Author: Jesse Coghlan, Cointelegraph; Compiler: Songxue, Jinse Finance

According to a newly unsealed court document, former Binance CEO CZ tried to use his multi-billion-dollar stake in Binance.US as collateral to be allowed to temporarily return to the United Arab Emirates.

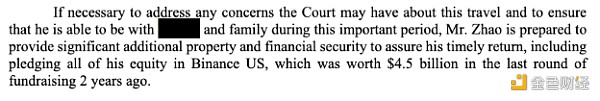

Court documents dated January 24 revealed a previously sealed letter dated December 22 from CZ’s attorney to Judge Richard Jones. According to the letter, CZ provided as collateral his stake in Binance.US, which was worth $4.5 billion based on a funding round two years ago.

CZ had hoped to travel to the United Arab Emirates in early January to help friends or family members who were undergoing surgery and were hospitalized, but the letter noted that federal prosecutors did not agree to the request.

Judge Richard Jones denied the request during a closed hearing on Dec. 29, court records show.

CZ pleaded guilty to money laundering charges on November 21 and is currently free in the United States on $175 million bail. He faces a maximum sentence of 18 months in prison and has agreed not to appeal against a sentence of no more than that length.

Some elements of the recently declassified correspondence remain redacted.

Redacted portions of the letter show that CZ provided his Binance.US stake. Source: Court Audience

Prior to this, Jones had prevented CZ from traveling to the UAE because of his huge wealth and properties abroad. This was originally part of his bail conditions. Jones said that if he returned to the UAE, he "may escape."

He ordered the former Binance boss to stay in the United States until his sentencing date on February 23. CZ’s specific whereabouts in the United States are unknown. He has maintained a relatively low profile on X, and his last release was on December 6, 2023.

CZ resigned as Binance CEO in November 2022, admitting to operating an unlicensed exchange and violating the Bank Secrecy Act as part of a $4.3 billion settlement with U.S. regulators .