Within two days, Near officially announced two controversial actions. First, the foundation announced a 40% layoff, and then released a 2024 update roadmap.

On January 11, the Near Foundation announced that it would reduce its team members by 40%, with the main impact being on the marketing, business development and community teams, involving a total of 35 employees. This layoff will reduce the Near Foundation team members from the initial 90 to about 55.

The next day, Near released the 2024 update roadmap, introducing stateless verification, developing zkWASM, improving data availability, etc. to improve the usability, scalability and decentralization of the NEAR protocol.

Today's encryption market is in a critical period of turning from bear to bull. Most Web3 projects are recruiting people and expanding their team size to welcome the next bull market. However, the Near Foundation is completely contrary to mainstream expectations and has laid off employees on a large scale and reduced the size of its team.

Why did Near announce massive layoffs at a critical moment in the crypto market cycle? Is this the long-rumored "infighting within the team" or a "self-rescue act"?

Foundation cuts 40% of its workforce

Currently, users and the market view the Near Foundation layoffs as more positive than negative. Most community users believe that the layoffs are the result of Near founder Illia Polosukhin (referred to as Illia, translated as "One Dragon" in Chinese) after returning to the foundation to reorganize the team, which not only streamlined expenses, saved costs, but also eliminated unnecessary personnel. This is a great benefit to Near’s future development.

The reason for this conclusion is that two pieces of key information were released in Near's layoff announcement. One is the result of a thorough review of the foundation's activities in order to improve its work efficiency; the other is the disclosure of the foundation's financial situation. Asset holdings are valued at more than $1.3 billion.

Yilong said in the layoff announcement that the Near Foundation, together with its Board of Governors (NFC), conducted a thorough review of the foundation's activities. During this process, there was feedback that the foundation was not always effective, sometimes moved too slowly and Trying to do too many things at once. After this review, the team decided to significantly integrate the core foundation team, narrow the scope of work, and focus on more impactful activities.

It said that as part of this reorganization, the NEAR Foundation will reduce its team by approximately 40%, affecting 35 colleagues, mainly marketing, business development and community teams.

The layoff announcement stated that the Near Foundation's financial position remains strong and sound, with more than $285 million in legal tender, 305 million NEAR tokens (valued at more than $1 billion), and $70 million in investments and loans.

After the announcement of Near's layoffs, some community users expressed their optimism that Near's layoffs would streamline personnel, improve efficiency while reducing expenses, and solve the long-standing complaints from users about the foundation's low efficiency and lack of attention to the development of the ecosystem. problem, and the solid financial data also indirectly clarified the long-rumored rumor that "Near Foundation is short of money."

In this regard, a community user commented that Near has finally begun to pay attention to the issue of the foundation. As an important organization that promotes the ecological development of blockchain projects, the foundation not only manages the huge treasury funds that determine the future of the project, but also needs to formulate policies that meet the requirements of the project. Its own tonal development, marketing strategies and support for high-quality early ecological projects, etc. Today, the Near Foundation has publicly stated that it has more than 1.3 billion US dollars in crypto assets under its control, and most of these funds will be used to support the development of the ecosystem, or to vigorously support the ecosystem. project, which is a great benefit to Near’s future ecological growth.

On the day the layoffs were announced, the price of the NEAR token surged from $3.19 to $3.69, an intraday increase of more than 15%. On January 22, the price of NEAR fell back to $2.9 and fluctuated up and down.

Three "top leaders" changes in 2 months

There is an important reason behind users' concern about Near Foundation's layoffs: whether this layoff is related to founder Yilong's return to the foundation.

Since September 2023, the Near Foundation’s senior management has undergone three major changes.

In September last year, Marieke Flament, CEO of the Near Foundation since the first quarter of 2022, announced her resignation.

Subsequently, the foundation was handed over to the leadership of legal counsel Chris Donovan.

On November 7, Near founder Yilong announced that he would return to the foundation as CEO, responsible for leading the Near ecosystem into the next stage of building an open network, and Chris Donova was transferred to chief operating officer.

In January 2022, after the Near Foundation announced the appointment of Marieke Flament, a former executive of Circle and Mettle, as CEO, Yilong withdrew from the foundation.

In less than two months, the Near Foundation CEO has undergone three personnel changes. Users have various opinions on the reasons for the foundation's frequent personnel changes, and there are constant rumors of internal strife within the team.

What really ripped open the veil of problems with the Near Foundation was the "Wintermute USN Exchange Controversy" incident.

On November 8, 2023, Wintermute founder Evgeny Gaevoy publicly posted on social media to criticize the Near Foundation and Aurora Labs (Near's EVM chain Aurora developer and founding members are also from the Near team) for breach of trust, saying they did not abide by the contract. Refusing to fulfill the commitment agreement to redeem the stablecoin USN worth $11.2 million.

To put this dispute simply, Aurora previously told Wintermute that it could convert any amount of USN back into USDT without providing a source of funds. Under this promise, Wintermute purchased $11.2 million worth of USN stablecoins from FTX assets, but when Wintermute redeemed USN for USDT, Near and Aurora refused.

In response to this matter, Illia and the foundation responded and explained that after USN was closed due to insufficient mortgage, the USN Protection Plan (USNPP) was established and operated by Aurora Labs to protect affected individuals. Wintermute rejected the request because it existed or used the USN it purchased from FTX for price difference arbitrage, which would bring losses to ecological users.

However, this incident once again pointed the finger at the Near Foundation and the aborted stablecoin project USN, with constant doubts about the relationship between them.

Some users left messages saying: "The Near Foundation is worse than hackers. It originally promised that USN can be exchanged for USDT, but now it is no longer supported. It swallowed tens of millions of dollars.", "The stable currency USN is not officially launched by Near at all. However, the operation of the Near Foundation seems to have an unusual relationship with the USN and seems to be an official incubation project, which is really chaotic management." The rumor that "Near Foundation has no money" also originated from here.

Public information shows that the stablecoin USN is a project issued by Decentral Bank on Near in 2022, although Decentral Bank claims that it is an independently operated community-operated project without direct financial assistance from the Near Foundation. However, since the stablecoin is mainly generated by NEAR token mortgage and received public support from the Near Foundation in the early stages of its launch, this gives users the illusion that USN is officially operated by the Near Foundation.

In October 2022, after USN announced its closure due to insufficient collateral, the Near Foundation immediately established a US$40 million fund to support the conversion of USN to USDT. This exchange support operation has made users suspect that there is an unspeakable relationship between USN and Near Foundation officials.

As of January 22, the dispute between Wintermute and the Near Foundation has not yet come to a clear conclusion, and the founder of Wintermute has not stopped complaining against it. He has said that if the Near Foundation continues to do so, he will take legal measures.

The controversy with Wintermute revealed issues such as chaotic management of the Near Foundation team and unclear boundaries of relationships with ecological stakeholders.

Yilong's return at this juncture was also considered to be an attempt to rectify the chaotic management of the Near Foundation team. Two months after returning to the foundation, he announced a layoff of 40%, which was a purge of the team.

Near’s development dilemma: stagnant TVL growth and poor on-chain applications

Since Yilong announced his return to the foundation, Near has also announced a series of new actions in terms of products.

First, the Near Foundation announced its cooperation with Polygon Labs to develop the zero-knowledge proof ZK virtual machine zkWASM; secondly, it launched a new project Near DA data availability layer to enter the field of modular blockchain; then, it cooperated with Eigen Labs to build Layer2 for Ethereum The fast termination layer shortens the transaction time and reduces the cost by one four thousandth of the original.

With the overall recovery of the crypto market, the price of NEAR currency has also been rising, from a high of $1.5 on November 8 to a high of $4.6 on December 6, a cumulative increase of more than 200%, before falling back to $2.9 on January 22.

However, judging from the on-chain operation data, this series of actions did not bring any improvement to the development of the Near ecosystem. The number of on-chain applications has stagnated and there has been no new growth in TVL.

According to the DeFiLlama data platform, TVL on the Near chain has been hovering at US$30 million for a long time since April 2023, and it did not improve until the end of December. On January 22, the value of the crypto assets locked on the Near chain was US$88.27 million. TVL ranks 31st among many public chains, and there are only 22 applications on the chain.

Regarding Yilong's series of actions after returning to the fund, community user Moli (pseudonym) regarded it as Near's self-rescue behavior. At present, Near's development is in trouble. The on-chain ecology has been stagnant for a long time. There are no new applications and user activity is not high. New vitality needs to be injected into it.

He explained that compared with chains such as Solana, Polygon, and Avlanche at the same time, Near’s development has always been slower, and the gap between them is getting wider and wider. In the last wave of EVM network hype, Near was the latest to launch and did not launch the EVM network Aurora until the end of the bull market. Now, Solana has completely emerged from the haze of the FTX collapse by relying on the ecological wealth creation effect; Polygon has successfully transformed by firmly grasping the Layer 2 narrative. It is the leading project of Layer 2 and has attracted a group of developers; although the popularity of Avlanche has not yet fully recovered, the hype among locals on the chain has not stopped.

Correspondingly, the status of the Near network has always been unstable, and there are basically no new applications on the chain. There are only a few established DEX, lending, and liquid staking protocol for participation.

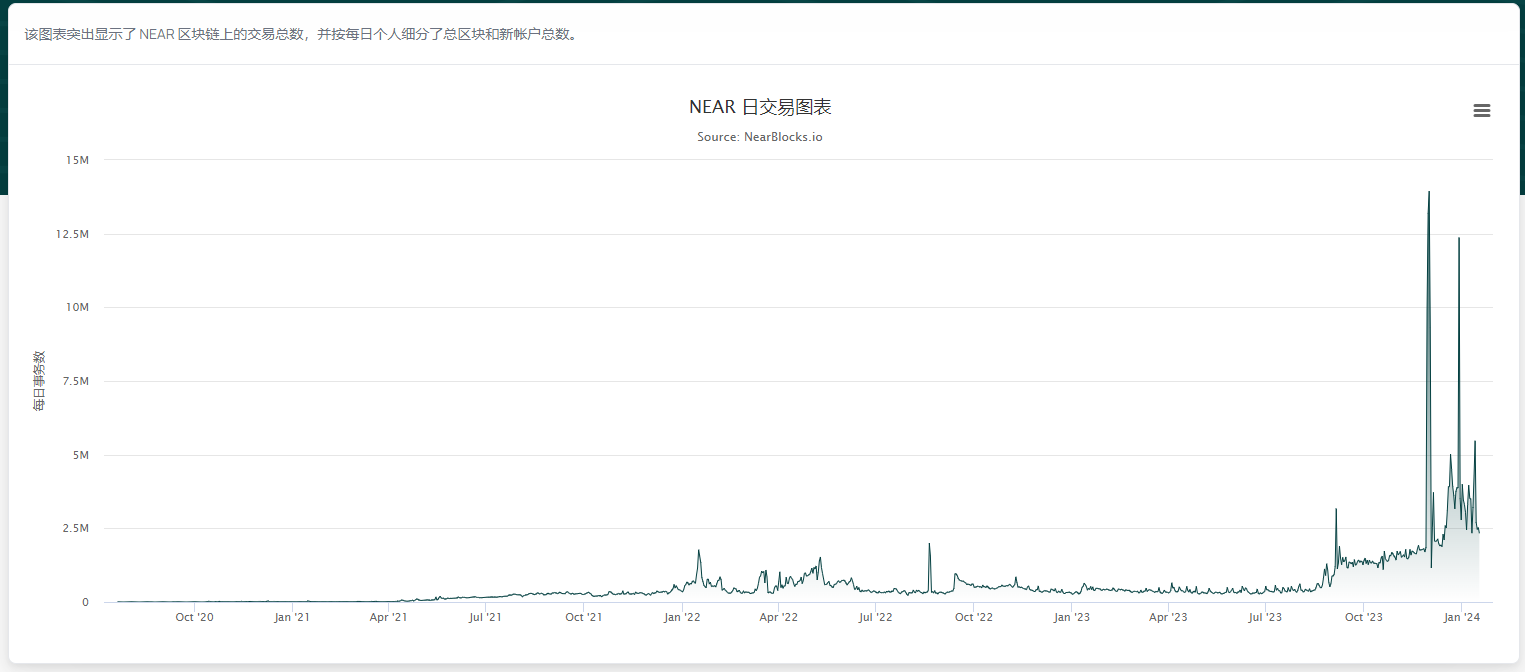

During the public chain inscription hype in November last year, the Near chain also launched the inscription project NEAT, and received retweet support from Yilong and many Near ecological KOLs. It attracted a large number of users to participate, and even caused Binance and OKX to temporarily Stop withdrawing coins. On November 30, the number of transactions on its chain exceeded 10 million, setting a single-day transaction history, and the number of new wallet addresses on the chain exceeded 170,000.

Although the emergence of NEAT has brought a huge amount of heat and attention to the Near ecosystem in a short period of time, the ecological applications cannot bear it. In addition to hyping the price of Inscription, users can't seem to find a more interesting application.

As the popularity of Inscription cooled down, the price of NEAT currency also began to fall. It has dropped by more than 50% in the past 14 days and is now quoted at US$0.1. At the same time, the transaction data on the Near chain also began to decline.

On January 17, according to ChainCatcher news , Near ecological re-pledge platform Linear announced that it would airdrop the governance token LNR to community users. It once again attracted a wave of traffic to Near, and interactive Near ecological applications once became a new topic in the encryption community. However, after entering the ecosystem, users found that there were very few playable applications on the Near chain.

In this regard, community user Kai (pseudonym) said that although Near has made innovations in the sharding technology architecture, the current public chain competition has entered a white-hot stage. It is no longer a competition in early technology, but a competition in the application ecology and on-chain Competition for the operational capabilities of project parties, including users, developers and communities.

He suggested that the most important thing for Near right now is to focus on developing the ecosystem, especially applications such as DeFi. Don’t wait until there are no applications to take over every time traffic comes. Moreover, ecological prosperity does not occur in clusters and requires official support for developers. , the community continues to provide resource support and empowerment.

Focusing on Web2 chain reform, Near is trying to "help itself"?

Regarding the stagnation of TVL data on the chain, Nick, a long-term NEAR holder, said that the level of TVL data currently does not truly reflect Near’s on-chain activity. This is mainly related to the ecological development strategy adopted by Near. At present, Near encourages and has users. Cooperate with basic Web2 applications to help them rebuild their business models with the help of blockchain technology.

The strategy of “actively supporting chain modification of Web2 applications” can be confirmed from Yilong’s interview with DeFiant in January.

Regarding the development of Near ecological applications, Yilong said that at present, Near hopes to help Web2 applications that already have user groups find their own business monetization models with the help of blockchain, rather than focusing on whether the project can bring TVL.

He gave an example. Sweatcoin, the currently active project on the Near chain, was originally a Web2 sports project. Through cooperation with Near, it was successfully transformed into a Web3 walking currency earning project. The SWEAT coins earned by users sweating through exercise can not only be used for trading to earn price differences. , and can also be used to purchase cooperative brand products, such as yoga classes, daily necessities, etc.

The KaiKai application that led to a surge in transaction data on the Near chain in September 2023 was not a native encryption project on the Near network. It was a "chain-modified" shopping platform under Cosmose AI, a consumer shopping data analysis platform it co-invested in. It was launched with the help of Near With KAI-Ching, a stable currency pegged to the US dollar, users can earn additional KAI-Ching tokens by using KaiKai App to shop, play or write product reviews.

According to ecological data collected by Near Daily, KaiKai and Sweatcoin have become the projects with the most active users in the Near ecosystem in the past 30 days. KaiKai has more than 2 million active users and Sweatcoin has more than 1 million users.

Although these applications did not directly bring TVL growth to Near, their arrival also brought existing users into the Near ecosystem, but allowed Web3 technology to be used by more outside users, and the number of interactions and wallets on the chain increased. are also growing.

Perhaps by becoming a chain modification tool for Web2 applications, I have tasted the traffic dividends brought by cooperation with it. The current development strategy of Near is also focused on providing developers and users with a high-performance, good-experience underlying network, realizing the vision of Near network being adopted by the mainstream.

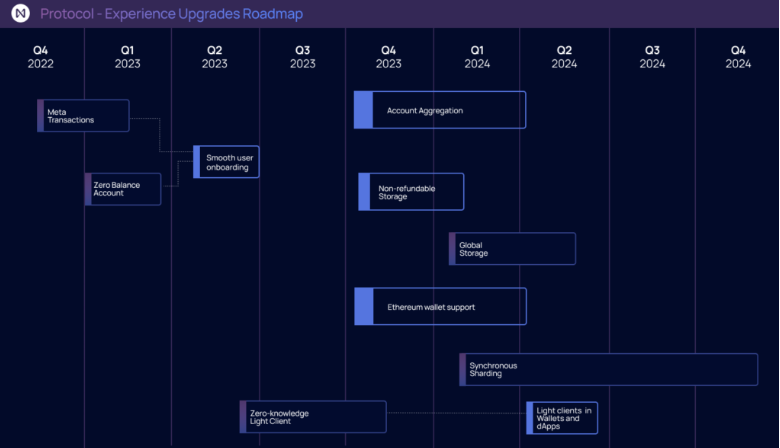

It can also be seen from the 2023 work results and Q4 update roadmap released by Near.

There are two functional improvements to the Near network in 2023 that greatly lower the threshold for using and entering the Near ecosystem. Among them, a new meta transaction function has been added to support Gas-free transactions, that is, users do not need to use NEAR tokens to pay Gas fees when using applications on the Near chain; in addition, a zero-balance account has been added, so that users do not need to hold NEAR You can create a wallet account with tokens, which solves the problem that users have complained about in the past that creating a wallet account requires holding more than 0.1NEAR tokens first, making it easy for new users to use the application.

In the 2024 roadmap, in terms of product performance, the stateless verification function introduced by Near can not only improve the security of the network and avoid the implementation of fraud proofs, but also improve the throughput and performance of each shard; and The zkWASM co-developed by Polygon can be used as the EVM execution environment for L2 networks, and the launched data availability layer NEAR DA can help developers build L2 networks more easily.

In terms of user experience, the proposed account aggregation function will allow users to use one Near account to control accounts on different chains, which is also an important step in the Near chain abstract vision plan. In addition, the problem of Ethereum wallets such as MetaMask being unable to support the Near network that causes headaches for users will also be solved.

Currently, NEAR DA, the data availability layer product launched by Near, has been integrated with developer stacks such as Polygon CDK and Arbitrum Orbit. Developers can use it to build their own L2 or L3 networks.

However, regarding the roadmap for this update, some community users commented that this is in line with Near's consistent "imitation" style of revising the roadmap every quarter. First, they copied Ethereum sharding, and then turned to AI things after FET and other AI boom this year. Now after modular TIA and Layer2 became popular, they copied the DA layer. I hope that from now on, Near's imitation strategy will end. Be able to forge a different path on your own.