The market as a whole is in a trend of shock and accumulation, with Bitcoin fluctuating at US$70,000 and Ethereum at US$3,600.

Altcoin as a whole are also fluctuating with the broader market, with the public chain sector and the Meme sector performing slightly stronger.

1. Market analysis

Yesterday, some friends in the core group asked me, which stage of the bull market are we currently in?

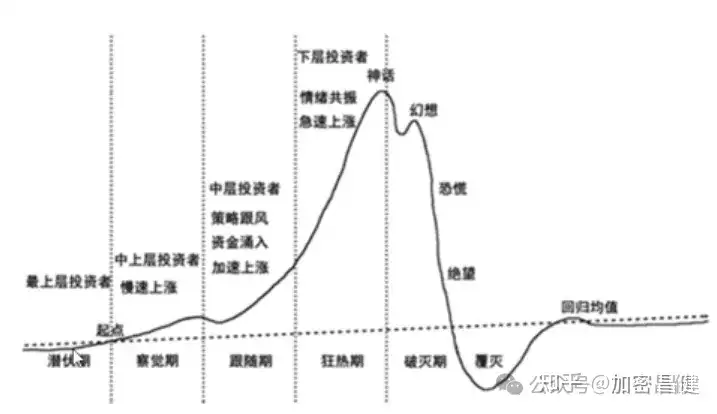

I believe that the market is already in the middle stage of the bull market. It has now passed the early incubation period and detection period and has entered the following period. At this stage, more and more investors begin to enter the market and funds begin to pour in, but the final frenzy period has not yet been reached.

Usually during the mania period, the price of Bitcoin rises rapidly, relatives and friends around you begin to discuss Bitcoin, uncles and aunts begin to enter the market, and market FOMO reaches its peak. But at present, the market is obviously not at this stage yet.

Calculated from the bottom of 15,000 US dollars, the price of Bitcoin has increased nearly 5 times. If Bitcoin can rise to 200,000 to 300,000 US dollars in this bull market, there is still about 3 to 4 times the room for growth.

So overall we are now in the mid-term stage.

It is worth noting that there is an analysis organization called 10X Research. They recently released a chart predicting the price trend of Bitcoin.

They believe that unless Bitcoin falls below the key support level of $68,330, Bitcoin has the potential to break through $83,000 and even reach an all-time high of $100,000.

In addition, the inflow of funds into the U.S. Bitcoin spot ETF has exceeded US$10 billion, and its holdings have exceeded 400,000 Bitcoins.

This number is important because it exceeds the annual supply of Bitcoin produced through mining, which is approximately 164,000 coins.

This massive inflow shows that Bitcoin supply is limited but demand for it is increasing.

In addition, the ETF market in the United States is very large, reaching US$7 trillion. If only 1% of funds flowed into Bitcoin, it would be enough to double the market value of Bitcoin.

As the supply of Bitcoin gradually dwindles and Bitcoin balances on exchanges fall to a six-year low, demand for Bitcoin will further increase.

Coupled with the upcoming Bitcoin halving event, the halving will cause the price of Bitcoin to increase because the halving directly reduces the supply of new Bitcoins.

Although the growth rate of Bitcoin price has decreased after each halving in history, the gradual maturity of the crypto market and the inflow of ETF funds may bring new growth momentum to Bitcoin.

Bitcoin is now more than just a savings value. With the promotion of new technologies such as Ordinals, BRC20 tokens, and Bitcoin layer2, the Bitcoin ecosystem will become more prosperous, and the market demand for Bitcoin will further expand.

There are currently less than 2.4 million Bitcoins circulating in the market, and only half of them may actually be active. About 70% of Bitcoins have not been transferred in more than a year, which shows that many people hold Bitcoins and are not eager to sell.

All the above signs indicate that the number of Bitcoins circulating in the market has become less and less, and most of the Bitcoins are locked in cold wallets by whale and institutions.

Once all the Bitcoins circulating in the market are bought, whoever owns more Bitcoins will have pricing power.

For us ordinary retail investors, the only thing we need to do is to find ways to hoard more Bitcoins and not get off easily, so that we can reap the dividends of this round of industry growth.

If you haven't gotten on board yet, once there is a big correction in the market, it will be your last chance to buy the dips.

If you feel that the current price is too high and you really can’t make a move, you can buy a Bitcoin mining machine to buy a buy the dips, because having a mining machine is equivalent to investing in Bitcoin at a price of US$20,000 every day.

2. Meme track

Recently, the overall performance of the Meme sector is still very strong, with wif, shib, and Slerf all rising to varying degrees.

Currently, the most popular projects in the Meme sector are BOME, SLERF and WIF.

First, let’s take a look at BOME. BOME is a project founded by the mysterious crypto artist Darkfarms 1.

Darkfarms 1 hopes to realize a grand dream through the BOME project: to save memes permanently on the blockchain, which will not only protect memes from loss and tampering, but also allow people in the future to appreciate the creativity of this era.

BOME not only provides a platform for meme creation, but also uses blockchain technology to achieve decentralized storage of meme content, which makes it stand out among many Memecoin projects.

Moreover, Bome may have been controlled by some large investors. Currently, Binance’s chips exceed 50%. This means it will be easier to pull later.

Then there is SLERF, which is a latecomer and this project uses a standby character. It has quickly carved a niche in the market through its innovation and community involvement.

Different from BOME's decentralized storage vision, SLERF focuses more on community building and participation, enhancing the attractiveness of its projects through interaction with users.

Slerf does a better job with the narrative, it does it real justice because slerf doesn't even have a pre-sale.

The market value of BOME and SLERF has both experienced rapid growth. BOME's market value once exceeded US$1.5 billion. Although it has declined recently, it still remains above US$700 million.

SLERF is not far behind. Its market value has increased significantly in a short period of time, and was once close to the market value of BOME.

In addition to Bome and SLERF, the market has also paid a lot of attention to WIF recently. WIF is an emerging Meme coin based on the Solana chain. This project uses a naughty dog wearing a hat as its iconic image, bringing a new meaning to the encryption market. Humor and community interactivity.

WIF was inspired by the Dogwifhat project, which emphasized community participation and decentralized management. It hopes to allow community members to have more say in the direction of the project.

Through summary, it is not difficult to find that these successful Meme coin projects have several key success factors: an attractive brand image, effective social media marketing strategy, close community interaction, huge wealth effect, and continuous innovation.

Not only does this attract new investors and users, it also helps projects stay ahead of the curve in a highly competitive market.

The Solana chain has become the platform of choice for many Meme coin projects due to its efficiency and scalability. Solana can process more transactions at a lower cost than Ethereum, which is crucial for meme coin projects that need to spread quickly and at scale.

The Meme coin craze on Solana is somewhat similar to the ICO era on Ethereum. Solana has promoted the activity and growth of its ecosystem in this way.

The charm of Meme coins lies in their emotional expression. They represent people's direct expression of dissatisfaction with injustice, allowing participants to gain a sense of accomplishment and belonging while pursuing interests.

Meme coins have become a unique phenomenon in the Web3 world, converting attention directly into financial value.

I think Meme coins will become an indispensable part of the cryptocurrency world, because Meme coins play an important role in attracting new users and expanding the awareness of cryptocurrency, so this track may be used by crypto investors and investors in the bull market. Capital takes turns to speculate.

However, it should be noted that the risk of investing in meme coins is very high, and the fluctuations will be very large.

It is recommended to only focus on top meme coin projects, such as pepe, doge, bome and other projects.

And you must strictly control your positions. The position you invest in meme coins cannot exceed 10% of your total position. Large positions should still be placed in Bitcoin and Ethereum. You must not put the cart before the horse.

If you cannot accept the violent fluctuations of meme coins, it is recommended not to participate in such projects.

3. Summary

In general, the market as a whole is in a trend of oscillation and accumulation, and projects such as Sui and Aptos in the public chain sector, as well as Wif and Slerf in the Meme sector, have seen a rising trend.

The market has now entered the mid-term stage of the bull market. It has now passed the early incubation period and detection period and entered the following period.

At this stage, more and more investors begin to enter the market and funds begin to pour in, but the final frenzy period has not yet been reached.

Usually during the mania period, the price of Bitcoin rises rapidly. Relatives and friends around you begin to discuss Bitcoin, uncles and aunts begin to enter the market, and market FOMO reaches its peak.

But at present, the market is obviously not at this stage yet, and many people have not yet jumped on board this bull market.

Judging from the current trend, Bitcoin will most likely reach $100,000 in the second half of the year. What we need to do is to find ways to hoard more Bitcoins, and don’t get off the bus easily, so that we can reap the dividends of this round of industry growth.

If you feel that the current price is too high and you really can’t make a move, you can buy a Bitcoin mining machine to buy a buy the dips, because having a mining machine is equivalent to investing in Bitcoin at a price of US$20,000 every day.

In terms of operational strategy, 80% of long-term positions can be held without moving the currency. It is recommended to buy these positions into Bitcoin mining machines or Bitcoin spot. The goal is to hoard more Bitcoins in the long term, so as to capture the growth of the entire industry. dividend.

Remember, for every penny we make in the crypto market, the ultimate goal is to increase the number of Bitcoins we have.

We should now define the market based on the Bitcoin standard, and can no longer define the market based on the legal currency standard.

The 20% position can be used to buy leading projects in each track, or you can also use it for short-term selling high and buying low, and taking profits in batches. This way you can advance, attack, retreat and defend.