Global Market Overview

- The A-share market as a whole was volatile and differentiated, showing a shallow V trend, and closed slightly higher this week. The Hong Kong stock market first rose and then fell, closing overall higher. The increase was greater than that of the A-share market. The higher-than-expected CPI and import and export data during the period boosted sentiment. The financing support of Vanke from many banks alleviated market concerns. Foreign investors have been bullish on the Chinese stock market.

- Although technology stocks with better performance once led the stock market to rebound, as CPI and PPI both exceeded expectations, the market cooled down on continuous easing expectations. The three major U.S. stock indexes collectively closed down this week; while inflation growth in Germany and France slowed down, European stock markets as a whole closed higher. The average salary increase Japan's Haruto has received so far is 5.28%, a 30-year high. Analysts believe this may prompt the Bank of Japan to raise interest rates in March, putting Japanese stocks under slight pressure.

- Chip stocks have fallen for three days in a row. BTC hit a record high of $73,600 on Wednesday and then fell back to a minimum of $64,500 (-12%), continuing its weakness over the weekend.

- The 10-year Treasury bond yields of major countries in the United States and the Eurozone rose significantly this week, with the 10-year Treasury bond exceeding 4.3% and returning to the high point a month ago. The Fed's "front-running" deal appears to have failed once again, with inflation's stubbornness forcing investors to make adjustments.

- WTI crude oil prices rose 4% this week, and copper prices rose 6%, mainly supported by the possible tightening of supply after Chinese smelters discussed joint production cuts; gold prices fell 1%.

- The U.S. dollar strengthened, but the RMB performed strongly among non-U.S. currencies and closed down only 0.14%. Compared with the euro, which fell by 0.5%, the British pound and the Australian dollar fell by 1%, and the Japanese yen fell by 1.3%.

Macroscopic points

In the past year and a half, even when CPI was higher than expected, the drag on U.S. stocks was short-lived. The results of the CPI day last week were similar, but the market's concerns about inflation and deflation were rekindled after the release of PPI, although the current data is not enough to prove that inflation will rebound significantly.

However, it is indeed possible that the macro economy will shift from the "Goldilock" economy (strong recovery, moderate inflation) in the fourth quarter of last year and the first quarter of this year to the "stagflation" in the first and second quarters of this year. The reasons why "stagflation" may occur in the first and second quarters of 2024 are:

- Inflation levels in some developed countries and emerging markets have risen to a certain extent. Some emerging market central banks have already begun to "pause" interest rate cuts. High inflation will put pressure on economic growth.

2. The U.S. labor market has finally begun to cool down, as shown by:

- Full-time jobs have fallen by about 3 million in the past three months

- Attrition rate drops to lowest level since COVID-19 lockdown in Q2 2020

- Labor demand from small businesses also fell to its lowest level since the second quarter of 2020

- A cooling job market means that economic growth momentum is weakening.

3. The United States will achieve economic growth of 3.2% and inflation of 2.x% in the fourth quarter of 2023, which is a "Goldilocks" ideal economic state. But entering the first quarter of 2024, U.S. economic growth may slow down to below 2%, while inflation is still around 3–4%, so it is a stagflation combination.

4. Oil prices have significantly outperformed the Nasdaq index this year, which also confirms the market’s concerns about stagflation.

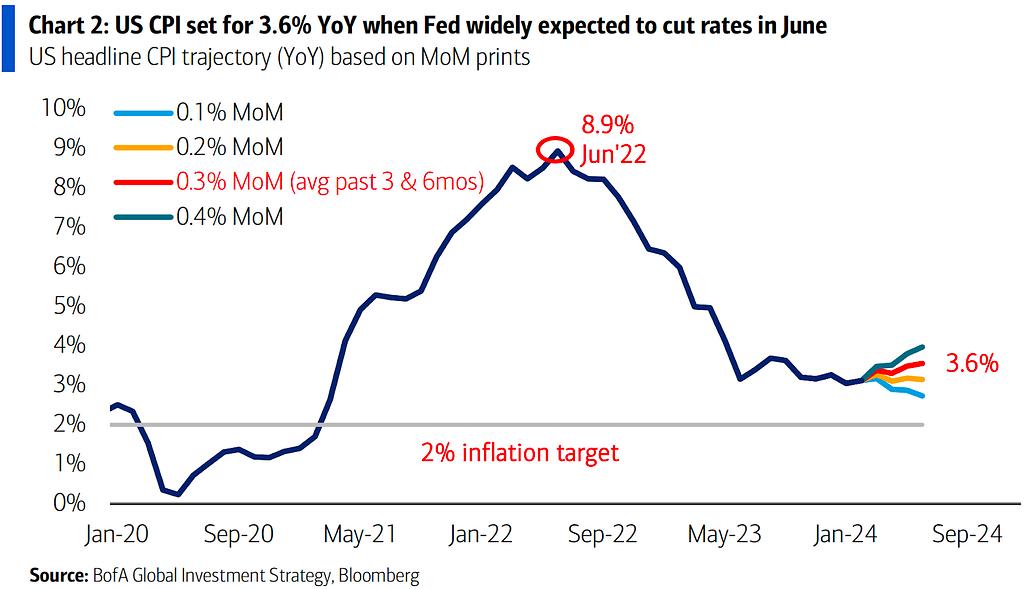

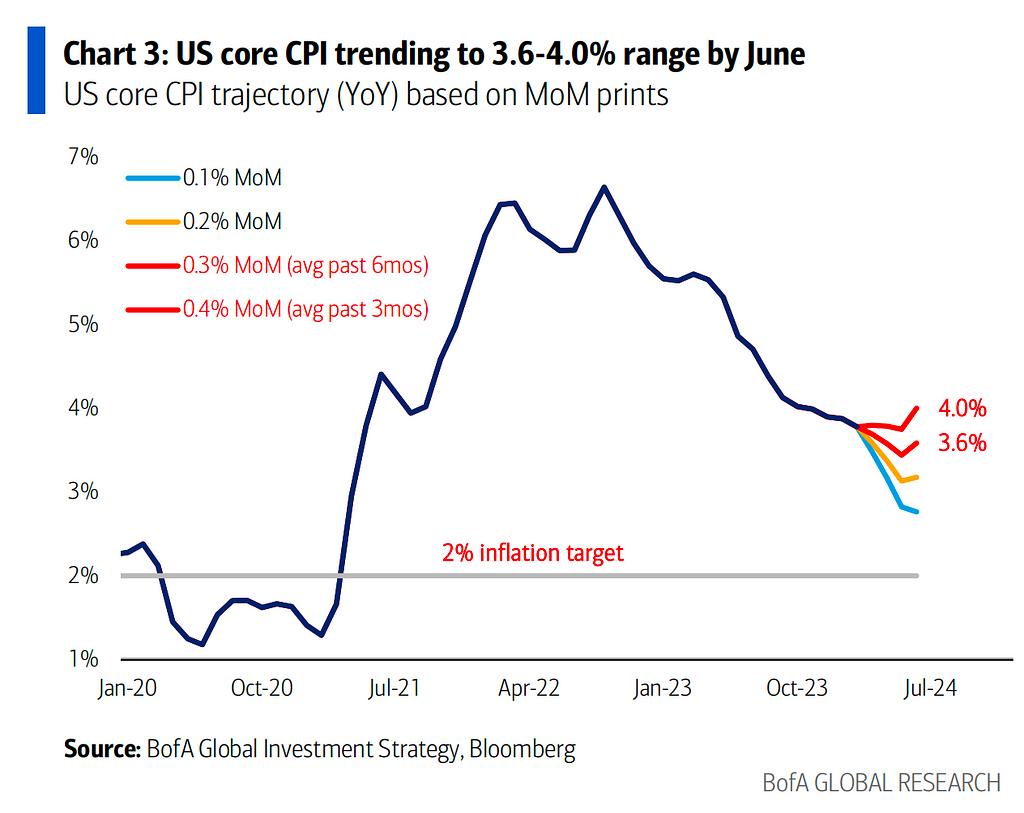

The overall/core inflation rate in the United States will still remain at 3.6-4% in June, and the market expects the Federal Reserve to cut interest rates by then, even if it is still far from 2%. In this way, the Fed acquiesces to higher inflation and can reduce the United States' debt burden. But the decline in policy credibility means currency devaluation, which is the important background for cryptocurrency and gold prices to hit new highs:

During the period of stagflation, asset allocation needs to focus on anti-inflation and defensive assets and avoid asset classes that are sensitive to economic cycles.

According to historical experience, during the stagflation period, due to weak economic growth and high inflation, there are obvious differences in the performance of different asset classes:

Assets that will rise:

- Commodities: Stagflation is usually accompanied by rising commodity prices, especially agricultural products, energy and other daily necessities. Precious metals such as gold are also often favored as a hedge against inflation.

- Real estate: When inflation rises, the prices of real estate and other real estate assets tend to rise to combat the risk of inflation.

- Defensive stocks: stocks of companies in essential consumer fields such as daily consumption, medical care, etc., with stable cash flow and strong risk resistance.

- Anti-Inflation Bonds (TIPS): The income is linked to the level of inflation and can hedge against inflation to a certain extent.

Assets that will fall:

- Growth stocks: The profits of these companies are highly sensitive to economic cycles and will face greater pressure when economic growth is weak, such as technology stocks.

- Regular fixed-income bonds: Rising inflation erodes a bond’s real yield, so bond prices tend to fall.

- Cash: While holding cash is a defensive choice, the purchasing power of cash can be quickly diluted when inflation is high.

- Optional consumer stocks: representative industries such as catering, tourism, retail, etc. When economic growth is weak and residents' disposable income declines, these non-essential consumer demands tend to be compressed.

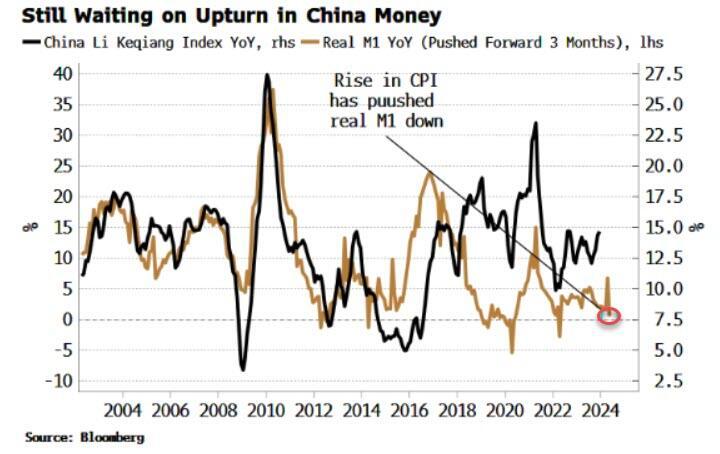

China’s liquidity has not yet been released

Although China's economy is stabilizing and recovering, the recovery is still moderate and the effect of monetary easing is limited. This indicates that China's economy will be difficult to rebound strongly in the coming period and will still face certain downward pressure. The market has been expecting the government to step up policy efforts and provide stronger support for economic recovery.

Figure – Money supply M1 and the broader Li Keqiang Index:

liquidity

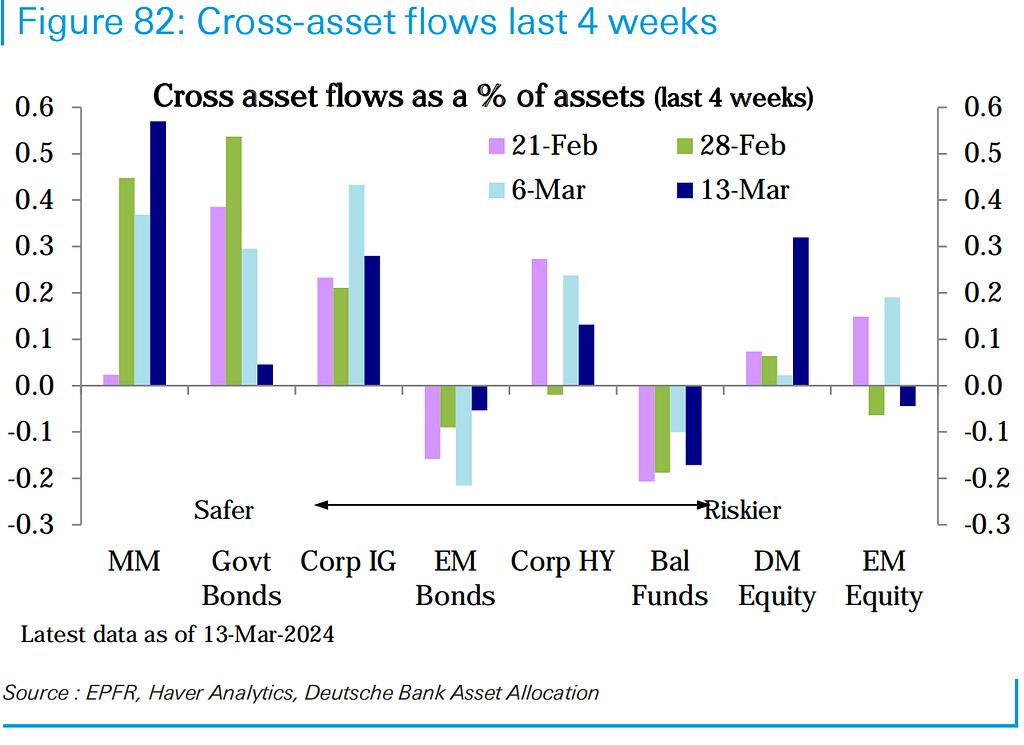

Equity funds this week recorded their largest weekly inflows in three years, totaling $55.7 billion, driven mainly by record inflows in the United States ($56.1 billion). Inflows into bond funds slowed to a six-week low of $7.8 billion. Money market funds attracted $49.7 billion in inflows, a 10-week high.

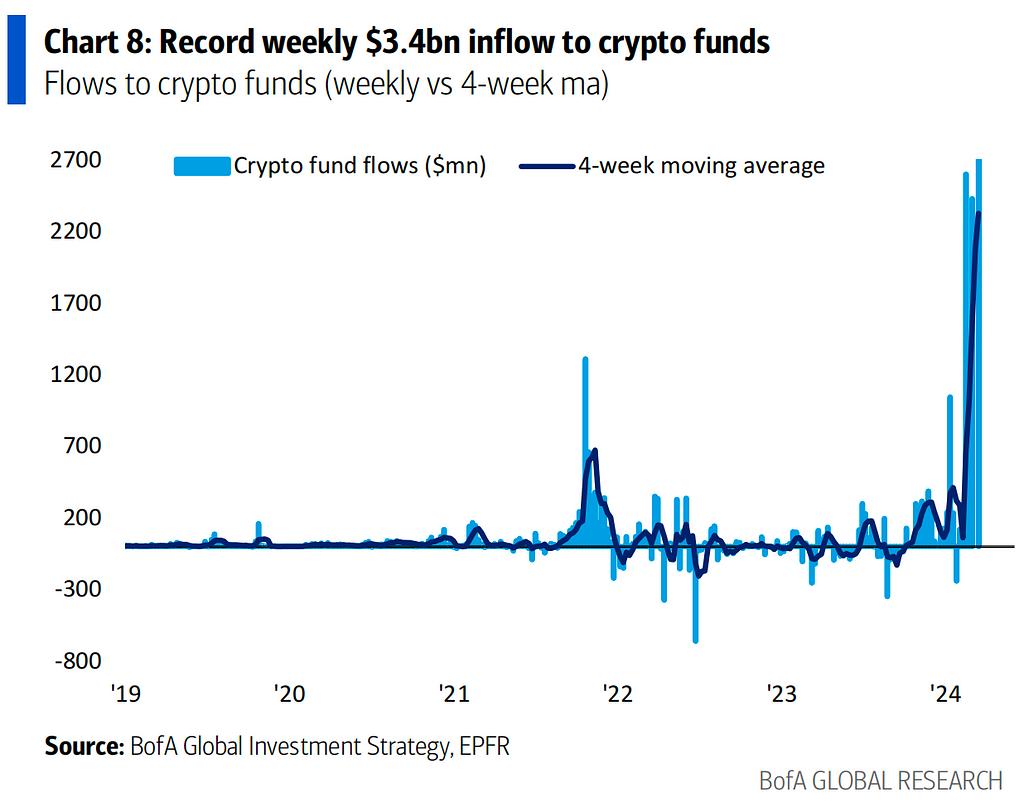

Cryptocurrency fund inflows set new record again with $3.4 billion

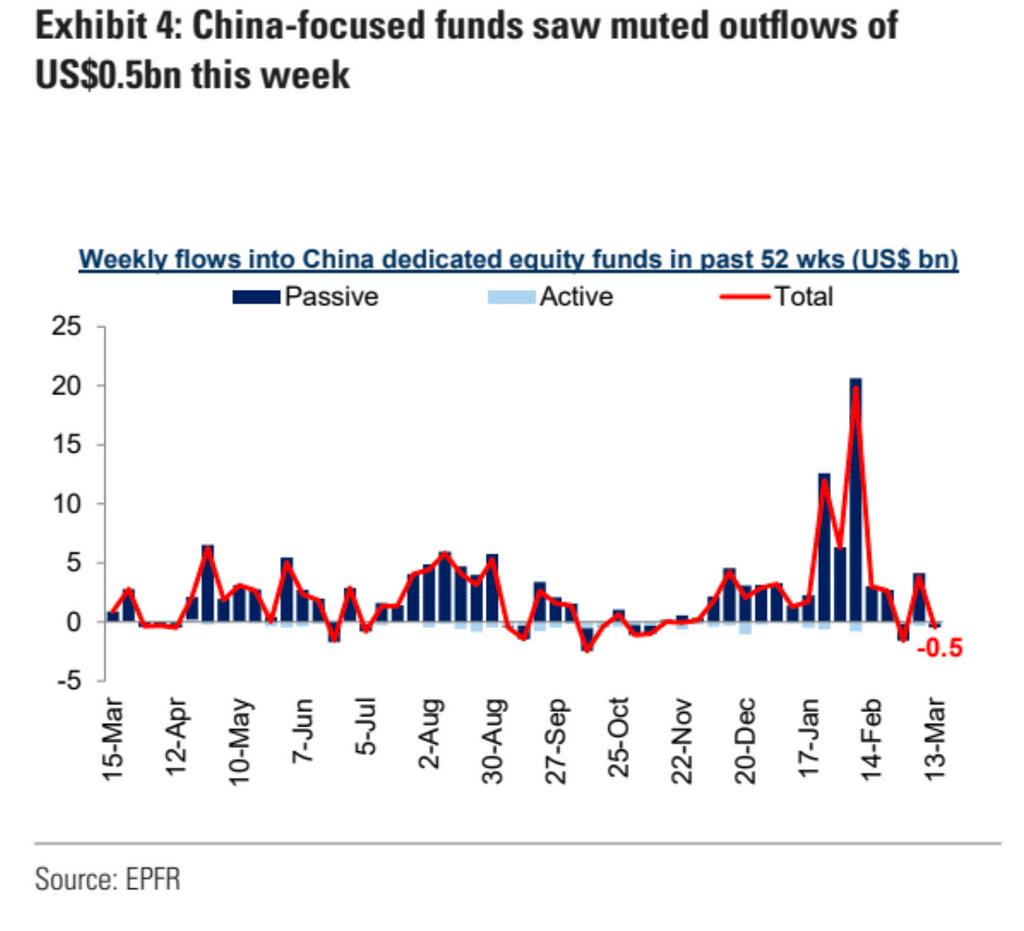

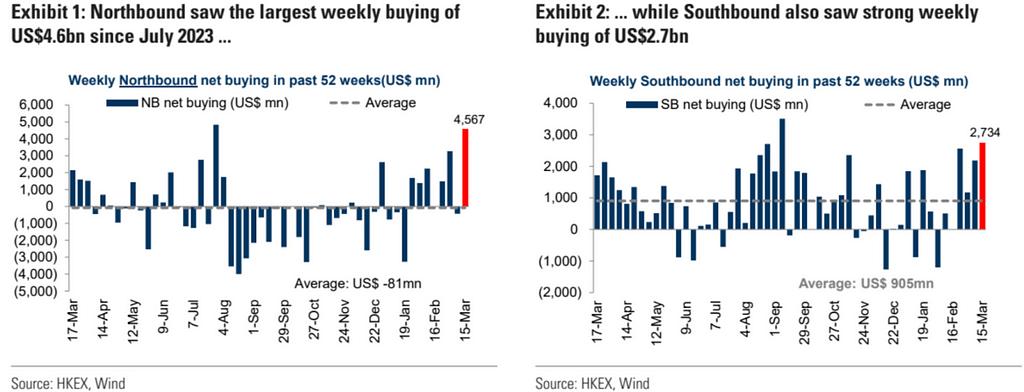

The concept of China has cooled down internationally, and value funds have slightly flowed out of Chinese stocks:

However, north-south capital flows hit a new high and remain active. Judging from the breakdown of data, trading positions have changed significantly. HSBC has mainly increased its holdings recently. European and American investment banks have not changed much, and some such as UBS and Goldman Sachs have reduced their holdings. Judging from market performance, sectors such as real estate, optional consumer goods, and media and entertainment that have experienced large increases have surged, reflecting certain characteristics of short selling and covering. In addition, the increase in the weight of A-shares in the FTSE Index, which takes effect on Friday, may bring tens of millions of dollars in passive inflows, which is another reason for the large north-south capital flows.

In terms of BTC spot ETF liquidity data, there was a net inflow of US$2.5 billion throughout the week, and the transaction volume exceeded 35 billion. Although the inflow on Thursday was only 139 million, the lowest level this month, considering three consecutive days of decline and three consecutive days of net inflows, despite the slowdown, it can still be seen that buying is surging, because theoretically most When ETF prices fall, it is difficult to get inflows.

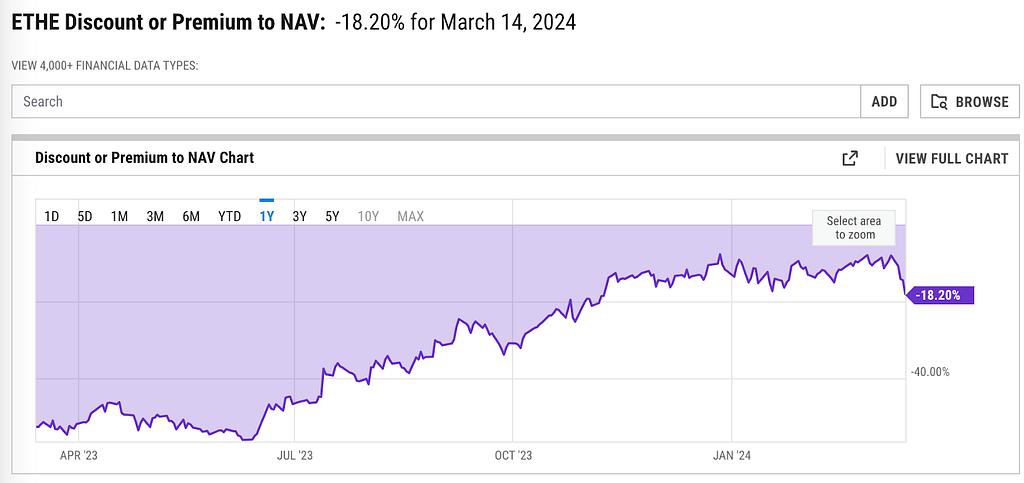

ETHE's discount to ETH narrowed from 5x% to 10% and then expanded again to 18%, mainly due to market reports that the probability of ETH Spot ETF approval in May dropped to 30%:

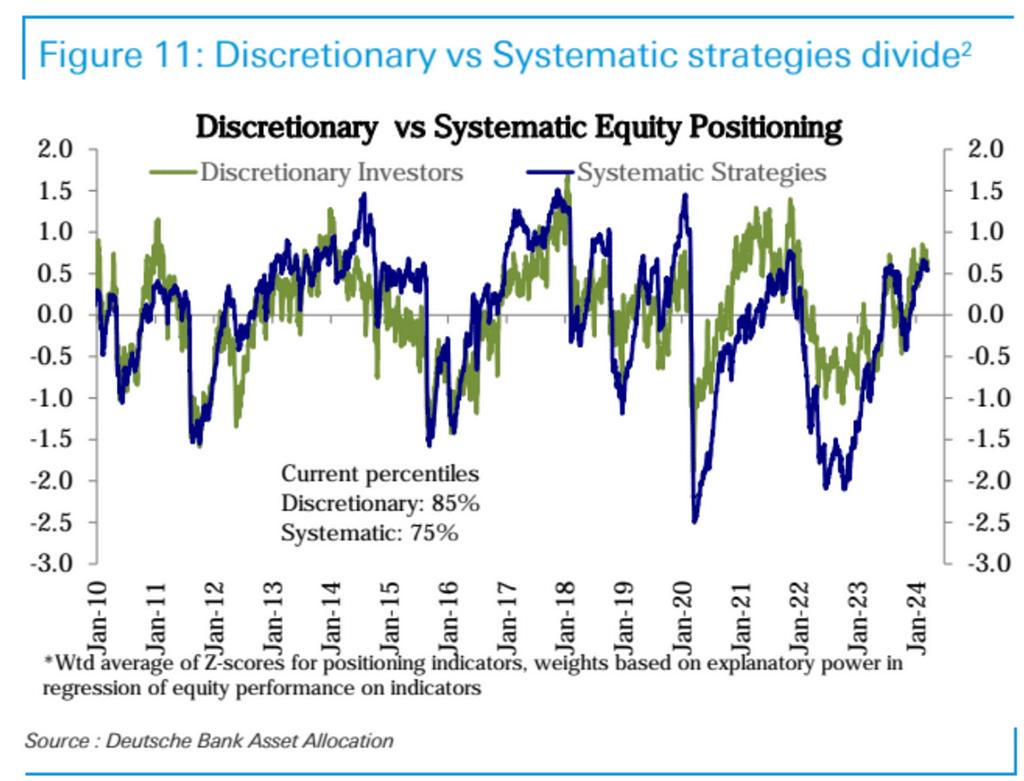

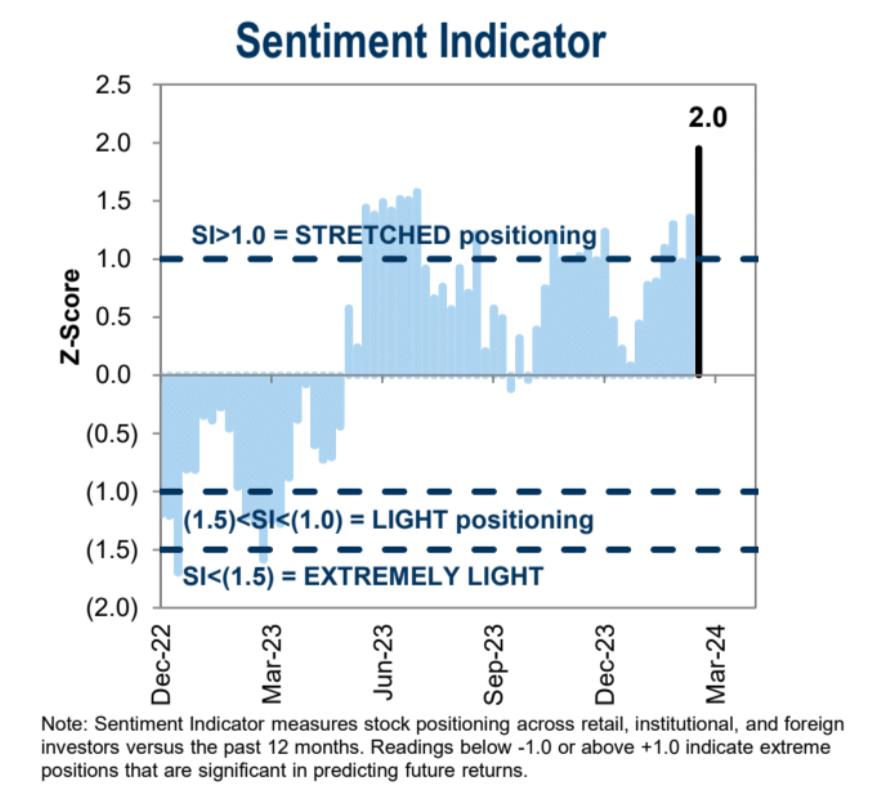

The positions of systematic strategies remained essentially unchanged (75th percentile), while those of independent investors decreased slightly (85th percentile):

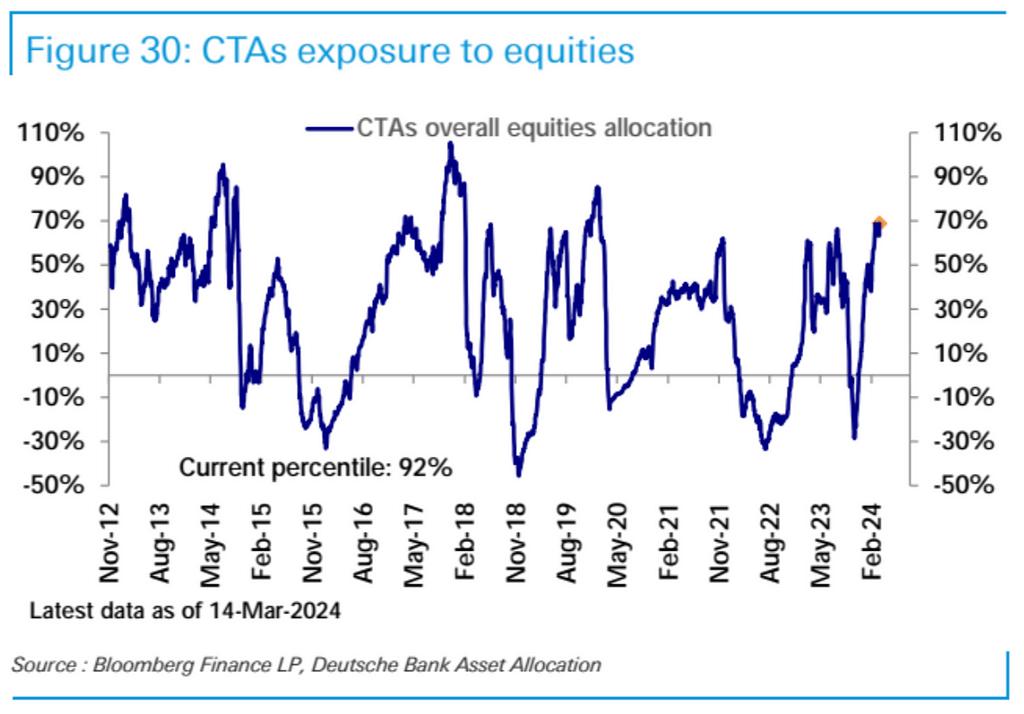

CTA fund positions are still hovering at historical highs:

U.S. stock futures net longs have fallen sharply to November levels:

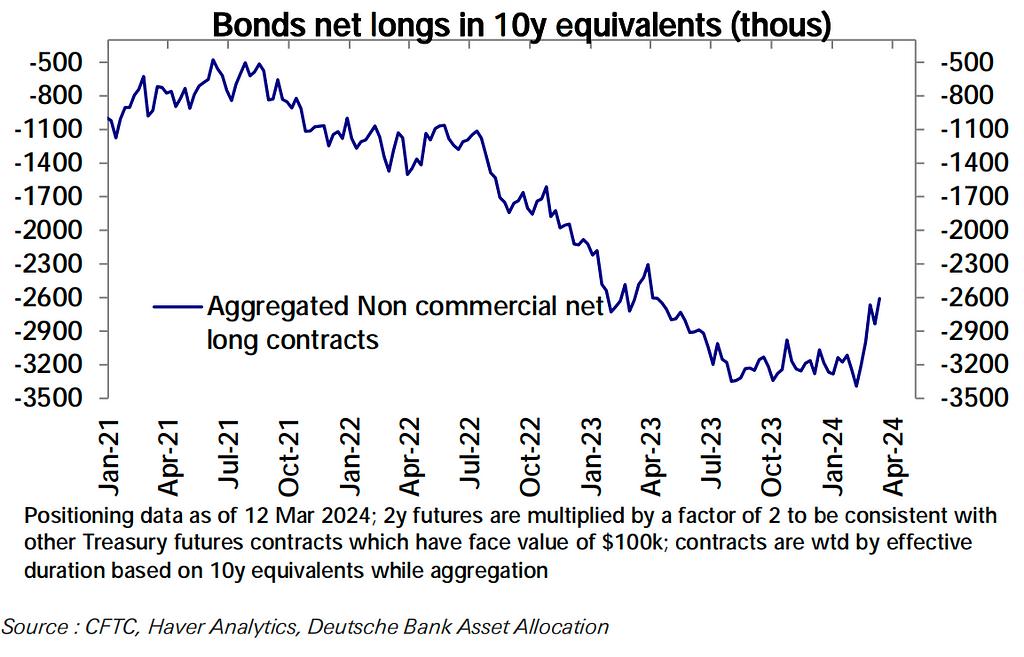

Bond futures net shorts appear to be taking advantage of the recent price declines to unwind positions aggressively:

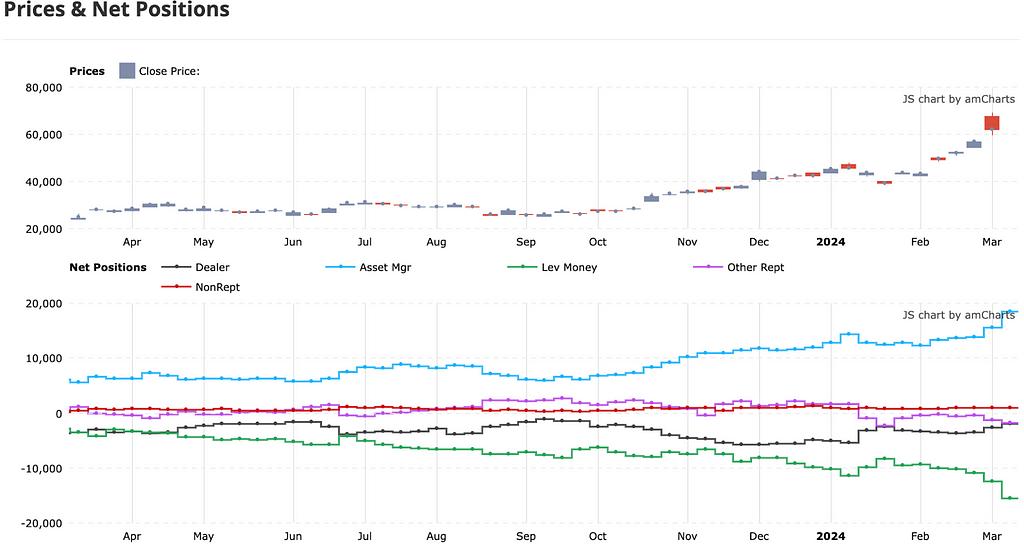

The Bitcoin CME Futures Market Leveraged Fund currently holds nearly 100,000 BTC short positions, which is slightly higher than the net long number of asset management:

institutional perspective

[Goldman Sachs: Nvidia is just the beginning, there are three major stages of AI investment worth paying attention to]

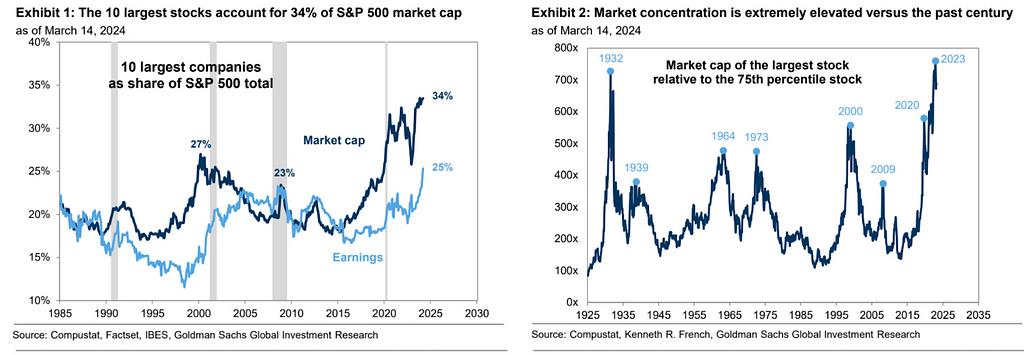

Concentration in the U.S. stock market has increased significantly due to the outperformance of market-leading large technology companies, with the top 10 stocks now accounting for 34% of the S&P 500's market capitalization and 25% of earnings, the highest levels in decades.

If there are no major changes in interest rates or the earnings prospects of major companies in the short term, a big rise or fall is unlikely.

Investors are advised to focus on companies at different stages of the AI value chain as a strategy to deal with stock market concentration risks.

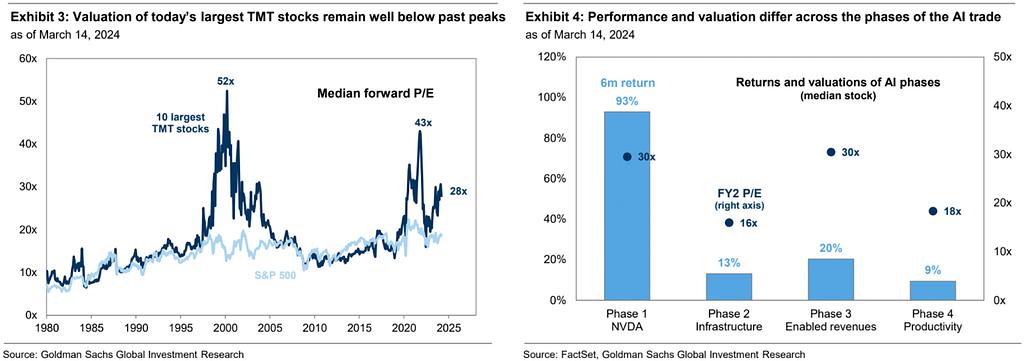

Four stages of AI technology:

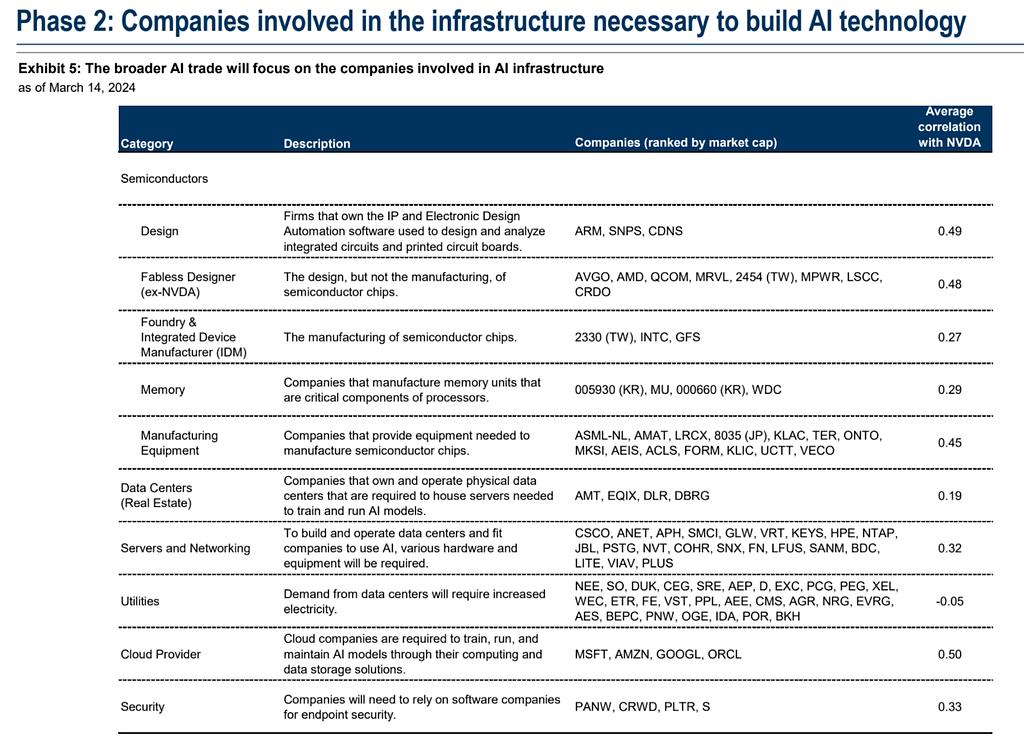

The first phase mainly focuses on NVIDIA, and the second phase focuses on AI infrastructure outside NV, including semiconductor companies, cloud service providers, data center REITs, hardware and equipment companies, software security stocks, and utility companies.

The third phase focuses on companies that can increase revenue through AI technology, and the fourth phase will focus on companies that can increase productivity through AI technology.

The report also discussed rising investor enthusiasm for AI, but argued that this enthusiasm has not yet reached historical bubble levels.

Valuations have improved for most companies in the second phase, but earnings revisions have varied widely. Stocks worth watching include Synopsys, chip design software company Monolithic Power Systems, wireless and broadcast communications operator American Tower, and electrical equipment company Vertiv.

The third stage is the "AI empowered revenue" stage, focusing on companies that integrate AI into products to increase revenue, such as software and IT service companies. In addition to well-known large technology companies, cloud service provider Cloudflare, software design company Autodesk, database company MongoDB and cloud service provider Nutanix are also potential stocks.

Goldman Sachs pointed out that Stage 3 stocks have returned 8% so far this year, and although the excess returns of these stocks are driven by factors other than AI, investor attention to these stocks is rising.

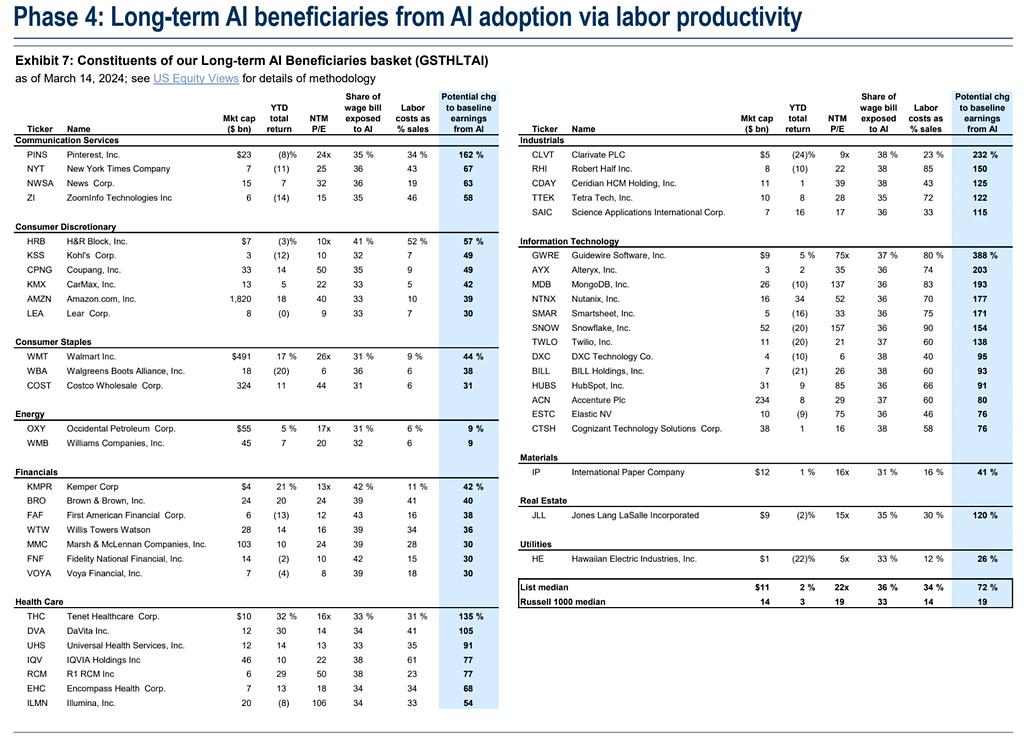

The final fourth stage is the "productivity improvement" stage, which focuses on companies in various industries that use AI technology to improve production efficiency, especially labor-intensive industries such as software services and business services, which are vulnerable to the impact of AI automation.

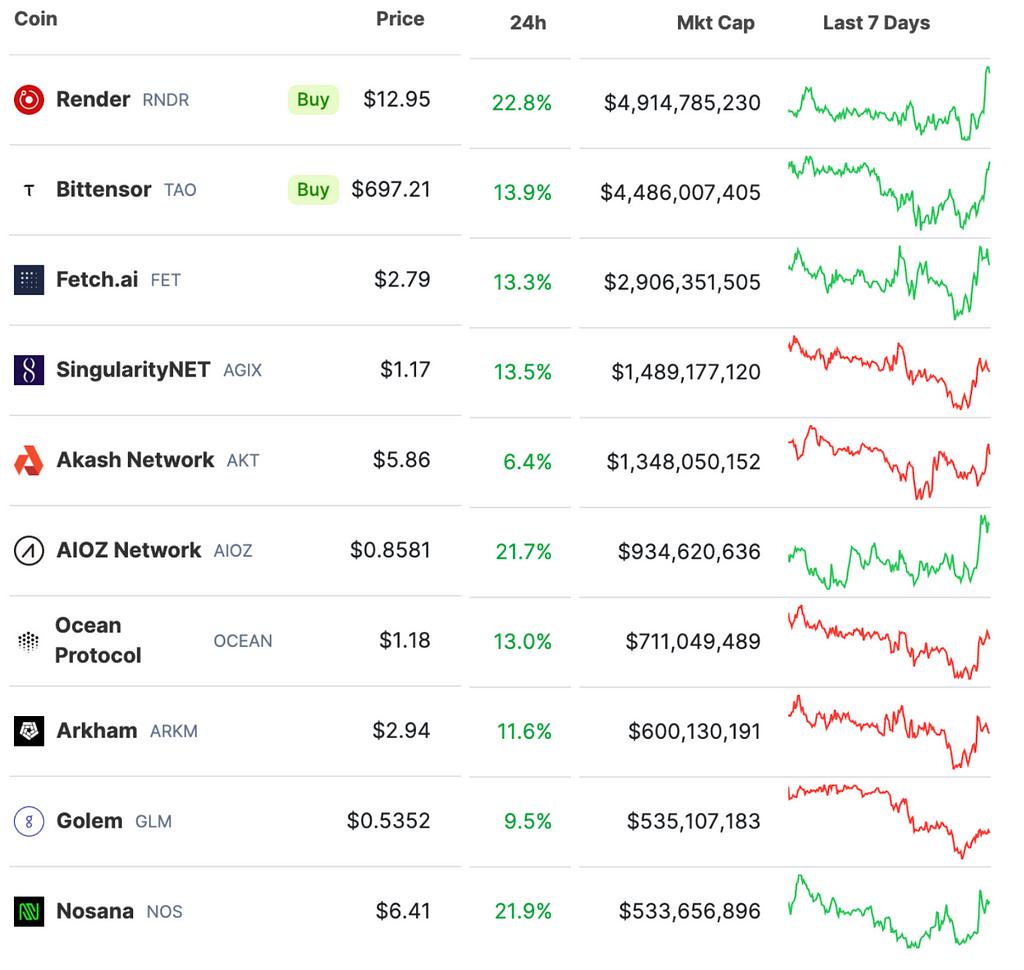

The top ranked AI concept market value projects in the blockchain track are basically platform/infrastructure projects at the software level.

[NVIDIA GTC2024: In addition to B100, also look at the application side]

From March 18th to 21st, NVIDIA's annual AI conference GTC (GPU Technology Conference) 2024 will be held at the San Jose Convention Center in the United States, at 1:00 pm on March 18 (Monday) (4:00 am on Tuesday, March 19th, Beijing time) , NVIDIA CEO Jensen Huang will give a speech with the theme of "1# AI Conference for Developers".

As one of NVIDIA's most important release platforms every year, GTC has become a recognized "AI weather vane". This GTC is also the first time it has been held offline in five years.

According to NVIDIA, Huang Renxun will release the latest breakthrough results in accelerated computing, generative AI and robotics. The market generally believes that there are four focuses of this conference: 1. Next-generation Blackwell GPU architecture, 2. New B100 chip, 3. Humanoid robots, 4. AI + medicine. In addition, NVIDIA will also release a series of generative AI applications, which may become its new growth point.

Wall Street expects that this GTC will help Nvidia stock end its recent volatile trend and continue its strong growth of more than 80% so far this year.

On the eve of the GTC conference, the AI concept cryptocurrency has rebounded significantly:

[JPMorgan Chase: ETH will be the next driving force for Coinbase]

JPM issued a report on Friday that the cryptocurrency ecosystem is in the midst of a substantial increase in participation, which will benefit Coinbase's revenue growth in the short term. The report focuses on the importance of Ethereum (ETH) to Coinbase’s business and revenue. Ethereum YTD rose by 70%, surpassing the $4,000 mark. The report estimates that Ethereum-related services will contribute approximately $230 million in revenue to Coinbase in the first quarter of 2024, accounting for 23% of incremental revenue.

On March 13, 2024, Ethereum successfully completed the Dencun upgrade, which is expected to expand the capacity of the Ethereum ecosystem and reduce second-tier network transaction fees. The upgrade is expected to promote the development of the cryptocurrency market, thus benefiting Coinbase in the long term.

It is expected that the Ethereum ETF may develop in a similar trend to the recently launched Bitcoin ETF, with strong capital inflows and price increases. This could lead to more incremental revenue for Coinbase’s Ethereum trading business in the second quarter of 2024 and beyond.

Raise Coinbase target price from $95 to $150 previously, details of valuation assumptions:

- Cryptocurrency market capitalization remains unchanged at $2.7 trillion

- Trading volume is 13.5% of market capitalization

- The commission rate for retail transactions is 1.2%, and the commission rate for institutional transactions is 0.025%.

- Risk-free interest rate 3.5%

- The staking business is estimated based on the “normalized” Ethereum price of $4,000.

- Net profit margin is 14%, corresponding to a price-earnings ratio valuation of 40 times

- Coinbase is expected to generate annual profits of approximately $375 million

With Coinbase currently trading above $240, the stock price may be reflecting overly optimistic expectations.

[10x Research: Bitcoin may adjust to $63,000]

10x Research released a latest report (author Markus Thielen) saying that the prospects for Ethereum ETF approval appear less optimistic; recent inflation data from Europe and the United States have been released, and central bank officials’ reluctance to commit to interest rate cuts has further hit market sentiment, leading to trading in Asia There was a Bitcoin sell-off during the session.

Given these factors, Bitcoin could drop to 63,000 as a potential target before resuming the uptrend.

Additionally, Altcoin closely tied to Ethereum’s rally may have reached a short-term top, with tokens like SHIB seeing significant volume surges.

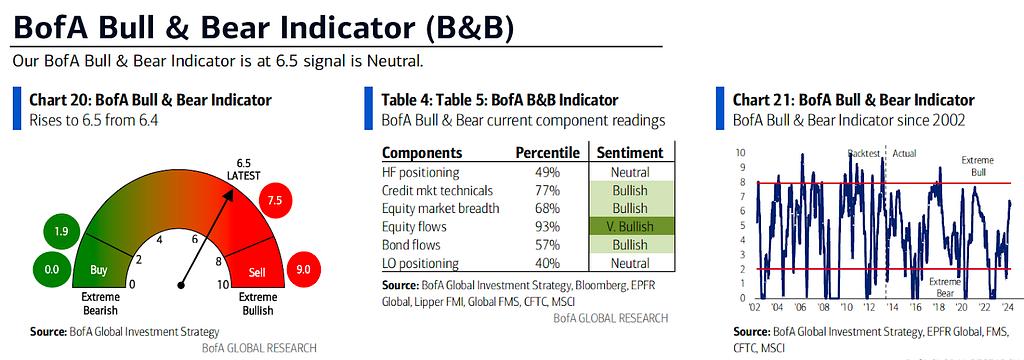

sentiment indicator

LD Capital

As a global blockchain investment firm, we have built a portfolio of over 250 investments since 2016, spanning across various sectors, including infrastructure, DeFi, GameFi, AI, and the Ethereum ecosystem. We focus on investing in projects with disruptive innovations, actively taking on the role of primary investors, and providing comprehensive post-investment services to these projects. We employ a combination of direct investment from our own funds and a distributed fund model to cover all-stages of investment.

Trend Research

Trend Research division specializes in crypto hedge funds focusing on secondary areas within the crypto market. Our team members come from top platforms and institutions like Binance and CITIC. We excel in macroeconomics, industry trends, and project data analysis, with trend, hedge, and liquidity funds.

Cycle Trading

We specialize in Web3 project investment and service, with a strong emphasis on Infra, applications, and AI. We have a team of nearly 20 senior engineers and dozens of crypto experts as advisors, assisting projects in strategic design, capital platform relations, and liquidity enhancement.

website: ldcap.com

twitter: twitter.com/ld_capital

mail: BP@ldcap.com

medium:ld-capital.medium.com