Author: Helen Partz, CoinTelegraph; Compiler: Deng Tong, Jinse Finance

Multiple industry analysts say April’s Bitcoin halving is just a small factor in the cryptocurrency’s potential for stunning gains this year.

Investment researcher Lyn Alden said that next month, the Bitcoin halving will reduce the daily production of BTC by about 450 BTC from the current daily average of 900 BTC.

However, Alden said the supply reduction pales in comparison to the daily flow of fiat currency into and out of cryptocurrency exchanges and Bitcoin exchange-traded funds (ETFs).

“In fact, inflows or outflows could easily exceed 10 times that value, ” Alden said, adding that overall demand for Bitcoin is “a more important factor than the supply crunch.”

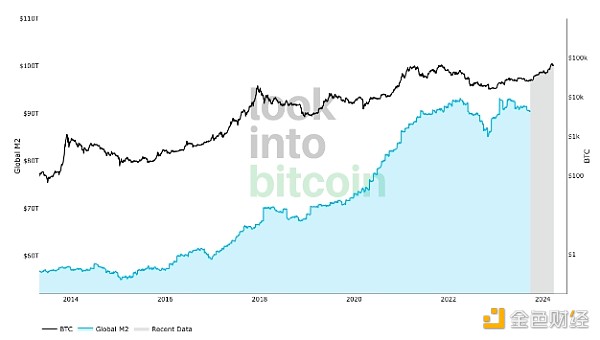

Alden emphasized that historically, demand for Bitcoin has been more correlated with global liquidity indicators, such as global broad money supply, referring to a chart that reflects Bitcoin price against the global money supply (M2).

Bitcoin price and global liquidity (M2). Source: Look into Bitcoin

"So I think the halving is important, but it's just one of many factors that determine the occurrence and timing of a bull market. The combination of various measures of global liquidity, HODL waves and other catalysts can play a bigger role, " Alden said, and Added:

“I’m optimistic about the next two years due to expectations of halving, improving global liquidity, and the fact that so many coins have turned to strong hands in a bear market, so a relatively small increase in demand could drive prices higher.”

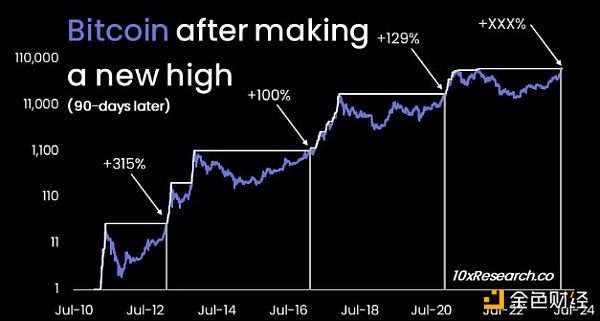

Markus Thielen, CEO and chief analyst at 10x Research, said the current rally is "certainly comparable to the bull market of 2020 and 2021," which initially peaked in April 2021.

When it comes to tools like quantitative analysis, Thielen has been bullish on the price of Bitcoin after the cryptocurrency broke through multi-year highs on March 13, 2024.

Based on historical price changes and Bitcoin's recent highs, 10x Research expects Bitcoin to reach $77,000 by early April and $99,000 by May 2024.

“When Bitcoin hit a new high of $68,300, we saw a wave of intraday selling, but every attempt to push the price lower was met with relentless buying,” Thielen wrote on March 14.

The analyst noted that each time Bitcoin experienced a new price breakout in February 2013, February 2017, and November 2020, the price could rise by 189% after 180 days. Thielen noted that ultimately, Bitcoin will peak 9 to 11 months after its historical breakout.

Bitcoin hits new bull run high 90 days later. Source: 10x Research

Thielen predicted that Bitcoin could rise to an eye-popping $146,000 between December and February 2025, or 9 to 11 months after the March 13 breakout.

“While corrections and retracements can occur at any time, traders can use the breakout level – $68,300 – as their new line, above which we can consider Bitcoin to have a strong performance in the coming weeks and months. Could move sharply higher ," the analyst added:

“While Bitcoin has the potential to climb to $146,000 this summer, we currently maintain our $125,000 price target as we expect this bull run to continue into 2025.”

eToro cryptocurrency analyst Simon Peters emphasized that the current Bitcoin rally is the first time Bitcoin has experienced a parabolic rise and reached an all-time high before the block reward halving.

Peters said the main reason for this breakthrough was the launch of a spot Bitcoin exchange-traded fund (ETF) in the United States on January 11, 2024.

“Demand for Bitcoin is rapidly outpacing new supply, which is something we’ve never really encountered in previous cycles,” Peters stressed. He added that before the launch of the ETF, demand was primarily driven by retail investors, And the current cycle will be "more institutionalized."

Peters said that Bitcoin miners are the only natural sellers as they have been actively selling BTC since August 2023.

“This suggests to me that miners have sold off on the current rally in preparation for the upcoming block reward halving,” the analyst said, adding that due to the high demand for spot ETFs , all sell-offs are "good bids." "

“ If we do see spot ETF inflows slow, it could be a sign that the market has peaked and is losing momentum , but it’s worth noting that while ETFs have been a major contributor to the rally so far, they are not the only players in the space . Other entities such as MicroStrategy and Bitcoin whales also continue to accumulate.”

At the same time, Exness financial market strategist Li Xing believes that macroeconomic developments will drive the rise of Bitcoin prices this year.

The analyst said that in addition to the launch of spot Bitcoin ETFs, other economic developments, such as expectations of weaker monetary policy and lower interest rates in the United States and elsewhere, may enhance Bitcoin's appeal as an alternative store of value.

"In addition, geopolitical risks and uncertainty about the U.S. election are likely to continue to boost demand, signaling the beginning of a sustained bull market going forward ," Li added.

Bitcoin halvings are scheduled to occur every 210,000 blocks, or roughly every four years, and are designed to maintain Bitcoin's deficit and offset inflation.

Since its launch in 2009, Bitcoin has experienced three halving events in 2012, 2016 and 2020, with its miner incentives reduced from the initial 50 BTC to the current 6.5 BTC. The upcoming Bitcoin halving in 2024 will further reduce mining rewards from 6.5 BTC to 3.125 BTC.

Historically, Bitcoin halvings have been associated with post-halving rallies. For example, Bitcoin surged approximately 3,000% in the 17 months following the 2016 halving, reaching the historical milestone of $20,000 in December 2017.