Summary

The recent attack on WOOFi, a decentralized application built by WOO, has raised concerns in the decentralized finance (DeFi) space. The attacker manipulated the WOOFi swap contract, resulting in approximately $9 million in losses. This blog post delves into the details of the attack, examining the attacker's behavior and the vulnerability exploited.

Project: WOOFi

Chain: Arbitrum

Attacker: 0x9961190B258897BCa7a12B8f37F415E689D281C4

Tx attack: 0xe80a16678b5008d5be1484ec6e9e77dc6307632030553405863ffb38c1f94266

Attacked contract: 0xeff23b4be1091b53205e35f3afcd9c7182bf3062

Deep Dive Understanding

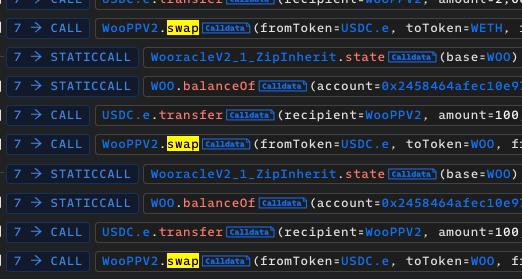

Attacker Behavior

Preparing stage:

The attacker initiated the attack by obtaining funds through flash loan.

The acquired funds totaled 10,504,796 USDC.e and 2,721,172 WOO.

The attacker collateralized the 7,000,000 USDC.e in Slio Finance to borrow 5,092,663 WOO using the collateralized USDC.e.

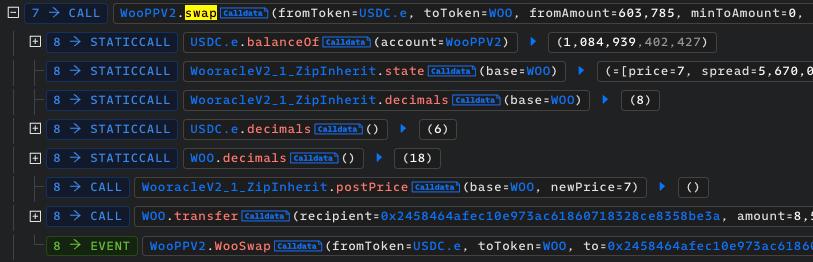

Price manipulation WOO token:

Utilizing 300,000 USDC.e, the attacker executed multiple swap operations within WOOFi's swap function. It raised WOO price from 56,884,100 to 60,400,479.

The actual attack occurred when the attacker swap back 8,196,117 WOO for USDC.e. This led to drop the price of WOO, reaching 0.00000007, an 8.62 million times.

Finally, the attacker used a small USDC.e to gain more than 8,574,462 WOO via swap. The attacker then repaid the initially borrowed funds, ultimately cashing out and absconding with the drained funds.

Vulnerability Analysis

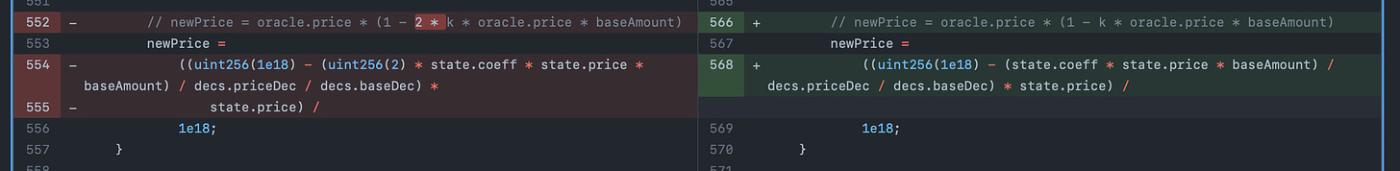

Examination of the contract code revealed a flaw in the price data processing mechanism during the conversion of BaseToken to QuoteToken, _calcBaseAmountSellQuote function.

The main vulnerability in model is direct calculating the amount by multiplying and dividing based on the price, so that there is no slippage in the exchange process but the price will change with the rate.

The WOOFi team promptly addressed the issue by removing the constant coefficient, as evidenced by the commit on their GitHub repository.

Conclusion

In conclusion, the attack on WOOFi highlights the vulnerabilities that can arise from flaws in economic model calculations within decentralized applications. The attacker's manipulation of token prices and subsequent draining of funds underscores the importance of robust security measures in DeFi projects.

The Verichains team regularly updates the most recent vulnerabilities discovered in projects they have assessed and those they are presently auditing, as well as information from the blockchain security community.