Written by: Climber, Jinse Finance

On March 18, the Ethereum re-pledge protocol ether.fi was launched on major exchanges. After opening high, it fell back to around $3, and has been rising since then, reaching a maximum of $8.66 in less than two weeks. It is rare for a new project to see such a short-term increase. In addition, the re-staking track is gaining momentum. As the leader, ether.fi is naturally worthy of attention.

This article will comprehensively explain this leading project on the track, ether.fi, to help readers understand the project and find out its value.

strong performance

Judging from the currency price trend, ether.fi has performed well since its listing. As of this writing, the ETHFI currency price is as low as $2.83 and as high as $8.66, with an increase of 208% during the period. For newly listed currencies on the exchange, a twofold increase in a short period of time is quite objective.

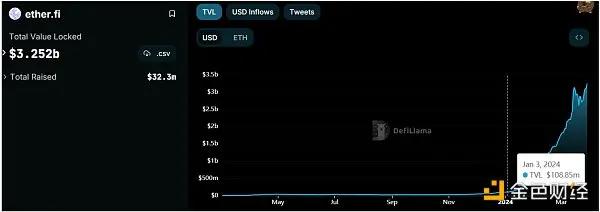

Judging from the data performance on the project chain, according to DefiLama data, the current TVL of ether.fi is US$3.252 billion. As can be seen from the figure above, Ether.fi TVL has entered a high-growth mode since about January this year. In just three months, it has increased from nearly US$100 million to over US$3 billion, an increase of up to 30 times.

Comparing it with other competitors in the same track, it can be clearly seen that ether.fi is far ahead of other similar competitors, and its TVL is about twice that of the second place Renzo. From the perspective of TVL growth, the monthly growth rates of ether.fi, Renzo, and swell network are all around 100%, especially Renzo.

Regarding the generally high growth of TVL on the re-staking track, a senior industry analyst said that this is mainly due to the huge expected demand for projects that can provide consensus-safe AVS services. At the same time, the re-pledge track is also favored by many institutions and investors.

Jinse Finance once compared the development status of the top projects in detail in the article "Comparison of the development status of representative projects in the article "The re-staking track continues to heat up" in early February this year, and pointed out that the re-staking track exploded due to the impact of the Ethereum Cancun upgrade. If possible, readers can refer to it.

ether.fi Introduction

ether.fi is a non-custodial staking protocol built on Ethereum, founded by Mike Silagadze and launched in 2023.

Unlike other liquid staking protocol, ether.fi allows participants to retain control of their keys while staking their tokens, and can exit the validator at any time to reclaim their ETH.

This is mainly reflected in two aspects:

- Stakeholders generate and hold their own staked ETH keys.

- NFTs are minted for every validator launched through ether.fi.

As with most other delegated staking protocols, the starting point is for stakers to deposit their ETH and be matched with a node operator, who generates and holds staking credentials. Although this approach can make the protocol unmanaged, in most cases it actually creates a managed or semi-managed mechanism. This could expose stakers to significant and opaque counterparty risk.

With ether.fi, stakers can control their keys and retain custody of their ETH, while entrusting their stakes to node operators, which greatly reduces the risks they suffer.

Technically speaking, in Ethereum's PoS pledge, two keys will be generated: a withdrawal key and a verification key. The withdrawal key is used to withdraw the user's assets, while the verification key is used by the node operator to verify the block within the specified time to obtain verification rewards.

ether.fi uses key management technology to realize the separate management of withdrawal keys and verification keys in pledge delegation, further optimizing the security of ETH pledge services. It also creates a node service market where stakers and node operators can register nodes to provide infrastructure services, and the revenue from these services is shared with stakeholders and node operators.

Users can deposit funds into ether.fi and obtain investment returns in the form of staking rewards(supply-side fees). In the process, ether.fi can also automatically pledge users' deposits to Eigenlayer to obtain income. Eigenlayer uses staking ETH supports external systems (such as rollups, oracles), which improves the returns of ETH stakers by establishing an economic security layer.

The sum of all staking rewards is divided between stakers, node operators, and the protocol at 90%, 5%, and 5% respectively. Users can generally obtain: Ethereum staking rewards; ether.fi loyalty points; re- staking rewards(including EigenLayer points); and rewards for providing liquidity to the Defi protocol.

Financing information:

- ether.fi completed US$5.3 million in financing on February 2, 2023. North Island Ventures, Chapter One and Node Capital led the investment, and BitMex founder Arthur Hayes participated.

- In addition, ether.fi also completed US$23 million in financing in February this year. The financing was supported by more than 95 investment institutions and individual investors including Amber Group, BanklessVC, and OKX Ventures.

At present, ether.fi has announced the information of 5 team members in the official Docs, among which the founder Mike Silagadze: is currently the CEO of the DeFi fund company Gadze Finance, and is also the CEO of the Canadian higher education platform Top Hat (2021 Series E financing of US$130 million) Founder.

Token Economics:

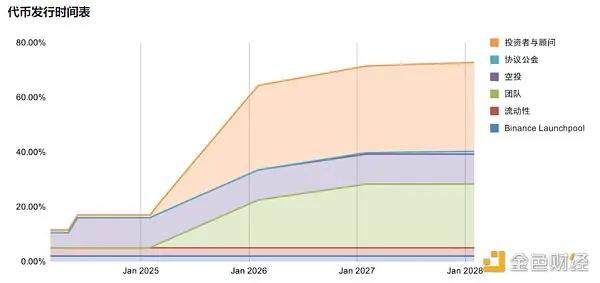

The ether.fi token economic model shows that the total supply of ether.fi token ETHFI is 1 billion, and the initial circulating supply is 115.2 million. 2% of the token allocation will be used for Binance Launchpool, and 11% will be allocated to airdrops. 32.5% is allocated to airdrop investors and advisors, 23.26% is allocated to the team, 1% is allocated to the Protocol Guild, 27.24% is allocated to the DAO Treasury, and 3% is used to provide liquidity.

However, from the perspective of unlocking time, ETHFI will not be significantly released until next year, and it will not reach more than 60% until 2026. This reflects the certain scarcity of ETHFI's market chips.

However, judging from the airdrop information of ether.fi on March 18, the top 20 addresses in the reward list contributed one-third of the TVL (273,000 ETH) to ether.fi and received 9.96 million ETHFI. airdrop.

The person who received the largest number of airdrops was Justin Sun, who deposited 120,000 ETH ($435 million) into ether.fi on the 13th and received 3.45 million ETHFI airdrops. Judging from the pledge airdrop ratio, it is about 1:3, which means that users must pledge 1 ETF to obtain 3 ETHFI, which is only US$26 based on the highest price of ETHFI.

Project progress and roadmap

In March this year, ether.fi launched the second quarter of the points activity StakeRank, which will be held from March 15 to June 30. The rewards will account for 5% of the total supply of ETHFI. Not long ago, ether.fi conducted an airdrop of 68 million ETHFI (6.8% of the total amount), and the project also launched the Restaking Paradigm product with Manta Network.

In February, DeFi yield market Pendle announced that it would cooperate with the Ethereum staking protocol ether.fi to launch the first LRT asset eETH on Arbitrum. In January, ether.fi announced the establishment of an advisory board, with members including independent Ethereum educator sassal.eth, Polygon founder Sandeep Nailwal, Arrington Capital founder Michael Arrington, Ethereum Foundation member SnapCrackle.eth, etc.

In November last year, the ether.fi mainnet was launched and the liquid staking token eeth was released. In October, ether.fi launched the liquid pledge token (LST) eETH and also announced its decentralization roadmap. In May, ether.Fi launched the first phase of mainnet.

According to its official website roadmap:

- Last August, ether.fi jointly launched the first DVT mainnet validator with Obol Labs, which was then included in the first batch of mainnet validators, which were operated by a geographically dispersed group of small independent operators. run.

- In October last year, ether.fi open sourced its smart contract suite. In November, eETH was launched. eETH is ether.fi's Liquid Stake token. Users will be able to participate in Ethereum staking in a completely permissionless manner and buy and sell pledged assets on demand.

- In April this year, ether.fi is expected to complete the second phase of DVT integration. In DVT Phase 1, ether.fi has partnered with Obol Labs to offer mainnet DVT - verifications shared by different individuals, none of whom has the full validator key. The second phase will move towards fully automated integration, where users will arrive, apply and start as individual stakers, unmanaged and unassisted by ether.fi and Obol.

At the same time, ether.fi will also implement DAO governance and TGE.

In addition, ether.fi mainnet v3 is scheduled to be released in early Q2 and will include some special features, such as the ability for users to run personal nodes with 2 ETH Bond.

summary

Since last year, there has been more and more discussion and research around the re-staking track. At the beginning of this year, the re-staking track has gained momentum, and ether.fi, as the leader of the track, was the first to be listed on the exchange and performed well, which inevitably makes investors more optimistic about the track.

For users who prefer staking to earn money, security and yield are the biggest considerations. ether.fi's DVT technology can greatly ensure the security of users' pledged assets, and can also provide users with relatively good returns. Therefore, the current products and services of ether.fi do have certain prospects, but the smart contract and technical security aspects still need to be tested by time.