The Market

Bitcoin has finally reached its all-time high (ATH) last week, touching $69,000 first on Tuesday and then $70,000 on Friday. We experienced two consecutive weeks of strong positive returns in BTC. The last time we saw such strong returns was at the beginning of January 2021, when BTC reached its then ATH at around $38,000. Two months after that ATH, it saw another whopping 70% return, reaching a level above $60,000. We may see similar escape velocity again, with BTC potentially reaching above $100,000—a 50% increase from today’s level—before the halving.

The funding rate peaked last Tuesday, leading to a large liquidation potentially due to high leverage, briefly pushing BTC's price down to $58,000. However, strong buying pressure quickly pushed the price back above $60,000. The funding rate has since come down toward the end of the week, indicating healthier leverage in the market.

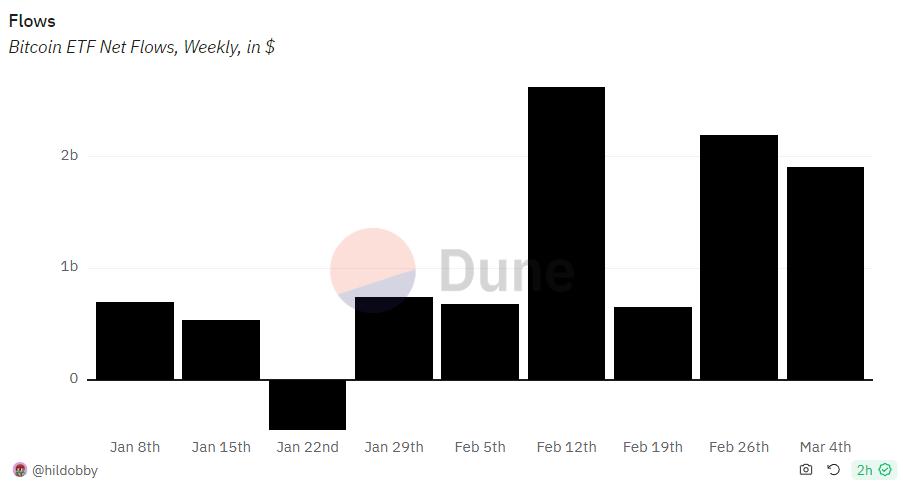

The BTC spot ETFs are still demonstrating strong inflow, with $1.9B last week. As we mentioned in previous weeklies, institutional demand from wealth management platforms has not yet fully materialized. Encouragingly, Blackrock filed an amendment last week to include BTC exposure to include BTC exposure in its Strategic Income Opportunities Fund (BSIIX), a $36B asset allocation fund. This, combined with Fidelity Canada’s move to add BTC to its asset allocation ETFs, signaled the beginning of institutional adoption. Even Arizona Pension has advanced a resolution that would enable state pension funds to allocate to the Bitcoin ETFs.

The biggest risk factor to break the current euphoria of price actions is macro, which looks promising as of now. Powell indicated that “Fed can and will begin rate cuts this year” in his congressional hearing last week, conditioned on the economy stays strong and inflation starting to cool. The February jobs report shows a slight uptick in the unemployment rate but strong new jobs added. The February CPI number will come out next week, while the current estimation according to Cleveland Fed’s nowcast is showing stable CPI and PCE heading into March.

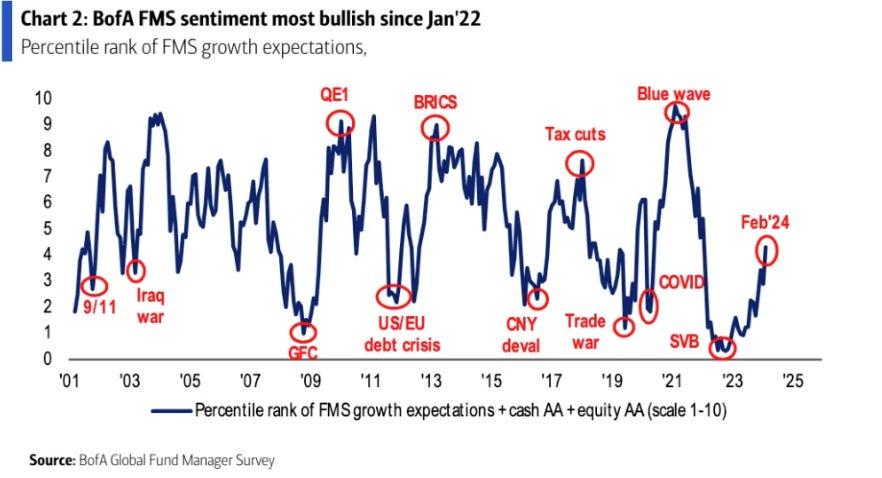

The traditional market is also buoyed by rising bullish sentiment, as the Bank of America survey of large global equities managers has shown the most bullish sentiment since January 2022.

According to the same survey, TradFi manager’s allocation to Tech stocks has raised allocation to tech by 10 percentage points MoM to net 36% overweight. The main driver is the rise of AI, as firms like OpenAI and NVIDIA are enabling mass adoption. On a YTD basis, NVIDIA stock has outperformed BTC, while BTC outperformed the broad tech stock index QQQ. The crypto+AI sector has served as a high beta play on AI theme, with RNDR, the largest decentralized computing protocol by market cap, outperforming NVDA. The sentiment around AI is particularly strong heading into NVIDIA’s GTC conference. We expect more volatility in the AI sector as investors observe whether rising demand in AI would match NVIDIA”s increased production.

DeFi Update

ETHBTC ratio has started forming an ascending wedge pattern this year as two big catalysts in the Ethereum ecosystem are playing out:

Dencun Upgrade

The Dencun upgrade refers to an Ethereum Improvement Proposal (EIP 4844) that makes sending large chunks of data to Ethereum cheaper and more scalable. The biggest beneficiary of this upgrade is Ethereum L2s as Data Availability (DA) cost accounts for ~80% of the total transaction cost. It is estimated that Dencun will reduce Ethereum’s overall transaction cost by ~30%, while reducing L2’s overall transaction cost by 10X or more. L2 super chains, such as OP and ARB are positioned well to reap the benefits as they have the lions’ share of L2 activities.

We also expect to see a Cambrian explosion of app-specific roll-ups as Rollup-As-A-Service (RAAS) providers make it easy to build a roll-up on Ethereum without the need of heavy blockchain engineering expertise. AltLayer, for example, enables the no-code launch of L2s with advanced features such as ZK and decentralized sequencing, as well as a menu of alternative DA choices.

Furthermore, interoperability solutions that unify liquidity among different L2 and L1s stand to benefit from the growth of app-specific rollups and chains. The recent funding round for Wormhole at $2.5B and LayerZero at $3B have been bullish for interoperability solutions with tokens such as Axelar and Chainflip. Chainflip’s JIT AMM will be live on March 11th, offering users low-slippage swaps for native BTC and major chains, providing a competitive alternative to Thorchain. Given Chainflip and Thorchain are the only two solutions that support native swapping of BTC to other assets, and FLIP’s circulating market cap is less than 1/10th of Thorchain’s RUNE, we believe there is more room for FLIP to grow.

EigenLayer Mainnet Launch

It is widely expected that EigenLayer mainnet will be live in Q2 2024. The liquid restaking protocols (LRTs) are planning to airdrop their tokens before the Eigen Mainnet launch, followed by AVS airdrops likely in Q3 after EigenLayer is live. The “wealth creation” effect of these airdrops will provide fuel for ETH holders who choose to restake and earn potential airdrops from the LRT, Eigen and the AVS protocols. As we mentioned in the last weekly, ETH’s TAM is expanded because of EigenLayer, and the liquid supply of ETH is reduced due to staking, which will provide a near-term tailwind for ETH’s price.

As more airdrops come to the market, there is a risk for protocols competing for limited attention and capital. There is also uncertainty around how the points are linked to future airdrops and the timing of the airdrop, as we learnt from Starknet. It is estimated that there are 115B points issued by crypto projects so far. Therefore, we believe protocols that enable points trading, such as Whales Market and KelpDAO (founded by the Stader team) will see increased demand as investors seek to cash out before the bull market runs out of steam.

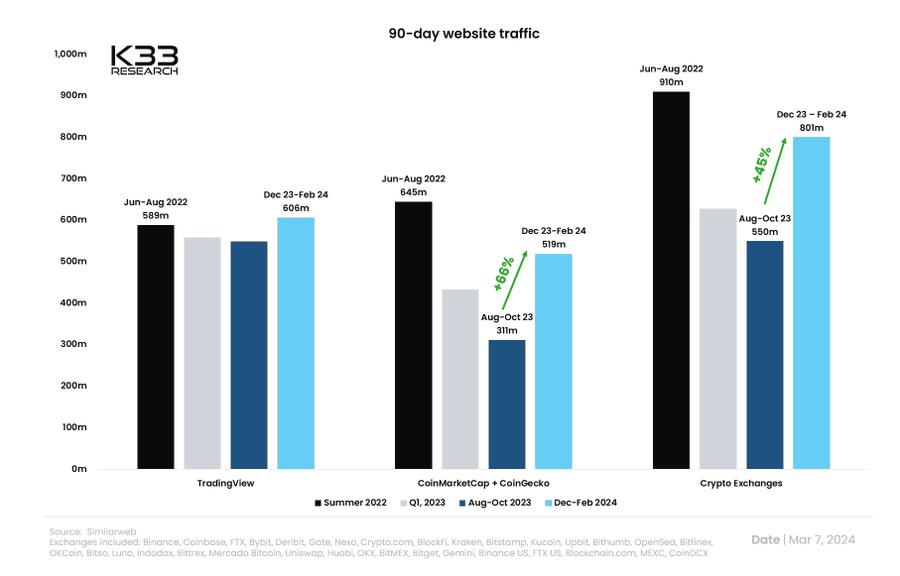

With strong buying pressure supporting BTC and ETH, and the macro environment continues to be supportive, we see the bull market momentum continue for crypto. Crypto website traffic has increased drastically this year, although still below the level seen at the last peak of the bull market. As BTC enters mainstream, we expect this bull cycle to be longer but also milder for BTC. Altcoins will behave like an elastic band tied to BTC, with higher up and downside based on their own narrative strength. We are likely in the first third inning of a bull market, so buckle up and enjoy the ride!

Top 7d Gainers and Losers

Top 100 MCAP Winners

Pepe (+96.60%)

FLOKI (+77.46%)

Fetch.ai (+69.55%)

Arweave (+56.69%)

RNDR (+57.91%)

Top 100 MCAP Losers

Bitcoin Cash (-13.35%)

Kaspa (-11.83%)

Bitcoin SV (-11.33%)

Flare (-9.07%)

Chainlink (-6.74%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.