Basic Information

One sentence introduction

Renzo is the LRT (Liquid Restaking Token) of the Eigenlayer ecosystem. By providing node services and risk management, it can provide higher returns than staking native ETH and unlock restaking liquidity.

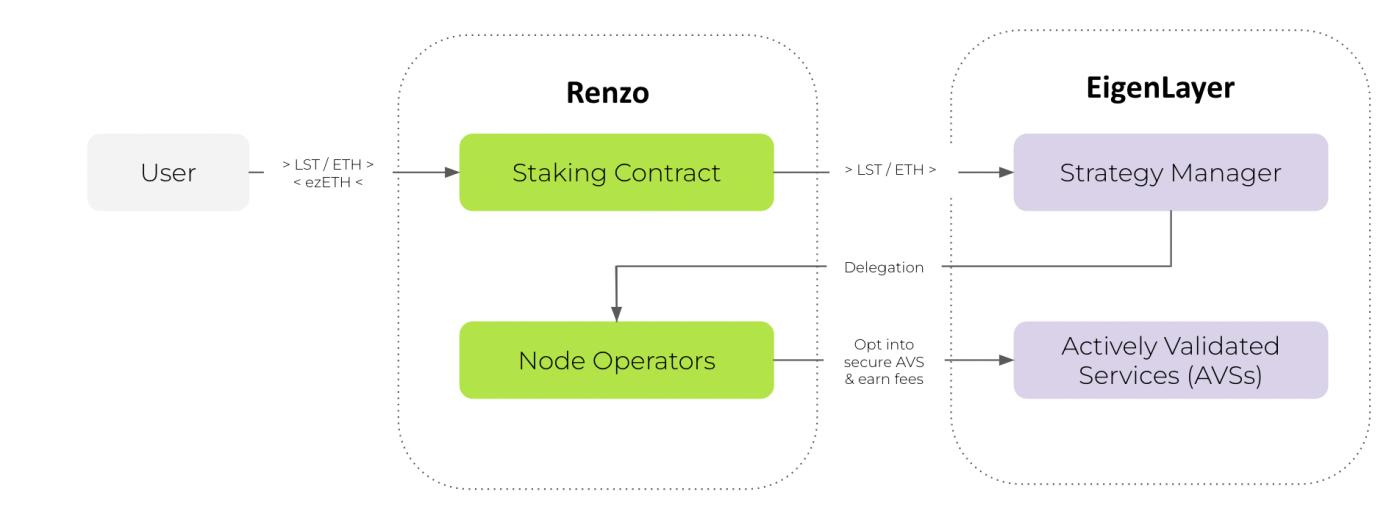

working principle

- Users deposit LST (i.e. stETH, rETH and other liquid pledge tokens) or ETH to get the corresponding amount of ezETH

- Renzo’s smart contract distributes the deposited LST/ETH through Eigenlayer to AVS and node operators selected through risk analysis and DAO

- Users can receive rewards for staking native ETH, Eigenlayer points and ezPoints rewards. In the future, ezETH can be used in more financial scenarios

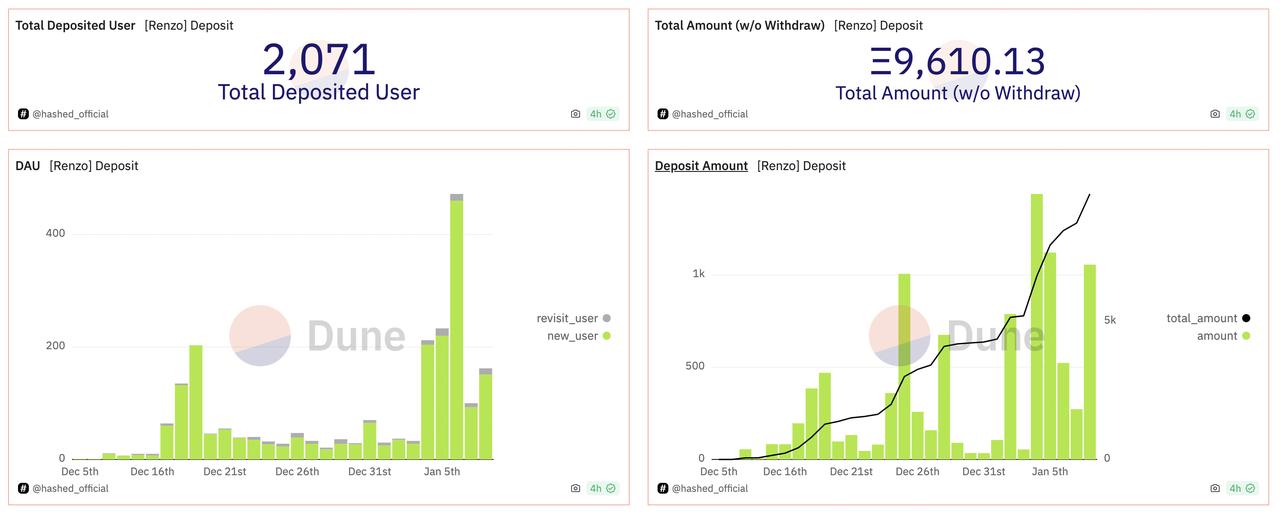

Data performance

Ends January 9th

Vision

Renzo abstracts all the complexity for end users, allowing them to obtain the additional benefits of eigenlayer with low barriers to entry, thereby promoting the widespread adoption of eigenlayer. The long-term vision is to work with Eigenlayer to promote permissionless innovation on Ethereum and unlock more defi revenue channels and composable gameplay.

Investors

Maven11; SevenX Ventures; Figment; etc

Interpretation Project

Restaking has a hot narrative and the Eigenlayer ecological market has broad prospects

In articles judging and budgeting the hot narratives of the crypto market in 2024, Restaking is on the list without exception. This concept first proposed by Eigenlayer hopes to realize security sharing between various types of Rollups, side chains and middleware (DA Layer/Bridge/Oracle, etc.), thereby further maintaining the network security of Ethereum. For the user side, the motivation to participate in re-pledge comes from more benefits. To put it simply, LRT (Liquid Restaking Token, Liquid Restaking Token) is the matryoshka version of LST (Liquid Staking Token, Liquid Staking Token). You can get LST by pledging ETH, and you can get LRT by pledging LST for the second time. LRT can Perform financial operations such as pledging, borrowing, etc. again. Every additional pledge is an additional opportunity to use liquidity to earn profits. It is worth noting that LRT protocols like Renzo also support direct native restaking to Eigenlayer, thus bypassing Eigenlayer’s current upper limit on the maximum TVL for each LST type.

So how big is this market? The current number of pledged Ethereum is 29,235,511, with an amount of approximately US$67 billion, of which Liquid Staking accounts for 37.1%, with a total amount of US$24.7 billion. Among Liquid Staking, Lido accounts for 85.2% and 31.5% of all pledged Ethereum. The current ETH Balance of the Eigenlayer ecosystem is 277,746, and the Total Balance is US$550 million. Compared with Liquid Staking, the entire ecosystem has 50 times room for growth.

An eye-catching lineup of partners creates competitive barriers in all aspects

Like LSD, Restaking is also a track (BD Game) that attaches great importance to business cooperation. At present, Renzo has reached cooperation with front-line projects such as Figment, Gauntlet, Biconomy, Balancer and Wormhole. It also has the former Lido BD leader as a project consultant. In addition, it is also creating competition barriers through the following four aspects.

Build brand influence

Renzo Protocol attaches great importance to research and conducts discussions around LRT and AVS (Active Validator Service) to establish professionalism and influence in this field.

Leverage network effects

- The Renzo team has rich experience in DeFi products and has obvious advantages in the speed of implementation. As the only LST currently launched on the main network, Renzo's product interaction is simple and smooth, laying the foundation for attracting users and expanding the user base during the rapid development period of the Eigenlayer ecosystem.

- Renzo supports Wormhole in product design and can expand cross-chain via news

risk management capabilities

Compared with LST, LRT involves more complex risk management, especially for institutional users. Renzo is able to provide users with the best risk-adjusted returns.

Tokenomics

- The veToken model incentivizes long-term holding of tokens while guiding the direction of incentives (AVS can be bribed to rent more security)

- Binding operators without permission: Learn from Rocketpool and pledge a part of Renzo to obtain the power to run AVS services for Renzo Restaker, which can reduce the number of circulating tokens.

- Used for the acquisition and rewards of early quality operators to quickly bootstrap liquidity.

potential risks

- Risks of Renzo smart contracts

- Risks of third-party protocols: including risks of the underlying LST protocol and risks of Eigenlayer

- LRT token depeg risk: similar to the anchoring relationship between stETH and ETH, which is affected by market supply and demand and liquidity

- AVS slashing risk: Higher Restaking income means higher risk. In extreme circumstances, the user’s principal may be slashed.