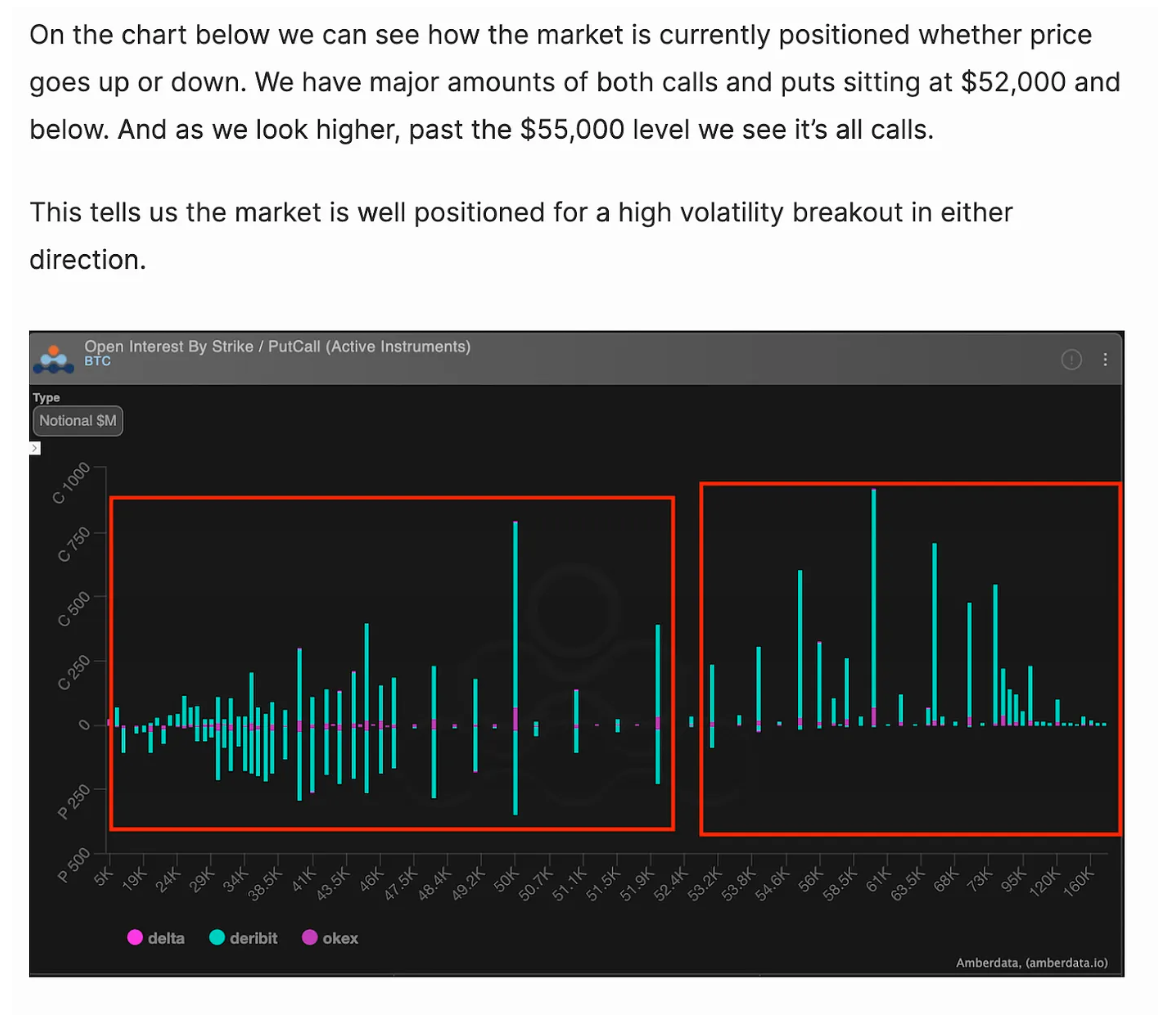

Last week, we mentioned that the market was preparing for a high-volatility breakout between $50,000 and $53,000, with heavy put option holdings below $50,000 and above $55,000, as we saw in the net position chart last week shown.

The following is a snippet from last week’s update, friends who missed it can refer to it:

On Monday, this positioning powder keg found its spark as billions of dollars flowed into Bitcoin ETF spot.

If you tuned in to "The Trading Pit" on Tuesday morning, you heard Ben Lilly and I break down how this unfolded.

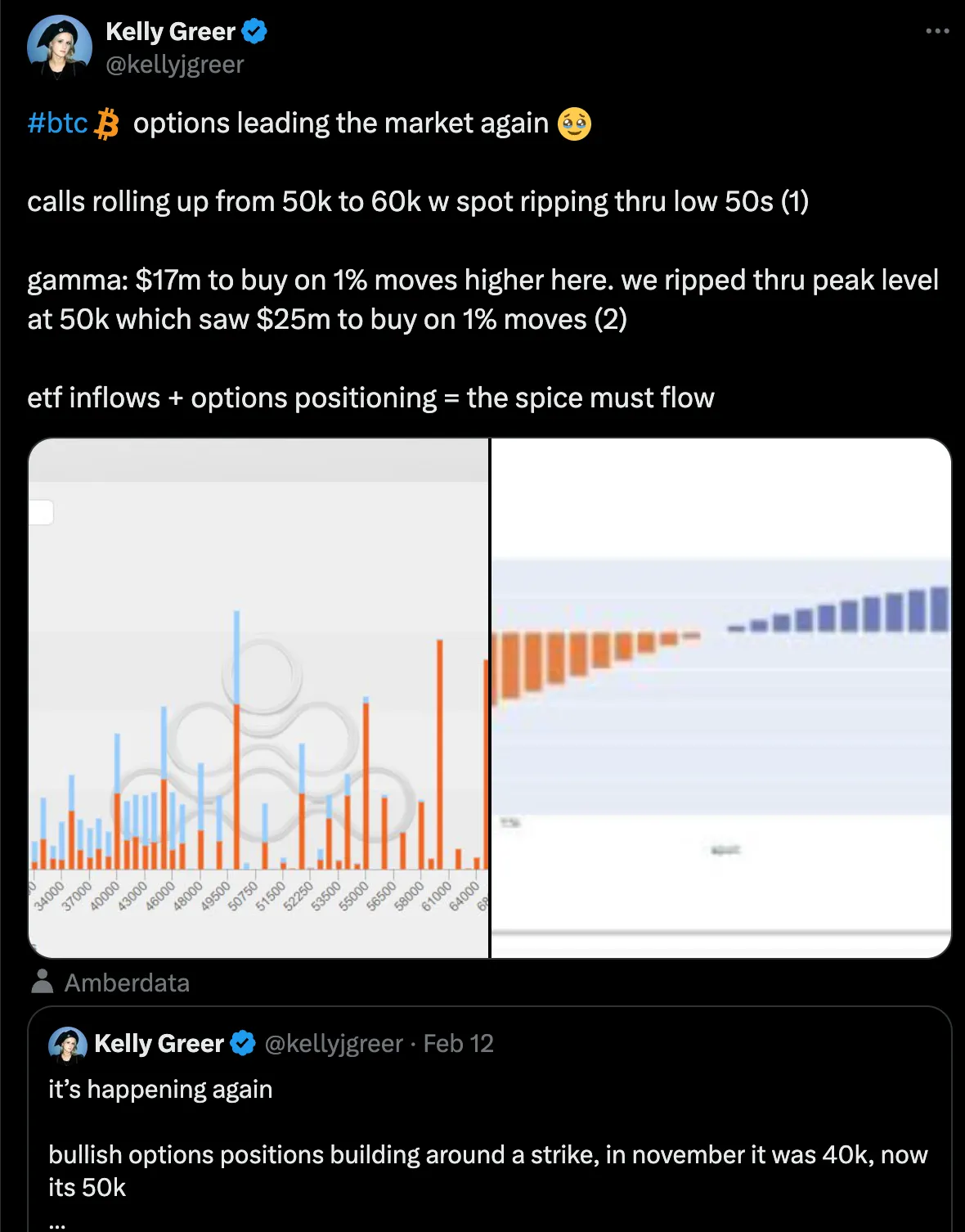

In short, as the price accelerates past the crucial $52,000 mark, the race for options traders is on. It was these market makers who sold the previously out-of-the-money call options. The price movement forced them to start hedging short (short also refers to selling the contract) call option positions on the Bitcoin price, like a man on fire looking for water... all because the price went parabolic.

As Galaxy HQ’s Kelly Greer points out, this means that for every 1% rise in Bitcoin, traders are forced to buy an additional $17 million worth of BTC in order to remain delta neutral.

It's like someone using just one finger to lift a bulldozer on its fulcrum.

Combined with continued spot buying from ETF inflows and short-shoring unwinding, this creates the perfect storm for BTC to surge above $60,000 for the first time since 2021.

This is not dissimilar to what happened last October when it broke $30,000, another example of the reflexive nature of the options market.

Since most cryptocurrency traders rarely venture outside of perpetual futures and spot markets, this remains a misunderstood area of the market. However, traders being on the wrong side of “gamma” is often the main driver of Bitcoin’s biggest single-day moves.

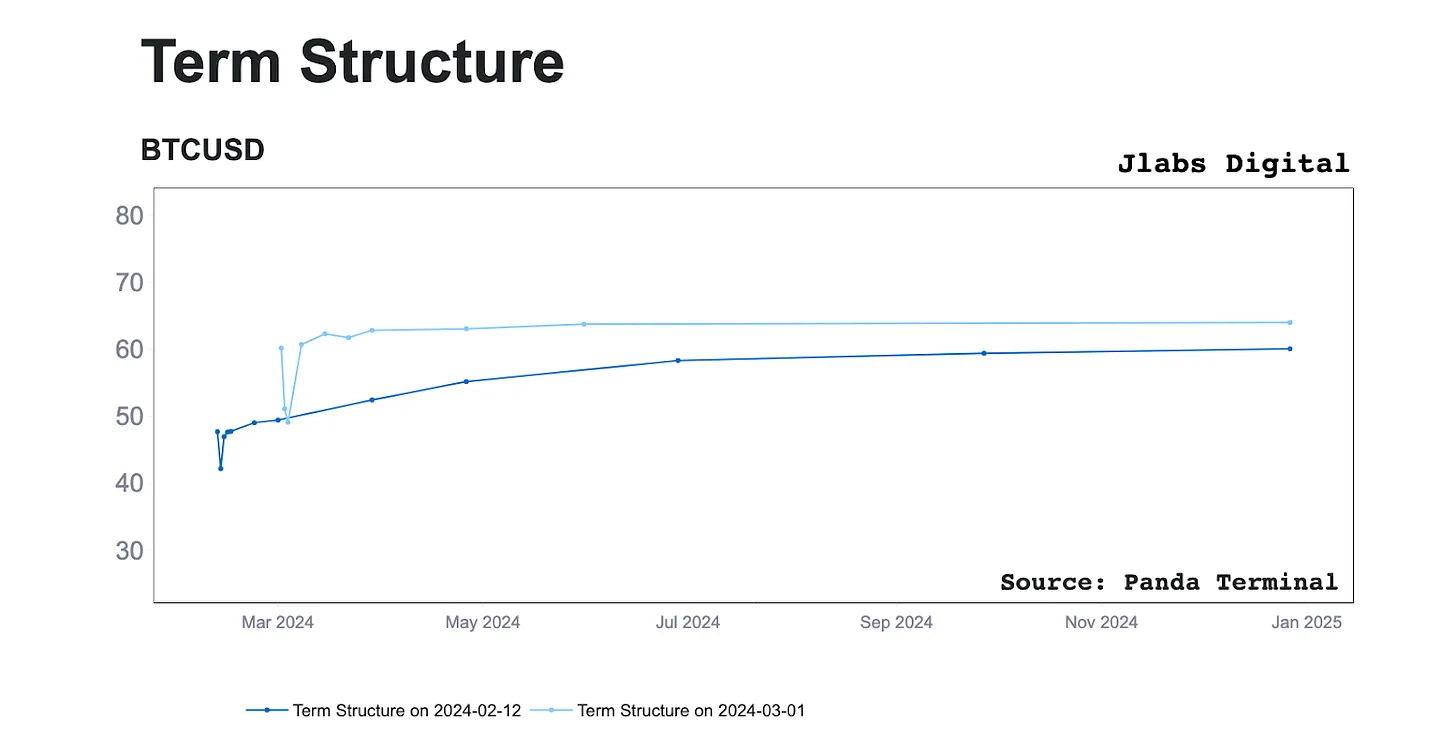

If we look at the impact of trader deviations on these calls on the options market, we can now see how the current term structure chart compares to the old term structure chart.

Term structure plots provide a glimpse into the extent to which option pricing is affected by implied volatility. Comparing two different structural diagrams helps us identify trends.

The notable change we see is that traders may have learned the lesson of selling volatility at too low a price.

If we compare the current IV structure to what we saw in early February (dark blue line), we see that the slope in early February is being priced in. We mentioned this as an opportunity just two weeks ago, but it has now been taken.

This correction caused the IV index to be broadly higher today.

The sharp increase in IV values also suggests that the market is preparing for greater volatility throughout 2024. Otherwise, we could see more selling pulling this value lower. If you want to learn more about the nuances of this topic, we have prepared for you an educational series on how to effectively trade Bitcoin options in 2024, as this movement in the term structure occurs during the current phase of the Bitcoin cycle. has happened.

Hope you've been paying attention.

But having said that, now may be the time to be cautious about long volatility positions at the end of the first quarter, and avoid call FOMO if you don't already have a position, as the recent surge in premiums will be difficult to sustain throughout March.

If you miss this move, remember that the options market moves quickly, and the worst thing you can do after missing a move like the one we just experienced is to chase the rise and kill the fall. The result of this can be paying high premiums on a contract that has a very high depreciation rate.

There are bound to be better opportunities throughout this year to capture volatility when premiums are lower.

Low-risk, high-reward volatility setups like the one we saw last week occur all the time in options, so don't rush into someone else's exit liquidity out of fear of missing out when options premiums trade at such high short-term premiums .

We'll be sure to let you know when this happens again, but trade it safe for now and remember that volatility can take away gains just as quickly.

see you later....