Source: Chain Teahouse

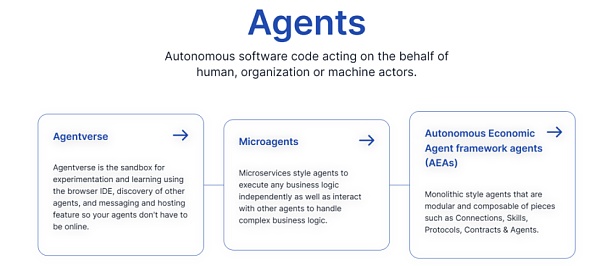

Fetch.ai is a blockchain-based decentralized machine learning platform. Its open source software project aims to build infrastructure for developing modern, decentralized and peer-to-peer (P2P) applications. Fetch.ai uses artificial intelligence and automation technologies to provide a variety of tools and frameworks to create and connect intelligent agents to perform complex tasks in the digital economy. An intelligent agent is an autonomous software code that can act on behalf of humans, organizations or machines. The platform's outstanding feature is the democratization of access to artificial intelligence (AI) by creating a permissionless network. Anyone can connect to the network to use and contribute to datasets for autonomous AI operations. This setup is particularly beneficial to various fields, including DeFi trading services, transportation, and smart energy systems.

Fetch.ai's network is a cross-chain protocol based on Cosmos-SDK, which can implement advanced cryptography and machine learning logic on the chain. Fetch.ai also has its own token, called FET, with a current circulation of 746 million and a maximum supply of 1.153 billion.

Core Technology

A key aspect of the Fetch.ai protocol is its combination of distributed ledger technology (DLT), machine learning (ML), and trust protocols to create an intelligence-driven agent system. This system allows for a dynamic, automated, and efficient transaction network that incentivizes disintermediation and direct exchange between economic agents. The Fetch protocol aims to reduce transaction and contract costs and shorten delivery times, opening up potential for emerging markets based on the immediacy and granularity of service delivery.

Key features include:

The Autonomous Economic Agent (AEA) architecture is a distributed intelligent agent architecture for building autonomous and collaborative intelligent agent networks. AEA stands for Autonomous Economic Agent, which is a digital entity that can automatically perform tasks such as data collection, negotiation, or transactions based on its environment and market conditions. AEA can represent a service, an individual, or a device. The core idea is to combine artificial intelligence and blockchain technology to build a decentralized intelligent economy and realize intelligent, autonomous, and decentralized economic interactions.

Open Economic Framework (OEF): OEF is the abbreviation of Open Economic Framework. It is a space for AEAs to search, find, communicate and trade with each other. The virtual environment it defines provides APIs for AEAs (free and paid, paid with FET tokens). For example, AEA codenamed 001 has certain data (data provider), so it declares that it has data in the network. AEA codenamed 002 happens to need this data for machine learning, so it searches for and purchases 001's data in the network, realizes trade behavior, and uses it for machine learning.

Smart Ledger: Fetch.ai uses a high-speed, scalable blockchain that allows for secure, decentralized coordination of large volumes of transactions and interactions between agents.

Machine Learning and Artificial Intelligence: The platform integrates artificial intelligence and machine learning technologies to support predictive analytics, decision making, and intelligent agent behavior.

FET token

The FET token is an integral part of the Fetch.ai ecosystem, serving as the primary medium of exchange that facilitates transactions between agents, deployment of agents, and compensation for services provided. As of the latest update, the price of the FET token is approximately $0.289, with a market cap of approximately $243,346,673. The 24-hour trading volume of FET is approximately $30,949,090. There is a circulating supply of 840,755,479 FET out of a total supply of 1,152,997,575 FET, with a fully diluted market cap of $333,721,4349.

FET plays a vital role in the Fetch.ai network. Its specific uses and functions include:

Transaction Fees: FET is used to pay for transaction fees on the Fetch.ai network. This includes the cost of deploying and executing smart contracts, conducting transactions, and interacting with the network.

Staking: Participants in the Fetch.ai network can stake FET tokens to participate in network security and governance. Staking FET qualifies holders for rewards distributed for helping to secure the network, validate transactions, and maintain the overall integrity of the platform.

Accessing Resources: FET tokens can be used to access or purchase resources within the Fetch.ai ecosystem. This includes purchasing computing power, data, and other digital assets or services provided by Autonomous Economic Agents (AEAs) on the platform.

Governance: FET holders may also have governance rights, allowing them to vote on proposals that affect the development and direction of the Fetch.ai network. This includes decisions on changes to the protocol, network upgrades, and deployment of community funds.

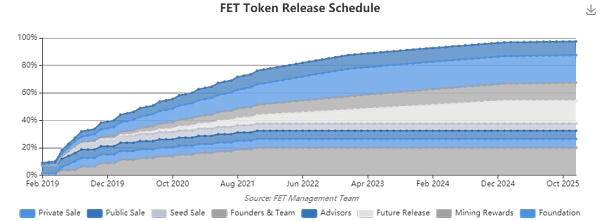

Token release: As shown in the figure below, about 1.04 billion FETs are currently in circulation, with a current market value of about 2.46 billion, accounting for about 90% of the total tokens. The current price is $0.236, and the current market value is about $247 million.

Token fundraising: as shown below.

Chip distribution: Currently, FET tokens exist in three chains: Ethereum, BSC, and Fetch, with Ethereum being the main chain. According to the block browser, more than 25% of FET (Ethereum + BSC) is stored in Binance Exchange, and the chips on the chain are relatively dispersed.

Profit and loss ratio: According to the on-chain data, more than 91% of the currency holding addresses/more than 98% of the on-chain chips are currently in a profitable state. Since more than 30% of FETs are stored in various exchanges rather than independent addresses on the chain, this data is for reference only.

Team / Cooperation / Financing

Most of the Fetch development team graduated from prestigious universities or came from Fortune 500 companies, and are experts in AI or algorithm-related fields.

Humayun Sheikh: CEO and co-founder, early investor in Deepmind, founded itzMe in 2014 and uVue in 2016, a blockchain network driven by machine learning and artificial intelligence, focusing on the drone field. In August 2017, he founded Fetch.ai, and in June 2020, he founded Mettalex, a DEX built using Fetch.

Fetch has many partners, and the areas of cooperation mainly include the Internet of Things and AI. These include world-leading traditional companies such as Bosch, Festo, Telekom Innovation Laboratories, Datarella, Yoti, star blockchain projects such as IOTA and Conflux, and medical companies and institutions such as GE Healthcare, Pfizer, and the Poznan Supercomputing and Network Center in Poland. In addition, Fetch has joined the following organizations: the European Blockchain Alliance (members include Ripple, NEM, Cardano), the MOBI Alliance (members include BMW, Ford, General Motors and other car companies and Accenture, IBM and other Internet companies), the University of Warwick Business School, etc.

In terms of financing, in March 2021, Toronto digital asset company GDA Group invested $5 million; in March 2022, Fetch launched a $150 million development fund to encourage developers to develop projects on its ecosystem. The fund was led by MEXC Global, with participation from Huobi and Bybit. In March 2023, it received a $40 million investment from DWF Labs. This round of financing will be used to deploy decentralized machine learning, autonomous agents, and network infrastructure. The corporate financing on April 28, 2023 raised 91 million euros, led by Bitget.

Current status and future prospects

Fetch.ai was complex in the beginning. Its technology was so niche that it was hard for people to understand what it did. After its first price increase in 2019, Fetch.ai went through a downturn. However, after the bull run in 2021, the project has made a big comeback. It was with a gain of over 1000% that the project first attracted the interest of the community. Since then, Fetch.ai has experienced multiple peaks and troughs, with the recent Bitcoin price increase of 0.0% pushing its value close to the $0.50 mark.

However, the previous rise in FET prices can also be attributed to the launch of the new AI economy open platform DeltaV. Fetch.ai's AI agents power this search-based AI chat interface that can understand written conversations and provide relevant answers. In addition to having a simple user interface and providing precise responses, DeltaV also allows users to register for any AI service they wish to profit from.

At present, the challenges facing the project mainly include its technical complexity. The project needs continuous R&D investment and innovation to maintain its leading position. In addition, popularizing education and improving user acceptance are also major challenges; secondly, competition from other blockchain and AI projects in the market may pose a threat to Fetch.ai. Continuous innovation and differentiation are the key to maintaining competitiveness; and the uncertainty of the global regulatory environment may affect the development of Fetch.ai, especially when it comes to cross-border transactions and digital asset supervision.