Web3 development should be more careful than ever

Recently, SLERF has become the most watched project in the encryption market. Originally, SLERF may have been just one of the many meme coins in the Solana ecosystem. However, with a series of events such as the founder of SLERF losing the right to mint coins, destroying LP and airdrop reserved tokens due to misoperation, and apologizing and crying on Twitter Space, etc. After fermentation, SLERF has become the most popular meme currency on the Solana chain, with a market value of over US$600 million.

SLERF put on a big show for the entire crypto community and became the new king of memes. After watching the show, if we think back carefully, we will find that a series of wrong operations by the founder of SLERF caused huge losses to its investors. How should Web3 project parties avoid similar mistakes and losses? Today Beosin will answer the question for you.

SLERF incident progress

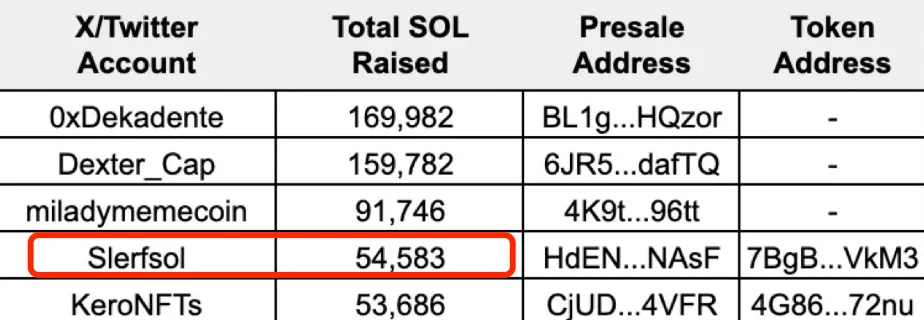

Amid the Solana meme coin craze, SLERF raised 54,583 $SOL (approximately $10 million) in just a few days, becoming the fourth largest project in the Solana meme token presale.

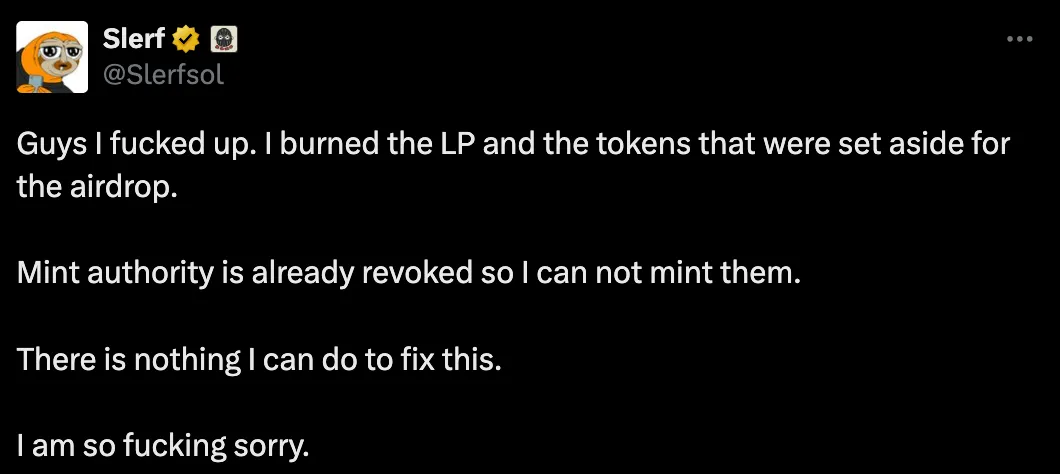

However, the difference between SLERF and other meme coins is that the SLERF team tweeted that they destroyed $10 million in pre-sale tokens and lost the right to mint due to a mistake. This resulted in SLERF being unable to pay the corresponding tokens to investors in its pre-sale.

The burning of SLERF unexpectedly plunges the token into deflation, and transaction fees on SLERF will also reduce its supply. Such a dramatic event coupled with the benefits of token destruction, since the destruction event, SLERF has been listed for trading on many centralized exchanges such as KuCoin, HTX, LBank, and decentralized exchanges such as Raydium on Solana. It is worth noting that SLERF Transaction volume on Raydium has exploded, with transaction volume exceeding $7.1 billion.

At the same time, the plan to “rescue SLERF pre-sale participants” is also widely discussed in the crypto community. SLERF has launched a donation campaign, and all donated funds will be used to compensate pre-sale participants. LBank served as the first donor and donation address custodian in this compensation action, and many users in the crypto community also participated. In addition, some exchanges such as HTX and Bitget announced that all fees generated by SLERF transactions will be used to repay pre-sale investors who suffered heavy losses . With the help of all parties, there is a feasible compensation plan for the losses caused by the Slerf team.

How do SLERF errors occur?

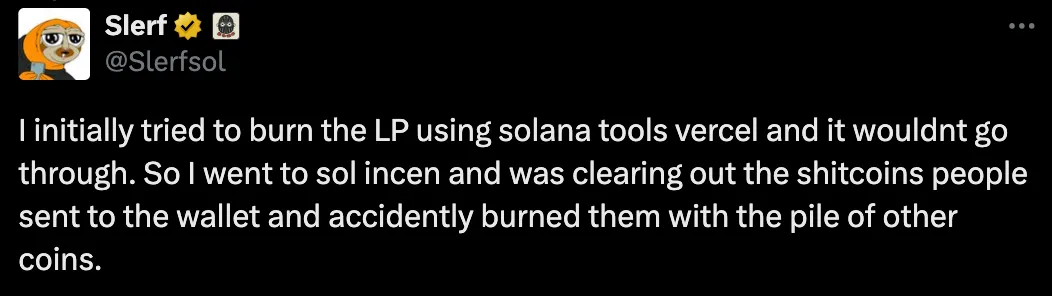

First, let's look at how SLERF caused over $10 million in losses. According to SLERF’s official statement, its founder wanted to destroy LP but failed, and then used Sol Incinerator’s destruction program, which resulted in the destruction of all tokens in his wallet:

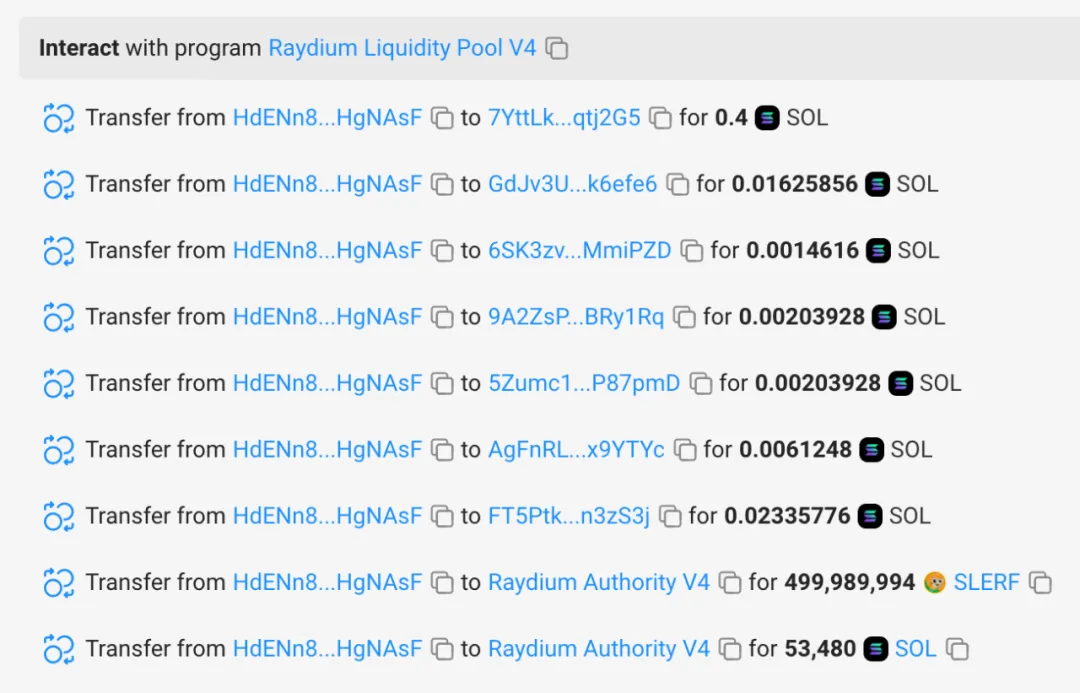

Looking at the series of operations of the SLERF pre-sale address HdENn8wP6srk1AuE2CaJj6bRbjcU2kYs12H4C4HgNAsF, we found that SLERF’s statement is true.

At 14:53 Beijing time on March 18, SLERF created LP on Raydium, a decentralized exchange on the Solana chain:

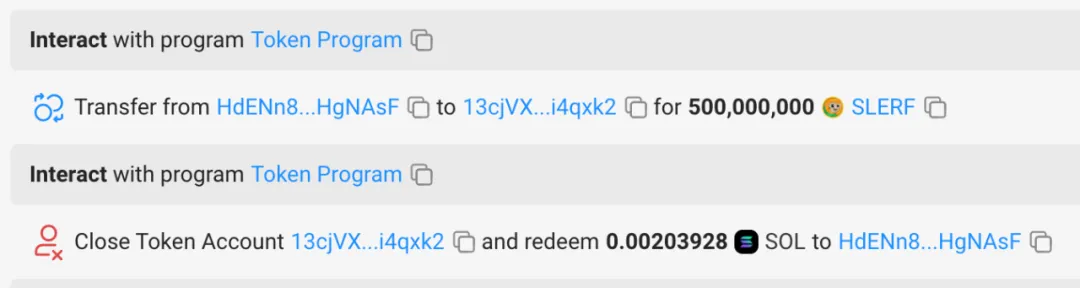

Six minutes later, the address called Sol Incinerator to destroy all Altcoin in its wallet, including 500 million SLERF . At this point, SLERF has destroyed half of the tokens and pre-sold SOL, causing irreparable losses.

Among them, Sol Incinerator is Solana's "incinerator", which is used to destroy various tokens and NFTs, clean up useless blockchain space, and thereby recycle a certain amount of Solana.

Lessons from the SLERF Incident

For developers and project parties, the SLERF incident highlights the need for development testing, security checks, and clear communication with investors.

Development testing and security checks play a vital role in Web3 security . In the SLERF incident, the SLERF team did not conduct comprehensive testing and preparation for the token launch, and randomly invoked other procedures, resulting in serious consequences of investor asset losses. All development teams should conduct comprehensive testing before the project goes online, including unit testing, integration testing, system testing, etc., to ensure the high quality and stability of the project and avoid functional failures and accidents.

In addition, clear communication with investors is also important . In the SLERF incident, SLERF promptly announced the error and actively communicated with investors and the community, avoiding investment risks caused by information asymmetry and obtaining a compensation package for pre-sale investors.

For investors, users should treat various pre-sale opportunities with caution and thoroughly review the technical qualifications and safety of the project before investing funds to avoid possible capital losses .

Beosin KYT will also support the Solana network. Beosin KYT can quickly identify suspicious transactions in the Solana ecosystem, conduct comprehensive risk assessments, identify risks in on-chain relationships, and effectively identify and prevent risky behaviors such as security attacks, Dark Web transactions, coin mixer use, fraud, extortion activities, and gambling.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of the country or region where you are located.