A. Market View

1. Macro Liquidity

Currency liquidity improves. The Federal Reserve's tightening cycle is coming to an end. The timing of the first interest rate cut is the key to global assets, and the key to the rate cut lies in employment data. While U.S. employment has slowed for four consecutive months, wage growth has also cooled further. The interest rate on the 10-year U.S. Treasury note fell from 5% in October to the current 4%, slightly easing concerns about financial tensions. The U.S. stock market is volatile, with investors worried about a future economic recession. Crypto markets are performing strongly, hitting another high in more than a year.

2. Whole market conditions

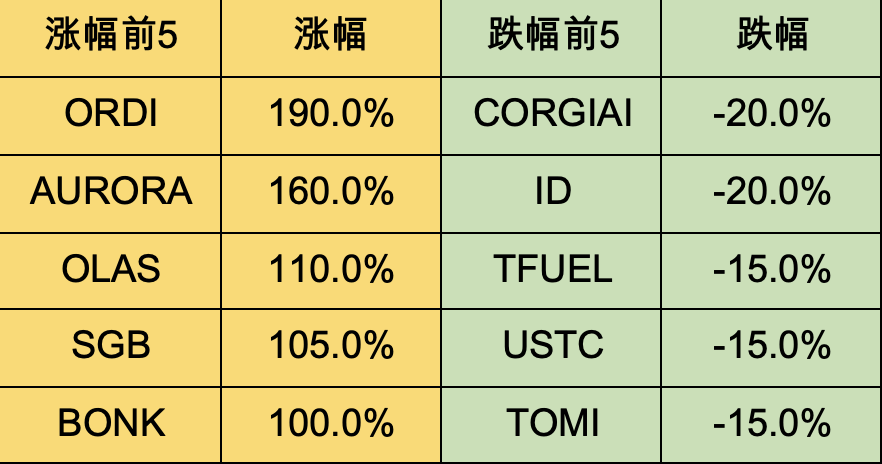

Top 100 gainers by market capitalization:

BTC has surged this week, and altcoins have generally risen. Market hot spots revolve around BTC ecology, games and Depin. BTC Inscription is the engine of this bull market, bringing more new users and new funds, and motivating developers to build a simple Defi ecosystem around BTC. The gaming track has generally seen a general increase, with game public chains, game guilds, launch platforms, new games, etc. all recording several-fold increases.

1. ORDI: It is the leader of the BTC ecosystem and the first inscription of the BRC20 protocol. Recently, due to the different views of BTC core developers, chips have changed hands significantly. Historically, as the leader of a new class of assets, it has a high probability that it will enter the top 30 in market capitalization.

2. RUNE: It is a cross-chain trading platform of the Cosmos ecosystem. The token has a strong ability to capture value and comes with triple leverage. Recently, the transaction volume has grown rapidly, benefiting from the influx of funds into the Cosmos Ecosystem OLAS: it is an oracle in the AI track. The founder comes from the original FET team and has strong technical strength. The market value of OLAS has surpassed FET, becoming the leader in the AI track.

3. BONK: It is the meme currency of the Solana ecosystem. It comes from the satire of SBF and unites the Solana developer community. BONK has increased more than 40 times in this round, and its market value is second only to DOGE and SHIB, becoming the third largest dogecoin.

3. BTC market

1) Data on the chain

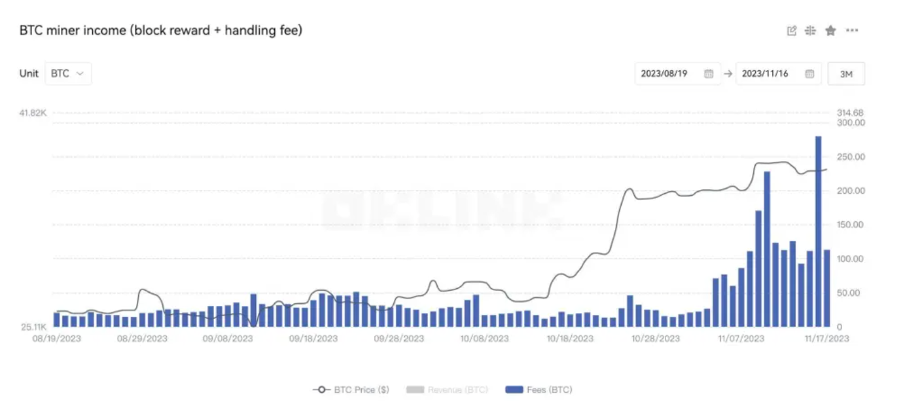

BTC surpassed ETH in daily revenue for the first time since 2020. The development of the BTC inscription market has greatly improved miners' fee income. The proportion of handling fees on the BTC chain increased from 2% in August to 25% in November, mainly due to the introduction of Ordinals trading pairs. It is expected that this proportion may reach 50% by April 2024 when production is reduced.

The market value of stablecoins continues to rise. The total market value of USDT exceeded 90 billion US dollars, setting another record high.

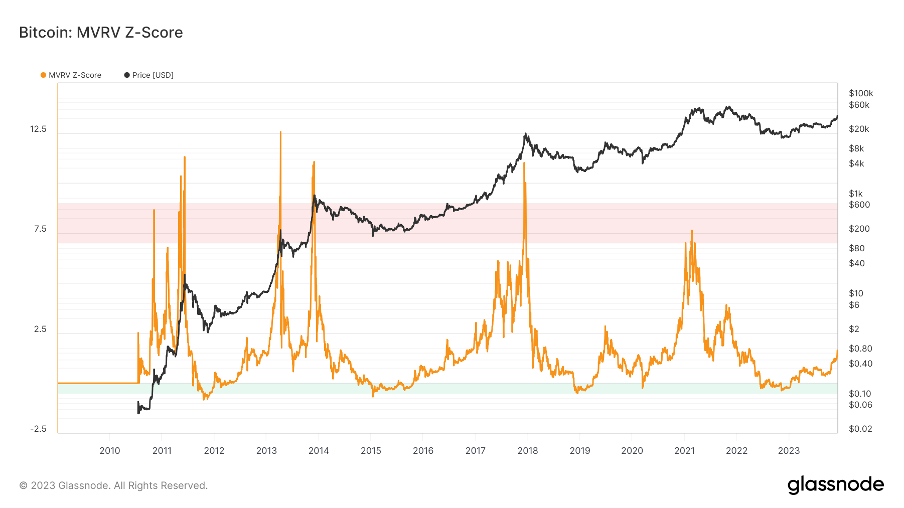

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level 1 and holders were in the red overall. The current indicator is 1.6, entering the recovery stage.

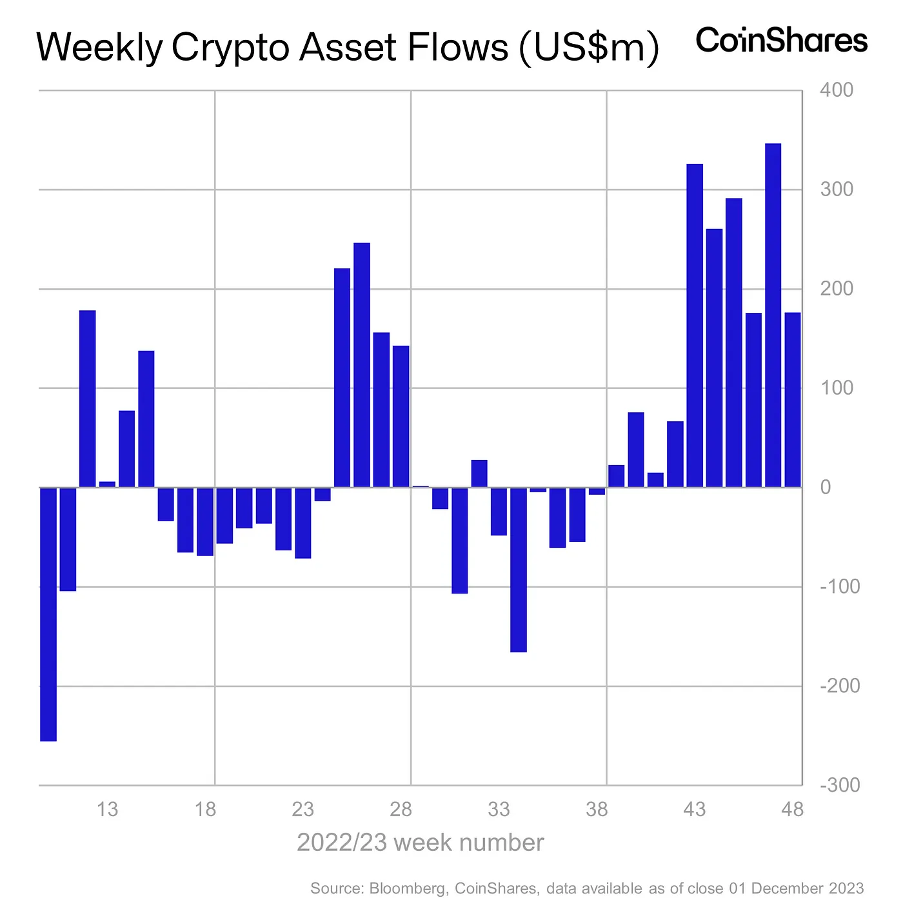

Institutional crypto investment products have experienced net inflows for 10 consecutive weeks, with total inflows exceeding $1.8 billion. Looking at regions, there was a net inflow of funds in Europe and the United States, and a net outflow of funds in Asia.

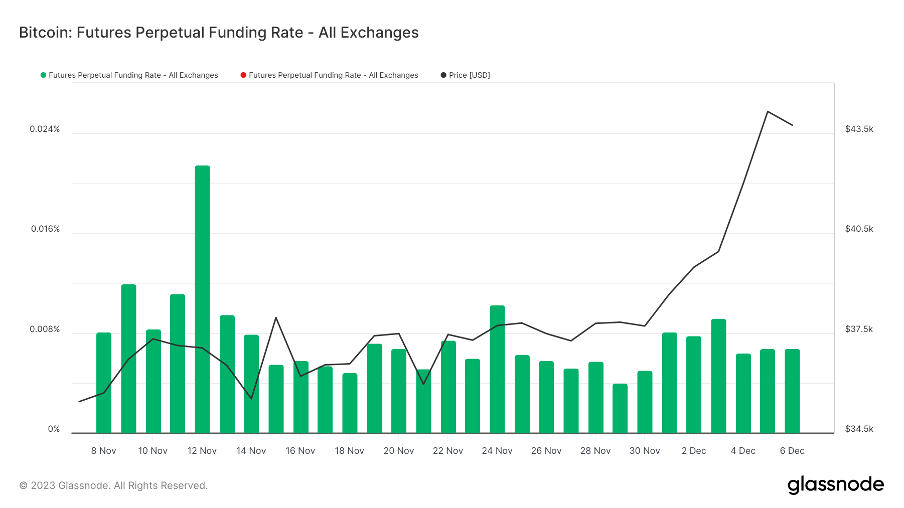

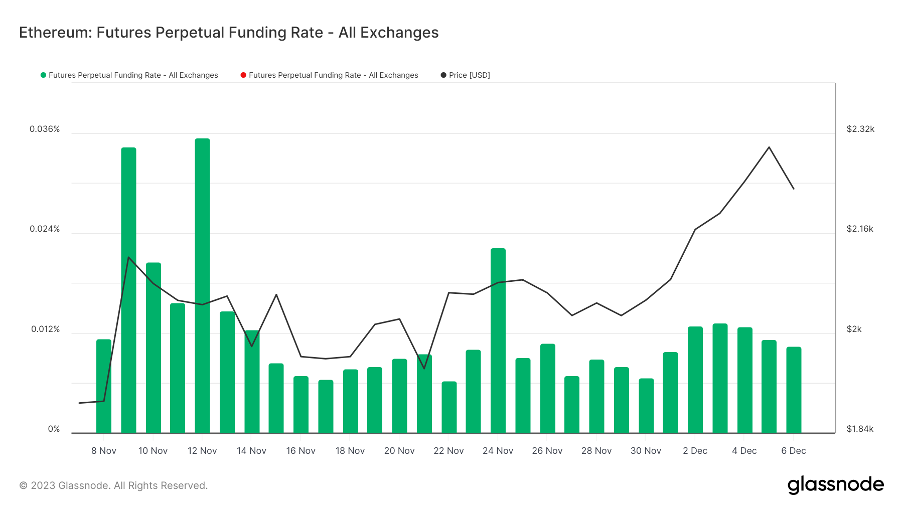

2) Futures market

Futures funding rate: The rate is positive this week, and market sentiment is normal. The market began to adjust after BTC rates hit the highest rate this year on November 12. The fee rate is 0.05-0.1%, and the long leverage is high, which is the short-term top of the market; the fee rate is -0.1-0%, the short leverage is high, and it is the short-term bottom of the market.

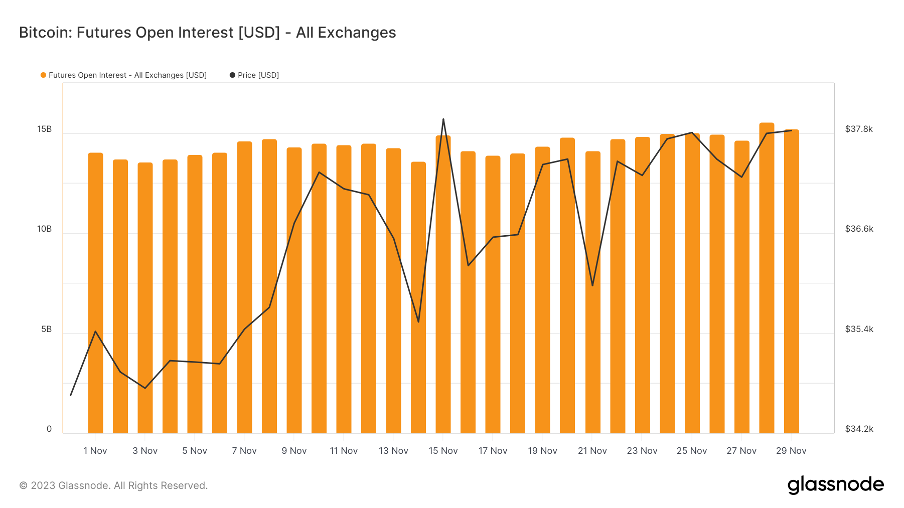

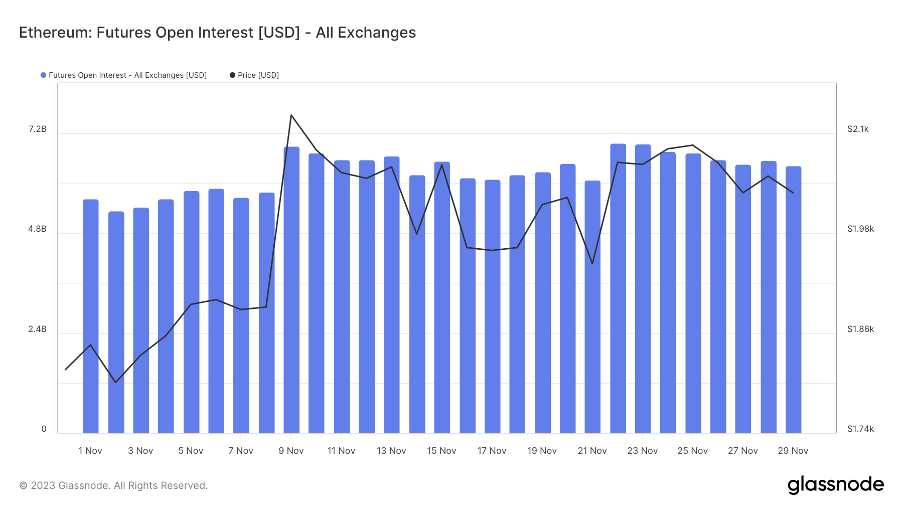

Futures positions: Total BTC positions increased slightly this week, basically synchronizing with price fluctuations.

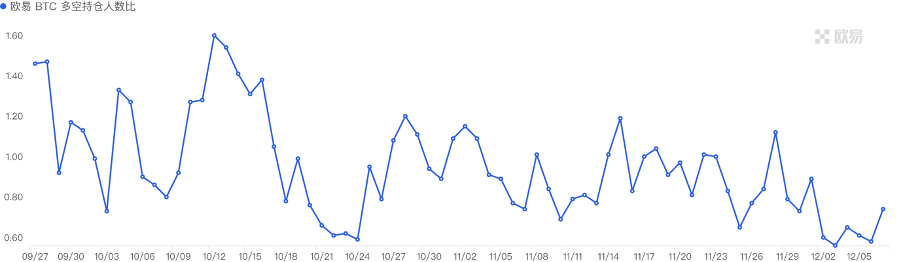

Futures long-short ratio: 0.8. Retail investor sentiment is bearish. Retail investor sentiment is mostly a reverse indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3) Spot market price

BTC surged above 42,000, returning to the level when the LUNA thunderstorm occurred in April 22. The prosperity of the BTC Inscription ecology, coupled with the expectation of the passage of spot ETFs, and the upcoming halving cycle next year, resonated with this sharp rise. MicroStrategy purchased another US$600 million in BTC last month, and now holds a total of more than US$5 billion, becoming the biggest beneficiary. The next 48,000 is the starting point of this round of decline. At that time, people who want to unwind may be inclined to sell, or it may be a greater resistance level.

B. Market data

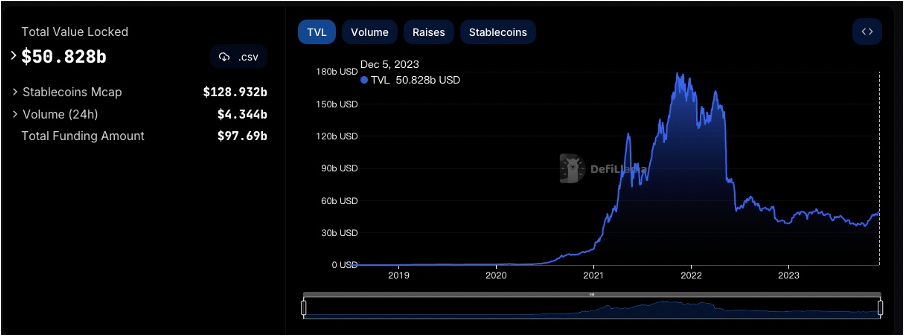

1. The total lock-up amount of the public chain

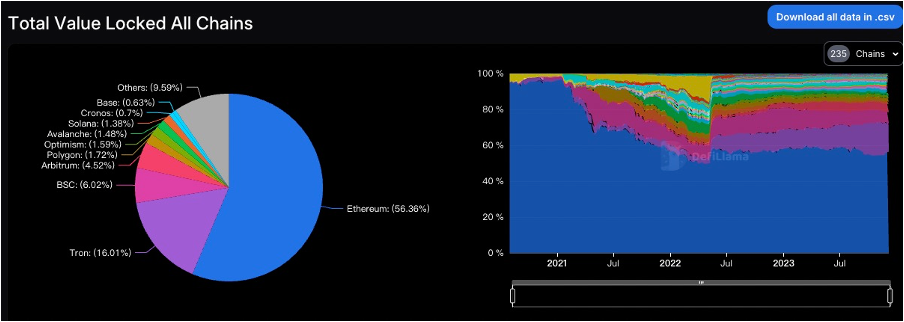

2. TVL proportion of each public chain

This week, TVL increased overall by US$360 million, an increase of about 7.8%. The market has grown significantly this week, with BTC successfully breaking through the price of 38,000 and directly reaching 44,000. TVL has risen sharply this week, and all the top 20 mainstream public chains have surged. The ETH chain rose by 8.3%, the BSC chain rose by 2.4%, and the TRON chain, ARB chain, and POLYGON chain all rose by about 7%. The BASE chain has increased by 10% and the number of protocols has reached 194. It is expected to surpass OP in the number of protocols by 2024.

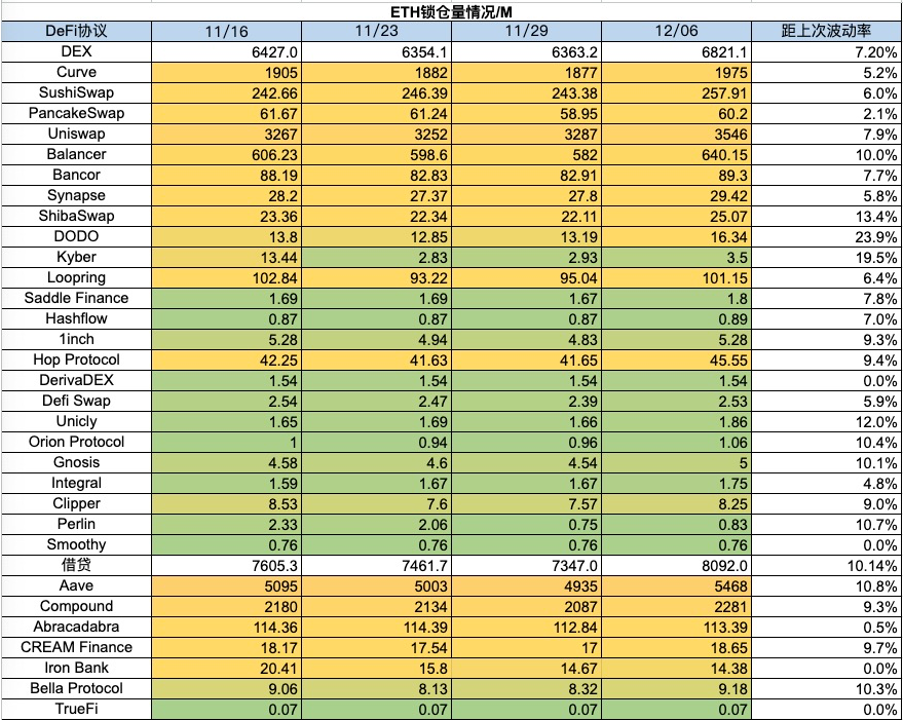

3. Lock-up volume of each chain protocol

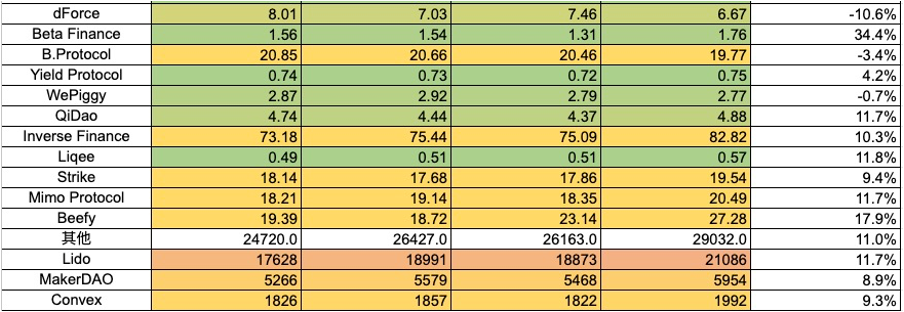

1) ETH lock-up amount

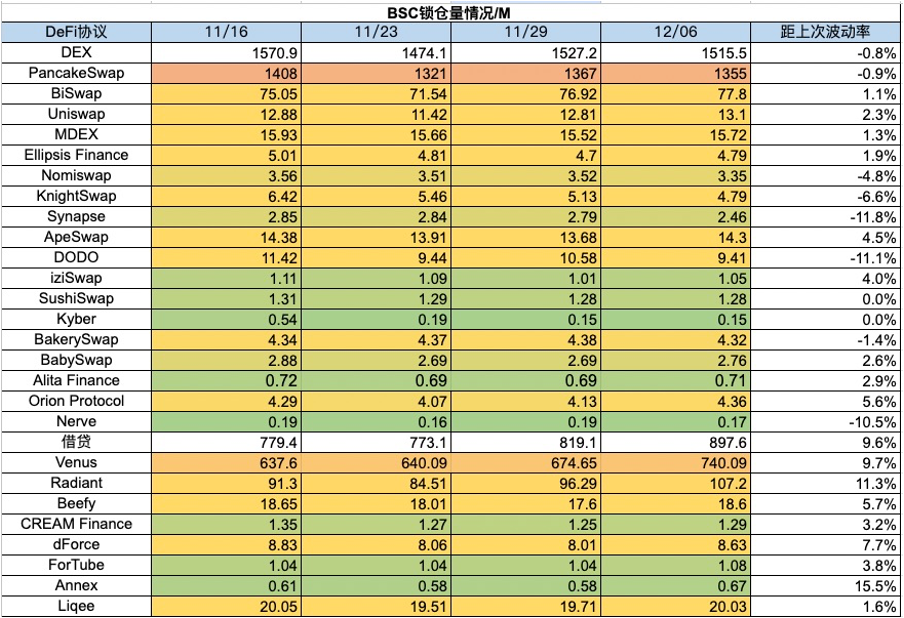

2) BSC lock-up amount

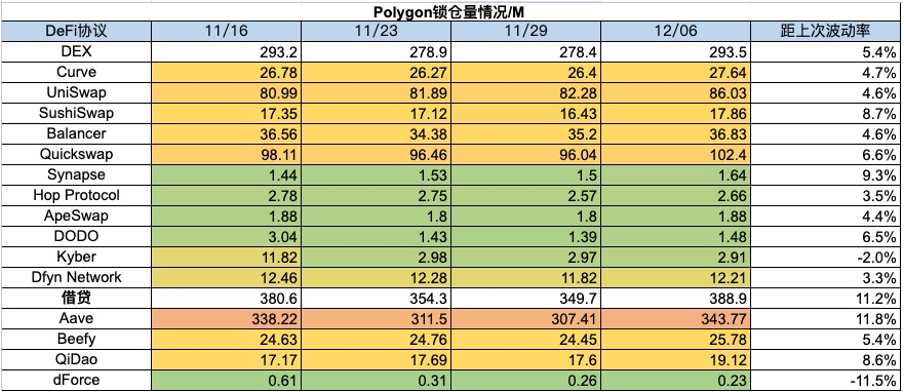

3) Polygon lock-up amount

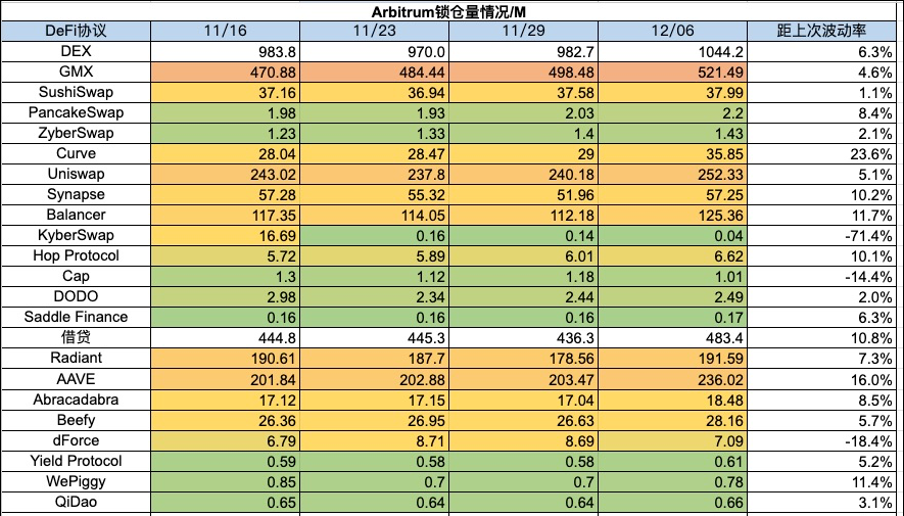

4) Arbitrum lock-up amount

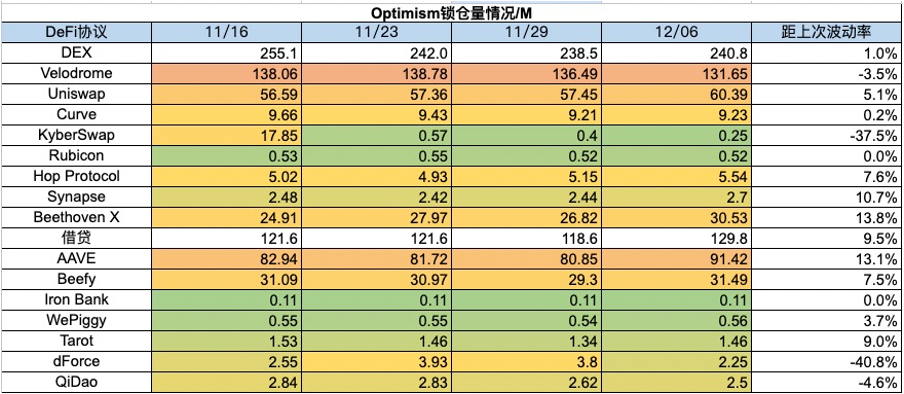

5) Optimism lock-up amount

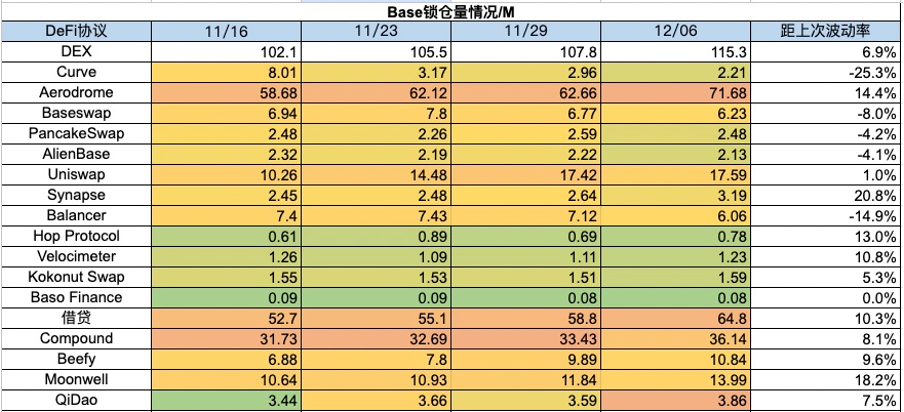

6) Base lock-up amount

4. Changes in NFT market data

1) NFT-500 Index

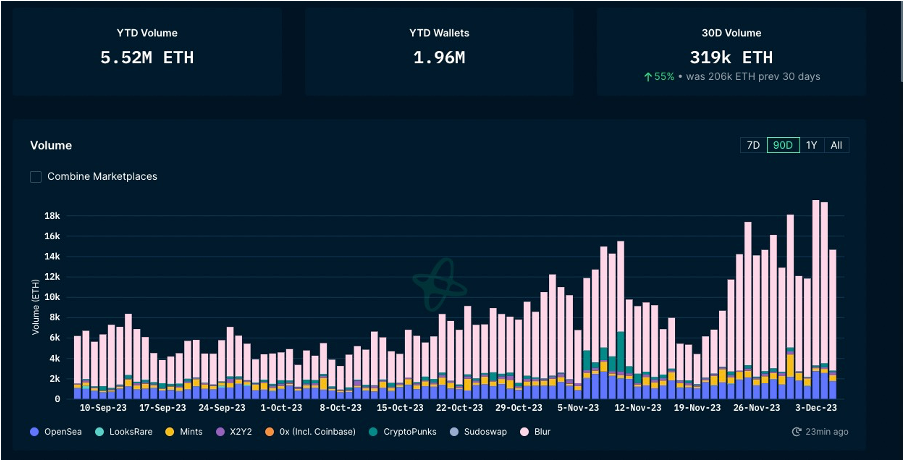

2) NFT market situation

3) NFT trading market share

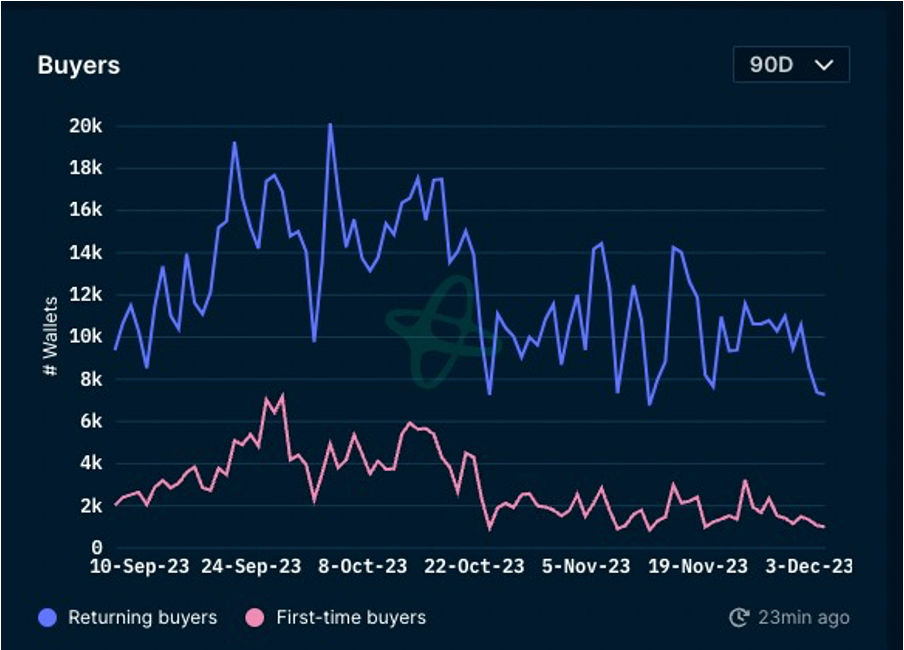

4) NFT buyer analysis

Floor prices for leading blue-chip projects have basically risen sharply this week, with MAYC rising by 11%, Pudgy Penguins soaring 66%, Azuki soaring 50%, Moonbird soaring 59%, and Milady soaring 17%. The transaction volume of the NFT market has continued to rise significantly in the past week, and gas fees and usage have also increased further. As the market continues to rise, the NFT market has gradually come out of its trough. Before the bull market comes next year, it is very likely that there will be more NFT projects with novel modes of gameplay displayed in front of us. Let us look forward to how NFT will perform before the new round of bull market comes.

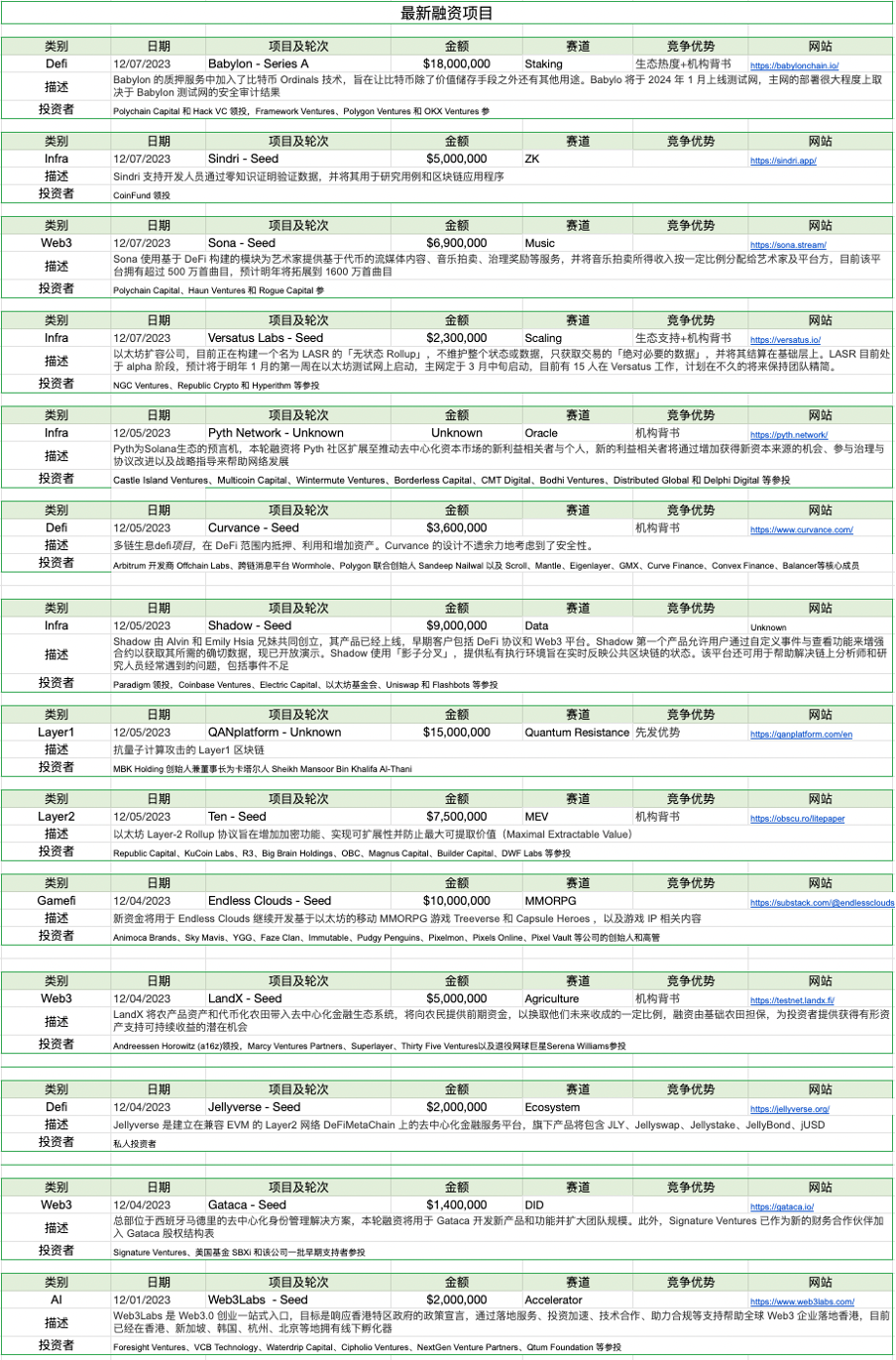

5. Latest financing situation of the project

6. Post-investment dynamics

1) HyperOracle - ZK Infrastructure

HyperOracle is integrating with Polygon CDK, opening up a new realm of possibilities and providing Polygon builders with unparalleled computing power. HyperOracle will also work to provide a Type 1 zkWASM attestation solution for CDK.

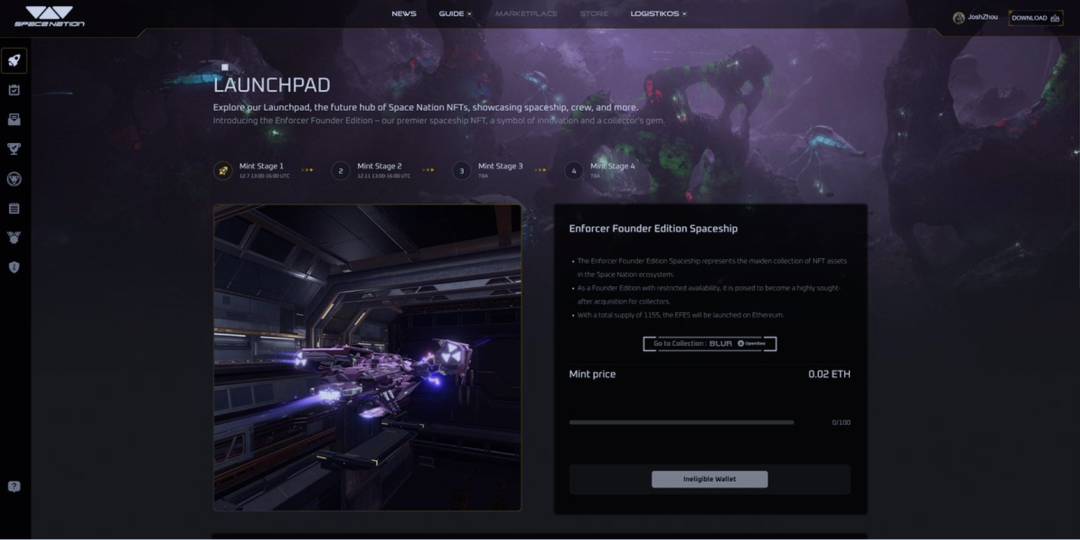

2) Space Nation - Gamefi

Space Nation releases details of first NFT Spaceships:

- Total supply: 1155

- Publishing platform: Logistikos

- Chain: Ethereum

- Minting stages: 4 stages

- WL price: 0.02 ETH

- Stage price: 0.03 ETH

3) Shardeum-Layer 1

Shardeum releases Dapp Boilerplate, a turn-key one-stop solution that allows developers to write code directly and start working through an easily configurable template repo.

Early Access: https://t.co/YDeInokwH8

4) Polyhedra Network-Infra

Polyhedra Network has added support for Trust Wallet, providing users with more secure and decentralized asset transfer and interaction options, allowing Trust Wallet to initiate NFT and Token transfer operations on Polyhedra Network by connecting to the wallet.

Polyhedra Network focuses on the design and implementation of zkBridge, providing cross-chain infrastructure for interoperability between Layer1 and Layer2.