Author: Frank, PANews

Editor's note:

The public chain is the soil for the growth of blockchain technology. In the process of development and progress of blockchain technology, the innovation and evolution of public chain technology have played an indelible role. From Bitcoin to Ethereum, it has brought a new territory of smart contracts to the encryption world; from Ethereum to new public chains such as Solana, it has opened up the possibility of large-scale application of Web3. In every bull market, new public chain leaders stand out and become the vane of the bull market and the new cradle of technological innovation. In order to have a deeper understanding of the entire crypto world, PANews hereby launches a series of articles on "New Narratives of Public Chains" to explore the new narratives and potential of each public chain from the latest developments, technological changes, market potential, etc.

In the past month, the market performance of Fantom's governance token FTM has been particularly outstanding among many public chains. It rose from US$0.42 on February 24 to as high as US$1.23 on March 21, an increase of nearly three times. Surrounded by many Meme waves, achieving such market performance can be described as brilliant.

"I am even more confident in Fantom today than I was in 2019. The team is 100 times stronger than before. The financial position is 250 times stronger than before. Our technology stack is 160 times faster and more optimized. If you thought Fantom was going to zero or disappear In a sea of irrelevant blockchain projects, I am willing to accept this contrarian bet." Andre Cronje (hereinafter referred to as "AC"), known as the godfather of Defi, once again expressed his confidence in Fantom on Twitter, although There have been several withdrawals, but AC remains the same with Fantom. AC's confidence may come from Fantom's new technology Sonic, which was just released on March 25. According to Fantom officials, “The Fantom team has been working hard over the past two years to build our new technology Sonic, which is the most scalable and secure blockchain technology to date. Compared to Opera’s 200 TPS, Sonic Being able to process 2,000 TPS at sub-second speeds is a huge improvement." Sonic technology will also likely become one of Fantom's main narratives in the next few years.

With the momentum of AC, Fantom is emerging from the quagmire of the multichain incident. In this bull market, PANews analyzed Fantom’s recent dynamics and found that the upcoming Sonic upgrade, the construction of the Meme currency ecosystem, and the return of AC may become the main elements for Fantom’s comeback in this bull market.

Sonic upgrades to become the highlight of Fantom

Sonic upgrades are undoubtedly the current focus of Fantom's narrative content. On March 25, Fantom founder Michael Kong released the first part of Sonic in a blog post. This blog post introduces Fantom Sonic-related performance upgrades and a series of management solutions. The introduction of Fantom Sonic shows that Fantom Sonic can achieve a TPS increase of more than 10 times. According to past practice, the original story of the rise of public chains is related to performance, which has been reflected in previous star public chains such as Solana and Avalanche.

For Fantom, the technical part is obviously the most important narrative content at present. Both the Fantom Foundation and AC have recently been vigorously promoting Sonic's performance advantages. In summary, the main performance improvement of Sonic lies in the improvement of efficiency. Combining Directed Acyclic Graph (DAG) and Byzantine Fault Tolerance (BFT), Fantom implements a consensus mechanism that does not require a centralized leader, which is compatible with Fantom's existing Opera chain. Compared to , Sonic's performance has been greatly improved.

Andre Cronje made a notable comparison between EVM and FVM on Twitter:

The base Ethereum Virtual Machine (EVM) is capped at around 200 TPS, and by adding optimistic parallelism (best-case scenario with foreseeability), it can be improved by up to 40 TPS, for a total maximum of 240 TPS.

The base Fantom Virtual Machine (FVM) is capped at about 30,000 TPS, and by adding brute force parallelism (bad), this can be increased by up to 4,500 TPS, for a total maximum of 34,500 TPS.

How to understand the changes brought about by this technology? We can explain it with a simple analogy:

Imagine that you are running a fast food restaurant (Ethereum main chain) and customers (transactions) are queuing up to order and pick up their food. In order to improve service efficiency, you come up with two solutions:

Parallel EVM: Just like adding multiple ordering windows and kitchens in a fast food restaurant, allowing multiple employees to serve customers at the same time. Each ordering window and kitchen can work independently, but they are still in the same fast food restaurant and follow the same rules and processes. By processing customers' orders in parallel, fast food restaurants' service speed and customer satisfaction are improved.

Sonic: Sonic works like the introduction of a highly optimized central kitchen that can produce large quantities of standardized food in a short period of time and then quickly distribute it to various branches (Layer 1 and Layer 2). This central kitchen (Sonic) uses advanced equipment and processes to produce food at an extremely high speed and efficiency, far exceeding the production capabilities of a single fast food restaurant or branch.

If the technology can be realized as scheduled, it will likely bring more new projects and users to the Fantom ecosystem. To this end, the Fantom Foundation has also proposed plans to expand and accelerate the Sonic Labs funding program (Sonic Labs is a startup accelerator program launched by Fantom in February this year to promote innovation within its new Sonic technology stack. The program will select up to five projects, each project will receive 1 million FTM (approximately US$294,000) in funding, technical support, joint marketing and mentor guidance). It also said that it will also launch a series of reward activities for users. It is expected that the new chain will be launched this summer. Launched in late autumn or early autumn.

Can the official Meme coin that actively carries goods recreate the Solana-style legend?

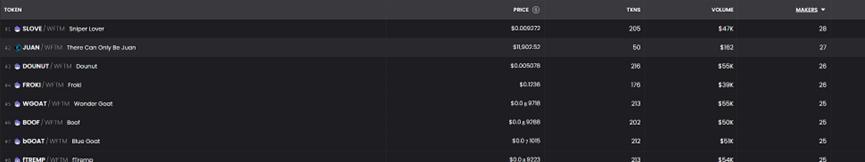

Meme currency ecology has become a battleground for public chains in this round of bull market, and there is even a situation where those who win Meme will win the world. Recently, the Fantom Foundation forwarded an introduction to the $sGOAT Meme. As a result, $sGOAT has become the MEME coin with the most holders on Fantom (more than 1,000 holders) within just one day of its launch. Combined with Fantom's official upgrade content, including performance improvements and gas fee reductions, Fantom has built a soil suitable for Meme's ecological growth. Combined with the special comparison with Solana during the introduction. Coupled with the official proactive forwarding of some Meme information, Fantom is much more interested in Meme than before.

Fantom Foundation retweeted meme coin $sGOAT

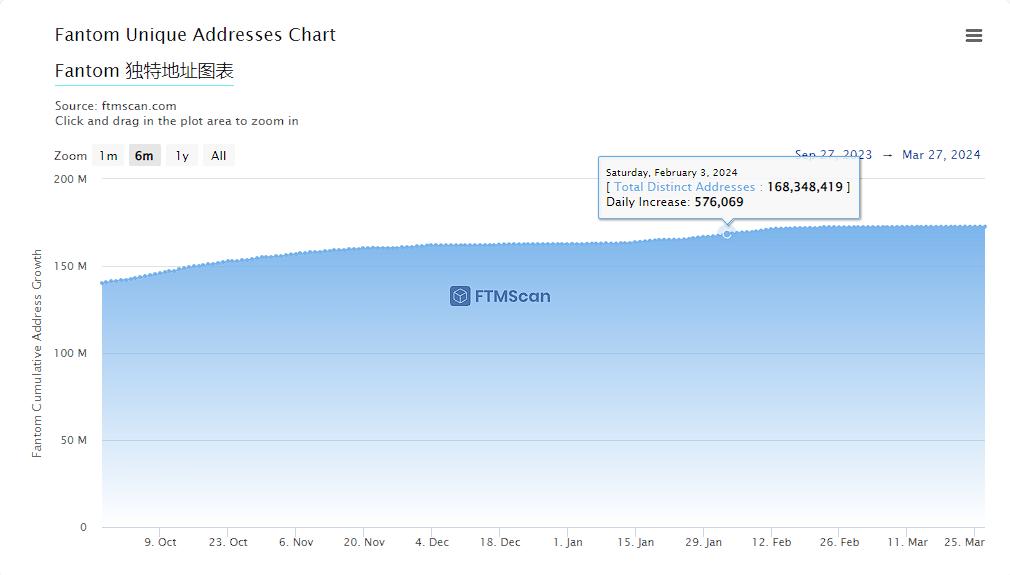

However, the explosion of Meme coins often represents the result of ecological prosperity. There are currently 254 projects in the Fantom ecosystem. In February 2024, there was a sudden increase in new addresses, with a maximum of 570,000 new addresses added in a single day. However, despite recent official actions, there are only a few thousand new addresses added every day. The number of newly issued Meme coins every day is also about 100, and the average number of coin holders is only between 20 and 30 people. According to tokenterminal data, Fantom’s average daily active users in the past month are about 50,000. Overall, there is still a big gap between the ecological activity and public chains such as Ethereum and Solana.

Fortunately, Fantom may still have a trump card that can stimulate the activity of the Meme coin market. That is the return of Andre Cronje. AC used to be a hot topic in the encryption world, and his influence cannot be underestimated. In March 2022, AC announced that it was leaving Fantom, causing YFI to fall by 10% and FTM to fall by 20%. After AC announced its return to Fantom in November 2022, it once again caused FTM to rise by 44%. Now, AC is once again active on Twitter and has begun to build momentum for Fantom, similar to the effect of the founder of Solana’s previous call for Meme coins. Once AC, known as the Godfather of Defi, starts selling Meme, it may have a different effect.

Or join forces with Frax to repair the Defi ecosystem

The biggest difficulty in restarting may be the remaining troubles caused by the Multichain incident. In the Multichain incident, Fantom's ecosystem losses accounted for approximately one-third of the total losses, approximately US$65 million. Recently, the Fantom Foundation applied to the court to liquidate the Multichain Foundation to help recover and distribute lost or frozen assets. Even so, it can still be seen that the Twitter comment areas of AC and Fantom Foundation are filled with a large number of complaints about the loss of users caused by the Multichain incident. Since the Multichain incident, Fantom’s on-chain TVL volume has dropped rapidly, from an average of 200 million US dollars to around 70 million US dollars, and has only recovered to a maximum of 150 million US dollars so far.

Among the 254 ecological projects listed by Fantom, there are 118 Defi projects, accounting for nearly half. The recovery of the Defi ecosystem may be Fantom’s top priority.

On March 28, Fantom announced the progress of a new round of financing for sonic. The first angel investor to participate was the founder of FraxFinance. The cooperation with Frax may find some new paths for Fantom’s Defi recovery. However, this still needs to be observed the degree of cooperation between the two parties.

Currently, there is a growing demand for high-performance, scalable blockchain infrastructure. If Fantom Sonic can achieve its goals of high performance, scalability, and establish an active and diverse ecosystem, it is expected to become an important player in the field of blockchain infrastructure.

Powerful enemies are waiting around to make a comeback, and it’s unknown

In the Layer 1 track where Fantom is located, there are strong opponents such as Ethereum and Solana.

Fantom has implemented highly targeted marketing strategies for these two ecological competitors. The first is to take advantage of performance advantages for parallel EVM on Ethereum. AC said on Twitter: "Parallel technology is not even ranked in the top three of Fantom technology improvements."

As for Solana, a more powerful opponent, Fantom focuses on criticizing Solana's performance stability. In a report on Fantom for the first quarter of 2024 by Reflexivity Research forwarded by the Fantom Foundation, it was emphasized that Fantom has been uptime 99.9% of the time since its launch. In contrast, Solana's multiple outages were highlighted. object of criticism.

However, there are also many uncertainties in Fantom. Although AC's comeback has brought activity to Fantom to a certain extent. But judging from AC's personality of repeatedly withdrawing and coming back, his personal changes may also become an uncertain factor for Fantom. Once there are major changes in members or mistakes in key decisions, it may have a negative impact on the development of the project and community confidence.

In addition, Fantom Sonic has not accepted performance verification, and the current performance advantages of Fantom Sonic are based on test environments. Since the upgrade is still incomplete, its technical implementation still needs to withstand the test of practical applications and large-scale transactions. In April 2023, AC stated that Fantom planned to launch its own crypto bank, which it planned to launch that year. To date, this matter has not yet been resolved.

Fierce competition in the field of blockchain infrastructure and changes in the narrative structure of the industry. Fantom's competition from other Layer 1 and high-performance blockchain projects is the biggest market pressure in this bull market. As the industry evolves, it has become an indisputable fact that it is difficult to gain much recognition simply by relying on performance indicators as the main narrative. Perhaps, Fantom has never lacked narrative, and the vision of realizing narrative may be more recognized by the market.