Social finance was born, but it quickly fell.

Written by: Tim Copeland, THE BLOCK

Compiled by: Elvin, Chaincatcher

Summary:

- Decentralized crypto social media apps have made positive progress this year with a focus on scalability and opening up to more users

- Social finance platforms have seen a surge in attention but failed to retain users

This year marks a big step forward for a new wave of encrypted social media apps, with some opening up access while others are gaining considerable traction.

Such applications fall broadly into two categories, with some degree of overlap. The first is so-called "decentralized social," which includes social media applications that run on decentralized networks, aiming to provide users with more control over the application and avoid being responsible for an overarching centralized entity .

The second category is called “social finance,” where applications embed cryptographic functionality in a very direct way, bringing monetization into the core of the application. FriendTech is leading the development of such applications.

Decentralized social app open

Because decentralized social applications rely on complex infrastructure that is still under development, these applications often have limitations for new users. However, as these platforms become more assertive, they begin to open their doors to wider audiences.

For example, Ethereum co-founder Vitalik Buterin spends much of his time on decentralized social media app Farcaster, which in October became completely permissionless, meaning anyone can use the platform.

“This year, decentralized social has moved from the alpha stage to the beta stage, and both Lens and Farcaster will enter a stage that is more open and ready to expand, which will make 2024 the year of understanding the actual needs of users as we move away from the whitelist and strict quotas," said Joonatan Lintala, CEO of Lens-based social media platform Phaver.

“In a way, it sucks that it took so long to get there, but bears are built to do things in hibernation, so the timing should actually be good. Now it’s up to Phaver and other user-level applications to figure out how to These charts put it to good use and really add value to users, including those outside of the crypto bubble,” he added.

While Lens hasn't quite opened its doors yet, it's made great strides this year. In April this year, it launched Momoka, which enables it to move large amounts of data storage off the Polygon blockchain on which it runs. This move is intended to enhance its scalability. In July, it launched a second version of the protocol, offering a wider range of capabilities.

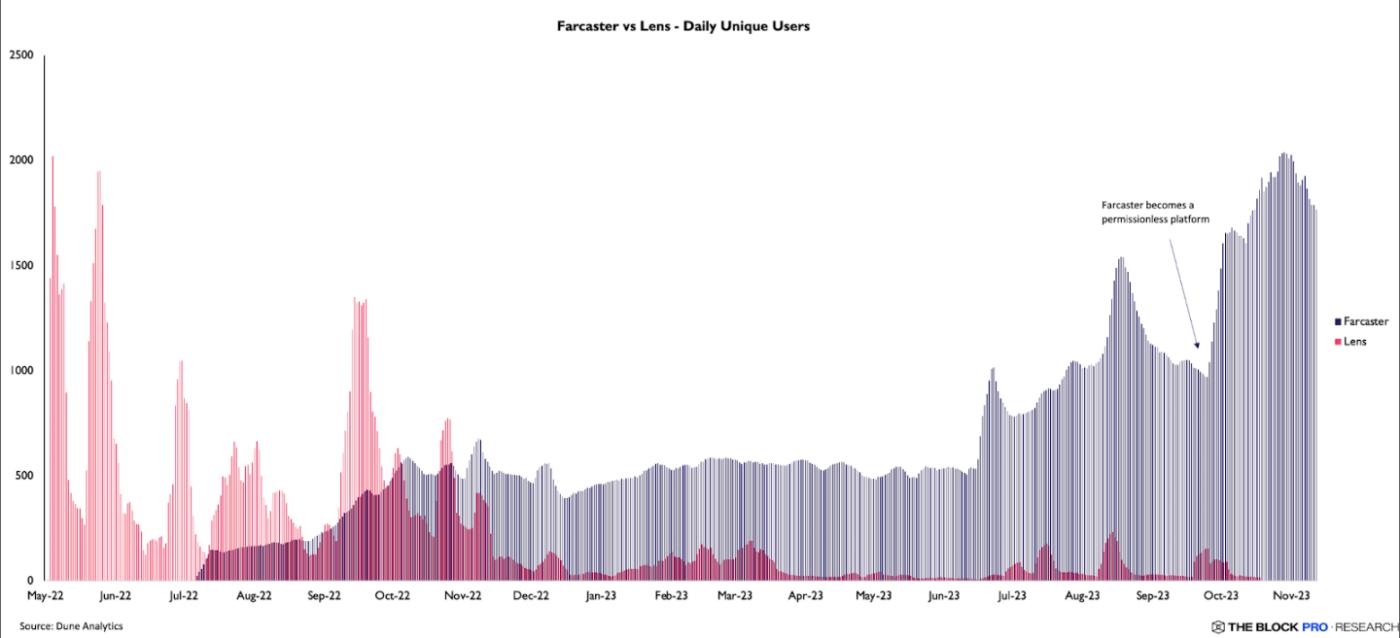

Despite these improvements, Lens still lags behind Farcaster in adoption, in part because Farcaster's doors are wide open. Lens has 126,000 profiles, while Farcaster has 196,000 registered IDs, according to a November research report by The Block Pro.

The number of daily users of Farcaster is growing rapidly. Image: Block Pro/Dune Analytics.

Farcaster is known for attracting users looking for quality discourse and a community-oriented environment. In contrast, while Lens provides rich functionality for creators, the current level of interaction is low. "The Block Pro researcher Brad Kay pointed out.

Social finance was born, but it quickly fell.

While decentralized social platforms are slowly expanding, social financial platforms have emerged and developed rapidly.

FriendTech is an original application blended with financial engineering. It provides a space where users can purchase keys that give them access to influencers’ closed group chats. The price of keys lies on the bonding curve, which means that the more keys purchased, the more expensive the keys become. What about the kicker? There is a 10% fee for each transaction, split between platform creators and influencers.

This financial incentive model has led to much speculation. According to a Dune dashboard created by a data analyst named Crypto Koryo, 843,000 users have spent a total of $267 million in ether across 12 million transactions since its launch in August. According to DefiLlama, this has generated $59 million in fees, half of which is dispersed among its user base. Although activity has decreased over the past few months, $35 million in value is still locked in the platform’s smart contracts.

“The huge growth from the peak we saw in September was staggering. Likewise, in the absence of new retail and a bear market, FriendTech was able to generate more revenue in a short period of time than the largest DeFi protocols such as Uniswap, Lido and even Ethereum. Fangchain itself,” Crypto Koryo pointed out.

The campaign is driven by two themes. First, users want to make money quickly by buying keys and selling them at a higher price. The bonded chain mechanism means prices can get expensive quickly, offering potentially high returns but also the risk of losing money due to bad trades and high fees. One user named Vombatus made nearly $2 million by accumulating his own keys and then eventually dumping them all at once on users who also purchased their keys.

The second assumption is that the platform will conduct airdrops at some point based on activity. This concept is supported by the platform’s points system, which awards points to users based on their activity, which many users speculate will be used to determine eligibility for potential airdrops. So far, this has not happened.

“Once FriendTech became ‘mainstream,’ it was interesting to observe the behavior of different groups. After most of the ‘crypto Twitter’ community joined in, we started to see non-crypto native people join in, such as OnlyFans members, musicians (including Pussy Riot) , sports stars, and even Web2 media companies,” Crypto Koryo added. "This is because monetization is an issue for both Web2 and Web3 content creators."

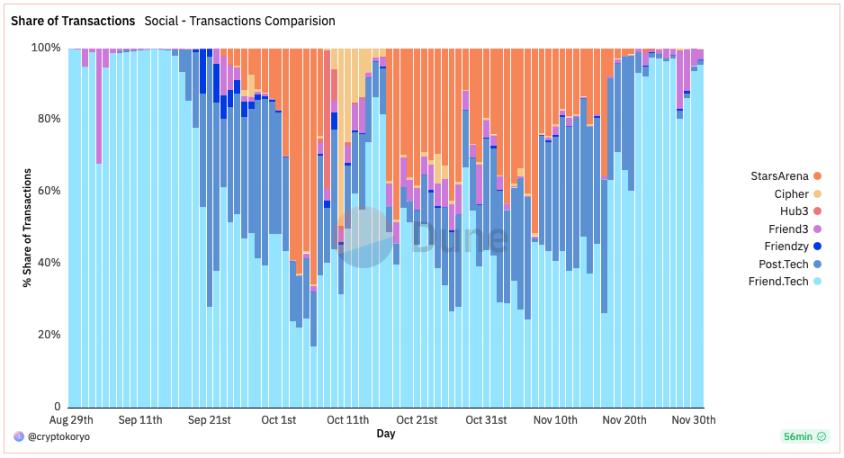

Following the success of FriendTech, other platforms have emerged offering similar products. Avalanche-based Stars Arena is one of the most popular games, but it's struggling to regain momentum after suffering a $2.9 million breach and disagreements within the team. Other apps, such as New Bitcoin City, which is based on Bitcoin Layer 2 NOS, offer far more features than FriendTech, but none attract a similar user base. These apps now have much lower daily transaction volumes, while FriendTech maintains its lead.

StarsArena had more daily trading volume than FriendTech at its peak, but that didn't last long. Image: Dune Analytics/Crypto Koryo.

Looking to the future

While bringing decentralization and cryptocurrencies to social media has been challenging both from a technical perspective and in terms of creating a sustainable financial mechanism, there does seem to be a potential audience for such an approach.

Saurabh Deshpande, a researcher at crypto communications Decentralized.co, pointed out on Twitter: "Blockchain as a payment rail means Web3 social networks can reward users around the world without the platform needing to exploit user data or serve ads."

Deshpande added that the core concept of social networks compensating users for content they post does have value.

“We’re not there yet, but we’ll get there over time by leveraging features like ownership, composability, permissionless access, and censorship,” he noted.