

There will be a saying in the market: This time is different - cryptocurrency has become a mainstream investment product! The bull market will last for several more years!

There is a reason behind everyone's Fomo. From a project perspective, more retail investors must participate in order to obtain investment. From the perspective of retail investors, more funds must be allowed to speculate on Altcoin before prices will rise. Therefore, they will continue to Fomo you and continue to CX you.

Of course, although the bear market has arrived and prices are falling, there are occasional hot spots in the market. Bitcoin peaked in November 2021. However, in the following months, FTM and Luna continued to rise.

Once prices plummet, there will be hindsight and they will say, "I told you, prices were going to fall!"

After missing out on the last two-year bull market, what makes me so convinced that there will still be a cryptocurrency bull market?

Because, I have already bet my career and the next ten years of my life on DeFi. I have full confidence in this field.

Let me briefly explain the reasons:

Under the current economic conditions, it is becoming more and more difficult for ordinary people to live under increasing pressure, which is mainly reflected in the following aspects:

- Credit card debt hits record high

- Debt per capita hits record high

- Increased student loan repayments

- Credit card interest rates hit record highs

- Debt interest payments are about to hit record highs

- Average monthly payment for new cars hits record high

- Not to mention the housing prices

The current economic situation makes life difficult for everyone. The cost of living is rising year by year, and the income from going to college or finding a job is not enough to buy a house.

While all this is happening, society’s threshold for success is also increasing.

Among the young people of this generation, no one wants to grow up slowly, and no one wants to achieve wealth and freedom in middle age and old age. Young people want to get rich now and have huge wealth at a younger age.

Cryptocurrency is not just a new financial asset for young people, it is a dream. For them, there is no faster place to make money than cryptocurrency.

Cryptocurrency is a great opportunity for young people to realize their dreams and strive for change.