Original: Liu Jiaolian

The falling clouds and the solitary owl fly together, and the autumn water becomes the same color as the sky.

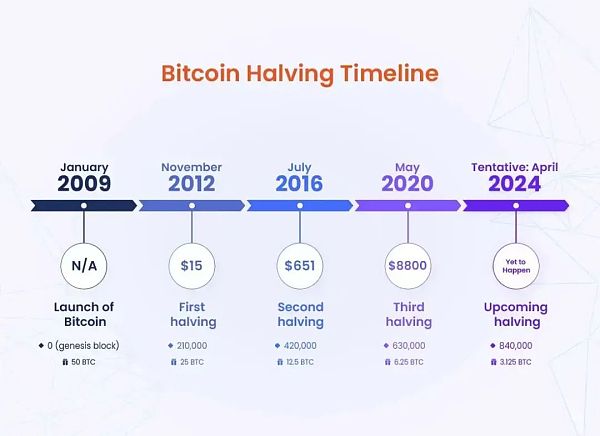

Gradually, gradually, the footsteps of spring are approaching. Gradually, gradually, the halving of Bitcoin (BTC) production is approaching. As mentioned yesterday, " In more than 20 days, the fourth-stage rocket will burn out, and the fifth-stage rocket will be activated to continue propelling us towards the stars and the sea! "

The BTC production halving event is a major event in the encryption industry. This is the time for the rocket to switch. Once the switch is successful, the new first-stage rocket will push BTC farther and deeper into space.

This is not only a big deal for BTC, but also for Altcoin. Before and after the halving, BTC share will reach a local high. Then as the bull market progresses, it will gradually fall. When the bull market is at its craziest, it will reach its lowest level. This means that Altcoin are competing to rise one after another, falling into a carnival called "altcoin season"!

While all the beauties are vying for beauty, BTC has been left out in the cold. As described in the words:

Outside the post station, beside the broken bridge, it is lonely and ownerless.

There is no intention of struggling for spring, and once everyone is jealous.

Four months ago, Jiaolian had already warned in its internal reference that the 2024 halving and the imminent copycat season were coming. At that time, the internal reference said this:

"It's almost 2024, and it's almost the halving time. The spring of the cottage. The so-called spring is the season of sowing. If you pick good seeds, when summer comes and liquidity spreads, they will suddenly grow into towering trees. Trees. If you sow melons, you will get melons, and if you sow beans, you will get beans. Just like Jiao Lian started planting uni for less than $2 in October 2020. However, the fruits are counterproductive. After they mature quickly, they must be picked in time. Don’t wait for the fruits to rot on the ground. Here. Risk control is very critical. Don’t exceed 10% of the position. Try to see if you can outperform. Be prepared to underperform. Be prepared to face the worst results. "

As of February 28 this year, the Jiaolian article " Many crypto professionals are bullish on ETH/BTC, which may promote the outbreak of the altcoin season " quoted netizen Negentropic's view that the rebound of ETH/BTC will promote the exchange rate of the altcoin season. This It will be the Blow-Off Top pattern of the Elliott Wave Theory.

Let’s take a closer look at the evolution of copycat seasons over the past few cycles, and learn from history.

The copycat season of 2016

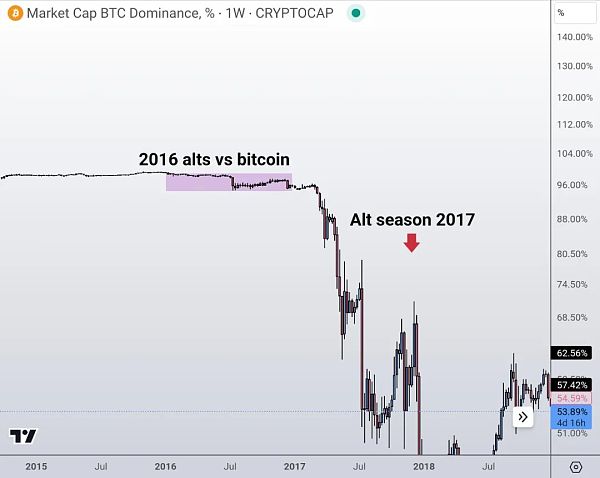

In 2016, after the BTC production was halved, the counterfeit industry went through a 7-8 month downturn and preparations. It was only in 2017 that it exploded with the start of the BTC bull market.

But please note that in 2016-2017, the copycat market was almost non-existent. Before the outbreak of the altcoin season in 2017, BTC’s market share was in an absolute dominance of over 95%.

The copycat season of 2020

In 2020, after the halving of BTC production, the copycats couldn’t wait to start accelerating the upward trend. In the first half of 2021, as BTC reached its first calf top, the total market value of the altcoins also reached a local high. Then during the "519" violent correction in the middle of the year, it also fluctuated violently downward. At the end of 2021, as BTC reached its second calf top, the altcoins also started their second spring.

From this, we can observe:

First of all, the outbreak of the altcoin season is closely dependent on the outbreak rhythm of BTC. BTC is slow at first and then fast, and the altcoin season first declines and then rises, such as 2017. BTC rushes and falls, rushes and falls again, and the altcoin season also rushes and pulls back, rushes and pulls back again.

This well confirms what Jiaolian has said many times, " Only Bitcoin has the ability to launch a bull market ."

The reduction in BTC production is the reason for the bull market (internal cause). The bull market is again responsible for the copycat season.

It can be said that any argument that a certain copycat will create a bull market, whether it is ICO in 2017, DeFi and new public chains in 2021, or RWA, DePIN or something else in 2024-2025 It will create a bull market. All kinds of rhetoric, without exception, are either pure ignorance and pretending to understand, or they are full-blown lies. Referred to as "either stupid or bad".

Secondly, after the halving, there is only a short window for the preparation time for a correction, whether it is downward or upward. Investors who want to find alpha (financial terminology: the excess return relative to the benchmark return beta) in 2024 will not have much time to carefully select and slowly build positions.

Just like JiaoChain in 2020, before the bull market broke out, when Uniswap's currency opened at a high of 8 dollars and then fell below 2 dollars, it started building a position. However, because the bull market started too quickly, the cost of adding positions was quickly raised. After traveling through the bull and bear market, we arrive at today, with UNI at $12, the position is only slightly profitable, far from outperforming BTC.

However, Jiaolian’s attitude towards this “looking for alpha” experiment is dull.

In the encryption industry, the beta strategy is to hold BTC without moving, 1 BTC = 1 BTC. The alpha strategy can generate excess returns compared to holding BTC unchanged, which is the part that outperforms BTC.

BTC is the gold standard. Bitcoin is the new gold standard.

Therefore, alpha excess return means that exchanging BTC back can increase the absolute number of BTC in your hands.

Regardless of the a priori theory or the experimental verification of teaching the chain to travel through bulls and bears, it has proved an ironclad truth: to hold copycats, you must sell them in the bull market and implement the alpha excess returns into actual BTC spot. The best time is when the copycat outperforms BTC by a large margin.

At least, part of alpha’s excess returns must be reduced and exchanged for BTC.

In this sense, holding a copycat is equivalent to a kind of soft leverage. If you use the perspective of leverage to examine an Altcoin, you may gain a new understanding and thorough understanding.

Abandon the fiat currency-based yield thinking and goals, such as 10 times, 100 times and so on. Switching to the BTC standard, let me ask if your copycat can achieve 5 times the alpha in a bull market?

That is, convert the copycat currently worth 1 BTC into an actual 5 spot BTC.

able? That would be so cool!

cannot? Then just hoard BTC honestly.