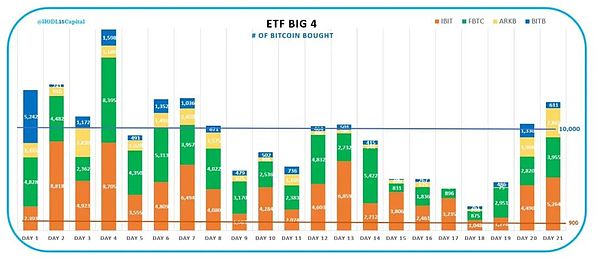

Since the SEC approved more than a dozen Bitcoin spot ETFs in January 2024, institutions have "didn't wait to raise the whip" and tried their best to attract customers and compete fiercely. Needless to say, the two big brands, BlackRock (IBIT) and Fidelity (FBTC), have seen their positions increase dramatically. Upstart Bitwise (BITB) and Cathie Wood’s Ark Fund (ARKB) are also unwilling to be outdone and actively buy. These four have thus become the “Big 4” of Bitcoin spot ETFs in the U.S. stock market.

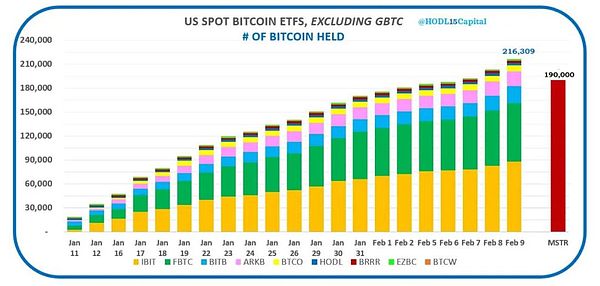

After the approval of the Bitcoin spot ETF, in just 20 days, nine of the ETFs accumulated a net purchase of more than 216,000 BTC. This number has exceeded the 190,000 BTC positions accumulated by the well-known large currency hoarder Micro Strategy over the past three years.

Spot ETFs have truly brought purchasing power to Bitcoin, and it is a purchasing power that cannot be underestimated. This strong purchasing power from the U.S. stock market has also made the Bitcoin spot ETF officially rank among the most popular ETFs in the history of Wall Street!

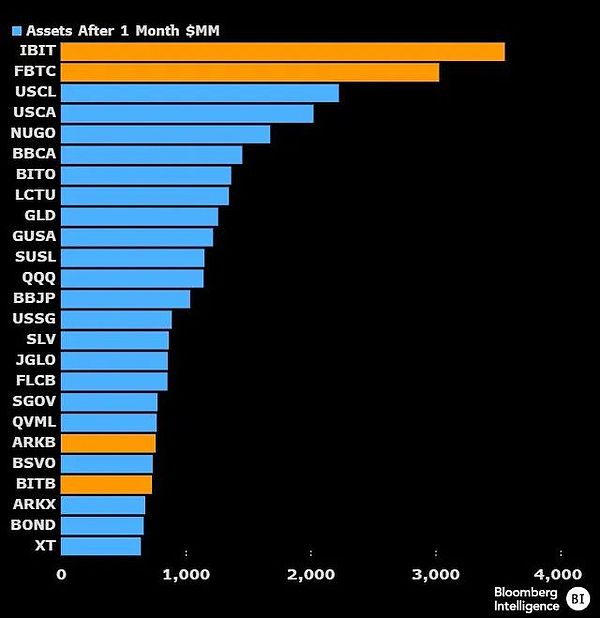

The above chart shows that within one month of the ETF’s listing, BlackRock’s IBIT ranked first and Fidelity’s FBTC ranked second in terms of the amount of funds that poured in, putting them ahead of the various ETF products behind them.

Of course, it far exceeded the performance of the gold ETF (GLD in the picture) that year.

However, why is it that while ETF issuers are buying and selling, the market is calmer than when it was first listed? On January 11, BTC reached a maximum of 48.9k. On February 11, BTC just returned to above 48k.

The key is that the institutions' opponents, whether they are small shrimps holding less than 1 BTC, "middle class" holding 1-10 BTC, or large investors holding 10-100 BTC, all have been net sellers in the past 30 days. out.

Only institutions with positions of more than 100 BTC are constantly adding positions.

It can be seen that the main theme of the market in the past month has been "changing hands".

Buying power and selling power have reached a dynamic balance. Retail investors gave up their BTC and institutions hoarded them.

The chips you gave up at 40,000 dollars may be bought back at a higher price after 100,000 dollars.

In this secret battle over the control of ETFs and BTC, retail investors and institutions walked towards each other, passed each other, and said good night to each other.