Written by: TechFlow TechFlow

The liquid market is the lifeblood of the prosperity of the crypto ecosystem, especially for the new ecosystem.

When it comes to liquidity, the importance of DeFi is self-evident. Allow users to use a shared liquidity pool system to lend and borrow cryptocurrency assets without middlemen, through certain incentives, to lock in liquidity and bring leverage to funds within the ecosystem.

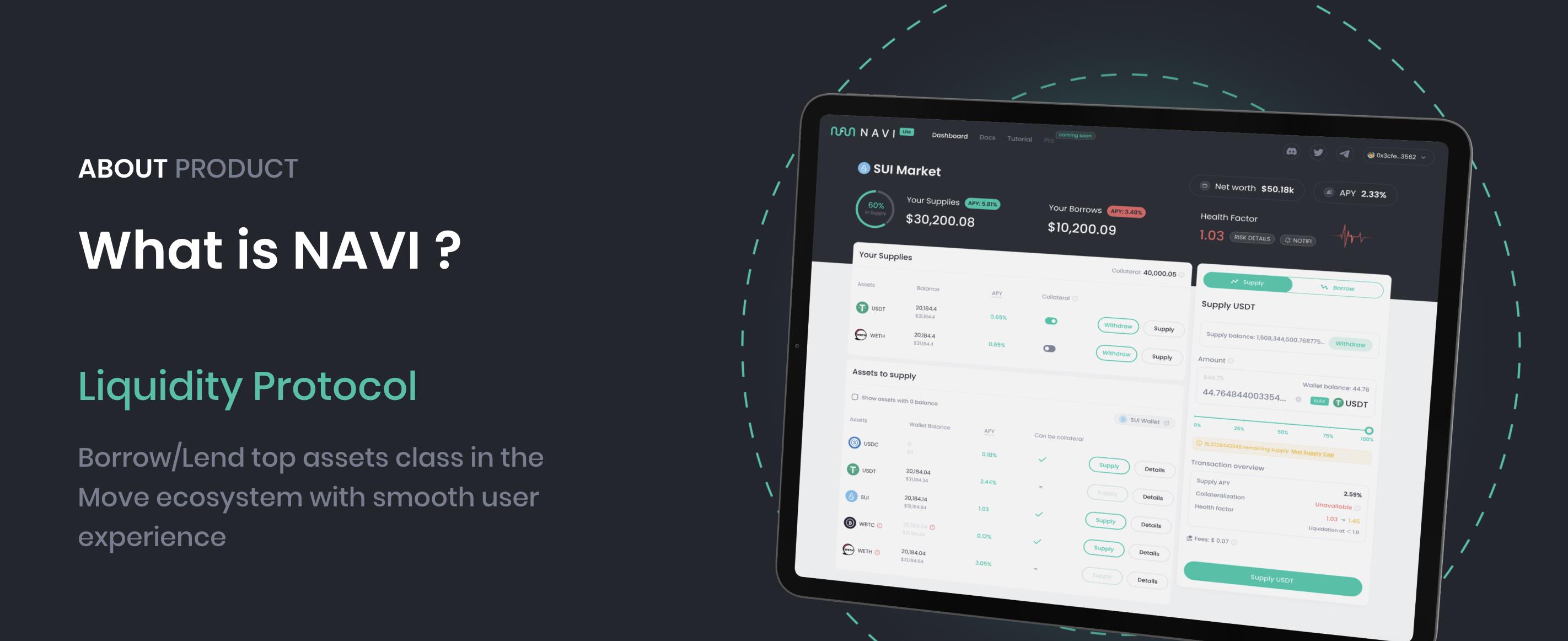

As a new ecosystem, one of the challenges Sui Ecosystem faced in its early stages was the lack of sufficient liquidity. This made it difficult for its internal DApp to attract enough users and funds in the early stages of its launch. In this context, the emergence of NAVI Protocol is undoubtedly a timely and powerful support, filling the liquidity gap for the Sui ecosystem.

NAVI: the native liquidity infrastructure of the Sui ecosystem

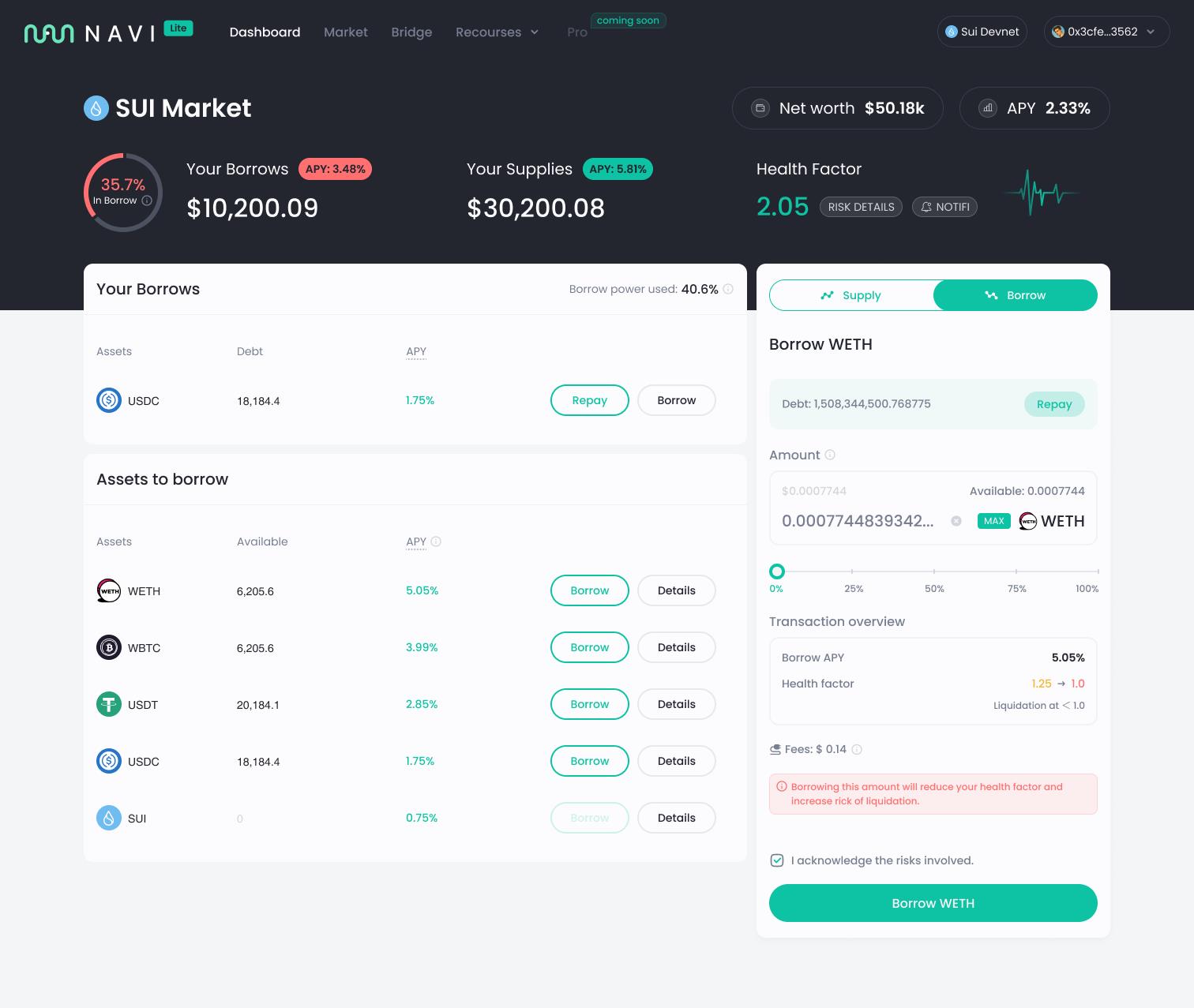

NAVI is the first native liquidity infrastructure on Sui, similar to AAVE, and its main mission is to enable users to participate in the Sui ecosystem as liquidity providers or borrowers.

Liquidity providers provide assets to the market and earn passive income through the income provided by NAVI, while borrowers can flexibly obtain loans in different assets, thereby adding a certain degree of leverage to their funds.

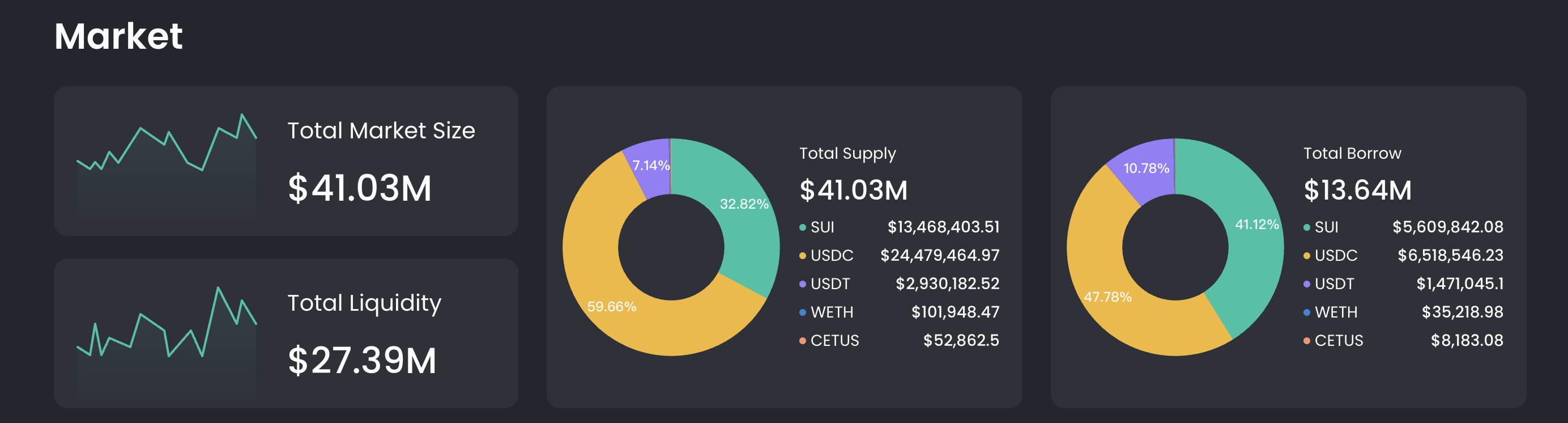

At present, the total market size of the NAVI protocol has reached US$41.03 million, and the total liquidity has reached US$27.39 million. We can see that USDC and Sui are the most important components of the $41.03 million, accounting for 59.71% and 32.82% respectively, with USDT, WETH and Cetus dividing the rest. Among the total loans, USDC and SUI also account for the highest proportions, reaching 47.78% and 41.12% respectively.

Why do Sui and USDC stand out so much?

This is because NAVI announced an exclusive cooperation with OKX DeFi to incentivize existing users and attract new funds. The event will start at 18:00 on December 7, 2023 and end at 18:00 on January 6, 2024. (UTC+8). The total reward for this event reaches US$50,000, distributed as follows:

Provide USDC to NAVI through the OKX wallet, and in addition to the basic annual interest rate, you will also receive a reward increase of up to 10% annual interest rate. The prize pool is 25,000 USDC.

Providing SUI to NAVI through OKX will receive a reward boost of up to 10% APR in addition to any base APR. The prize pool is 22,000 USDC.

Finally, another $3,000 will be allocated to provide additional assets to NAVI during the second week of the campaign, which is currently live.

Readers interested in this event can also view details at https://www.okx.com/cn/activities/defi-navi-bonus-event

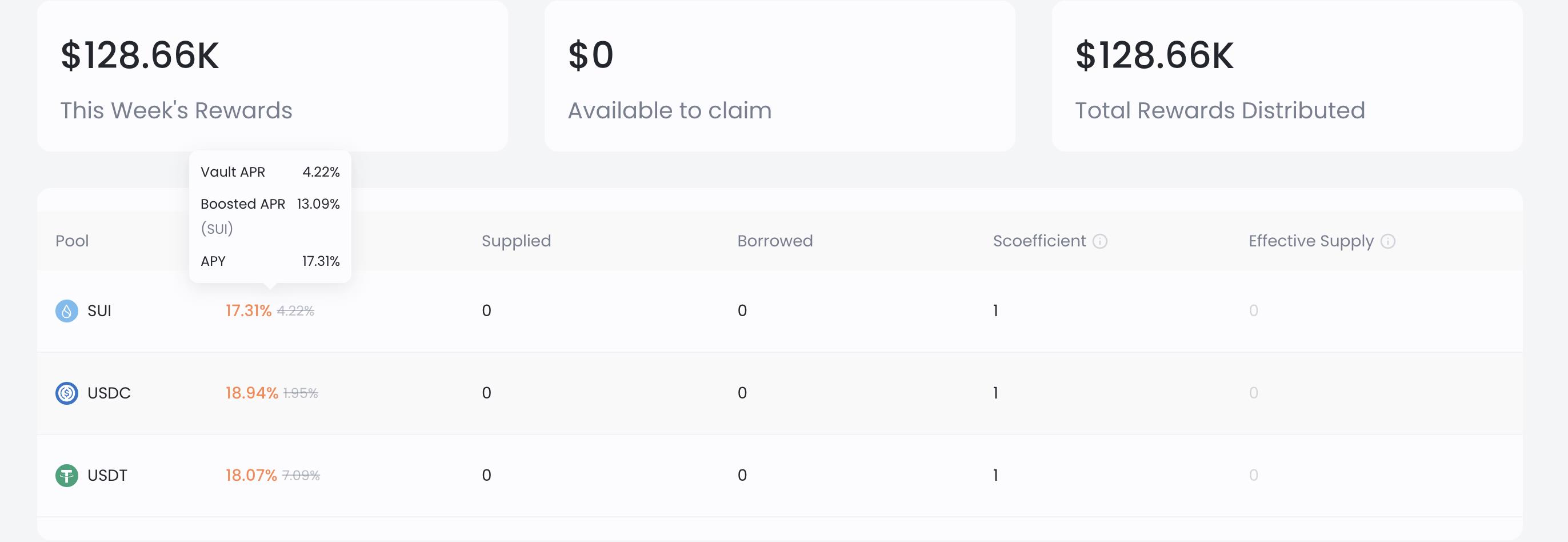

In addition, NAVI is also supported by investments from Mysten Labs, Coin98 Ventures, Galxe, Gate.io and ViaBTC, and has jointly launched its own liquidity incentive program - Liquidity Xplorer with Sui Foundation to increase users' storage income and encourages users to borrow money at lower interest rates. Calculated based on the current TVL ratio, NAVI has given Sui worth $18,000 in the past 5 months. The specific weekly volume schedule is as shown in the figure below:

Leverage vault and isolation mode, the guardian to ensure the safety of funds

Innovative features

In order to ensure the safety of users' funds and mitigate systemic risks, the NAVI protocol has launched two major innovations: leveraged vault and isolation mode. Among them, the leverage vault has the following functions:

Automated leverage: Through borrowing and lending, you can borrow and borrow assets multiple times to long or short, which is more technical and cumbersome. This function helps users avoid such repeated operations, making the entire process more intuitive and easy to understand.

Low annual interest rate asset lending and high mining returns;

Leverage strategy for native APY assets (liquid pledged assets and LP tokens).

Isolation mode is for:

Safely launch new assets;

New assets can only be pledged after approval by NAVI governance;

Eliminate systemic risks.

Through these two major functions, users can make full use of their assets and obtain new trading opportunities with minimal risk.

loan

The over-collateralization model has been fully tested in today's market. Therefore, on the premise of giving priority to capital security, NAVI's lending sector has also chosen this model.

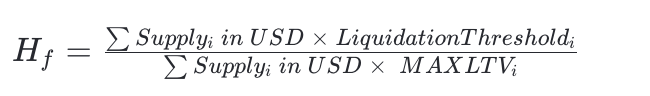

The assets provided by the user will affect the maximum loan value, where NAVI introduces the concept of health factor (Hf). The health factor is a numerical representation of the safety of a user's deposited assets relative to borrowed assets and their underlying value. The higher the value, the more secure the user's funding status is against liquidation situations.

It is based on the health factor (overcollateralization) that the maximum loan amount is calculated.

When the MAX button is clicked, the minimum health coefficient that the user can achieve will be calculated. The formula is:

According to the above formula, when the borrower's health coefficient is lower than 1, liquidation will occur. Because at this point the borrower's collateral value does not properly cover their loan/debt position.

Therefore, users are not liquidated and need to take certain measures to maintain a normal health coefficient. For example, users can give priority to repaying loans or depositing more assets to increase their health coefficient.

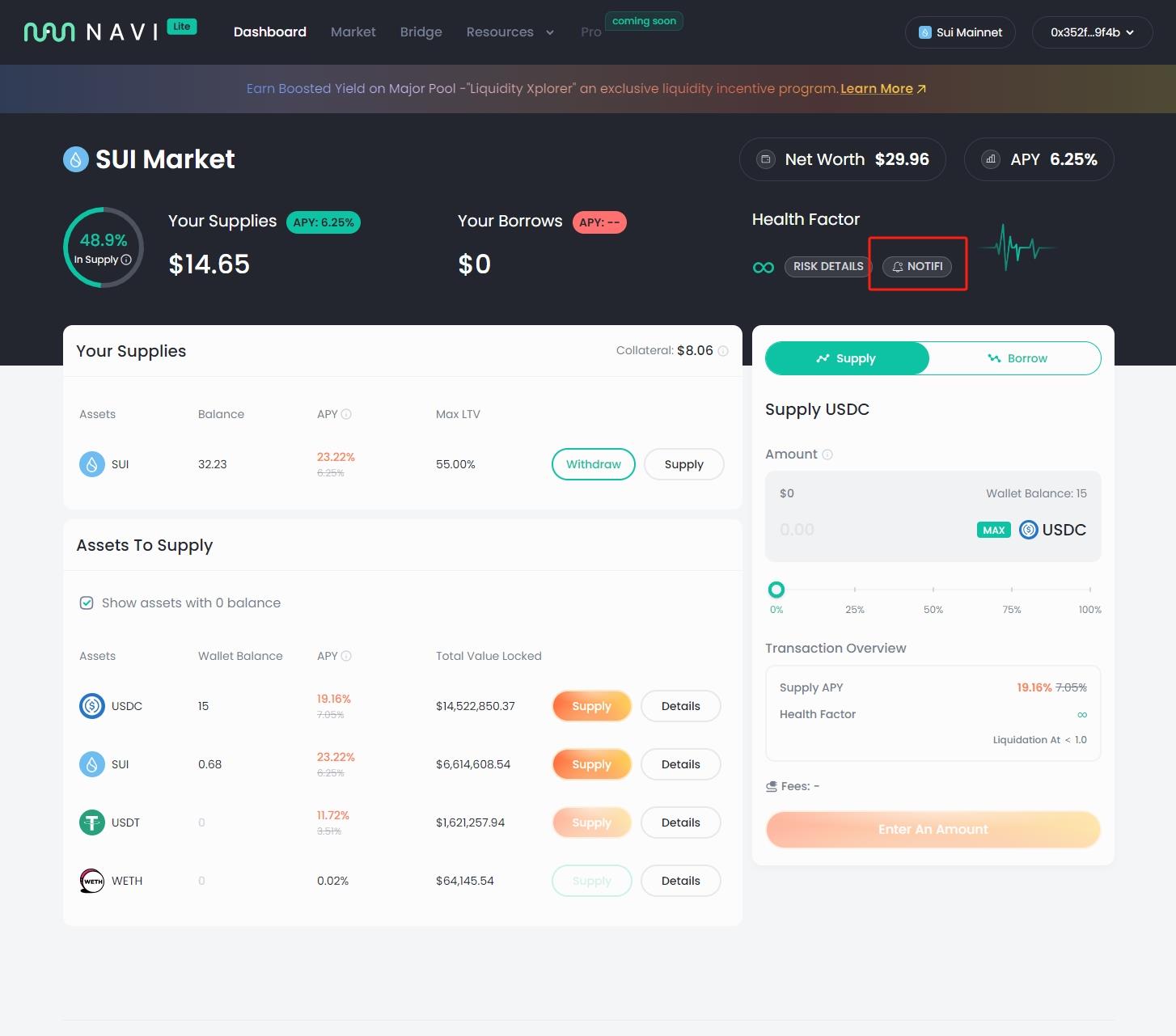

notify

However, it is impossible for users to be active in crypto 24/7. When the market fluctuates violently, some users will inevitably fail to respond in time, resulting in liquidation.

In order to avoid this situation to the greatest extent, NAVI has reached a long-term cooperation with Notifi to help users get notifications about health coefficient fluctuations. Users only need to open the Notifi button on the main interface and fill in the corresponding addresses and usernames of email, Telegram and Discord, and then they can monitor changes in the health coefficient in a timely manner through these three methods.

On the whole, on the premise of pursuing returns and capital utilization efficiency in lending, various designs of NAVI emphasize the risk management of funds and minimize the negative impact that risks may bring.

Token economy

NAVI native tokens have powerful empowerment in the NAVI ecosystem. Token holders can:

Staking : Users can stake native tokens to receive rewards from transaction fees and interest income from the lending platform. These reward distributions are proportional to the number of pledged native tokens, aligning users with the long-term development direction of the ecosystem;

Fee discounts : When users stake native tokens, they can receive varying levels of fee discounts on transactions. The more tokens a user stakes, the greater the fee discount they receive, which will encourage users to stake more tokens and actively participate in trading activities.

Governance: Token holders can participate in the governance of NAVI Protocol by voting on proposals and updates. The governance process is decentralized, ensuring that the development and future direction of the platform is led by its users.

In terms of native token emission, NAVI refers to Curve's Ve economy and introduces veNAVI to incentivize liquidity supply and adjust user interests.

When users stake their native tokens, they receive veNAVI tokens, which grant them voting rights to determine the issuance allocation of various assets in the liquidity pool. The amount of veNAVI a user receives is directly proportional to the number of NAVI tokens locked and the duration those tokens are locked.

When users use veNAVI tokens to vote on a specific pool, they influence the incentive distribution that will affect that LP pool. The more veNAVI tokens a pool gets, the higher the allocation for that particular asset.

On the one hand, such a system encourages users to provide liquidity for popular or high-demand assets and ensures fair distribution of rewards. On the other hand, it encourages more users to participate in the ecosystem to maintain the practical effect of native tokens.

route map

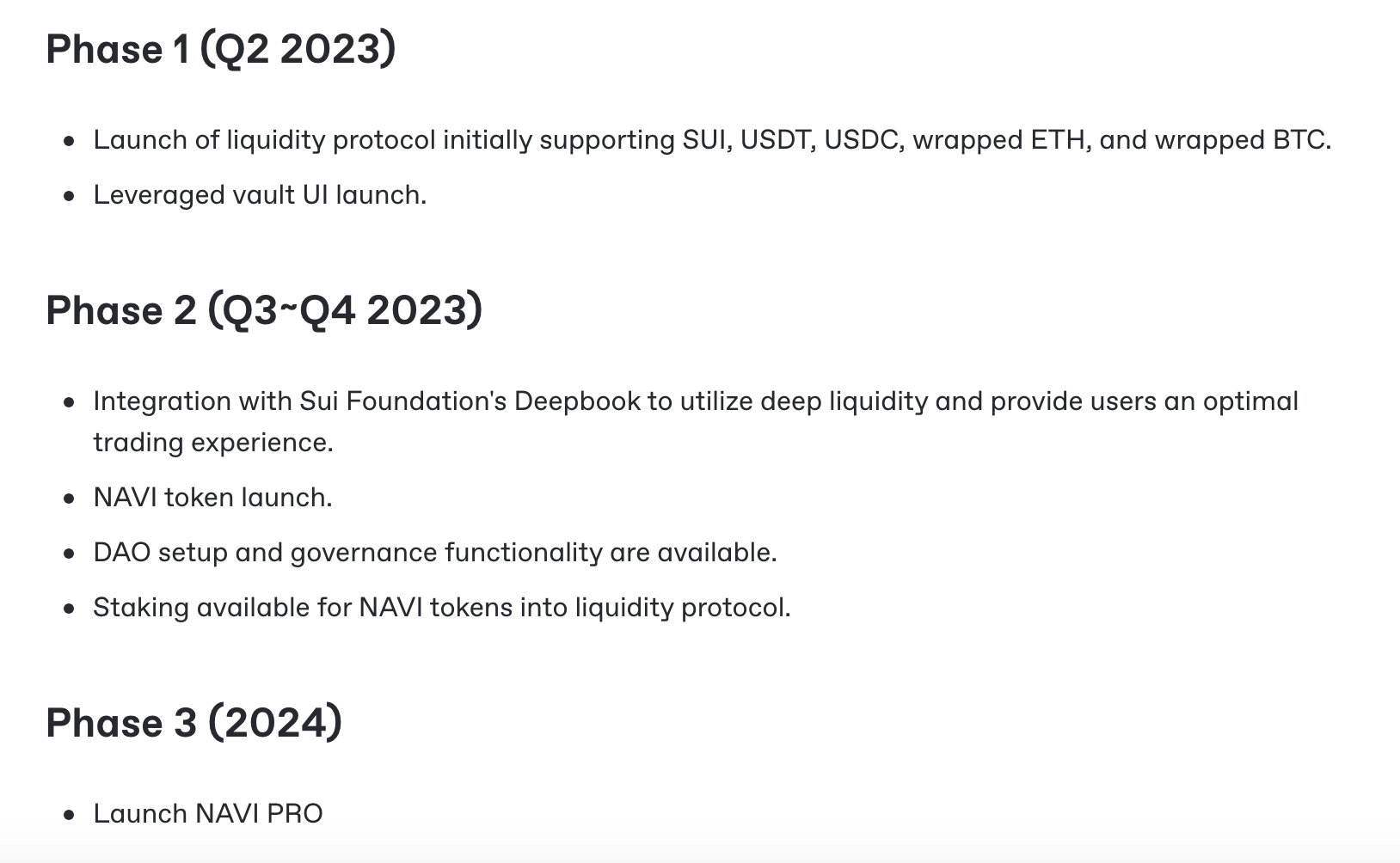

NAVI has now completed all objectives of the first phase of its roadmap, namely:

Launched liquidity protocol and supported SUI, USDT, USDC, WETH and WBTC.

Start the leverage vault UI.

Currently, NAVI is moving towards Phase 2:

Integrate with Sui Foundation Deepbook to utilize deep liquidity to provide users with the best trading experience.

NAVI’s native token is expected to be launched to the public in early Q1 next year.

Enable DAO and governance features.

NAVI tokens can be staked into the liquidity protocol.

This phase is expected to be completed from the third quarter to the fourth quarter of 2023.

Overall, NAVI has attracted a lot of attention as the first native one-stop liquidity protocol on Sui. With the cooperation with OKX, NAVI has entered a period of rapid development. How to retain these new funds has become the next problem faced by NAVI, or in other words, the Sui ecosystem.

And can NAVI also cause the DeFi explosion on Sui? let us wait and see.