Table of contents

ToggleCore Topic in 2023: Security and Compliance

One year has passed in the blink of an eye. Looking back at last year's industrial environment, due to a series of black swan incidents involving crypto companies such as FTX, Celsius and 3AC since 2022, last year became a "regulatory year" for the cryptocurrency market. Regulatory authorities around the world have tightened regulations on related crypto companies. legal regulations, and the operations of related entities face severe regulatory challenges around the world.

In particular, the U.S. Securities and Exchange Commission (SEC) under the leadership of Gary Gensler took tough enforcement against exchanges and cryptocurrency service providers including Kraken and Coinbase throughout last year when U.S. regulatory regulations were still unclear. action. In such an environment, cryptocurrency entities pursuing long-term operations are bound to invest a lot of resources in compliance to cope with the tightening global regulatory trend, as shown in the " 2023 Year-End Report " recently released by Binance Exchange. The content just presents such long-term strategic planning and actual actions.

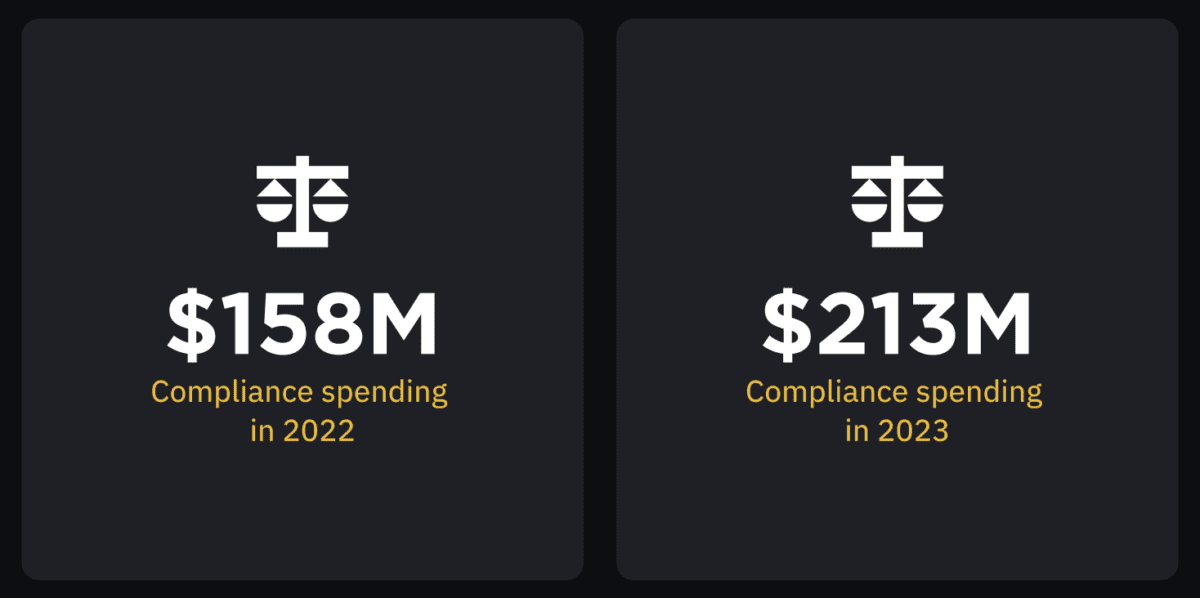

Binance spends $200 million on compliance in 2023

According to the report, investment in compliance continues to be one of Binance Exchange’s core priorities in 2023. Over the past year, Binance’s investment in compliance has increased significantly from US$158 million in 2022 to US$213 million, an increase of 35%.

We speculate that these increased compliance budgets will be mainly invested in the following aspects:

- Impact of Compliance Regulation Trends <br>As the global cryptocurrency market continues to grow, governments and regulatory agencies have increased supervision of cryptocurrency exchanges. This trend continues to heat up in 2023 and is very likely to continue into 2024. Therefore, as a global exchange, Binance must actively respond to changing compliance regulations to ensure that its business continues to operate and meet regulatory requirements. Therefore, increasing compliance budgets can be seen as a strategic move that helps avoid possible legal risks while enhancing their competitive position in business.

- Optimization of KYC/AML process

In terms of compliance, KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are also critical to a financial institution’s legal compliance. Through the continuous optimization process, it can be expected that Binance will be able to ensure higher security and effectiveness. This may include additional layers of identity verification, real-time transaction monitoring and risk assessment to ensure that the exchange blocks any bad actors and protects the platform from being exploited for illegal activities. - Increased market transparency

As part of the compliance process, Binance may seek to increase market transparency to build greater trust. This can be achieved through public reporting of compliance, transparency of transaction data and active cooperation with regulators. These initiatives will help attract more institutional investors and large enterprises, further promote the maturity of the cryptocurrency market and promote more potential cooperation and innovation. - Strengthening of information security <br>As its business scope expands, Binance has also invested considerable resources in building security measures for its platform to maintain a safe environment for users' digital assets and data. Currently, Binance has obtained ISO 27001 and ISO 27701 certifications for information security governance and privacy information management in four jurisdictions: France, the United Arab Emirates, Bahrain, and Turkey. At the same time, it also completed the SOC 2® Type II audit by the external audit agency A-LIGN.

A-LIGN – A technology-driven security and compliance management partner that helps reduce cybersecurity risks, trusted by more than 4,000 global organizations. - International Cooperation <br>Compliance is not only conducted at a single country level, but also requires global cooperation. By actively participating in and deepening cooperation with regulatory agencies in various countries, Binance will be able to exert its industrial influence and assist the positive development of the crypto industry. This includes working with other crypto companies, financial institutions, and government agencies to jointly formulate industry standards and deepen Work with law enforcement to combat financial crime.

All in all, Binance Exchange’s move to increase its compliance budget in 2023 is smart and will help ensure the sustainability and compliance of its business. As the cryptocurrency market continues to evolve and the regulatory environment changes, compliance will continue to be a key focus for the industry, requiring continued investment of resources to address challenges and opportunities.

Embrace compliance and create the future of the industry together

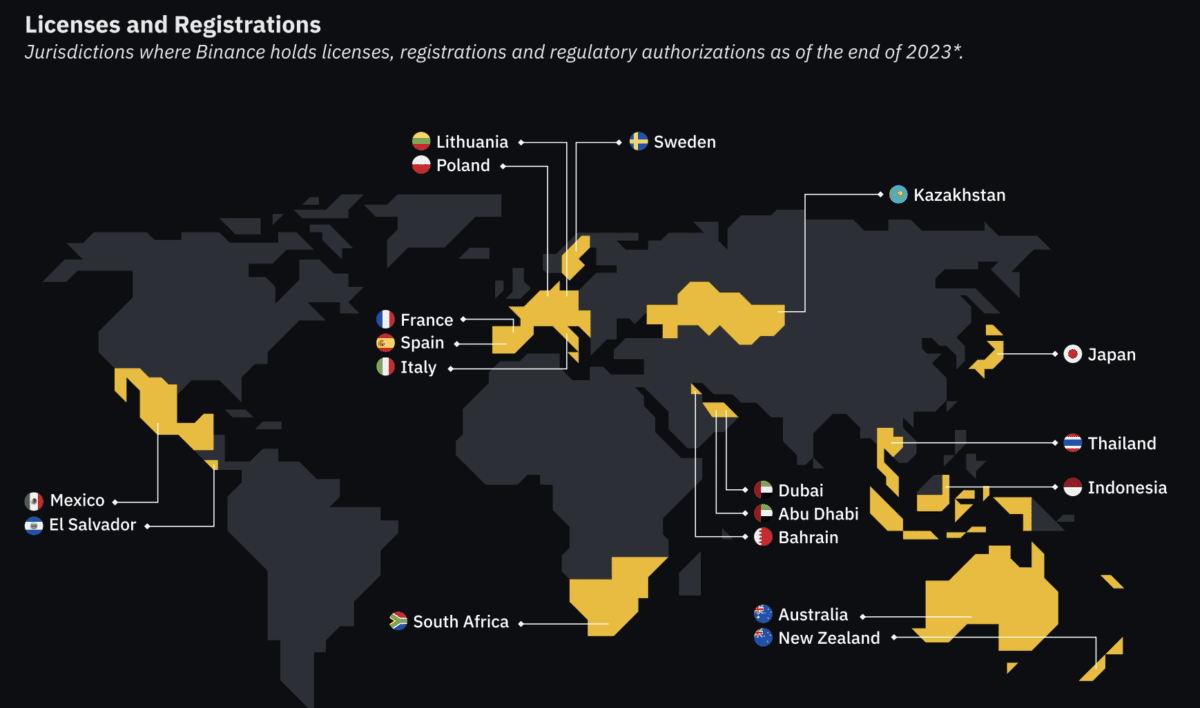

On the other hand, compliance is crucial to building trust among the industry, regulators and customers. Maintaining high compliance standards will not only help expand global business, but also become a competitive advantage for cryptocurrency entities. Take Binance as an example. In 2023, the exchange obtained operating licenses, registrations and authorizations in 18 jurisdictions around the world, including France, Italy and Japan among the G7 countries, setting a record for the largest number of licensees in history. There is no doubt that this is the key to Binance’s ability to gain users’ trust.

Binance’s global operating licenses and registrations enable it to expand into different jurisdictions, which not only expands its user base but also reduces geographic risk. This also helps diversify the business to offer a variety of products and services based on the needs of different regions and comply with local regulations. This global presence helps Binance maintain its market leadership.

Having the largest number of licensees means that Binance Exchange has a more competitive advantage in the market and can provide more diversified services and attract more institutional investors and retail users.

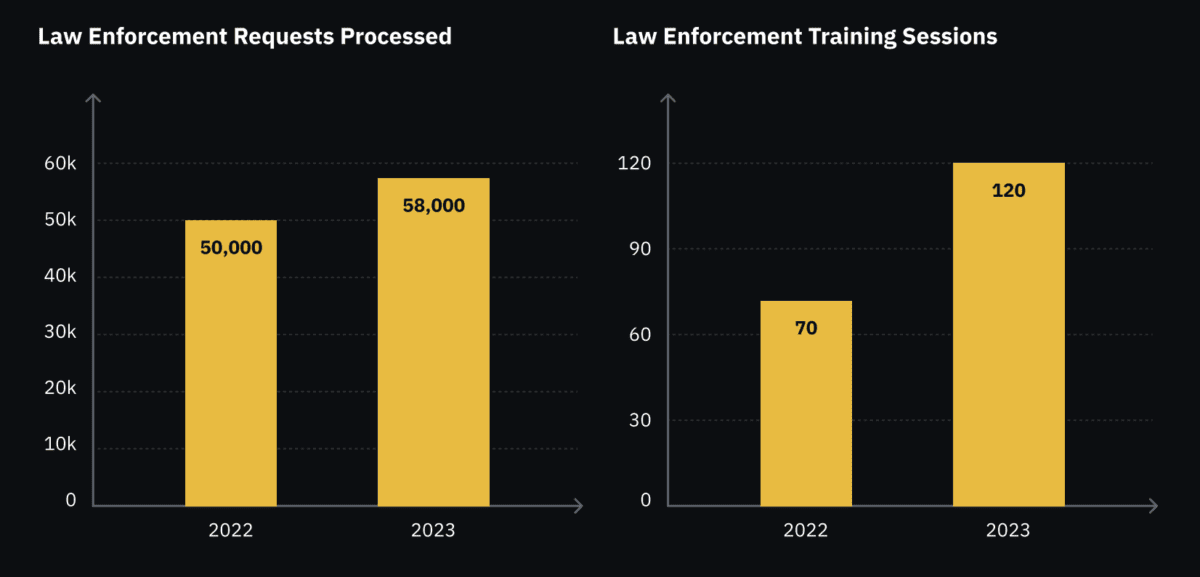

In addition, as of the end of 2023, Binance’s compliance team responded to a total of 58,000 law enforcement requests and seized billions of dollars in illicit funds in the process. Imagine that this number is equivalent to responding to more than 150 law enforcement requests every day. Binance’s compliance team handles multiple requests from regulators and law enforcement agencies every day to assist in investigations of possible illegal activities. Such an achievement Demonstrates the effectiveness and impact of Binance’s compliance team.

With billions of dollars in illicit funds, this figure not only represents Binance’s key participation in fighting financial crime globally, but also demonstrates Binance’s commitment to protecting users and contributing to the security of the crypto-asset ecosystem. Another perfect example.

At the same time, Binance has even cooperated with law enforcement agencies in Taiwan, Hong Kong, South Korea, Australia and other places to provide up to 120 educational training sessions for global law enforcement officers. This international cooperation and knowledge sharing helps combat transnational financial crime and improves the security of the global financial system. For example, in 2023, Binance will cooperate with the Taiwan Criminal Bureau, the High Prosecutor’s Office, and multiple local prosecutors’ offices to organize a series of education and training activities.

The Binance team shared the latest crypto-asset trends and investigation techniques at the event, helping more than a hundred Taiwanese law enforcement officers improve their understanding of crypto-assets and strengthen their case-handling skills.

More such international cooperation will not only provide professional knowledge for law enforcement officials, but also promote in-depth exchanges between the public and private sectors, set a good example for the industry, and at the same time combat illegal activities related to cryptocurrency. In terms of the long-term development of the currency ecology, it has all the benefits and no harm.

A new year, a new Binance

Binance actively launched a number of new products and services last year, including automatic follow-up functions and Web3 wallets, to promote the innovative development of the entire industry. These initiatives undoubtedly inject new vitality into the cryptocurrency industry and demonstrate Binance’s deep understanding of technological advancements and user needs.

However, we can clearly see from the above that even while pursuing innovation, Binance still puts "compliance" at the core of its business development. This persistence not only reflects Binance’s long-term strategic plan for global business development, but also reflects its ongoing commitment to ensuring the security, compliance, and transparency of the cryptocurrency ecosystem.

Looking back at the changes in the overall cryptocurrency market in 2023, various exchanges including Binance have experienced quite a bit of ups and downs. But in the end, Binance took responsibility for its past actions by reaching a settlement agreement with U.S. regulators, and regrouped and started again. I believe that after Richard Teng, who has extensive compliance experience, takes over as CEO, we will see a completely different Binance from the past. As Richard stated in his year-end open letter:

Building the future of finance and promoting the free flow of value is a long and bumpy road, but we are ready to work hard for the long term. With the unwavering support of the Binance community, we will prove that no challenge can stop us.