The Market

BTC surged above $70,000 again after briefly dipping below $62,000 last week, as positive spot ETF inflows returned following consecutive days of outflows the previous week.

The market reaction to the court ruling against Coinbase’s dismissal effort in the SEC case has been muted. It’s important to note that the ruling does not confirm Coinbase’s violation of SEC rules but rather denies Coinbase’s attempt to dismiss the SEC’s accusations. This means that Coinbase still needs to go to trial to address the issues of operating as an unregistered exchange and security sales through its stalking-as-a-service program. However, Coinbased did receive a favorable ruling on their wallet service, with the court determining that the service does not implicate US security laws.

BTC dominance has been on a declining trend since March, dropping from the post-FTX high of 55% since the beginning of March . Meanwhile, the Altcoin market cap has been rising during the same period. BTC dominance was around 70% during the last halving in May 2020 and 90% in 2016. As the crypto market continues to expand, it’s likely that the peak BTC dominance level will continue to decrease. Therefore, this cycle’s peak could be around 50-60%, indicating that we may have entered the early stage of an Altcoin season as the BTC dominance trends toward its potential peak level.

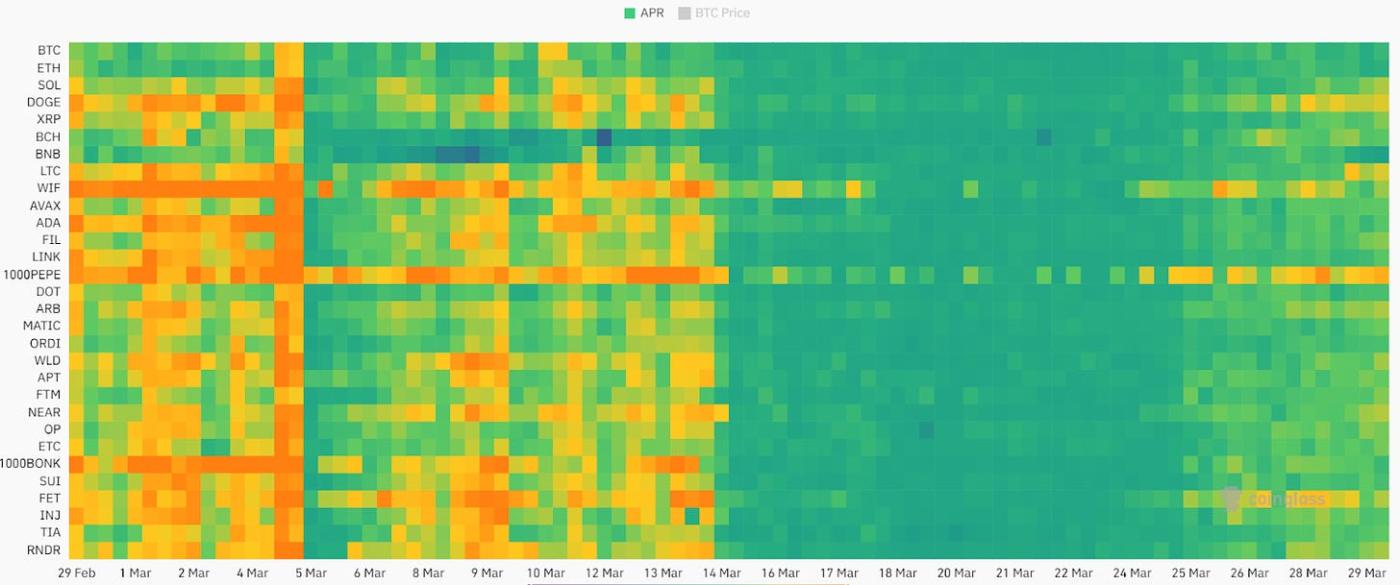

We are seeing leverage returning to the market as the funding rate rises in the riskier part of the crypto market, including several popular meme coins.

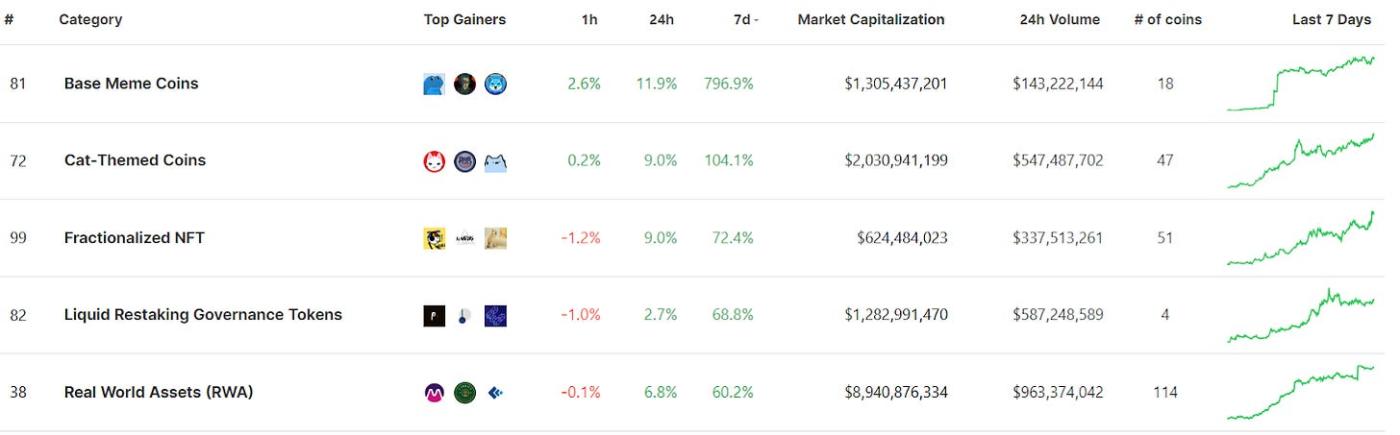

The best performing sectors continue to be Memes. The recent TGE of EtherFi, the leading LRT protocol by market share, also received a nice pump last week. Additionally, the encouraging news of Blackrock launching a tokenized money market fund on Ethereum has also contributed to the return of the RWA sector.

Source: CoinGecko, 3/29/2024

On the macro side, Powell indicated at the Monetary Policy Conference last Friday that the Fed is in no hurry to cut rates, citing strong employment data is buying the Fed more time to monitor inflation. The stock market is not deterred by the lower rate-cutting expectations, and according to Goldmans Sachs, this round of techstock-led rally still has more room to run and not in a bubble territory yet.

DeFi Update

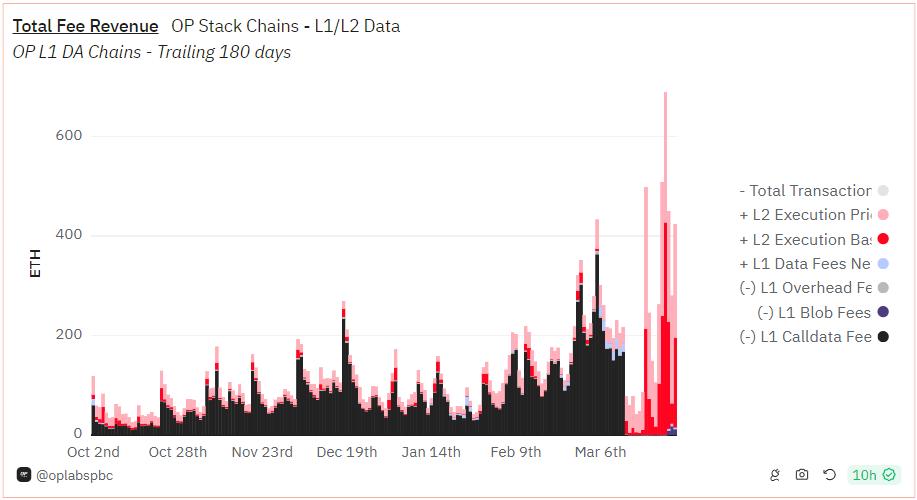

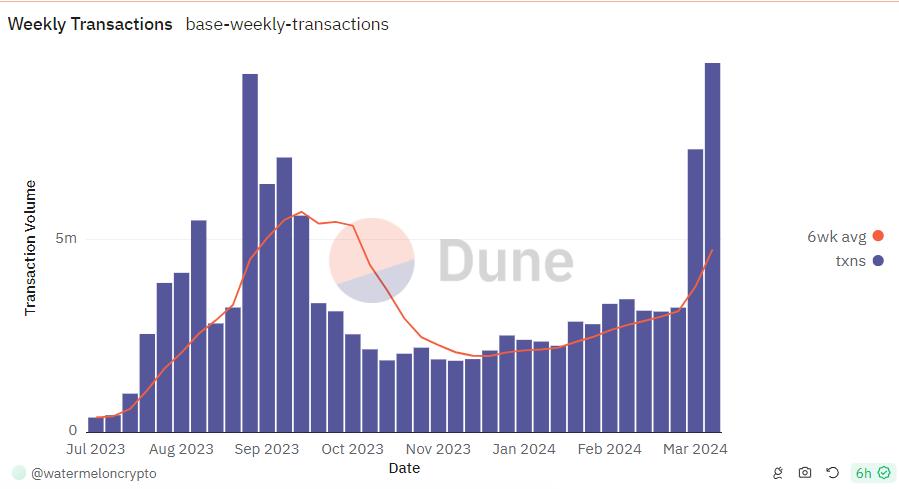

The activities on Ethereum L2s are picking up since the Dencun upgrade, led by Base. Although the DA cost has drastically decreased thanks to the Dencun upgrade, users are willing to pay much higher transaction fees due to heightened activities. This has resulted in the total transaction cost on L2s being higher than the levels prior to Dencun. Without parallel execution, L2s could still face high transaction costs when activities increase. This highlights the design advantage of Solana’s parallel execution approach.

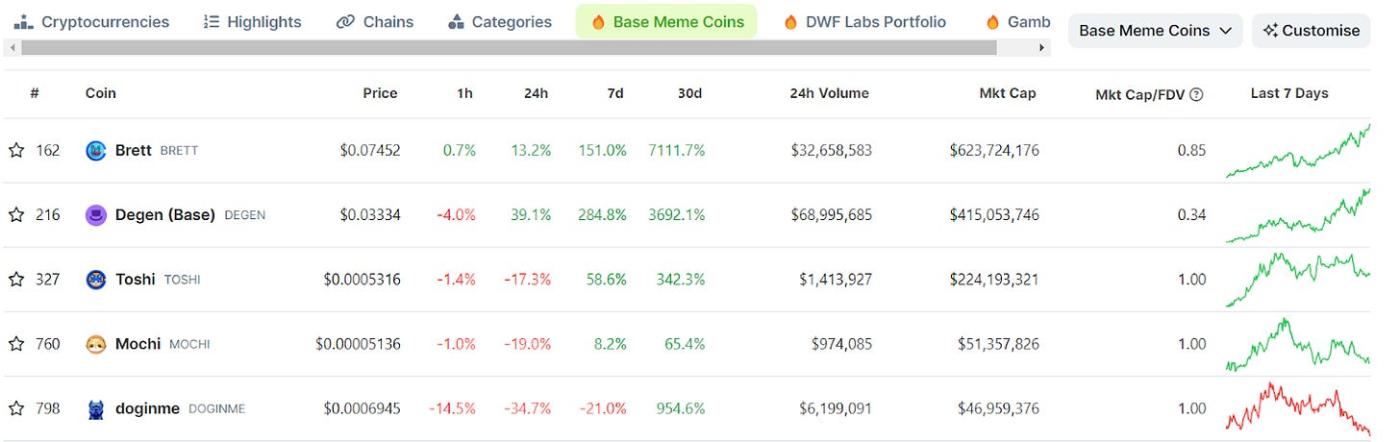

The Base meme coins have been catching up with Solana memes, with Degen and Brett printing 30X+ returns in the last 30 days.

The Base network has experienced rapid user growth and transaction volumes, making it a likely candidate for this cycle’s top ecosystem alongside Solana.

Top 7d Gainers and Losers

Top 100 MCAP Winners

CORE (+118.20%)

Dogwifhat (+88.23%)

Mantle (+57.08%)

Ondo (+34.69%)

ICP (+32.25%)

Top 100 MCAP Losers

KCKuCoin Token (-22.53%)

Bittensor (-14.22%)

Fantom (-13.54%)

Worldcoin (-6.07%)

Monero (-5.74%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.