A. Market View

1. Macro Liquidity

Currency liquidity improves. This week's Federal Reserve meeting gave a dovish tone, with plans to cut interest rates three times throughout the year, and the market raised its easing bets. The market expects that the Federal Reserve will begin to slow down quantitative tightening in May until the end of February next year. This period will correspond to the largest dividend period in the investment market. The Bank of Japan raised interest rates for the first time in 17 years. U.S. stocks fluctuated at high levels, and the crypto market rebounded following the adjustment of U.S. stocks.

2. Whole market conditions

Top 100 gainers by market capitalization:

The main line revolves around AI, MEME, and SOL ecology. BTC has made a sharp correction this week, and spot ETFs have seen net outflows. The main line of the market revolves around Meme and SOL ecology. The Solana chain is similar to the ETH market of ICO in 2017, taking over the outflow of BTC funds to Altcoin. This local dog fever is a small preview of the current bull market zoo.

1. BOME: The BOOK OF MEME issued by Pepe Meme artist Darkfarm increased 1,000 times in three days and was listed on Binance, setting off a boom in Meme pre-sales on the Solana chain. BOME can be understood as a permanent storage library for Meme, and will expand a series of Meme creation functions on its basis. There are more local dogs wandering around the Solana chain. If Meme cannot reach the big stage, it will gradually turn into a PVP mutual cut mode.

2. JUP: Transaction volume benefited from the boom in native trading on the Solana chain. Jupiter is a transaction aggregator built on the Solana chain and aggregates more than half of the transaction volume. The agreement launches launch platforms and incubators for horizontal expansion.

3. POLYX: BlackRock Fund launched the first tokenized fund on the ETH chain and plans to do real estate RWA. Polymesh is a public chain built on Substrate. It is specially designed for securities tokenization application scenarios. However, it faces great regulatory resistance from various governments and is difficult to enjoy the advantages of global liquidity.

3. BTC market

1. Data on the chain

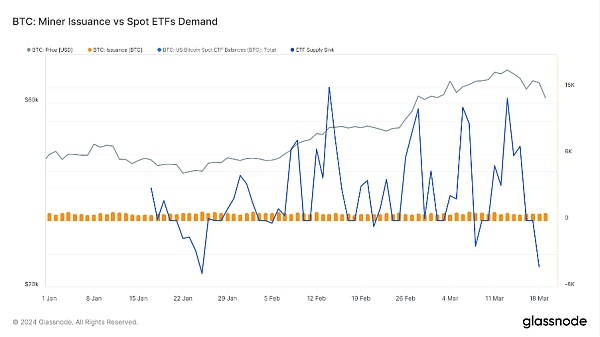

What’s different about this BTC cycle? As the halving approaches, the impact of newly mined BTC and released into circulation becomes smaller and smaller compared to the growing demand for ETFs. The amount of ETFs taken off the market is several times the amount of BTC minted every day. Miners currently bring approximately 900 BTC to the market every day. It will drop to 450 BTC after the halving, which under past market conditions may have exacerbated BTC’s scarcity and pushed the price higher.

The market value of stablecoins remained flat month-on-month, and the inflow of over-the-counter funds slowed down. The supply of USDE is stable and quickly exceeds 1 billion US dollars, mainly because the staking yield is as high as 60%.

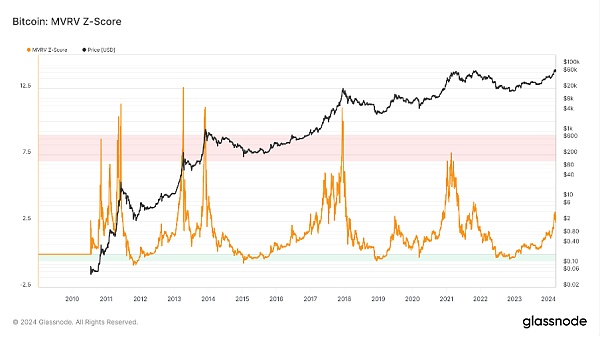

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level 1 and holders were in the red overall. The current indicator is 2.8, entering the intermediate stage.

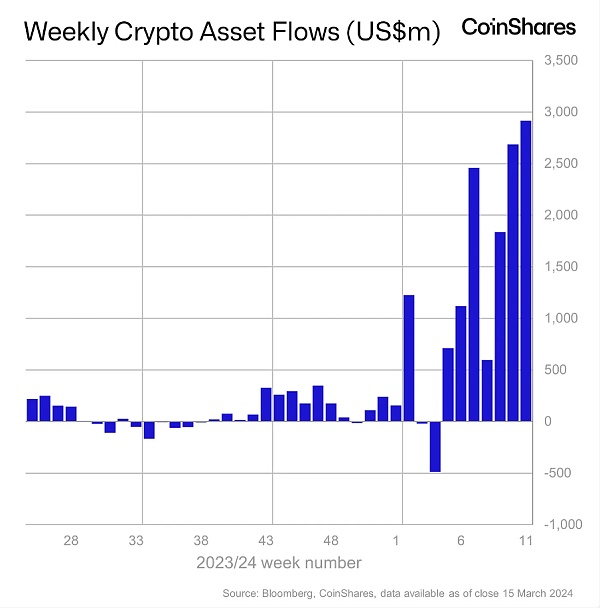

Institutional funds continued to see net inflows, with weekly net inflows hitting a new high.

2. Futures market

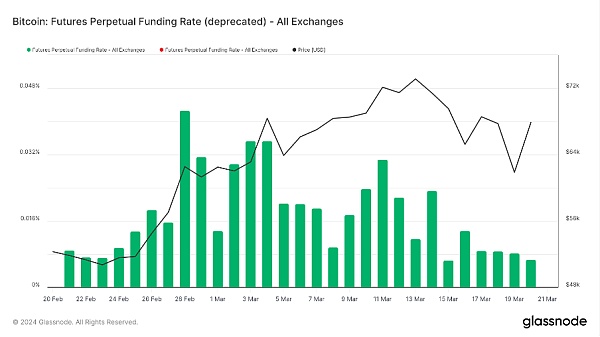

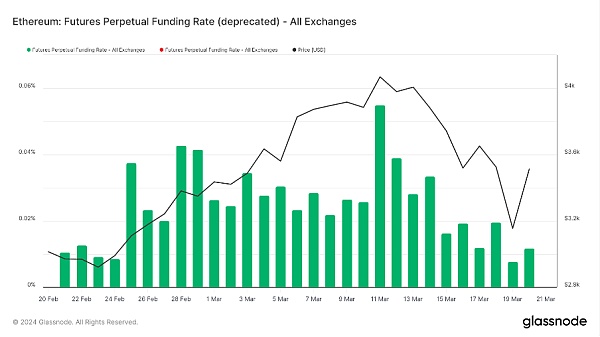

Futures funding rates: Rates returned to normal levels this week. The fee rate is 0.05-0.1%, and the long leverage is high, which is the short-term top of the market; the fee rate is -0.1-0%, the short leverage is high, and it is the short-term bottom of the market.

,

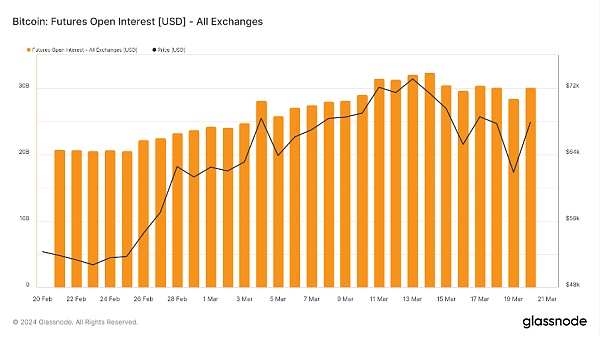

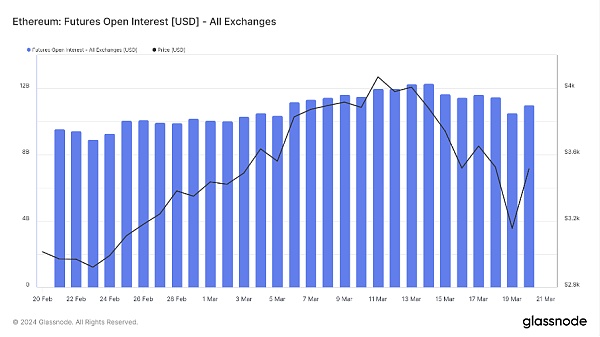

Futures positions: BTC positions followed the price correction this week.

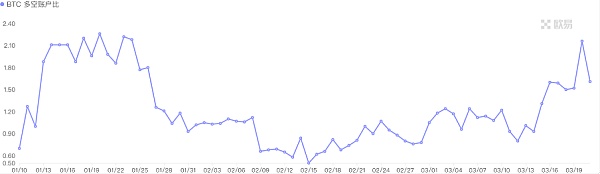

Futures long-short ratio: 0.8, market sentiment is normal. Retail investor sentiment is mostly a reverse indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

Futures long-short ratio: 1.2 , market sentiment is normal. Retail investor sentiment is mostly a reverse indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

3. Spot market price

BTC has had a tumultuous week, hitting new highs before experiencing a sharp correction. Contract rates returned to healthier levels as excess leveraged funds were liquidated. Historically, bull markets have experienced an average of 7 major corrections, averaging 20-30%. After BTC experiences its first major correction, funds usually flow from BTC to Altcoin, and Altcoin are expected to perform better in the future.

B. Market data

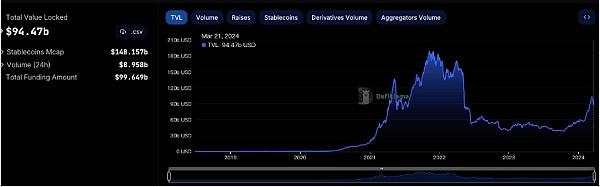

1. The total lock-up amount of the public chain

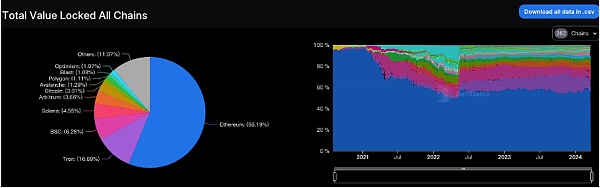

2. TVL proportion of each public chain

The total TVL this week was US$94.5 billion, an overall decrease of US$8.4 billion, or 8.2%. BTC's correction this week was close to 20%, successfully holding on to the 60,000 level, and its upward momentum is also relatively strong. This week, all mainstream public chains TVL, except the SOLANA chain, fell sharply. The most popular public chain recently must be the SOLANA chain, which has risen by 6% in the past week and 85% in the past month. In addition, the performance of the ETH chain has been relatively sluggish recently. This week, the ETH chain fell by 14%, the POLYGON chain fell by 15%, and the OP chain, BLAST chain, and ARB chain all fell by about 9%. The BSC chain fell by 7%, and the TRON chain fell by 8%.

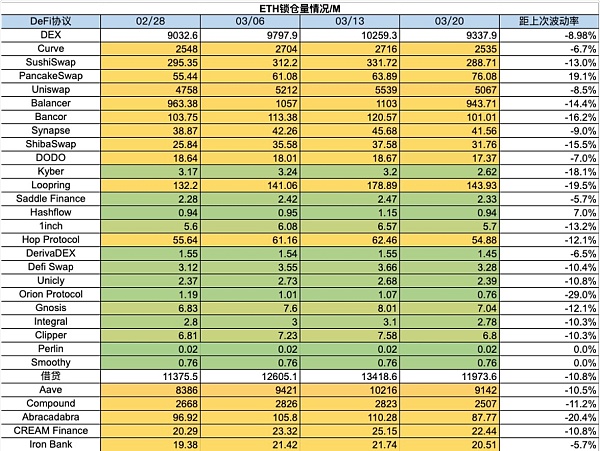

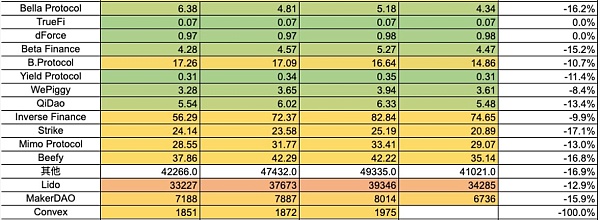

3. Lock-up volume of each chain protocol

1. ETH lock-up amount

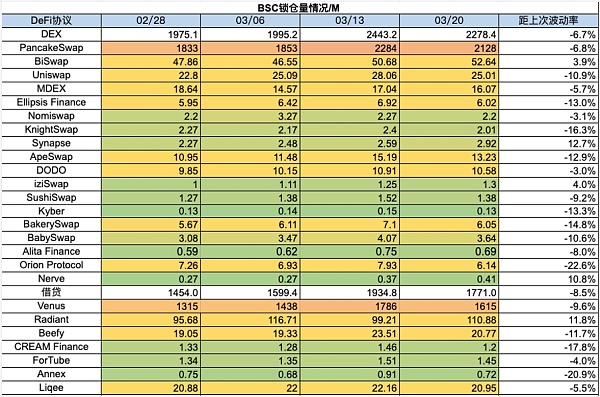

2. BSC lock-up amount

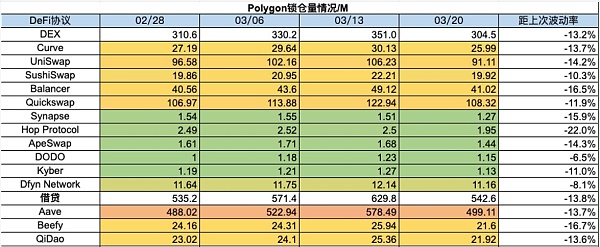

3.Polygon lock-up amount

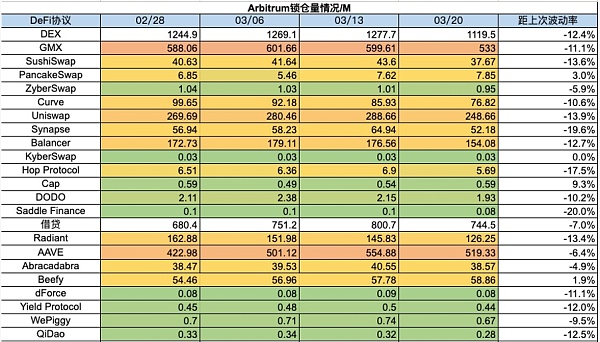

4. Arbitrum lock-up amount

5.Optimism lock-up amount

6.Base lock-up amount

7.Solana lock-up amount

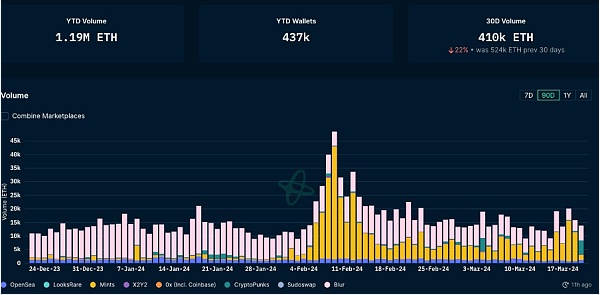

4. Changes in NFT market data

1.NFT-500 Index

2.NFT market situation

3. NFT trading market share

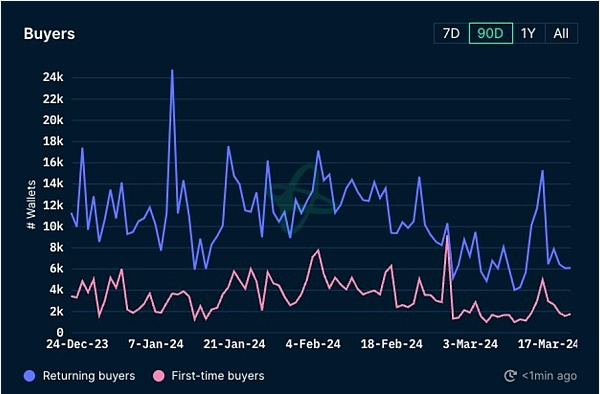

4.NFT buyer analysis

The floor prices of blue-chip projects in the NFT market have risen and fallen this week, but the fluctuations are not large. .BAYC is down 4%, MAYC is up 2%, CryptoPunks is up 7%, Azuki is up nearly 3%, Pandora is down 2%, and Milady is up 6%. The NF market continued to fall this week and has reached its lowest point in the past year. The total transaction volume of the NFT market has rebounded slightly this week, but the number of first-time NFT buyers and repeat buyers still has not improved. With the arrival of the bull market, the downturn in the NFT market continues.

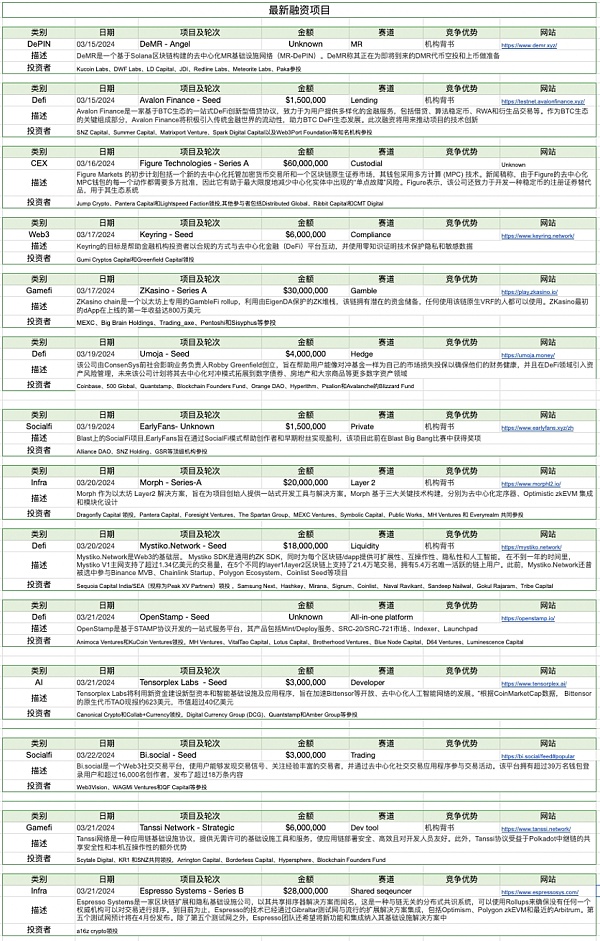

5. Latest financing situation of the project

6. Post-investment dynamics

1.Space Nation — GameFi

The space-themed Web3 MMORPG game Space Nation has released a trailer for the blockchain game "Space Nation Online". The game will include four main factions, powered by the Unity engine, and have PvE (player versus environment) and PvP (player versus player) functions.

Space Nation Online is expected to launch in closed beta on PC on April 1 this year, with a soft launch on PC later this summer, and a global release planned for PC and mobile devices this fall.

"Space Nation Online" has previously stated that it plans to carry out a series of developments in the next year, including strengthening the AI+Web3 universe, redefining the connection between players and MMO, using AI to create personalized stories, and providing players with an immersive interactive experience.

2.Node Guardians — Infrastructure

SNode Guardians v1 is launching soon and provides experienced smart contract developers with a comprehensive gamification experience to help them master Solidity and Zero Knowledge DSL.

Node Guardians has worked closely with L2s such as Starknet, Aztec, Optimism and Arbitrum and has helped hundreds of developers improve their development skills.

3.Ether.fi — Non-custodial liquid staking protocol

ETHFI has developed airdrop claims and is listed on Binance. According to the disclosed ether.fi token economic model, the total supply of ether.fi token ETHFI is 1 billion, and the circulating supply is 115.2 million. 2% of the token allocation will be used for Binance Launchpool, and 11% will be allocated to airdrops. , 32.5% is allocated to airdrop investors and advisors, 23.26% is allocated to the team, 1% is allocated to the Protocol Guild, 27.24% is allocated to the DAO Treasury, and 3% is used to provide liquidity.