The contents of this issue are as follows:

• As Bitcoin continues to retreat from its all-time highs, we take a look at the frequency and magnitude of retracements during major price cycles in the past.

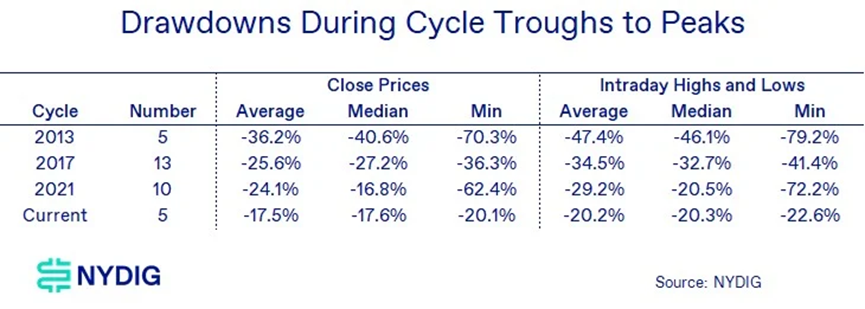

• Drawbacks of over 10% are common, even during Bitcoin’s rise from cyclical troughs to peaks.

•While the current drawdown is smaller than average (but likely not over yet), investors should be prepared for periodic drawdowns in excess of 10%.

Retracement in an “up” cycle

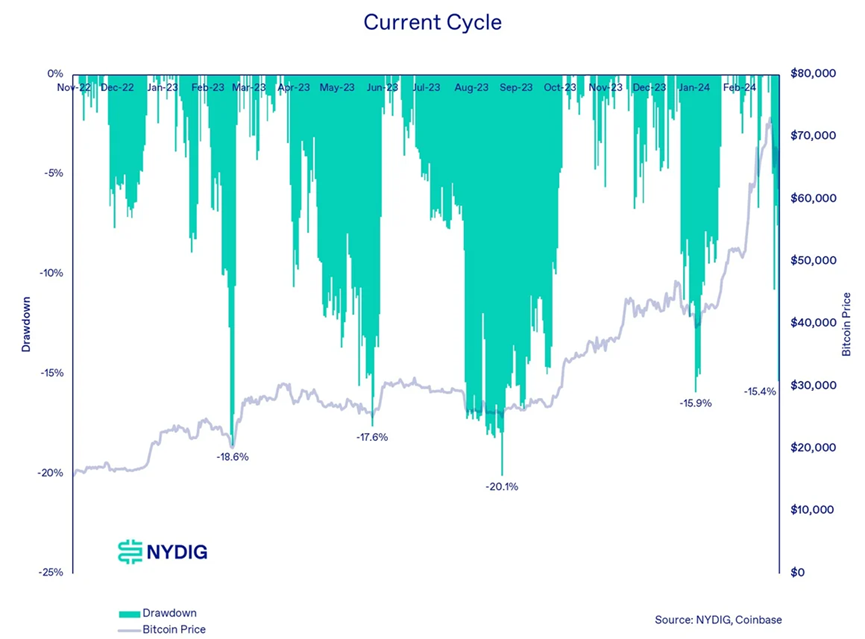

Last week, Bitcoin prices fell sharply, falling from a peak of $73,835 (Coinbase data) to a low of $60,771, a correction of 17.7%. The decline was triggered by days of outflows from spot ETFs since late January, leading many to question whether Bitcoin's rally has stalled or is simply taking a pause. Our analysis this week delves into historical trough-to-top cycles and intra-cycle retracements to provide insights into the current price correction.

Define past periods

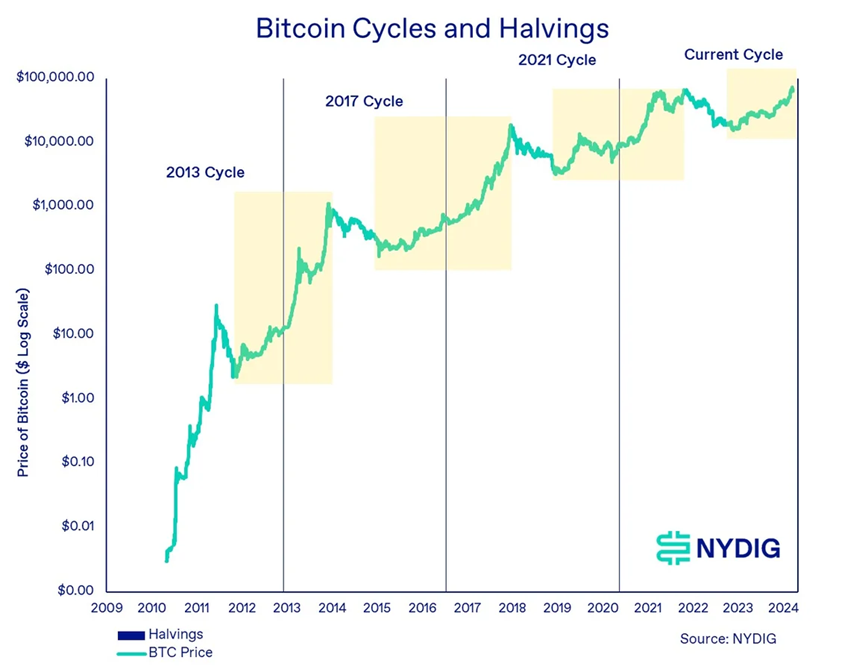

Bitcoin has experienced 4 important price cycles in its history, peaking in 2011, 2013, 2017, and 2021. These peaks were all centered on the reward halving. These peaks are followed by large long-term retracements of 75% or more from peak to trough. While debate continues about the reasons behind these cycles (and whether they actually exist), the existence of recurring price patterns challenges even the weakest form of the efficient markets hypothesis (EMH). Still, we can use these cycles to identify “up” phases, starting with Bitcoin’s lows, troughs, and all the way up to its peaks.

We are currently in this phase of the cycle, from the trough to the eventual peak (timing and price are uncertain). After Bitcoin fell to a low of $15,460 on 11/21/22 during the FTX crash, Bitcoin entered the “up” phase of the new cycle, recovering its previous losses and hitting a record high on 3/4 new highs.

Against this backdrop, we'll explore how retracements of past "up" cycles have unfolded and what insights they might provide for the current cycle.

look at the cycle

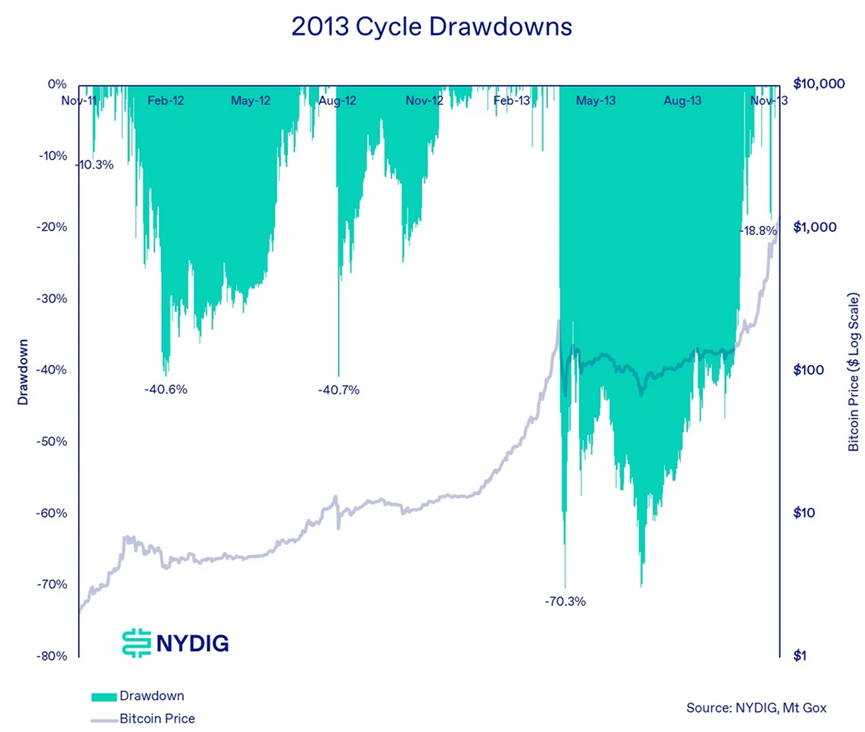

2013

Analyzing the 2013 cycle (we skipped 2011 due to the novelty of Bitcoin at the time), which peaked at the end of November, it is clear that there were multiple significant and sustained downturns, including two over 40% and one More than 70% (in spring 2013). Our focus is on recording retracements greater than 10% from the closing price to the closing price (midnight UTC). In the spring of 2013, the price of Bitcoin quickly fell to the bottom within 7 days, but it was not until November that the price of Bitcoin fully recovered and finally reached a new high in the cycle, which took a full 7 months.

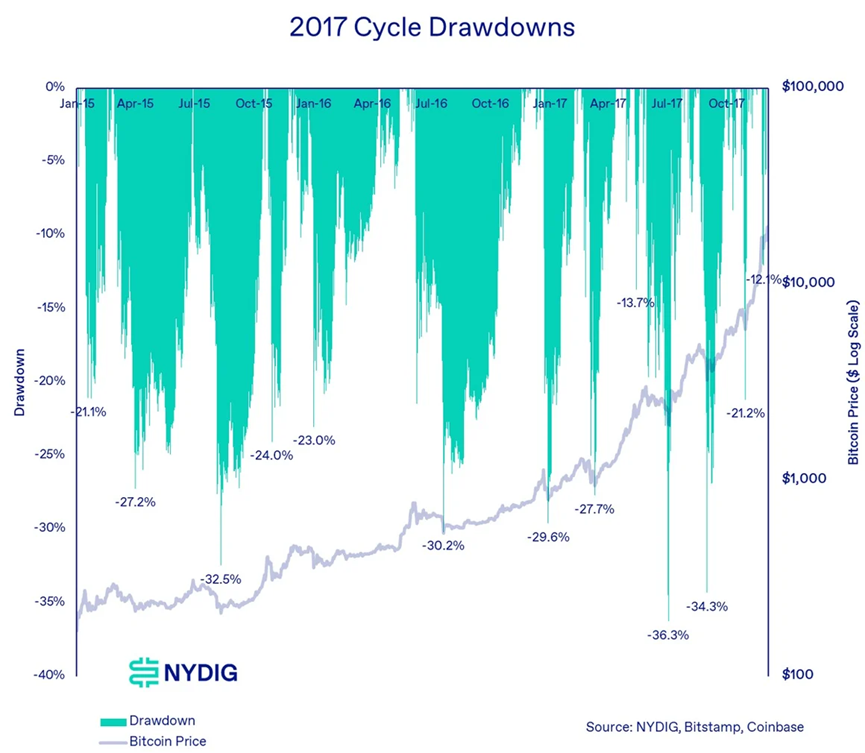

2017

2017 is a cycle in which Bitcoin enters the zeitgeist of the professional investment community. While Bitcoin eventually peaked at nearly $20,000, it has retraced more than 10% during this cycle. Unlike the 2013 cycle, which had only five such instances, the 2017 cycle experienced 13 retracements of similar magnitude. This made the 2017 cycle more volatile than 2013, although there was not a single massive retracement event.

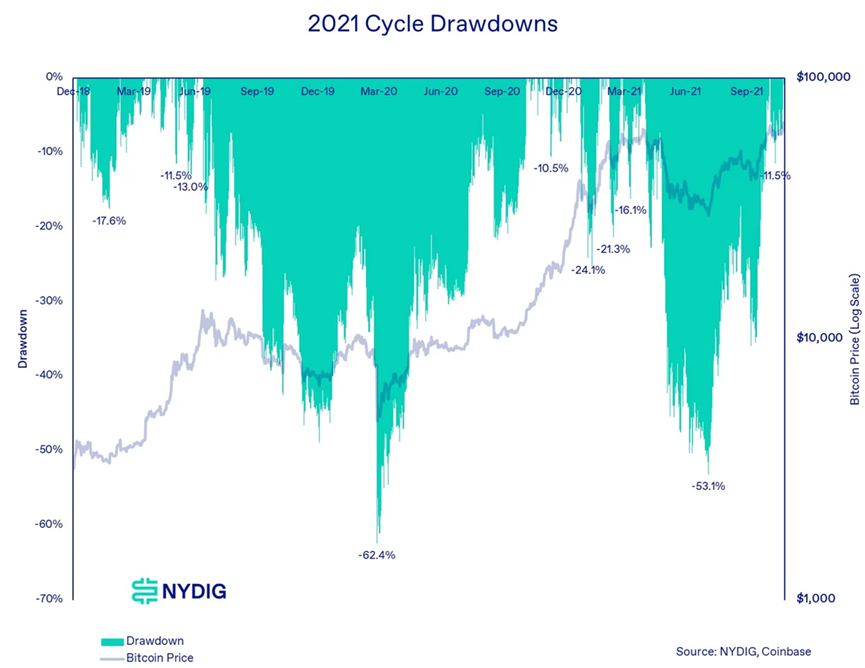

2021

The 2021 cycle peaked in November following the launch of the BITO Futures ETF and is the latest full cycle (unless we see the highs of the current cycle, but we don't think so). From a low of $3,128 in December 2018, Bitcoin surged to over $13,000 in the first half of 2019. It then experienced a sharp retracement over the next nine months, reaching a low in March 2020 when the COVID-19 crisis broke out, with a cumulative decline of 62.4%. Subsequently, the economic response to Covid-19, driven by monetary and fiscal stimulus measures, caused Bitcoin prices to surge. The cycle ends in November 2021 at a price of $69,000. Throughout the 2021 cycle, Bitcoin suffered 10 significant declines of 10% or more.

current cycle

The current cycle started from the November 2022 lows and has seen 5 major retracements over 10%, including the one we are in. Calculated based on the closing price, the current decline has reached 15.4%. If the intraday high and low points are considered, the decline has reached 17.7%.

put them together

Looking at all previous cycles with declines of more than 10%, we see that they are a regular feature of up cycles. The current retracement, while likely not over yet, is so far smaller than previous retracements. Our analysis includes both retracements measured by closing prices, as well as retracements measured by intraday highs and lows, which are more severe.

The current pullback, while challenging, is entirely consistent with Bitcoin’s previous price cycles. Investors should prepare for the inevitability of such events because, like all other financial markets, progress is not always linear. Our analysis of blockchain data from two weeks ago shows there are few signs that the end of the cycle is imminent.

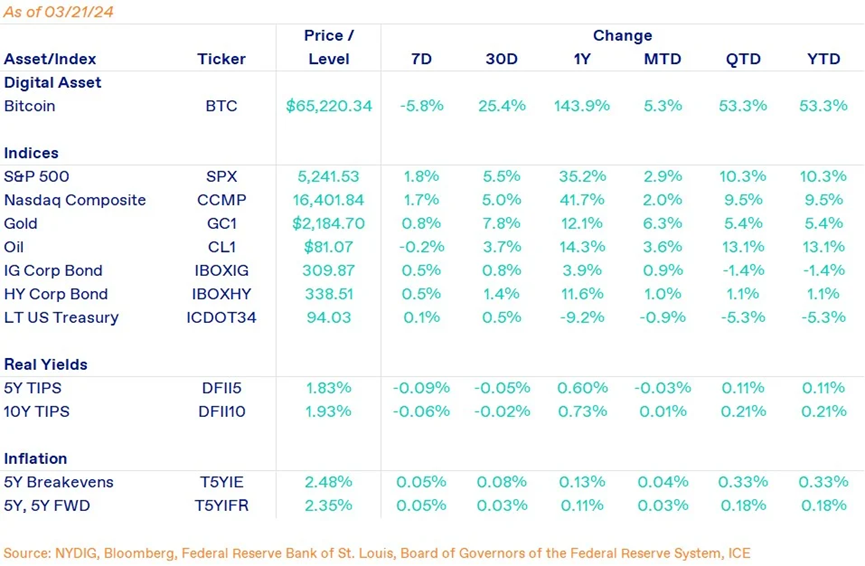

Market dynamics

Bitcoin ended the week down 5.8%, retreating from all-time highs set a few weeks ago as ETF inflows that drove the price have turned into outflows. GBTC investors have yet to stop outflows, which have reached $13.6 billion since the fund transitioned to an open-ended ETF, and flows into challenger funds have also slowed significantly. In terms of assets under management, GBTC still tops the list with $22.9 billion, but BlackRock’s IBIT has closed a huge gap and now stands at $15.9 billion. Fidelity’s FBTC is a distant third at $8.9 billion.

A dovish Federal Reserve left interest rates unchanged and left open the possibility of future rate cuts, sending most assets higher this week. On the stock market, the S&P 500 rose 1.8% and the Nasdaq Composite rose 1.7%. Bonds performed well on interest rate news, with investment-grade corporate bonds rising 0.5%, high-yield corporate bonds rising 0.5% and long-term U.S. Treasuries rising 0.1%. Oil prices edged down 0.2%, while gold prices rose 0.8%.

Important news this week

invest:

Bernstein raises Bitcoin year-end price target to $90,000, via CoinDesk

Standard Chartered raises year-end Bitcoin forecast to $150,000, predicting a high of $250,000 in 2025, via CoinDesk

JP Morgan says Bitcoin remains in “overbought territory” despite recent pullback, via The Block

Grayscale CEO Says GBTC Bitcoin ETF Fees Will Decline Over Time, via CNBC

Bitwise CIO says we may still be weeks away from launch of first institutional-backed spot Bitcoin ETF, via The Block

Regulations and Taxes:

U.S. Securities and Exchange Commission (SEC) investigating crypto companies in Ethereum as hopes for Ethereum ETF dim, via Forbes

company:

BlackRock launches first tokenized fund BUIDL on Ethereum network, via BlackRock

Coinbase will launch Dogecoin, Litecoin and Bitcoin Cash futures trading on April 1, via The Block

BlackRock’s head of digital assets explains views on other crypto products, via Twitter

Upcoming Events

March 29 - March CME expiration

April 21 - Bitcoin block reward halved