Written by: TechFlow TechFlow

Where there are interests, there are disputes.

Bitcoin Inscription, which is at the forefront of the encryption narrative, has recently been involved in a debate about technology and interests on social media.

The controversy originated from a tweet from Bitcoin Core developer Luke Dashjr:

""Inscription" exploits a vulnerability in Bitcoin Core to conduct spam attacks on the Bitcoin blockchain. Since 2013, Bitcoin Core has allowed users to include extra data in transactions they propagate or mine. Inscription works by including the extra data as a program Code-behind, thereby bypassing Bitcoin Core limitations."

In addition, the post also mentioned:

“Bitcoin Core still has vulnerabilities in the upcoming v26 version and hopes to be fixed before the v27 version next year.”

In plain English, the inscription system is exploiting a vulnerability and should be repaired.

The post seemed to be just a technical discussion and did not generate a lot of discussion at first. It wasn’t until Luke’s key reply in the comment area that the matter began to attract more attention:

“If the vulnerability is fixed, does it mean that Ordinals and brc-20 related tokens will no longer exist?”

"Yes".

The fewer the words, the greater the amount of information. To put it bluntly, this vulnerability means that the inscription uses too much block space, which may lead to a decrease in network efficiency and even spam transaction attacks.

From a developer's point of view, if there is a loophole, then we will fix the loophole. Everything is just a technical issue.

But beyond technology, inscriptions are more than just a string of codes.

Bitcoin Inscription is the key track of this round of bull market, and the wealth creation effect brought by its innovation goes without saying; at the same time, Inscription is no longer a technical experiment and involves the interests of all parties upstream and downstream in the industry. .

According to Luke's post and reply, since all transfer transactions in the brc-20 system involve the action of "engraving", if this bug is fixed, it will have a fatal blow to the normal operation of the current brc-20 system.

Cutting off a person's financial path is like killing his parents. Naturally, all parties involved in the whirlpool of interests in the deep inscription will not agree easily.

Bitcoin Core ≠ Developer “core” power

Everyone must know what Inscriptions are, but newbies who are new to the industry may not know Bitcoin Core.

What is Bitcoin Core?

In fact, Bitcoin Core is an open source client software with a certain history that implements the Bitcoin protocol and allows nodes to participate in the Bitcoin network, maintain a complete copy of the blockchain, and verify all transactions and blocks.

Bitcoin Core releases updates regularly, and these updates may include new features, security fixes, performance improvements, etc. Users will need to proactively update their clients to receive these improvements.

But back to the incident itself, do the developers of Bitcoin Core have the power to fix the vulnerability so that Inscription cannot run?

This talks about the relationship between the Bitcoin client and the Bitcoin network, and how changes to the Bitcoin protocol are decided:

First of all, the Bitcoin network is a decentralized network composed of globally distributed nodes. The Bitcoin Core client is just one of a variety of client software these nodes may use. Therefore, the name "Bitcoin Core" does not actually mean that it has the "core" power to modify Bitcoin.

Any major changes to the Bitcoin protocol, such as fixing bugs or introducing new features, require consensus from a majority of nodes on the network. This is usually accomplished through a soft or hard fork.

Bitcoin Core, although influential, does not control the Bitcoin network. Changes in the network depend on the joint decisions of community members, including developers, miners, merchants, and ordinary users.

In other words, developer Luke's post only expressed a technical concern, but it does not have the authority to declare death sentences for inscriptions and brc-20.

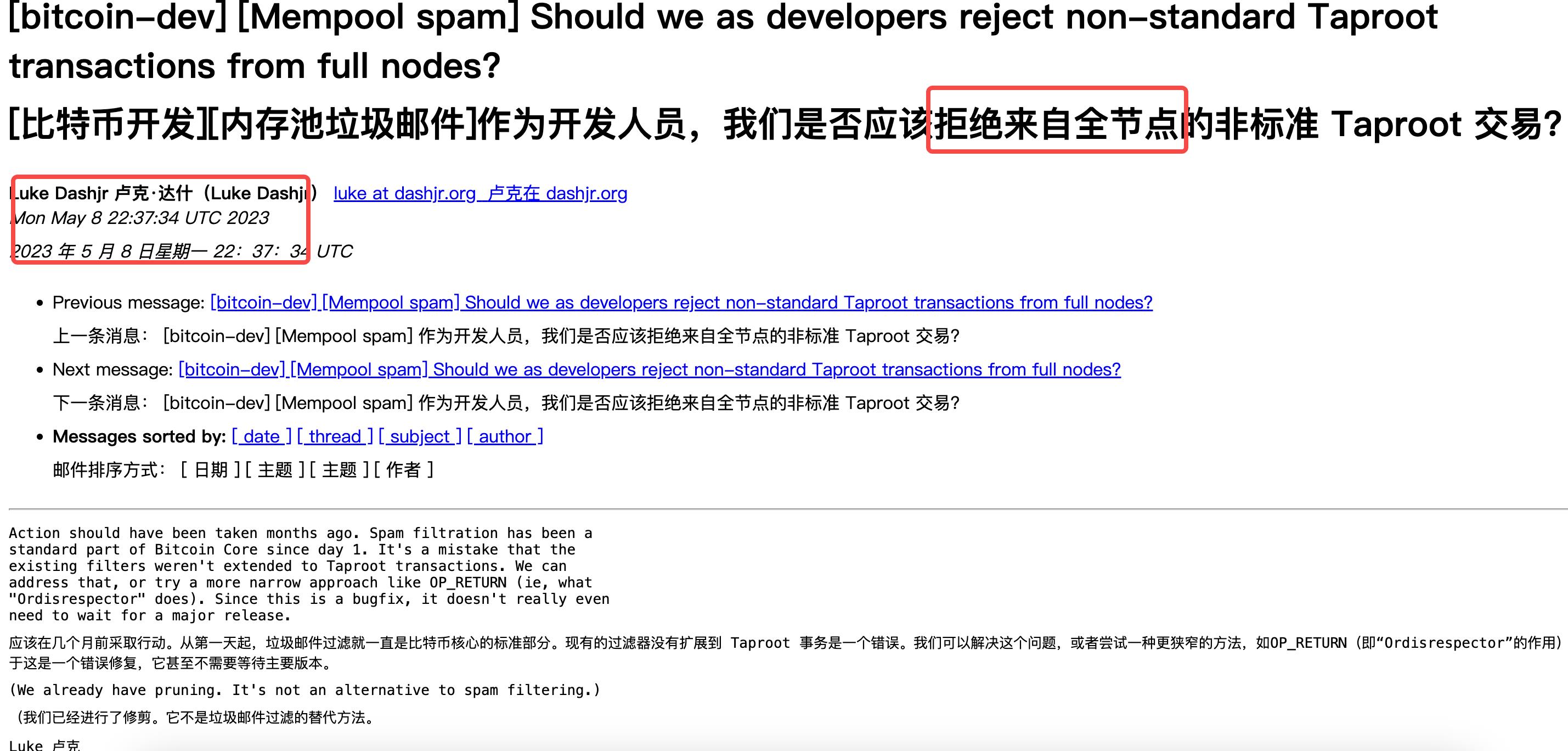

At the same time, this is not the first time Luke Dashjr has raised relevant questions.

In previous mailing lists and forums, he has repeatedly expressed concerns about the problems that may arise from the inscription function. His coherent speech records reflect his consistent technical stance and "concern" for the ecological health of Bitcoin.

It's just that this kind of care seems a bit rigid.

According to Wu Blockchain’s previous reports, although Luke is not a core developer of Bitcoin Core with code authority, his view has always been this, which actually reflects the insistence of most Bitcoin developers and fundamentalists on “payment + value storage”, Oppose the idea of reinventing the wheel by “issuing coins”.

Game of interests, where will Bitcoin’s inscription go?

The future of the inscription function not only depends on the technical decisions of developers, but is also affected by miners, users, investors, etc. Each group has its own interest considerations and influence, and their interactions and games will determine the fate of the inscription function to a large extent.

As the impact of the incident continues to expand, all parties upstream and downstream in the industry have also expressed their views.

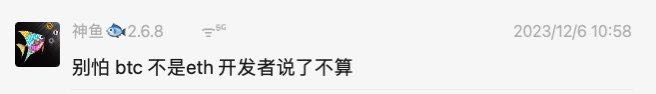

For example, Shenyu stated that "Bitcoin is not Ethereum, and developers have no say in it." This actually reflects that miners and developers have conflicting interests in some cases; at the same time, the author believes that it is not the developers who have no say, but the "Not entirely."

Inscriptions generate a large amount of transaction demand, which is certainly beneficial for miners to package transactions and earn handling fees; at the same time, miners also actively maintain Bitcoin nodes while earning profits, ensuring the consistency of the ledger and network security.

Therefore, it is a technical instinct for developers to try to fix bugs, but it is a business instinct to ensure profits. When the two confront each other, there will naturally be a game.

In addition, the well-known KOL Chen Mo also believes that in the Bitcoin world, there are checks and balances among miners, developers and capital, and who has a monopoly right to speak.

Indeed, in the Bitcoin ecosystem, no single individual or organization has decision-making power. This is also where Bitcoin, as the leader of the crypto market, best embodies decentralization.

If developers insist on upgrading and fixing vulnerabilities, the old plot of Bitcoin forking may happen again - one Bitcoin protocol supports the Inscription protocol, and the other does not.

But who the market chooses to abandon depends on consensus.

The market popularity of inscriptions reflects their commercial value, but it also brings about controversy over resource allocation.

Miners may support Inscription because of transaction fees, while long-term investors and developers may be concerned about its potential impact on network security. These different positions and interests will collide in community discussions and jointly shape the future of the protocol.

Although Luka's post caught the community's attention, Bitcoin updates and bug fixes require the agreement of the entire network. This includes miners, developers, investors and ordinary users.

@CryptoNerdcn went a step further and put forward a point worth pondering--"the battle for 51% other than computing power."

When there is a conflict of interest, the Bitcoin protocol and inscription must decide a direction; but in this decision-making process, the protagonists are not entirely core and miners, but rely more on all nodes of the entire Bitcoin network.

Everyone votes together to decide the final direction.

In addition to code and computing power , this battle may be more important than the people’s choice .

Each group has its own interests to consider, and the decision-making process often takes time to reconcile these different interests. Judging from past experience, the Bitcoin Core team and community have tended to proceed cautiously when dealing with disputes, emphasizing transparency and community engagement.

At the same time, historical experience also shows that any fork of Bitcoin will ultimately be less popular than Bitcoin itself.

In a vortex involving the interests of inscriptions, decentralization has brought about confusion of different opinions, but it also reflects the original charm of decentralization:

In the old land of Bitcoin, the word "consensus" has the most weight.