By Cosmo Jiang, Portfolio Manager, and Erik Lowe, Head of Content, Liquid Strategies

We are often asked by investors, “How correlated are various tokens during a bull market cycle?”

To provide some perspective on this, we will analyze the two most recent cycles when investable tokens other than Bitcoin had meaningful market share.

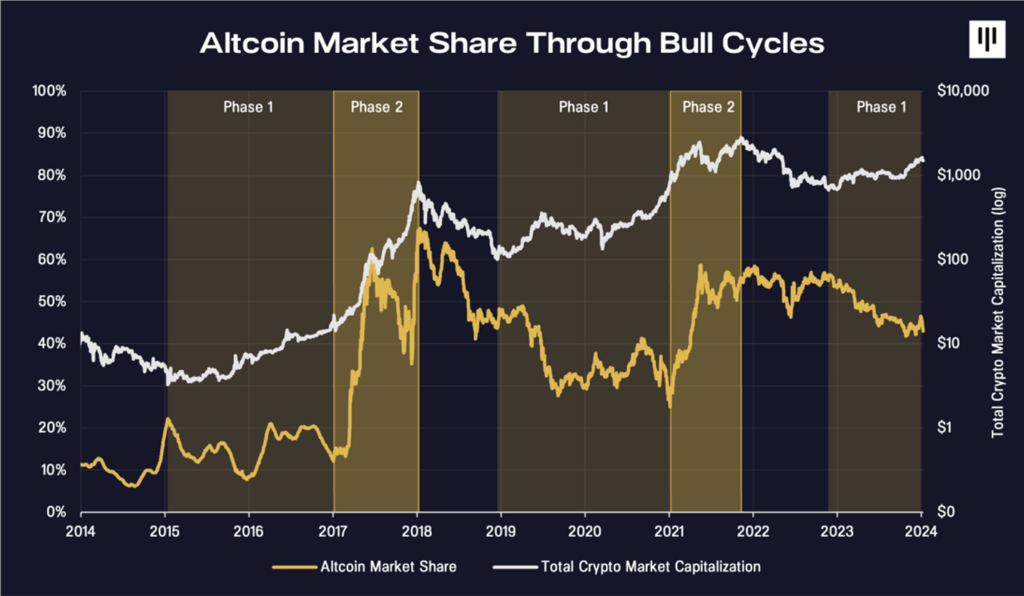

We observe that bull market cycles have two distinct phases. The first phase is the early stages of a rally, when Bitcoin tends to outperform the rest of the market. The second phase is the later stage when Altcoin tend to outperform the market.

We believe that Bitcoin’s outperformance in the first phase may be a by-product of a variety of reasons. First, it is the most widely supplied and liquid digital asset on the market. In 2023, Bitcoin’s average daily trading volume will be $18 billion. In comparison, Ethereum’s daily trading volume is $8 billion. Second, first-time investors often buy Bitcoin first before looking to invest in other coins. It has a 15-year track record and a brand that many consider synonymous with the industry itself.

While some investors' journeys end in Bitcoin, many will fall down the cryptocurrency rabbit hole . The range of investable tokens beyond Bitcoin is vast, and the bull market appears to be accelerating the expansion of the space as more entrepreneurs and developers enter the space. The second phase is when investors start looking for higher growth tokens that support different use cases, often driven by new innovations, namely ICOs in 2017–18, DeFi and NFTs in 2020–21. This phase may coincide with what Sir John Templeton described as the "optimistic" phase of the bull market.

Here's a visual of the two stages highlighted in gold shades. You’ll notice that Altcoin market share declined during the first phase of the cycle, while total market cap increased slightly, indicating Bitcoin’s outperformance. During bull market cycles, Altcoin’ market share quickly rises by around 60–70%.

Here’s a look at Bitcoin’s and Altcoin’ actual returns in terms of market capitalization growth, and how much each currency contributes to the overall growth of the cryptocurrency market.

In these cycles, Bitcoin has always outperformed Altcoin during the first phase of the rise. During the second phase, Altcoin significantly outperformed Bitcoin. Interestingly, Altcoin have outperformed by such a wide margin that Altcoin throughout the cycle.

While historically one of the highest sources of alpha comes from perfectly timed rotations from Bitcoin to Altcoin at the beginning of Phase 2, this relationship does not necessarily always hold true and for any trader, perfect timing Rotation is also not a reality.

Perhaps the most viable way to generate alpha in this space is to maintain consistent exposure to altcoins that have fundamental reasons to appreciate many times more than Altcoin.

Our thesis is that Altcoin underlying protocols that have product market fit and generate real revenue through strong unit economics will perform best in the next cycle, as is expected for other asset classes such as equities. Just like not all stocks are created equal, not all tokens are created equal. Token selection will be critical in the long term, as outperformance will be context-specific and not necessarily within a certain industry or based on fickle, short-lived speculative narratives.

So far in this cycle, Bitcoin is up 2.8x and Altcoin are up 1.7x.

Current status of blockchain venture capital

By Paul Veradittkit, Managing Partner

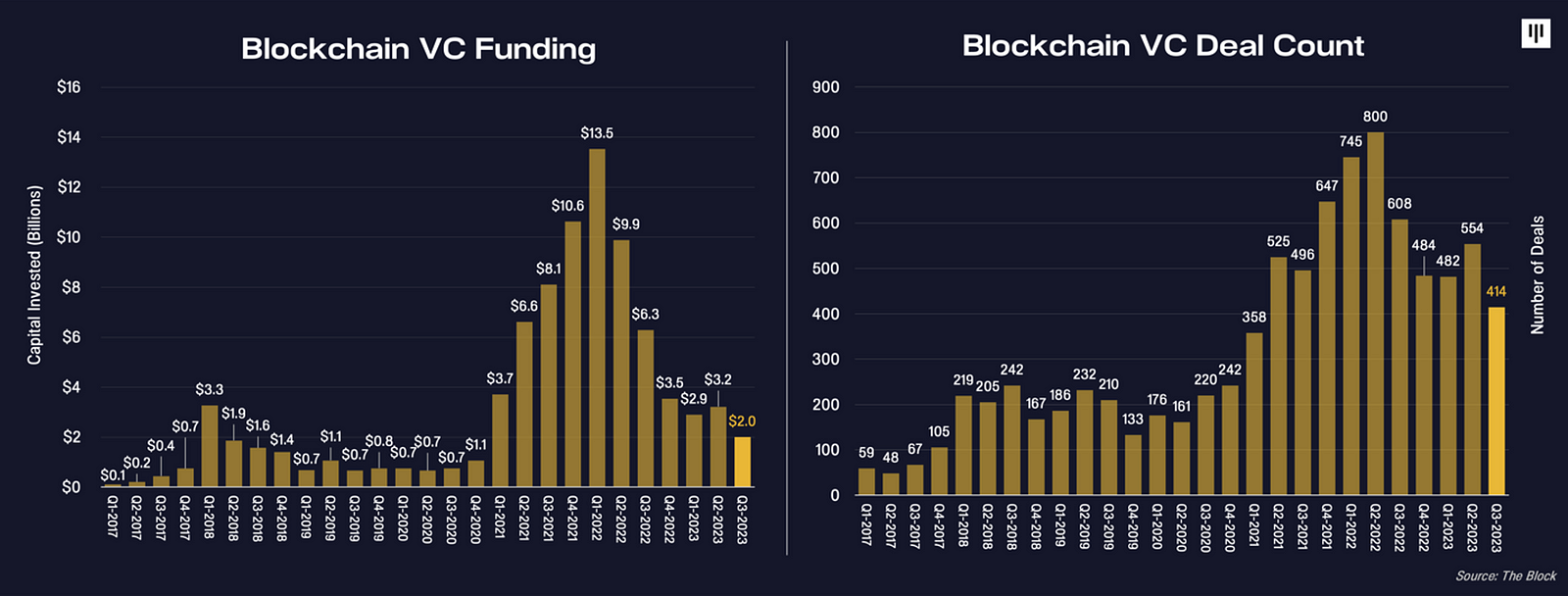

Blockchain financing of private placement transactions has been decelerating since the first quarter of 2022. According to The Block data, the number of quarterly financings and deals decreased.

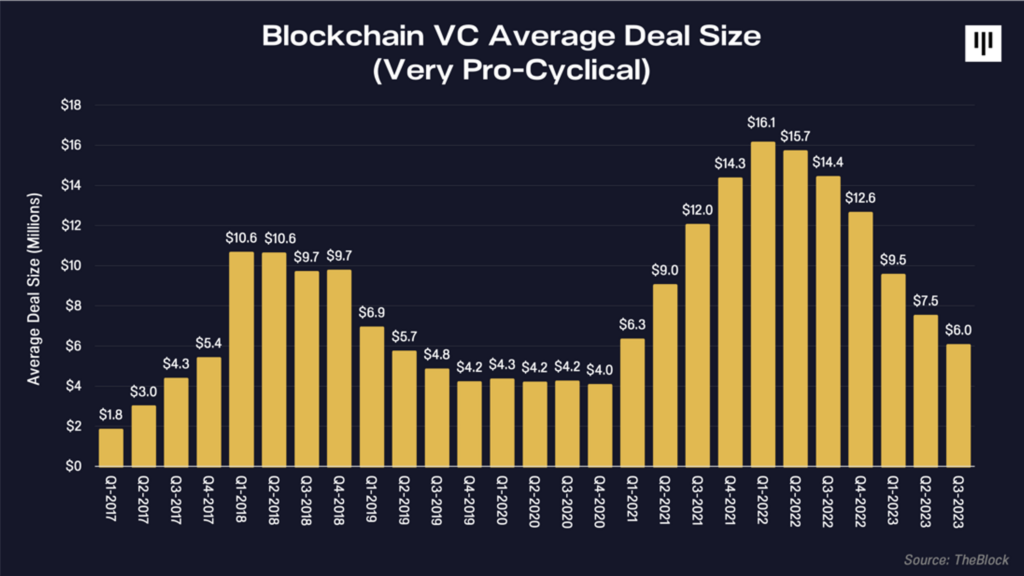

Average deal size has fallen significantly since its peak in early 2022.

It’s important to note that these numbers are based on news round announcements, which in my experience tend to lag by a quarter or two.

Based on our observations at Pantera, we believe the trough in funding and deal activity may have occurred last summer. Lately, we've seen a huge uptick in deal activity driven by entrepreneurs who entered during the last bull market, whose businesses have matured and potentially found product-market fit, or who have been executing on the right strategy and are now back with Raise money at a reasonable valuation.

This may take a little longer than most people expect, since during bull markets many VCs like us recommend companies raise an extra year of funding. So instead of raising capital for two years, they raised capital for three years and now we're starting to see them come back into the market.

We believe this is a good time to invest as deal activity has increased - which I expect will continue this year if the public markets continue to rebound.

2024 Forecast

By Paul Veradittkit, Managing Partner

1. The resurgence of Bitcoin and “DeFi Summer 2.0”

Bitcoin is making a comeback in 2023, with Bitcoin’s dominance (Bitcoin’s share of the total cryptocurrency market capitalization) rising from 38% in January to around 52% in December, making it the most noteworthy ecosystem in 2024 one. There are at least three major catalysts driving its resurgence next year: (1) the fourth Bitcoin halving in April 2024, (2) institutional investors expected to approve multiple Bitcoin spot ETFs, and (3) programmable Enhancements in functionality, both based on base protocols (such as Ordinals) and layer 2 and other extensible layers (such as Stacks and Rootstock) .

At the infrastructure level, we believe we will see the proliferation of Bitcoin L2 and other scalable layers to support smart contracts. The Bitcoin ecosystem should coalesce around one or two Turing-complete smart contract languages, with top contenders including Rust, Solidity, or extensions to Bitcoin's native languages (such as Clarity). This language will become the "standard" for Bitcoin development, similar to how Solidity is considered the "standard" for Ethereum development.

We also see the fundamentals of a possible “DeFi Summer 2.0” for Bitcoin. With the current market capitalization and total value locked (TVL) of Wrapped BTC (WBTC) at around $6 billion, there is clearly a huge demand for Bitcoin in the DeFi space. Today, about 10% of Ethereum’s $273 billion market capitalization is TVL ($28 billion). As Bitcoin DeFi infrastructure matures, we may see Bitcoin DeFi total value locked (TVL) rise from the current $300 million (<0.05% of market cap) to 1–2% of Bitcoin market cap ( Currently about $10–15 billion) price ). In the process, many of Ethereum's DeFi practices are likely to be transferred and "naturalized" to Bitcoin, such as the recently emerged BRC-20 Inscription and ideas such as Stake like Babylon's L2.

Bitcoin NFTs, such as those engraved on Ordinals, may also become increasingly popular in 2024. Due to Bitcoin's greater cultural awareness and meme value, web2 brands (such as luxury retailers) may choose to release NFTs on Bitcoin, similar to how Tiffanys partnered with Cryptopunks to release "NFTiff" in 2022 "Pendant Series.

2. Tokenized social experiences for new consumer use cases

Web2 has moved from social to finance, and Web3 is moving from finance to social. In August 2023, friend.tech pioneered a new form of tokenized social experience on Base L2, where users can buy and sell fragmented "shares" of other people's X (fka. Twitter) accounts, reaching a peak of 30k ETH TVL (10 (approximately $50 million in investments in January) and inspired several "copycat projects" such as post.tech on Arbitrum. It seems that friend.tech has successfully pioneered a new token economic model for the SocialFi space by financializing Twitter profiles.

In the coming year, we expect more experimentation in the social space, with tokenization (as both fungible and non-fungible tokens) playing a key role in reshaping the social experience. Fungible tokens are more likely to be novel forms of points and loyalty systems, while non-fungible tokens (NFTs) are more likely to serve as profile and social resources (such as trading cards). Both can be traded on-chain and participate in the DeFi ecosystem.

Lens and Farcaster are two leading web3 native applications that combine DeFi with social networking. Projects like Blackbird will also promote tokenized points systems for loyalty programs in specific verticals (such as restaurants), reinvent the consumer experience using a combination of stablecoin payments and tokenized rebates, and functionally offer credit cards. on-chain alternative.

3. The increase in TradFi-DeFi “bridges” such as stablecoins and mirror assets

There has been a lot of legal action in the crypto space in 2023, including several high-profile victories for the industry, such as the XRP ruling and Grayscale ETF lawsuit victory, as well as justice being served in the Binance and FTX financial fraud cases. At the same time, institutional interest and potential ETF approvals for Bitcoin and Ethereum have increased significantly.

By 2024, we expect a significant increase in institutional adoption, as they seek not only ETFs but also tokenized real-world assets (RWA) and TradFi financial products. In other words, TradFi assets will be "mirrored" in DeFi, and crypto assets will increase their exposure in the TradFi market, creating a TradFi-DeFi "bridge" that brings the two worlds closer together, thereby increasing Investor liquidity and diversification.

Stablecoins will become one of the most important links between the TradFi and DeFi worlds, with stablecoins such as USDC and PYUSD gaining wider acceptance as portfolio options and payment instruments. Circle is said to be considering an IPO in 2024 , and we may also see increased issuance and usage of non-USD stablecoins, most notably Euro-backed stablecoins such as Circle’s EURC, as well as GBP, SGD, and JPY Stablecoin. Some of these stablecoins may be launched by state-backed actors. This may also lead to the growth of on-chain fiat currency FX markets. Tokenized Treasury bonds have already gained traction, with $800 million tokenized through platforms such as Ondo .

4. Cross-pollination of modular blockchain and zero-knowledge proofs

The concepts of modular blockchain and ZKP have matured significantly over the past year, such as the recent launch of Celestia mainnet, Espresso's Arbitrum integration, RiscZero's open source Zeth prover, and Succinct's launch of the ZK marketplace. An interesting trend is how these two narratives are coming together, with companies in the ZK space “modularizing” by focusing on specific verticals such as coprocessors, privacy layers, proof markets, and zkDevOps.

In the coming year, I expect this trend to continue, with zero-knowledge proofs becoming the interface between different components of the modular blockchain stack. For example, Axiom's ZK coprocessor leverages ZKP to provide proof of historical state, which developers can then use to perform computations in DApps. As ZKP becomes the common interface between these different providers, we will see a new era of smart contract composability. This provides greater flexibility to developers building DApps and lowers the barrier to entry for the blockchain stack. On the consumer side, ZKP will likely see more use cases as a way to protect identity and privacy, such as in the form of ZK-based decentralized IDs.

5. More computing-intensive applications are on the chain, such as AI and DePIN

A lot of time, effort, and capital has been invested in solving the scalability problem of decentralized applications. Today, most scalability issues have been resolved — gas fees on Ethereum L2 are below $0.02 (compared to $11.5 on Ethereum mainnet), and fees on Solana are even 3–4 orders of magnitude lower .

As this trend continues over the next year, we believe that computationally expensive applications (applications can consume gigabytes of RAM) will become more economically viable on-chain in the near future. This includes on-chain artificial intelligence systems, decentralized physical infrastructure networks (DePIN), on-chain knowledge graphs, and vertical applications such as fully on-chain games and social networks. All of this has the potential to fundamentally reshape the on-chain data economy, greatly improving the experience for users and developers as they are freed from onerous gas fees and tight constraints on computing power.

Examples of computationally expensive projects that can take advantage of this much cheaper on-chain “computation” include Hivemapper creating a decentralized Google map on Solana, Bittensor creating a decentralized machine learning platform, Modulus Labs creating a decentralized machine learning platform on ZKML and AI Efforts to generate NFT art, The Graph's on-chain knowledge graph initiative, and Realmsverse create on-chain game worlds and legends on Starknet.

6. Integration of public blockchain ecosystems and the “hub and spoke” model of application chains

There has been a surge in infrastructure projects over the past few years. Although common technology classifications are Layer 1 (L1) and Layer 2 (L2), from a user experience perspective, there is not much difference. This is especially true for general public blockchains; today, L1s like Solana or Avalanche are direct competitors to L2s like Arbitrum or zkSync in terms of users, projects and volume.

With this homogeneity, liquidity becomes a centralizing force in general public blockchains, benefiting larger existing players such as Arbitrum, Optimism, and Solana, with the four largest ecosystems currently accounting for approximately the total value locked (TVL) 90%. Smaller ecosystems must focus their efforts on specific verticals (e.g. social, gaming, DeFi) to maintain an edge, effectively becoming “application chains” or “sector chains”. Three of the top 10 L2s in TVL (dydx, Loopring, Ronin) are actually application chains focusing on a single vertical field. The TVL "break-in" of smaller, newer L2 chains such as Base and Blast also relies heavily on a single "killer app" (such as friend.tech and Blur respectively) to establish a beachhead in numbers.

Additionally, most of the leading general public blockchains have released application chain toolkits (OP Stack, Arbitrum Nitro, StarkEx, etc.) to allow application chains to leverage liquidity on these public networks and place them in their ecosystems in system orbit. As a result, we are starting to see a "hub and spoke" model, where there are some general public blockchains that act as a central "hub" with many application-specific "spokes" surrounding them. By 2024, it may be worth keeping an eye on the major Aggregation-as-a-Service vendors leveraging this "hub and spoke" initiative, such as Caldera, Conduit, and Eclipse.

in conclusion

As we enter 2024, we may have weathered the worst of the bear market, turned the page on the series of brutal crashes we’ve seen over the past year and a half, and are ready to start exploring new use cases. Today, we are at an inflection point where cryptocurrency is no longer just about financialization, but a broader concept of how we use blockchain to redefine the consumer, social, and developer experience. I’m excited to see what the future holds for this emerging industry this year as we use decentralized technology to reimagine our digital culture.

Then and now :: This rally VS. Previous peaks

Ken Rogoff wrote a wonderful book, Why This Time Is Different: Eight Centuries of Financial Folly. Having humbly read the book and thought about some of my own experiences and felt like "but, this time is so different" , I'm going to go out on a limb and share some of the differences I've seen.

This rally was markedly different from previous rallies.

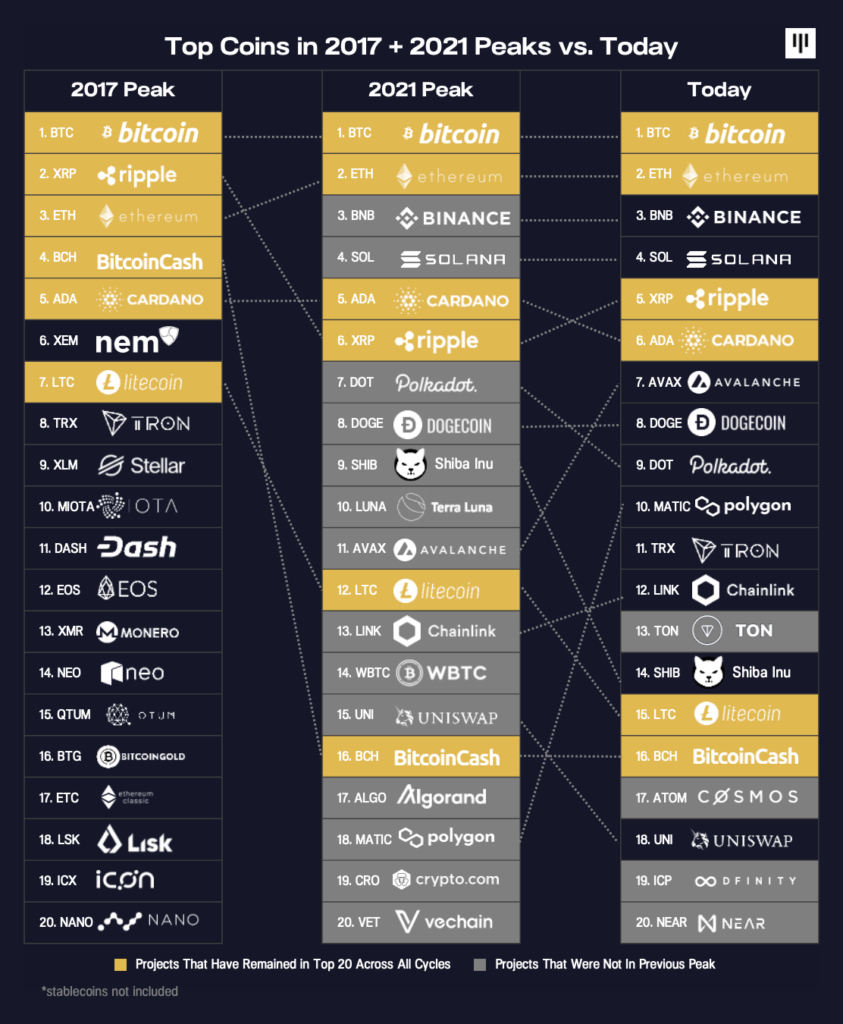

The 2021 peak saw massive exodus of top coins. At the height of the ICO-led craze in 2017, 14 of the top 20 tokens quickly fell out of the top 20. They fell far. Thirteen of the declining coins currently rank 123rd on average by market cap. (Tron was the only project to drop out of the top 20 and return.) In hindsight, we can say that this was a speculative bubble and hype for an unproductive token.

The 14 coins that fell out of the top 20 in 2017 were all replaced by coins that did not exist at the previous peak. That's crazy. Pure creative destruction.

What’s interesting about this rally is how little has changed. This is a complete reversal from the previous cycle.

This time, the top six companies, which account for 83% of the market capitalization, are all the same. Eight of the top ten are the same. There are 14 coins that remain in the top 20.

Through all these cycles, Bitcoin has been constant. There are only six tokens in all three lists (shown above in gold). In the twelve years since Litecoin’s launch, only four coins have occupied the second position: Litecoin, XRP/Ripple, Ethereum, and Bitcoin Cash. Bitcoin Cash is only held for one day! Bitcoin has always occupied the championship belt.

We have talked about this idea many times during 2022: while the magnitude of this decline is similar to previous bear markets, it is unique in that blockchain is not facing an existential crisis. Most price movements are driven by leverage and headlines caused by bad actors. That's why it's no surprise that we see the same projects coming back. Their decline is not because they are not good projects, but because of sympathy for the overall market. Solana is a particularly good example.

Three styles of blockchain

If you abstract away the three main flavors of blockchain: Bitcoin, Ethereum, and a combination of all the other projects, you can see the cycles.

The first thing to note is that Ethereum’s share has been fairly stable since its founding in 2017–18. The only major pullback was during the 2020–21 bull run, when competing layer 1 hyper-scalable blockchains such as Solana and Avalanche gained significant market share.

What fluctuates is Bitcoin and other things.

One of the earliest non-Bitcoin tokens and Pantera's first venture, Ripple, and its XRP token surged to 27% of the total market on May 17, 2017.

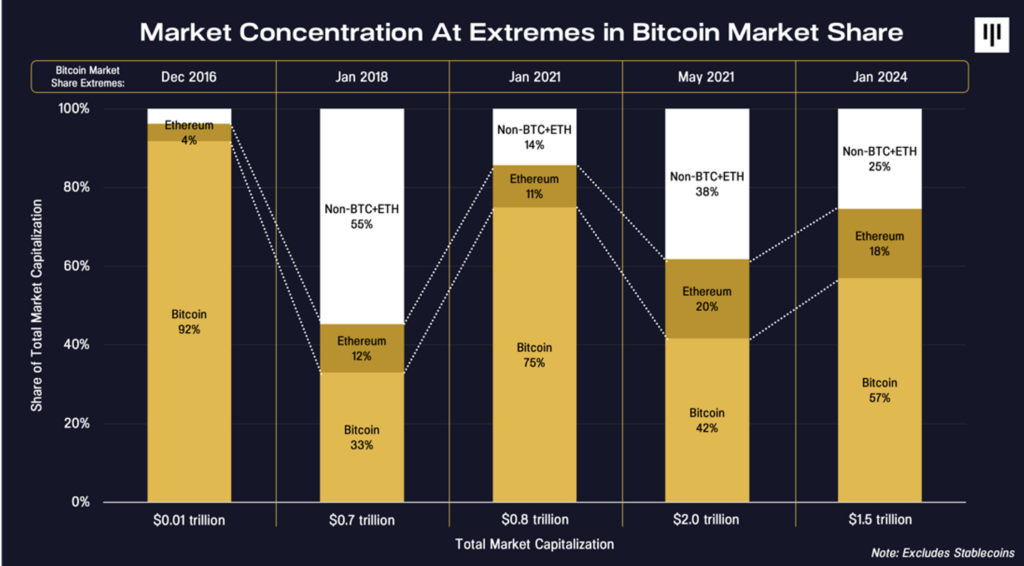

The chart below depicts three major issues in blockchain during the recent extremes in Bitcoin market share since 2016.

In January 2018, when Bitcoin and Ethereum market shares were at historic lows, the non-Bitcoin + Ethereum share was 55%.