Author: Climber, Jinse Finance

In this bull market, Solana has lived up to its believers.

Recently, Solana has become the focus of the market. Not only did the project currency SOL hit the historical record, but also many project tokens in its ecosystem continued to rise. The most eye-catching thing is that MEME coins, led by BOME, SLERF, and WIF, are setting off a new wave of wealth.

The once most vocal "Ethereum killer" has returned from the disaster and slapped countless critics in the face. At the same time, investors can't help but wonder, what factors prompted the former "downtime chain" to complete its evolutionary rebirth? How much room for imagination does Solana have in the future?

1. Solana performs The Return of the King

On March 18, the Solana project token SOL rose above $200, which also meant that the former "Ethereum killer" officially returned.

SOL's return above $200 is of great significance to Solana. It is not only the completion of self-salvation, but also a great comfort to project believers.

Looking back at November 2021, Solana currency price rose to an all-time high of $259.90. In terms of growth and popularity, the popularity is the same. However, as the crypto bull market receded, coupled with the FTX exposure incident, SOL fell all the way, falling as low as only $8.

But since October last year, Solana has skyrocketed as if cheating. The upward momentum has continued to this day and reached a maximum of $210.18 on March 18 this year, only one step away from the previous high.

In addition to the currency price, Solana's market value, TVL, DEX trading volume and ecological projects have all experienced a wave of rapid growth.

As SOL rose above $200 and reached $204, its market capitalization also exceeded $90 billion and surpassed BNB to become the fourth largest cryptocurrency by market capitalization. According to 8marketcap data, Solana's market value surpassed luxury car giant Porsche (market value of approximately US$90.26 billion) on March 18, ranking 192nd in the global asset market value rankings.

In addition, as of this writing, according to DefiLama data, DeFi TVL on Solana has reached $4.575 billion, a new high in 23 months.

In addition, since March 15, the average daily trading volume of Solana’s on-chain DEX has exceeded US$3 billion for 5 consecutive days, and ranked first on 4 of them.

The popularity of Solana has also driven the growth of ecological project tokens on the chain, such as JUP, GPT, RAY, PYTH, etc. However, the most shocking thing in the encryption market and caused the FOMO phenomenon is the Memecoin craze started on Solana. Among them, the most popular token Coins include BOME, SLERF, WIF, MYRO, etc.

2. Main reasons: good developer ecosystem, stable network performance, and client version upgrade

Regarding the last round of Solana’s phenomenal explosion, many analysts are more inclined to attribute it to the push of the bull market and capital. Especially with the advent of the bear market, SOL fell from US$259.9 to US$8, a nearly 97% drop that caused many people to lose faith in the project.

But fortunately, the long bear market and the thunderstorm factors of FTX did not put Solana at the bottom. Instead, the project staged a desperate counterattack. What kind of secret is hidden behind the magical reversal? How much value is there in Solana that needs to be discovered?

1. Developer ecology: steady growth of personnel, rich experience, and high retention rate

According to Solana’s official website, in 2023 the Solana developer ecosystem has made significant progress in tools, developer experience, content quality and diversity of available programming languages, and has more than 2,500 active developers per month on open source repositories .

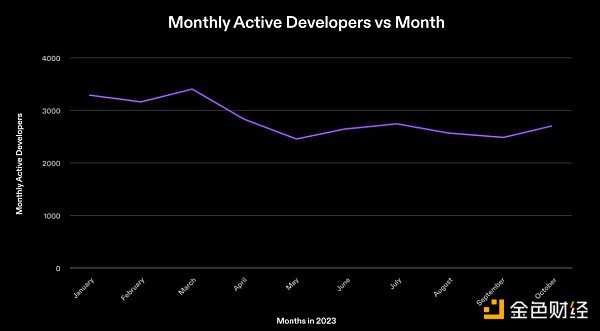

The number of monthly active developers building projects on the chain can well reflect the growth of the blockchain network. As can be seen from the above figure, in 2023, the number of monthly active developers building on Solana will stabilize at 2,500-3,000 about.

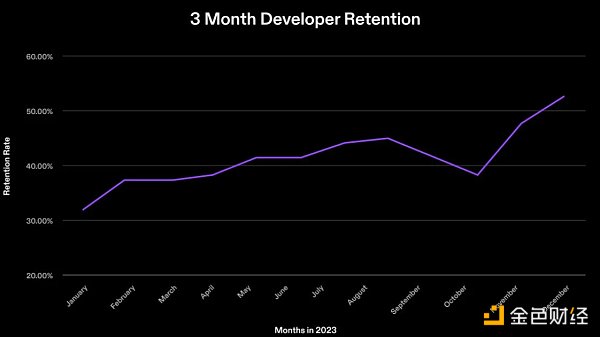

What's particularly important is that developers on Solana have a high retention rate, which means Solana has a good developer community environment.

In 2023, the 3-month developer retention rate within the Solana ecosystem increased from 31% to >50%, which means that the project retained more developers to join the ecosystem. In this regard, Solana’s official explanation is: developer onboarding is improving; the Solana blockchain has become a clearer choice for developers; and opportunities in the ecosystem have increased.

In addition, according to Solana officials, more than half of the developers entering the ecosystem on Solana have at least 3 years of experience.

Overall, although the Solana ecosystem is relatively new (the Solana mainnet beta was launched in March 2020), its developer ecosystem has grown to become the second largest ecosystem in total monthly active developers, second only to Ethereum.

Being able to have a current stable developer ecosystem mainly depends on the way the Solana Foundation operates or funds to develop the developer ecosystem. Some key initiatives include Solana Hackathons, Solana Hacker House, Breakpoint, educational bootcamps, and sponsored university events. Many ecosystem-led groups have also contributed to this growth, such as SuperteamDAO, mtnDAO, Metcamp and Gen3.

Data shows that since 2020, hackathons sponsored by the Solana Foundation have been held eight times. Over the past three years, more than 3,000 projects have been launched and more than $600 million has been raised for projects submitted to hackathons.

2. Network performance: enhanced stability and increased throughput

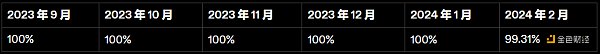

Since the launch of its main network, Solana has experienced frequent crashes, and has been criticized by the outside world for this. However, according to the March 2024 network performance report released by the Solana Foundation, in the past six months (September 1, 2023 to February 29, 2024), the uptime of the Solana network was 99.94%.

As you can see from the picture above, the Solana network only experienced an outage on February 6 this year, but the network was restarted in less than five hours. And the analysis report shows that the outage was caused by a bug in the LoadedPrograms function, which had been previously identified and planned to be deployed during the v1.18 release cycle. Most importantly, during the network outage, all funds were is safe.

Messari's Solana status report, also on January 11 this year, noted that the period from February 25, 2023 to December 31, 2023 was the longest period of no network outage in the network's history, reaching 309 days.

In terms of block time (the time when blocks are generated), except for the abnormal block generation caused by Solana network interruption, other times show overall stability and high speed.

figure 1

figure 2

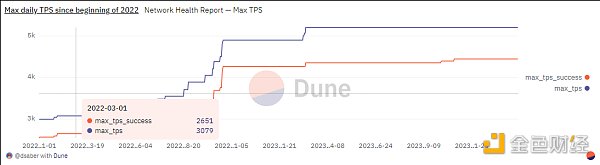

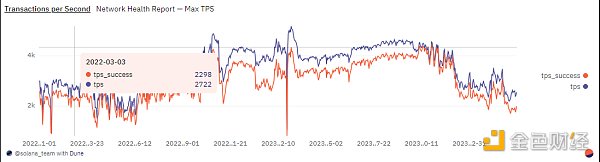

The above graph is a snapshot of the real-time performance of the Solana network, broken down into the average number of transactions per second and the maximum number of transactions per second on a given date, broken down by date. As can be seen in Figure 1, the average transactions per second has remained relatively similar since December 2022, but there have been some fluctuations related to high network demand. And the overall trend is upward and stable.

Figure 2 shows the decline in transactions per second from December 2023 to January 2024, which is mainly due to increased on-chain interaction activity. But we can still see that the Solana network TPS is above 2,000 most of the time.

3. Upgrade the network and launch a new version of the validator

Since last July, the Solana network has been undergoing continuous improvements and upgrades, such as QUIC, equity-weighted QoS, and localized fee markets, all in response to specific pressure points, slowdowns, and outages during periods of high activity and demand.

Meanwhile, developers are continuing to test and develop other network upgrades and initiatives, including increasing the maximum transaction size (currently limited to 1232 bytes) and simplifying voting logic, thereby reducing the overall amount of data that needs to be transmitted and stored.

In addition, the project team also released Solana Labs validator client versions 1.16 and 1.17. Version 1.16 was successfully launched in September 2023, and version 1.17 was launched on January 15, 2024. Both releases include new features, performance updates, and changes to improve network resiliency.

In the future, the Solana team will also launch:

Timely Voting Points: This is a protocol change and governance initiative primarily performed by validators. This change penalizes validators for being late to vote on blocks, incentivizing fast voting and improving the health of the consensus.

SFDP changes: SFDP (Solana Foundation’s Delegation Program) provides validators with support for self-reliance and sustainability, with the broader goal of maximizing decentralization, network resiliency, and network performance.

In addition to the above-mentioned internal reasons, many external institutions are also very optimistic about Solana and have chosen to cooperate with it, such as OKX, Shopify and investment institutions.

Summarize

It has to be said that Solana seems to be following the path that Ethereum has taken before, with ups and downs and ups again. The re-emergence of Solana has also rekindled investors' high hopes for this "Ethereum killer". In the final analysis, this is due to the deep cultivation of the Solana project team and the project's own advantages.

It can be seen that value investing may not be unworkable in the crypto. But for ordinary investors, the rising price of SOL is just a superficial appearance. What really needs to be paid attention to is Solana's core power source.